AstraZeneca’s $39-Bn Buy of Alexion: Will It Pay Off?

AstraZeneca took a step forward in its $39-billion acquisition of Alexion Pharmaceuticals with approval of the deal from the US Federal Trade Commission last month. The deal, which is expected to close in the third quarter 2021, provides AstraZeneca with assets in rare diseases. Will the mega move reap the expected rewards?

Inside the deal

AstraZeneca’s pending $39-billion acquisition of Alexion Pharmaceuticals, a Boston, Massachusetts-based bio/pharmaceutical company specializing in rare diseases, cleared a regulatory hurdle last month (April 2020) with approval from the US Federal Trade Commission. The deal, which was announced in December 2020, is subject to further regulatory clearances globally and approval by AstraZeneca and Alexion shareholders and is expected to close in the third quarter of 2021. The deal represented the largest bio/pharma deal in 2020 and is the largest deal thus far in 2021. Will the mega deal reap the desired rewards for AstraZeneca?

The acquisition would position AstraZeneca in immunology and the development of medicines for immune-mediated diseases. Alexion is focused on complement inhibition for immune-mediated rare diseases that are caused by uncontrolled activation of the complement system, part of the immune system. The complement system plays an important role in many inflammatory and autoimmune diseases across multiple therapy areas, including hematology, nephrology, neurology, metabolic disorders, cardiology, ophthalmology and acute care.

Inside Alexion Pharmaceuticals

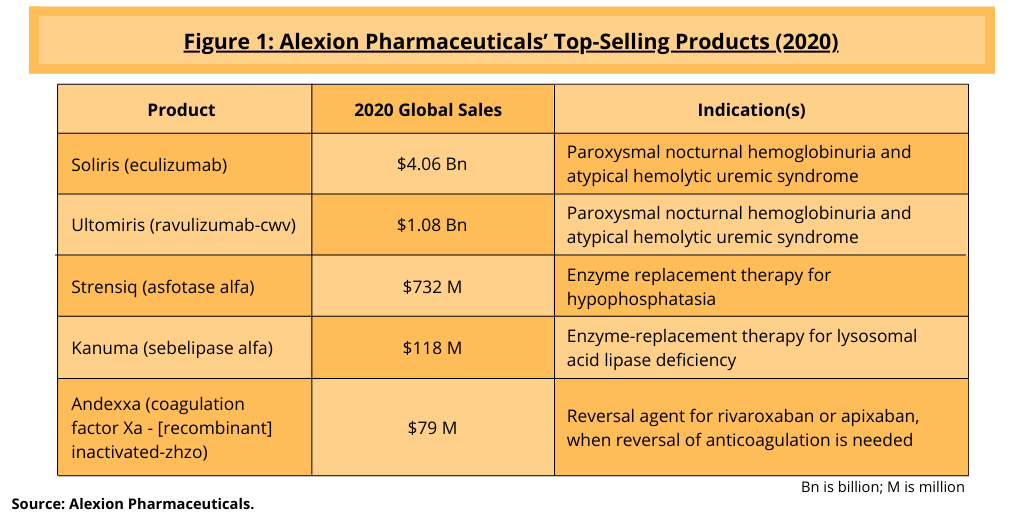

AstraZeneca is paying $175 per share for Alexion, or $39 billion, to acquire the bio/pharmaceutical company, which posted 2020 net product sales of $6.07 billion. Its top-selling product is Soliris (eculizumab), which is approved to treat two rare blood disorders, paroxysmal nocturnal hemoglobinuria (PNH), a disease that is characterized by destruction of red blood cells, blood clots, and impaired bone marrow function, and atypical hemolytic uremic syndrome (aHUS), a disease that causes abnormal blood clots to form in small blood vessels in the kidney. The drug posted 2020 revenues of $4.06 billion and accounted for 69% of the company’s 2020 net product sale (see Figure 1).

Soliris is an anti-complement component 5 (C5) monoclonal antibody and in addition to PNH and aHUS, it is approved for certain rare autoimmune diseases: generalized myasthenia gravis, a chronic autoimmune neuromuscular disease, and neuromyelitis optica spectrum disorder, a rare autoimmune disease of the central nervous system.

Soliris faces near-term biosimilar competition, and its successor product, Ultomiris (ravulizumab), which was approved by the US Food and Drug Administration in 2018 to treat PNH and in 2020 for aHUS, posted 2020 net sales of $1.08 billion (see Figure 1). Ultomiris is a second-generation C5 monoclonal antibody with a more convenient dosing regimen than Soliris. Alexion plans to file for approval in the US and the European Union for a subcutaneous formulation of Ultomiris and a device combination in PNH and aHUS in the third quarter of 2021. The drug is also in Phase III development for additional indications: (1) amyotrophic lateral sclerosis, so-called Lou Gehrig’s disease, a progressive nervous system disease that affects nerve cells in the brain and spinal cord, causing loss of muscle control; (2) neuromyelitis optica spectrum disorder, a chronic disorder of the brain and spinal cord dominated by inflammation of the optic nerve and inflammation of the spinal cord; (3) generalized myasthenia gravis; (4) hematopoietic stem-cell transplant-associated thrombotic microangiopathy, an endothelial damage syndrome that is increasingly identified as a complication of both autologous and allogeneic hematopoietic cell transplantation; and (5) complement mediated thrombotic microangiopathy.

In 2020, Alexion completed two acquisitions to add to its commercial portfolio and pipeline. In June (June 2020), Alexion completed its $1.4-billion acquisition of Portola Pharmaceuticals, a South San Francisco-based commercial-stage biopharmaceutical company focused on rare diseases. Portola’s lead commercial product is Andexxa/Ondexxya [coagulation factor Xa (recombinant), inactivated-zhzo], a Factor Xa inhibitor reversal agent, which reverses the anticoagulant effects of Factor Xa inhibitors, rivaroxaban and apixaban, in severe and uncontrolled bleeding. In January (January 2020), it completed its $930-million acquisition of Achillion Pharmaceuticals, a Blue Bell, Pennsylvania-based clinical-stage biopharmaceutical company focused on developing oral small-molecule Factor D inhibitors for certain rare diseases.

Near-term revenue targets for Alexion

As a standalone entity, Alexion is targeting revenues of between $9 billion and $10 billion by 2025 with the potential to have seven blockbuster franchises in hematology, nephrology, neurology, metabolics, cardiology, ophthalmology, and acute care. The company says it is on track for 10 product launches by 2023, which includes six launches for new indications of Solaris and Ultomiris and four new products: two internally developed and two with external partners: Caelum Biosciences, a biopharmaceutical company developing a therapy for light-chain (AL) amyloidosis, a rare systemic disorder that causes a misfolded immunoglobulin light-chain protein to build up in and around tissues, resulting in progressive and widespread organ damage, most commonly to the heart and kidneys, and Eidos, a clinical-stage biopharmaceutical company developing therapies to address transthyretin amyloidosis, a rare, inherited condition characterized by abnormal build-up of a protein called amyloid in the body’s organs and tissues. Its two near-term products for internal products are ALXN 1840 and ALXN 2040 (danicopan).

ALXN 1840 is in Phase III development, with results expected in the first half of 2021, to treat Wilson’s disease, a genetic disorder in which excess copper builds up in the body. ALXN 2040 is being developed to treat PNH with extravascular hemolysis with a Phase III study underway and a Phase II study expected to begin in the second half of 2021 to evaluate the drug to treat geographic atrophy, an eye disease marked by the chronic progressive degeneration of the macula, as part of late-stage age-related macular degeneration.

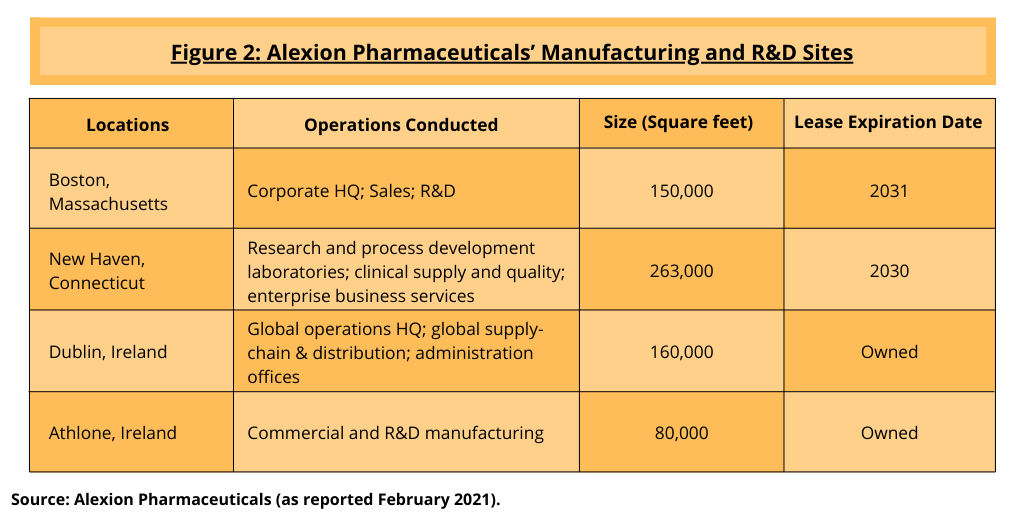

Alexion’s manufacturing and R&D sites

Figure 2 outlines Alexion’s current manufacturing and R&D sites. In April 2014, the company purchased a fill–finish facility in Athlone, Ireland, which was refurbished to become the first company-owned fill–finish facility. In July 2016, the company announced plans to construct a new biologics manufacturing facility at this site and since completed construction and is currently pursuing regulatory approval. In May 2015, the company announced plans to construct a new biologics manufacturing facility on its existing property in Dublin, Ireland. Construction of this facility has been completed, and in January 2021, the European Medicines Agency approved the facility as a manufacturer of drug substance for Soliris. The company is currently pursuing regulatory approval by the FDA.