CFOs Weigh in on Companies’ Work Return Amid COVID-19

As lockdown measures to COVID-19 are slowly being lifted globally, how are companies responding? A recent PwC survey of nearly 870 CFOs in 24 territories examines companies’ plans with respect to supply chains, sourcing, capital expenditures, remote working, staffing, and cost containment.

Taking the pulse of CFOs

As COVID-19 restrictions continue to slowly lift in some countries while others remain in lockdown, a survey conducted earlier this month (May 2020) of 867 chief financial officers (CFOs) in 24 territories by PwC as part of its COVID-19 Pulse series shows optimism among finance leaders about their companies’ ability to reopen safely while making adjustments to work environments and operations. Seventy-five percent of CFOs feel very confident they can meet customers’ safety expectations, and 70% are very confident they can provide a safe working environment for employees.

“As a number of economies slowly start to reopen, it is becoming increasingly clear that businesses have a key role to play in managing the way forward,” said Kristin Rivera, Global Leader, Forensics & Crisis, PwC US, in commenting on the results of the survey. “While governments are issuing broad guidance, it is companies that will need to determine when to bring their people back to work sites, how to keep them safe, and how to ensure this safety can be sustained throughout the crisis and recovery. The good news is that finance leaders are confident about their companies’ ability to design and implement effective return-to-work strategies.”

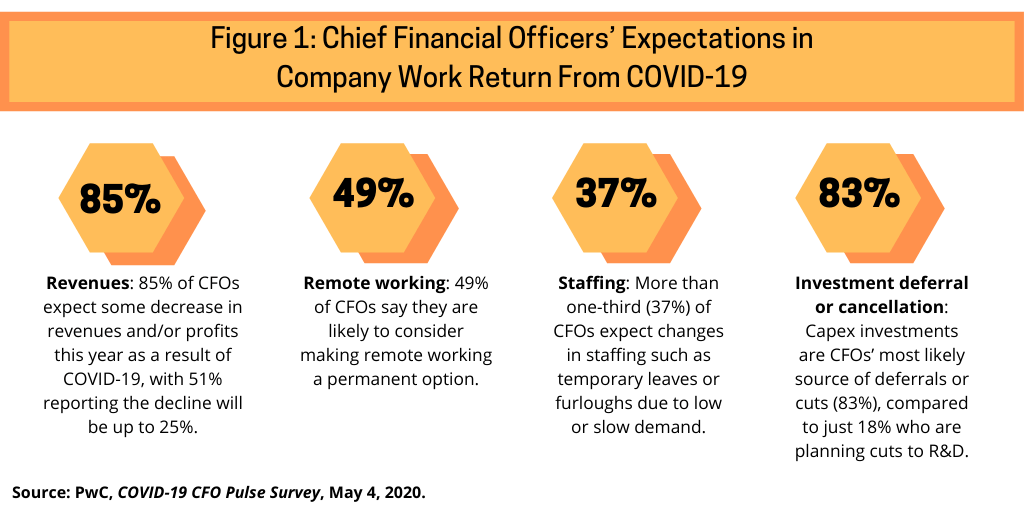

While the CFOs polled in the PwC survey plan to make adjustments to ensure workplace safety and employee protections, they are also anticipating changes in revenue, costs, and staffing. Figure 1 highlights some key findings from the study. Eighty-five percent of CFOs expect some decrease in revenues and/or profits this year as a result of COVID-19, with just more than half (51%) reporting the decline will be up to 25%. With respect to costs, capital expenditures (capex) investments are CFOs’ most likely source of deferrals or cuts (83% reporting as such), compared to just 18% who are planning cuts to R&D and 16% who expect to scale back their investment in digital transformation. With respect to staffing, more than one-third (37%) of CFOs expect changes in staffing such as temporary leaves or furloughs due to low or slow demand, and another third anticipate productivity loss to occur over the next month due to lack of remote work capabilities.

The transition back to on-site work

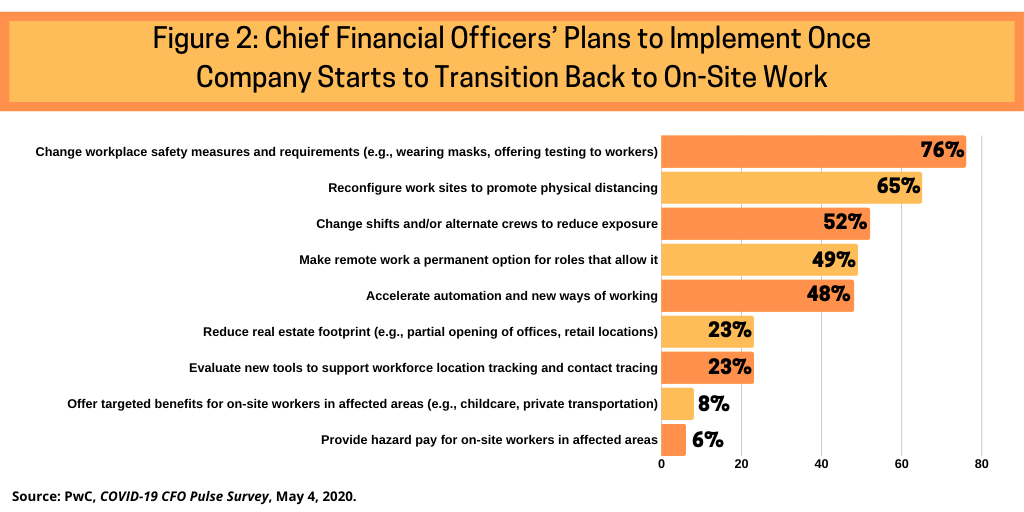

The PwC study also examined what measures companies are taking as they transition back to work (see Figure 2). With respect to workplace safety, among the tactical measures planned to protect staff, 76% of all CFOs surveyed are considering masks and testing, and 65% say they will reconfigure worksites to promote physical distancing. Given the need to limit the number of people in close contact, about half (49%) of CFOs are considering making remote work a permanent option where feasible, which corresponds to another finding: 72% of CFOs say that the work flexibility they have created in response to the crisis will benefit their company in the long run. Additionally, 48% of CFOs surveyed say that they plan to accelerate automation and new ways of working.

Changing safety measures is also a top choice across industries, led by CFOs in the industrial manufacturing and automotive industry and the technology, media and telecommunications industry (81%). Health industries CFOs are most likely to plan to reconfigure worksites (72%) and consider automation (60%). Although measures involving benefits to employees rank last among potential workplace adaptations in general, CFOs in health industries are most likely to consider targeted benefits such as childcare and private transportation (21%) and hazard pay (13%).

Re-evaluating supply chains and supplier networks

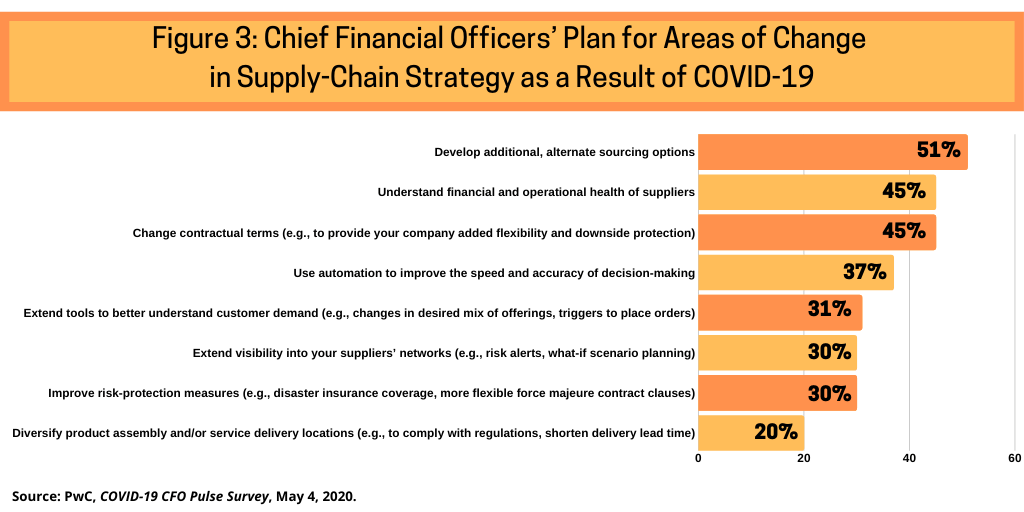

Another key part of the survey examined how CFOs plan to adjust their supply chains and sourcing activities. Overall, more than half (51%) of CFOs polled in PwC’s CFO Pulse survey cite the development of alternate sourcing options as the most pressing area (see Figure 3). In addition, 45% of CFOs surveyed underscored the importance of understanding the financial and operational health of suppliers, and 45% of CFOs say they plan to change contractual terms (e.g., to provide their company added flexibility and downside protection).

Other approaches to improve supply-chain planning cited by CFOs in the PwC study include: using automation to improve the speed and accuracy of decision-making with 37% of CFOs citing as such and extending tools to better understand customer demand (e.g., changes in desired mix of offerings, triggers to place orders) with 31% of CFOs citing as such (see Figure 3).

Additionally, 30% of CFOs say they are planning additional ways to extend visibility into their suppliers’ networks (e.g., risk alerts, what-if scenario planning) as well as improve risk-protection measures (e.g., disaster insurance coverage, more flexible force majeure contract clauses). One-fifth of CFOs (20%) say they plan to diversify product assembly and/or service delivery locations (e.g., to comply with regulations, shorten delivery lead time) (see Figure 3).

On a geographic and industry basis, in Germany (55%) and the US (52%) of CFOs are most likely to prioritize understanding the health of their suppliers, and CFOs in the Caribbean (61%), the Middle East (57%) and Africa (56%) say they are focused on changing contractual terms. The use of automation and other tools skews slightly lower among supply-chain approaches overall, which may also reflect the fact that many businesses are still stabilizing, rather than looking for ways to upgrade or increase efficiencies, according to the PwC study.

Energy, utilities and resources CFOs are most likely (61%) to consider alternative sourcing options and work to understand the health of their suppliers (59%). These data points correspond to insight from a separate PwC supply-chain study, the PwC COVID-19 Navigator, which finds that 47% of respondents from this industry rely on outsourced supply chains and/or operations, and 71% have operations that are geographically distributed to some degree. In the health industries, in which supply issues have been severe, 45% of CFOs say they expect to extend visibility into their suppliers’ networks. Financial services CFOs are more likely than average to use automation (49%) to improve decision-making capabilities.

Changes in revenue expectations

The PwC study shows that a decline in revenue/profits is largely expected by CFOs (85%) this year due to the novel coronavirus, but companies differ on the extent of the impact. As previously outlined (see Figure 1), overall, more than half (51%) of CFOs expect a decrease of up to 25% as a result of the current crisis. CFOs in Denmark and Germany — countries that have made notable progress in reopening — are the most optimistic regarding revenues, with 31% and 27% respectively expecting a decrease of less than 10%. Looking at industries, those most severely affected by lockdown restrictions, such as consumer markets, are most likely to expect a revenue decrease of more than 50% (in the case of consumer markets, 16% of CFOs cite as such in those markets). Health industries CFOs are more likely to expect revenues to increase (19%) or be unaffected (9%).

Expectations about decreased revenues—and growing acceptance about the likely impact of the coronavirus—are also reflected in CFOs’ view of recovery. Although 42% of CFOs believe their company could return to “business as usual” within three months if COVID-19 were to end today, there is a growing sentiment in many territories that recovery may take much longer. Overall, 8% of CFOs would expect it to take more than a year, led by those in consumer markets (10%) and industrial manufacturing and automotive (9%). In terms of financial disclosures, 48% of CFOs say they will include COVID-19 in their risk assessment or risk profile, and 47% will include it in their macroeconomic or industry factors. The lower numbers reflect timing, notes the PwC study, as many companies have already made COVID-19 disclosures and may not feel that it will be as much of an issue when it comes time for the next round of disclosures.