Injectable Drugs: CDMOs/CMOs and Suppliers Expand

Injectable drugs are assuming a larger role in recent drug approvals and drug development owing to the increase in biologic-based drug development and complexity of APIs, which make injectable delivery a preferred option due to molecule size, bioavailability, and stability. In response to these trends, CDMOs/CMO and other suppliers are proceeding with manufacturing expansions and advancing technology. DCAT Value Chain Insights rounds up the latest.

Injectable drugs and recent drug approvals

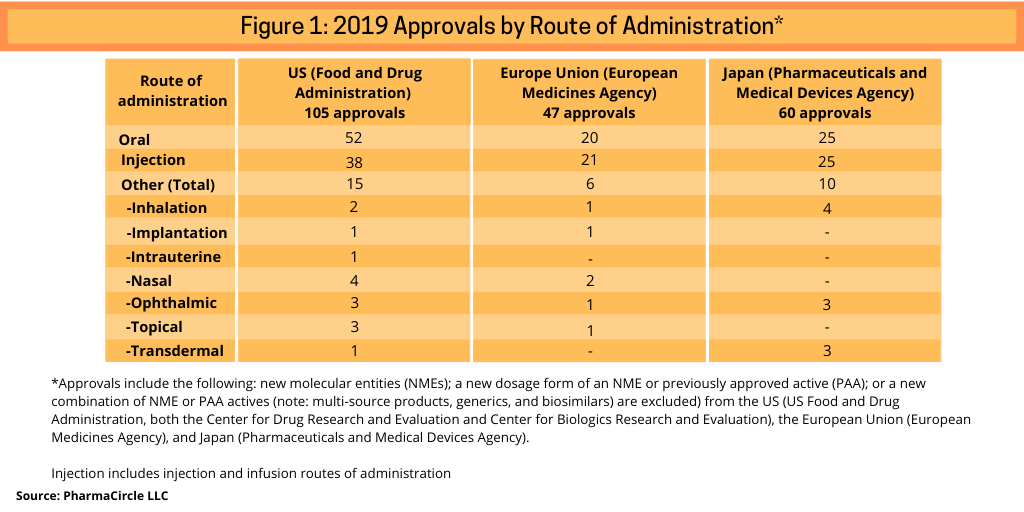

A recent analysis (1, 2) by PharmaCircle LLC, a business intelligence firm specializing in analysis of formulation and drug-delivery technologies and products, provides a breakdown of recent innovative product approvals by route of administration. Its analysis included the following: new molecular entities (NMEs); a new dosage form of an NME or previously approved active (PAA) or; a new combination of NME or PAA actives (note: multi-source products, generics, and biosimilars are excluded) from the US, the European Union (EU), and Japan in 2019 (see Figure 1).

Using this framework, 38 injectable drugs were approved in 2019 in the US compared to 50 oral products and 15 products using other delivery methods (see Figure 1). In the European Union (EU) and Japan, the number of oral and injection products was almost even in 2019: 20 oral products and 21 injection products approved in 2019 in the EU and 25 approvals each for oral and injection products in Japan (see Figure 1). In the case of the EU, PharmaCircle notes that this is due to the regulatory approval scope by the European Medicines Agency, which approves new products and dosage-form improvement for a relatively limited range of therapeutic indications. In aggregate, across three geographic markets (the US, the EU, and Japan), oral tablet and capsule presentations and simple injection dosage systems accounted for two-thirds of dosage-form approvals in 2019.

In evaluating the prevalence of technologies in active development, injection technologies represent the largest number of active technologies, according to the PharmaCircle analysis. PharmaCircle has identified 5,650 discrete active drug delivery and formulation technologies, of which some 3,030 technologies are applicable to delivery by injection. Approximately 1,650 of these technologies are being used in products that are identified as approved or in active development at a research, preclinical, or clinical stage, according to the PharmaCircle analysis. The firm attributes the prevalence of injectable technologies in active development in part due to certain limitations in other routes of administration relating to molecule size, bioavailability, and stability, that make injectable delivery a better option.

Manufacturing expansions and technology advances

Reflecting these trends, CDMOs/CMOs and other suppliers have been actively investing in new production and developmental capacity for injectable drugs and well as advancing technology enhancements. A roundup of the latest developments announced thus far in 2020 is outlined below.

A roundup of CDMO/CMO expansions thus far in 2020

Vetter. Vetter, a CDMO of aseptic filling and packaging, announced in July (July 2020), the purchase of a clinical manufacturing site in Rankweil, Austria. The production site was purchased along with its existing inventory, including a vial-filling line and a freeze dryer for liquid and lyophilized products as well as material preparation and laboratory equipment. Vetter says it plans to start operations at the site, Development Service Rankweil, in the second half of 2021. The new site expands the company’s European footprint and is a counterpart to its existing US clinical manufacturing site near Chicago. The new site in Austria will provide early clinical development for Phase I and Phase II projects.

The new site in Austria is approximately one hour from Vetter’s headquarters in Ravensburg, Germany, which also houses development support capabilities, clinical and commercial manufacturing operations and secondary packaging services. At the end of 2019, the company combined developmental and analytical laboratories at its site in Ravensburg with those from its site in Langenargen, Germany into one building at the Ravensburg site. The services at the 1,800-square-meter building include process development as well as functional and specification testing of packaging systems, chemical-analytical and biochemical analysis, and particle characterization. Non-GMP laboratory space and equipment combined with a GMP analytical laboratory allows for increased capacity and optimized work spaces.

As of early 2020, more than 50 employees work in the new labs. Prior to the bundling of its laboratories, the development studies and the corresponding analytical services for testing during process or packaging material development took place in several labs at different locations in Ravensburg and Langenargen. The company says by sequencing these services, processes have been synchronized and that expansion will continue within the building throughout 2020 and includes more lab space and the provision of additional analytical equipment and lyophilizer capacity. Vetter is also working on capacity expansion in filling and secondary packaging of injectables at all its sites.

In July (July 2020), Vetter and Rentschler Biopharma, a Laupheim, Germany-based biologics CDMO, announced a strategic collaboration to offer combined service offerings as a means to further facilitate efficiency in drug-development projects. The collaboration will use Rentschler Biopharma’s experience in drug-substance manufacturing, including bioprocess development and active pharmaceutical ingredient production, and Vetter’s expertise in drug-development support, aseptic fill–finish and secondary packaging. Over the next months, pilot client projects with joint teams from both companies will be further validated.

On the technology side, Vetter is also advancing the use of robotics in its secondary packaging operations, in particular collaborative robotics, which involve interaction with humans and machines. While large industrial robots work in restricted areas where humans are not permitted to enter during operation, collaborative robots provide close cooperation between humans and machines. Collaborative robots provide greater flexibility in packaging operations and address the trend toward small-volume parenterals and thus smaller batch sizes.

The company reported last year (October 2019), the completion of a successful pilot project, which included the use of a dual-arm robot in secondary packaging. The collaborative dual-arm robot, YuMi (You and Me), has been supporting automated secondary packaging processes at Vetter since 2018 by inserting finished drug products and components into folding boxes. Employees supply its work station with the required material and define its specific sequence of moves.

With the first collaborative robot now having been successfully deployed in a pilot project lasting more than a year, the company says it will be acquiring two more robotic models. The first model will be used to assemble a prefilled syringe barrel with plunger rod and finger flange. After its successful implementation in secondary packaging, the second model will be used for speed-bin-picking in aseptic production, where prefilled syringes are placed into trays after terminal sterilization.

Catalent. Catalent announced earlier this month (September 2020) plans to invest $50 million to install an additional high-speed vial filling line at its facility in Bloomington, Indiana. The new line is expected to be operational by April 2021 and provide capacity to produce up to 80 million vials annually under barrier isolator technology and a peristaltic pump filling mechanism under GMP. This marks the third major investment in the last two years at the Bloomington site. By the end of 2021, the site will have high-speed filling capacity across three vial lines, two syringe lines, and a flexible line capable of filling vials, syringes, or cartridges. The facility has expertise in sterile formulation, with drug substance-development and manufacturing and drug-product fill-finish capacity, including primary and secondary packaging.

In addition, in July (July 2020), Catalent announced plans to invest $30 million at its facility in Limoges, France to create a European center of excellence for clinical biologics, formulation development, and drug product fill–finish services. The expansion was scheduled to begin this month (September 2020) with completion anticipated in 2022. Catalent says it plans to gradually hire approximately 80 additional employees to support the center.

Also, earlier this year (April 2020), the company completed a $14-million expansion at its Bloomington, Indiana facility to increase biologics packaging capabilities and capacity. The expansion added 15,000 square feet of packaging infrastructure to the biologics and sterile manufacturing site, including five new packaging suites and a new quality control laboratory.

Grand River Aseptic Manufacturing. Grand River Aseptic Manufacturing (GRAM), a Grand Rapids, Michigan-based provider of sterile-manufacturing services, announced in June (June 2020) that it had completed a $60-million expansion project with the opening of a large-scale fill–finish facility in Grand Rapids, Michigan. The new facility is part of the GRAM’s current campus and is the company’s third fill–finish facility. With the opening of the large-scale fill–finish facility, GRAM more than tripled its existing footprint in Grand Rapids.

CordenPharma. CordenPharma reported this year (2020) the progress of an approximate EUR 30-million ($33-million) multi-year investment at its CordenPharma Caponago injectable drug-product facility in Italy. The investment is part of a three-phase capital-expenditure program to add commercial-scale capacity for aseptic fill–finish injectables and expanded R&D capabilities at the company’s injectables drug-product facility in Caponago, Italy, with certain key milestones in 2020 and beyond.

Phase 1 of the expansion program (completed in 2017) saw the introduction of aseptic fill–finish capability with the construction and qualification of a clinical/development plant. Phase 2a of the program (completed in 2018) saw the construction of an aseptic prefilled syringe and cartridge line, which has undergone regulatory approvals in the US and European Union. Phase 2b further saw the expansion of aseptic processing capabilities with the construction of a second filling line dedicated solely to vial production. Construction was completed, and the line received approval by the US Food and Drug Administration in 2019, with further approval by the Italian Medicines Agency (AIFA) expected in 2020. Completion of a lyophilized drug-product vial line is expected by the end of the year (2020), with approvals expected in early 2021. Phase 3 of the expansion saw the completion of the plan with the construction and regulatory approval of a dedicated R&D laboratory.

Ajinomoto Bio-Pharma Services. Ajinomoto Bio-Pharma Services, a CDMO of small- and large-molecule active pharmaceutical ingredients (APIs) and drug products, is proceeding with the addition of a new multi-purpose filling line at its site in San Diego, California to provide the company a 50% increase in its aseptic fill–finish capacity. The new line will be able to process ready-to-use syringes, vials, and cartridges. Construction began in 2019, and the company is starting site-acceptance testing and validation work in 2020, with the new line becoming fully operational in 2021.

Carbogen Amcis. Carbogen Amcis, a Bubendorf, Switzerland-based CDMO of APIs and drug products, announced last month (August 2020) plans for a new facility in Riom, France for the development and manufacturing of parenteral drug products. The facility will allow for the handling of complex formulations, including a range of different types of APIs as well as highly potent compounds and supply clinical batches up to Phase III and small-scale commercial projects.There will be two automated lines: the first one for both liquid filling plus lyophilization, and the second one dedicated to liquid forms. In addition, development and analytical laboratories will be incorporated to support customer projects. Construction of the facility will begin in January 2021, and operations are scheduled to begin during the first quarter of 2023.

Alcami. In January (January 2020), Alcami, a CDMO of APIs and drug products, acquired TriPharm Services, a new CDMO formed in 2019 that announced plans for a new manufacturing center for sterile fill–finish services near Research Triangle Park, North Carolina. Alcami’s acquisition of TriPharm followed Alcami’s $17-million expansion of its sterile fill–finish facility in Charleston, South Carolina. TriPharm’s facility adds to Alcami’s existing sterile fill–finish business by adding new prefilled- syringe capabilities and isolator technology as well as sterile fill–finish and lyophilization capacity. Phase I of the manufacturing facility is expected to be completed in the fourth quarter of 2020, which will bring the first two filling suites on line.

Thermo Fisher Scientific. Thermo Fisher Scientific reported earlier this year (2020) that it is investing to scale up its sterile drug development and commercial capabilities to cover a range of dosage forms for sterile injectables. In addition, the company is adding new commercial packaging capabilities with smaller production runs for sterile drug products. In 2019, the company announced investments to expand its sterile fill–finish sites in Monza and Ferentino, Italy and Greenville, North Carolina.

Recipharm. In February (February 2020), Recipharm completed its £505 million ($629 million) acquisition of Consort Medical, a CDMO of active pharmaceutical ingredients (APIs), drug products, and drug devices. Consort Medical was the parent company of Bespak, a CDMO of drug devices, which includes auto-injectors, and Aesica, a CDMO of APIs and drug products, including fill–finish services.

Samsung Biologics. Samsung Biologics announced plans earlier this year (2020) to expand its drug-product capability for aseptic filling by building a flexible filling line and adding two additional lyophilizer units with 41.2-m2 chambers. The filling line is expected to begin operations in the second half of 2021, and the expanded lyophilization line will become operational in the first half of 2022. Through this expansion, Samsung Biologics will add small-scale cartridge- and syringe-filling to its drug-product offerings and increase its total lyophilization capacity by 246% of current capacity.

PCI Pharma Services. PCI Pharma Services, a CDMO and contract provider of packaging services, announced earlier this year (2020) that it had completed an expansion of its new Biotech Packaging Center of Excellence in Philadelphia, Pennsylvania and announced an expansion of packaging operations in Ireland for biologics and injectable drug products. The new center is the company’s new US biologics flagship site. Additionally, PCI is planning to expand its biotech packaging capabilities at its operations in Ireland to complement existing capabilities in the UK and Germany. The expansions include increasing high-speed automatic syringe assembly and labeling, vial labeling and cartoning, auto-injector assembly and a build-out of existing cold-storage capabilities and manufacturing suites.

WuXi Biologics. In April (April 2020), WuXi Biologics, a contract biologics manufacturer, completed the acquisition of a drug-product manufacturing plant of Bayer’s in Leverkusen, Germany. WuXi Biologics took over the plant operations, purchased plant equipment, and signed a long-term building lease contract. Equipped with a drug-product filling line, the plant will provide sterile filling and freeze-drying services of up to 10 million vials per year.

Bushu Pharmaceuticals. Bushu Pharmaceuticals, a Saitama, Japan-based CMO of injectables and solid-dosage products, announced last month (August 2020) a five-year capital program of $100 million to expand its footprint, capacity and portfolio of services. Bushu is nearing completion of a 3,900-square-meter cold-chain warehouse facility at its plant in Misato, north of Tokyo. The new facility was scheduled to be commissioned and validated this month (September 2020) for storage of temperature-controlled sterile drugs and biologics for the Japanese market. The inspection capacity will be expanded to 12 stations for prefilled syringes, and seven stations each for liquid vials and for lyophilized vials. Of the 26 inspection stations, 23 will be supported by cameras. In addition to the new warehouse and inspection capacity, Bushu has also funded the addition of eight new packaging lines, including one prefilled packaging line and a new water-for-injection line to support its sterile manufacturing filling suite. Bushu is also upgrading its production automation systems and its laboratory information management system as part of a long-term information technology plan.

Evonik. Earlier this month (September 2020), Evonik announced the qualification of an advanced aseptic filling line for complex parenteral drug products at its Birmingham, Alabama facility. The line can aseptically fill powder, liquid, suspension, or combination forms into vials for clinical or commercial batch sizes. The line is suitable for highly potent, personalized, or sensitive drug products as well as for some specialized vaccines, which are often designed for systemic or localized delivery of small molecules, peptides, proteins, and nucleic acids.

LSNE Contract Manufacturing. In February (February 2020), LSNE Contract Manufacturing, a CDMO of fill–finish and lyophilization services, broke ground on a 26,000-square-foot addition of its existing facility at its Bedford, New Hampshire campus to increase commercial drug-product manufacturing capacity. Later this year (2020), the company received approval from the Spanish Agency of Medicines and Medical Devices (AEMPS) for the manufacturing of clinical-stage biologic-based therapeutic products at its aseptic fill– finish facility in León, Spain. LSNE has six GMP facilities: four located in New Hampshire, one in Wisconsin, and one located in León, Spain.

Berkshire Sterile Manufacturing. Berkshire Sterile Manufacturing, a Lee, Massachusetts-based fill–finish contract manufacturer for injectable medications, reported in June (June 2020) that it had secured $16.5 million in financing to expand its operations in Lee, including an additional robotic line for producing sterile drug products in vials, syringes, and cartridges. The company also plans to install a new pharmaceutical-grade water system, add additional testing capabilities in its microbiology and analytical labs, expand its warehouse, and double the size of its cleanrooms. The expansion is expected to be fully operational by early 2022.

Integrity Bio. Integrity Bio, a Thousand Oaks, California-based CDMO, reported in June (June 2020) the validation of its second fill–finish manufacturing line, which more than doubles the company’s manufacturing capacity.

Argonaut Manufacturing Services. Avid Bioservices, a biologics CDMO, and Argonaut Manufacturing Services, a CDMO, formed a co-marketing agreement earlier this year (July 2020) to provide an integrated manufacturing service to include services for process development, drug-substance manufacturing, and drug-product manufacturing. The companies will offer Avid’s process development and drug-substance manufacturing services in tandem with Argonaut’s parenteral drug-product fill-finish services to support parenteral drug products in clinical studies. Argonaut launched aseptic vial-filling services earlier this year (January 2020).

Suppliers of packaging materials and components for injectable drugs expand

Corning. Corning, a material sciences company, and Pfizer announced in June (June 2020) the execution of a long-term purchase and supply agreement for Corning Valor Glass, an alkali aluminosilicate-based product for parenteral drug packaging. The multiyear agreement provides for the supply of Valor Glass vials to a portion of currently marketed Pfizer drug products, pending regulatory approval. Corning partnered with Pfizer and Merck & Co. to develop the new glass vials to improve chemical durability and to resist breakage, damage, and particulate contamination. Pfizer and Merck provided insights on pharmaceutical formulation and manufacturing processes to aid in product development and for initial testing of the product. Corning announced in 2017 an initial investment of $500 million as part of a planned total investment of $4 billion, which included a new a pharmaceutical glass packaging manufacturing facility in Durham County, North Carolina to support production of the product.

Stevanato Group. Stevanato Group, a producer of glass parenteral packaging, headquartered in Padua, Italy, is opening a new Technology Excellence Center (US TEC) in Boston, Massachusetts, which is scheduled to open later this month (September 2020). Using the company’s knowledge in material science of glass, plastics, and rubber, US TEC will support biopharma companies in how to select the optimum glass container. The technology and knowledge transfer from the company’s Italian laboratory will be finalized in the fall (fall 2020).

In addition, Stevanato Group announced earlier this year (2020) a partnership with Cambridge Design Partnership (CDP), a UK- and US-based technology and product-design company, for the development of a pen-injector based on technology and intellectual property licensed exclusively from Haselmeier, a developer and manufacturer of self-injection devices based in Switzerland. The collaboration will use CDP’s design and development expertise in drug-delivery devices, and Stevanato Group’s experience in glass containers, tooling, injection molding, device assembly, and its global commercial network.

Schott. Schott, a specialty glass and materials company, is progressing a multi-year $1-billion investment in its pharmaceutical packaging business that the company announced last year (2019). Part of that investment is being used for the construction of a new production facility for the company’s Toppac ready-to-use polymer syringes and customized container solutions at its site in Müllheim, Germany and increased syringe-production capacity at its facility in St. Gallen, Switzerland. Overall, the company’s production capacity for polymer packaging will increase by 50% by 2020 and an additional 50% over the next several years. The company is also expanding its high-value vial product line, which includes the production ramp-up of its Everic pure vials for high-potent drugs, biologics and vaccines, and investment in the company’s iQ platform of ready-to-use vials. The ramp-up will occur at the company’s facility in Lebanon, Pennsylvania. The company will also double the capacity of lines producing coated vials in Germany. The investment also includes a greenfield facility for the production of syringes and a new production module for vials in India.

West Pharmaceutical Services. Earlier this year (2020), West Pharmaceutical Services, a provider of injectable drug-administration and delivery products and services, highlighted recent product introductions: two AccelTRA component line extensions; a Flip-Off Seal container closure system (CCS) compatible with a 5-mL Daikyo Crystal Zenith vial; and a new Ready Pack system with Schott’s adaptiQ® platform, which resulted from West’s recent partnership expansion with the packaging supplier. Also, in 2019, West increased its minority equity stake to 49% in Daikyo Seiko, a manufacturer of injectable components.

References

1. 1. K. Sedo and T. Kararli, “Global Report–2019 Global Drug Delivery & Formulation Report, Part 1,” Drug Development & Delivery, March 2020, https://drug-dev.com/global-report-2019-global-drug-delivery-formulation-report-part-1-a-global-review/.

2. P. Van Arnum, “Market Watch: Dosage-Form Development and Manufacturing,” DCAT Value Chain Insights,July 8, 2020. https://dcatvci.org/6621-market-watch-dosage-form-development-and-manufacturing

Note: The PharmaCircle analysis cited in this article was part of a four-part article series, “2019 Global Drug Delivery & Formulation Report”, in Drug Development & Delivery, March–June 2020, https://drug-dev.com/.

Editor’s Note: This article was updated to include additional information from Ajinomoto Bio-Pharma Services and Carbogen Amcis.