Market Watch: Dosage-Form Development and Manufacturing

Formulation and drug-delivery technologies play an important role in new product development, both in formulations with new active pharmaceutical ingredients (APIs) and in new routes of administration for existing APIs. How are solid-dosage products, injectables, and specialized technologies faring among recent new drug approvals and within the industry’s pipeline?

Small molecules versus biologics and drug delivery

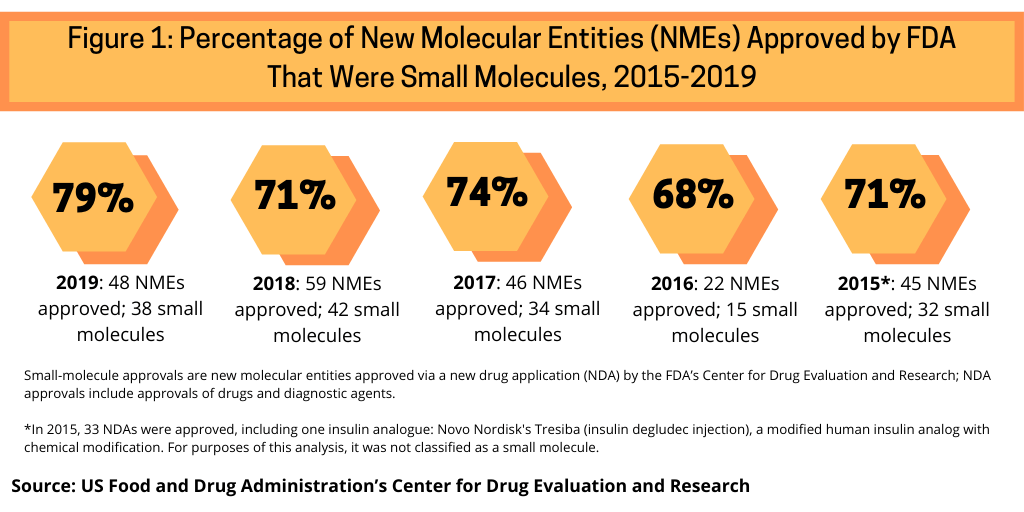

In evaluating the role of oral and injectable drug-delivery technologies, one measure is to first evaluate the trends relating to new drug approvals of small molecules versus biologics. In looking at recent approvals of new molecular entities (NMEs) by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER), between 2015 and 2019, small molecules have accounted for nearly three-fourths of NME approvals by the FDA’s CDER (see Figure 1).

Small molecules dominated new drug approvals in 2019, accounting for 79% of all NME approvals, representing 38 of the 48 NMEs approved by the FDA in 2019. Small molecules were strong also in 2018, with small molecules accounting for 71% of NME approvals, 74% in 2017, 68% in 2016, and 71% in 2015 (see Figure 1). Of the 38 small molecules approved by FDA’s CDER in 2019, 26 or 68% were solid dosage products (tablets or capsules) administered by an oral route of administration. The balance were parenteral drugs (one NME was approved both for oral and parenteral delivery) and other specialized drug delivery routes. Parenteral drugs, which may be a small molecule or a biologic, refer to drugs using non-oral means of administration by injecting the drug directly into the body typically through three common routes of administration: intramuscular, subcutaneous and intravenous,

Further breakdown: dosage forms and recent drug approvals

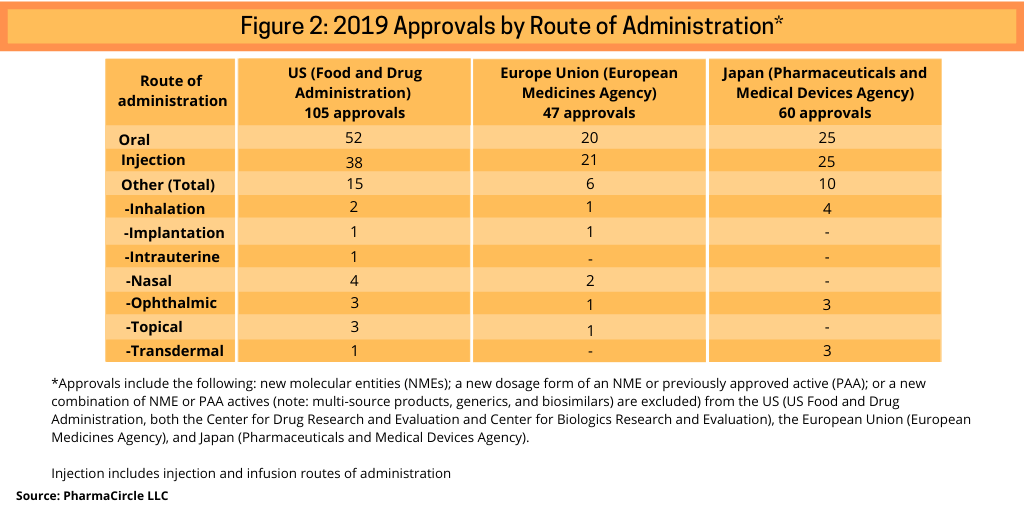

A recent analysis (1) by PharmaCircle LLC, a business intelligence firm specializing in analysis of formulation and drug-delivery technologies and products, provides a further breakdown of recent innovative product approvals to include the following: new molecular entities (NMEs); a new dosage form of an NME or previously approved active (PAA) or; a new combination of NME or PAA actives (note: multi-source products, generics, and biosimilars) are excluded) from the US, the European Union (EU), and Japan in 2019 (see Figure 2).

As was the case in 2018, oral products represented half (50%) of new product approvals in the US in 2019, according to the PharmaCircle analysis. In the EU, oral products represented 43% of new approvals in 2018 and 42% in Japan. In the EU and Japan, the number of oral and injection products were almost even in 2019: 20 oral products and 21 injection products approved in 2019 in the EU and 25 approvals each for oral and injection products in Japan. In the case of the EU, PharmaCircle notes that this is due to the regulatory approval scope by the EMA, which approves new products and dosage form improvement for a relatively limited range of therapeutic indications. In aggregate, across three geographic markets (the US, the EU, and Japan), oral tablet and capsule presentations and simple injection dosage systems accounted for two-thirds of dosage-form approvals in 2019.

Dosage-form development and the industry’s pipeline

In evaluating the prevalence of technologies in active development, injection technologies represent the largest number of active technologies, according to the PharmaCircle analysis. PharmaCircle has identified 5,650 discrete active drug delivery and formulation technologies, of which some 3,030 technologies are applicable to delivery by injection. Approximately 1,650 of these technologies are being used in products that are identified as approved or in active development at a research, preclinical, or clinical stage, according to the PharmaCircle analysis. The firm attributes the prevalence of injectable technologies in active development in part due to certain limitations in other routes of administration relating to molecule size, bioavailability, and stability, that make injectable delivery a better option. There are 1,090 technologies applicable to oral delivery, of which 630 are associated with one or more products that are approved or in development.

On a molecule basis, there are 4,282 active technologies identified as being applicable to small-molecule pharmaceuticals, according to the PharmaCircle analysis, with half (2,138) of these technologies being associated with one or more approved products or products in active development. For other molecule types, 1,879 protein and 1,740 peptide applicable technologies have been identified, according to the PharmaCircle analysis, which are associated with 734 and 492 products respectively that are approved or in active development.

One of the overarching issues for the pharmaceutical industry in terms of formulation and drug-delivery technologies is the composition of the industry’s pipelines. Although small-molecules still dominate late-stage clinical development, biologics continue to make inroads, particularly in early-stage development. A PharmaCircle analysis (2) (data as of April 2020) shows small-molecules’ share of all clinical-stage products dropped from 62% in 2015 to 60% in 2020; in the registration phase, small molecules accounted for 76% of the industry’s pipeline, but only 55% in Phase I.

On a therapeutic basis, cancer drugs continue to dominate the industry’s pipeline, accounting for 2,911 clinical programs in 2020, which represents a 77% increase between 2015 and 2020, according to the PharmaCircle analysis. In part reflecting the role of oncology-drug development and the rise of biologics in overall drug development, injection delivery has an approximately 49% share in clinical-stage products compared to 39% for oral delivery, according to PharmaCircle (analysis as of April 2020). A total of 552 injection route products were identified as being in Phase III development as of 2020.

References

1. K. Sedo and T. Kararli, “Global Report–2019 Global Drug Delivery & Formulation Report, Part 1,” Drug Development & Delivery, March 2020, https://drug-dev.com/global-report-2019-global-drug-delivery-formulation-report-part-1-a-global-review/.

2. K. Sedo and T. Kararli, “Global Report–2019 Global Drug Delivery & Formulation Report, Part 4,” Drug Development & Delivery, June 2020, https://drug-dev.com/global-report-2019-global-drug-delivery-formulation-report-part-4-the-drug-delivery-and-formulation-pipeline/.

Note: The above was part of a four-part article series, 2019 Global Drug Delivery & Formulation Report, in Drug Development & Delivery, March–June 2020, https://drug-dev.com/.