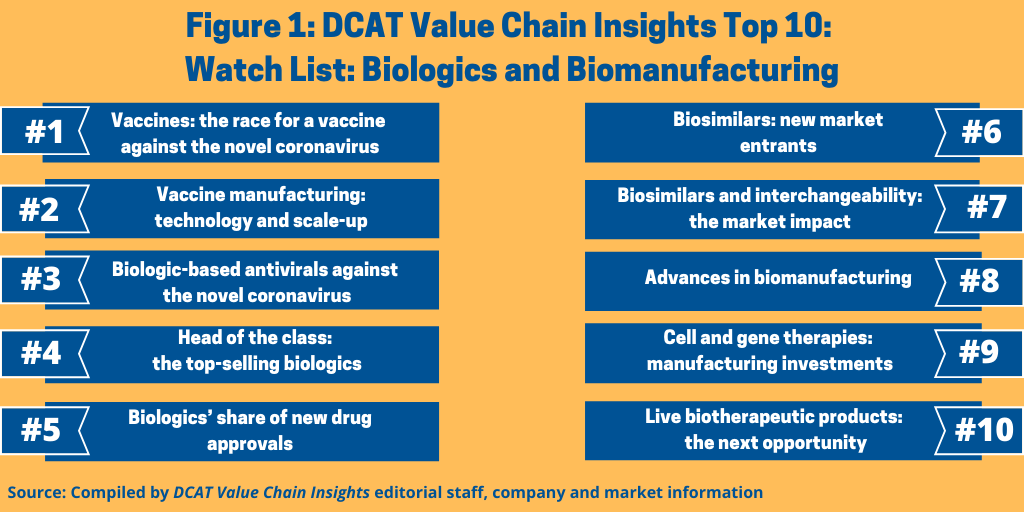

A Top 10 Watch List: Biologics and Biomanufacturing

Vaccines, historically a commoditized sector, have risen to the top of the industry’s watch list as the race for a vaccine against the novel coronavirus is on. What else is on DCAT Value Chain Insights’ Top 10 Watch List for Biologics and Biomanufacturing?

The Top 10 Watch List

Figure 1 outlines DCAT Value Chain Insights’ Watch List for Biologics and Biomanufacturing and as outlined below.

1. Vaccines: the race for a vaccine against the novel coronavirus. Vaccines, historically more of a commoditized sector, have taken on heightened importance as pharmaceutical companies, academic institutions, and research centers work to develop a vaccine against the novel coronavirus (COVID-19). A recent article in Nature Reviews Drug Discovery (1) noted that as of April 8, 2020, global COVID-19 vaccine research and development included 115 vaccine candidates, of which 78 were confirmed as active and 37 were unconfirmed (development status cannot be determined from publicly available or proprietary information sources). Of the 78 confirmed active projects, 73 are currently at exploratory or preclinical stages.

Key announced projects by the large pharmaceutical companies include Johnson & Johnson (J&J), which reports (as of late March 2020) that it had selected a lead COVID-19 vaccine candidate for which it expects to initiate Phase I clinical studies by September 2020. The company expects to initiate human clinical studies of its lead vaccine candidate at the latest by September 2020 and anticipates the first batches of a COVID-19 vaccine could be available for emergency use authorization in early 2021, a substantially accelerated timeframe in comparison to the typical vaccine-development process. Through a new partnership with the Biomedical Advanced Research and Development Authority (BARDA) of the US Department of Health and Human Services, HHS and J&J have committed more than $1 billion of investment to co-fund vaccine research, development, and clinical testing.

Earlier this month (April 2020), Pfizer finalized a collaboration, worth up to $748 million ($185 million upfront), with BioNTech, a Mainz, Germany-based biopharmaceutical company, for the co-development and distribution (excluding China) of a potential mRNA-based coronavirus vaccine aimed at preventing COVID-19 infection. The two companies plan to jointly conduct clinical trials for the COVID-19 vaccine candidates initially in the US and Europe across multiple sites. BioNTech and Pfizer say they intend to initiate the first clinical trials as early as the end of April 2020, assuming regulatory clearance.

Earlier this month (April 2020), Sanofi and GlaxoSmithKline, signed a letter of intent to develop an adjuvanted vaccine for COVID-19 using technology from both companies. Sanofi will contribute its S-protein COVID-19 antigen, which is based on recombinant DNA technology, and which has provided an exact genetic match to proteins found on the surface of the virus. The DNA sequence encoding this antigen has been combined into the DNA of the Baculovirus expression platform, the basis of Sanofi’s licensed recombinant influenza product in the US. GSK will contribute its pandemic adjuvant technology. The use of an adjuvant can be of particular importance in a pandemic situation since it may reduce the amount of vaccine protein required per dose, thereby allowing more vaccine doses to be produced. The companies plan to initiate Phase I clinical trials in the second half of 2020 and, subject to regulatory considerations, are aiming to complete the development required for availability by the second half of 2021.

In a separate deal, Sanofi and Translate Bio, a clinical-stage messenger RNA (mRNA) therapeutics company, formed a licensing agreement late last month (March 2020) to develop a novel mRNA vaccine for COVID-19. This collaboration leverages an existing agreement from 2018 between the two companies to develop mRNA vaccines for infectious diseases.

Among smaller companies, Moderna Therapeutics, a company specializing in messenger RNA (mRNA) therapeutics and vaccines, announced an agreement earlier this month (April 2020) for a commitment of up to $483 million from BARDA to accelerate development of the company’s mRNA vaccine candidate (mRNA-1273) against the novel coronavirus. A Phase I study of mRNA-1273 is being conducted by the US National Institutes of Health.

Inovio Pharmaceuticals, a Plymouth Meeting, Pennsylvania-based pharmaceutical company, reports that the US Food and Drug Administration has accepted the company’s investigational new drug (IND) application for INO-4800, its DNA vaccine candidate designed to prevent COVID-19 infection. The company was scheduled to begin Phase I clinical testing of INO-4800 in healthy volunteers beginning April 6, 2020.

2. Vaccine manufacturing: technology and scale-up. Just as important as successfully developing an effective vaccine against COVID-19 is having the ability to scale up manufacturing to meet demand for a COIVD-19 vaccine. A case in point is J&J, which with the announcement of its plan to initiate clinical trials of a lead COVID-19 vaccine candidate, also announced a manufacturing plan. J&J announced it is expanding its global manufacturing capacity, including through the establishment of US vaccine-manufacturing capabilities and scaling up capacity in other countries. The company says that the additional capacity will assist in the rapid production of a vaccine and will enable the supply of more than one billion doses of a vaccine.

3. Biologic-based antivirals against the novel coronavirus. Equally important as a vaccine against COVID-19 are potential treatments to reduce, mitigate, or alleviate the harmful effects of the COVID-19 infection. Antivirals, both small molecules and biologics, are being evaluated as potential treatments.

One biologic-based antiviral under development is Sanofi’s and Regeneron Pharmaceuticals’ Kevzara (sarilumab). Sanofi reported late last month (March 2020) that the first patient outside of the US has been treated as part of a global clinical program evaluating Kevzara in patients hospitalized with severe COVID-19. The global clinical program was also initiated in Italy, Spain, Germany, France, Canada, Russia and the US. Sanofi is leading trials outside the US while Regeneron is leading US trials. This is the second multi-center, double-blind, Phase II/III trial as part of the Kevzara COVID-19 program, and the companies say that they are continuing to work with authorities around the world to secure initiation at additional sites.

Kevzara is a fully human monoclonal antibody that inhibits the interleukin-6 (IL-6) pathway by binding and blocking the IL-6 receptor. IL-6 may play a role in driving the overactive inflammatory response in the lungs of patients who are severely or critically ill with COVID-19 infection, according to information from the companies. The role of IL-6 is supported by preliminary data from a single-arm study in China using another IL-6 receptor inhibitor.

CSL Behring and SAB Biotherapeutics, a Sioux Falls, South Dakota-based clinical-stage biopharmaceutical company, have partnered in the development of SAB-185, a COVID-19 therapeutic candidate on track for clinical evaluation by early summer (summer of 2020). The partnership combines CSL Behring’s protein-science capabilities with SAB’s immunotherapy platform capable of developing and producing fully human polyclonal antibodies without the need for blood-plasma donations from recovered patients. The therapeutic candidate, SAB-185, is generated from SAB’s proprietary platform that can produce large volumes of human polyclonal antibodies targeted to SARS-CoV-2, the virus that causes COVID-19.

4. Head of the class: the top-selling biologics. Biologics continue to play an important part in the global pharmaceutical market. In 2018, five of the top-selling prescription drugs, as compiled by Evaluate Pharma, were biologics. These were: Merck & Co.’s Keytruda (pembrolizumab), an immunotherapy for cancer, the number one selling drug in 2018; AbbVie’s Humira (adalimumab), an anti-inflammatory drug for multiple indications, the number two selling drug in 2018; Bristol-Myers Squibb’s Opdivo (nivolumab), an immune-oncology drug, ranked number four; Johnson & Johnson’s Stelara (ustekinumab) for treating psoriasis and psoriatic arthritis, ranked number eight; and Bayer’s and Regeneron Pharmaceuticals’ Eylea (aflibercept) for treating age-related macular degeneration, macular edema, and diabetic retinopathy, ranked number nine.

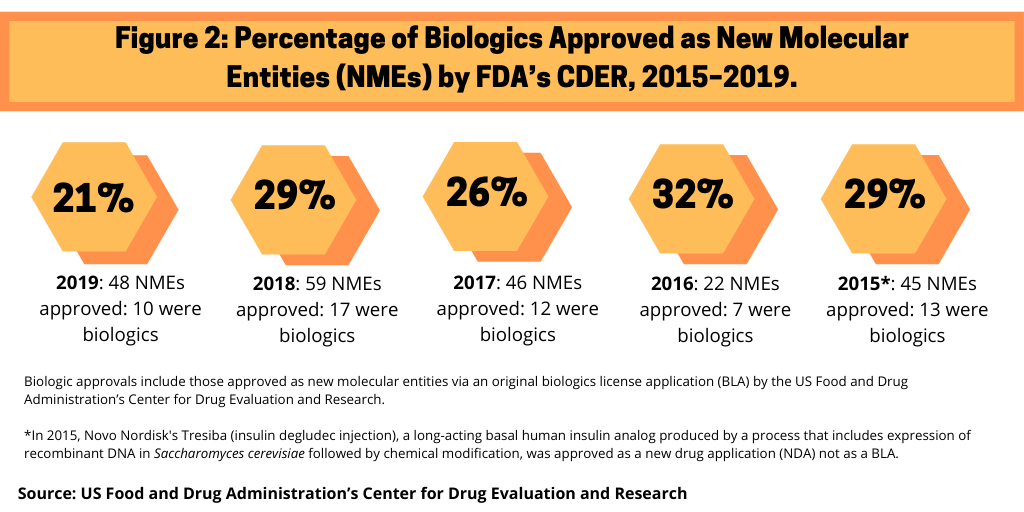

5. Biologics’ share of new drug approvals. Although small molecules still dominate in terms of new molecular entities (NMEs) approved by the US Food and Drug Administration’s Center for Drug Research and Evaluation (CDER), biologics continue to make inroads. Figure 2 outlines the share of biologics in recent NME approvals by the FDA’s CDER.

6. Biosimilars: new market entrants. Increasing biosimilar uptake is key for the current and future of the biosimilars market. A report in 2019 by KPMG, commissioned by Medicines for Europe, which represents generics and biosimilars developers in Europe, examined ways to increase the utilization of biosimilar, generic, and other value-added medicines in hospitals, which among European countries, account for the greatest share of healthcare expenditures, with medicines representing a part of those expenditures. The report analyzed the hospital systems and medicine usage in eight European countries (Belgium, France, Germany, Italy, Poland, Portugal, Spain, and the UK). The report analyzed the differences between countries in the utilization of generic and biosimilar medicines in hospitals. Comparing value and volume market shares, originators and off-patent brands typically have a combined volume market share of less than 30%, whereas the budgetary impact of originators and off-patent brands typically exceeds 60%. The report identifies biosimilar-specific key ingredients for increased utilization in the hospital setting. These biosimilar-specific key ingredients focus on improving market access of biosimilar medicines by increasing awareness of hospital physicians, nurses and pharmacists, implementing biosimilar target agreements and quotas, and by drafting guidelines on treatment switching.

7. Biosimilars and interchangeability: the market impact. Two recent actions by the US Food and Drug Administration (FDA) may open up the market for biosimilars in the US. Last year (2019), the FDA finalized a guidance describing how biosimilars can achieve an interchangeable status, which means they may be substituted for the reference biologic without a prescriber intervening. The Biologics Price Competition and Innovation Act of 2009 created an abbreviated licensure pathway for biological products that are demonstrated to be biosimilar to or interchangeable with an FDA-approved biological product. An interchangeable product is a biosimilar product that meets additional requirements needed to show that an interchangeable product is expected to produce the same clinical result as the reference product in any given patient. Also, for products administered to a patient more than once, the risk in terms of safety and reduced efficacy of switching back and forth between an interchangeable product and a reference product must have been evaluated, according to information from the FDA.

The designation as an interchangeable product may help to improve the uptake of these type of biosimilars. The FDA provided an example to illustrate this measure. For example, say a patient self-administers a biological product by injection to treat rheumatoid arthritis. To receive the biosimilar instead of the reference product, the patient may need a prescription from a healthcare prescriber written specifically for that biosimilar. However, once a product is approved by the FDA as interchangeable, the patient may be able to take a prescription for the reference product to the pharmacy and, depending on the state, the pharmacist could substitute the interchangeable product for the reference product without consulting the prescriber.

In a separate development opening up the biosimilar market, the FDA finalized a questions-and-answers guidance on so-called “deemed to be licensed” products last month (March 2020). Under the Biologics Price Competition and Innovation Act of 2009, Congress created a 10-year timeline to prepare for the regulatory transition of biological products that were historically regulated under the Federal Food, Drug and Cosmetic Act. Last month (March 2020), the FDA began receiving applications for proposed biosimilars to these licensed transition biological products, including insulin products. Approximately 100 drugs officially became biologics under the “deemed to be a license” provision.

8. Cell and gene therapies: manufacturing investments. Although niche modalities, cell and gene therapies continue to be an active area of investment by pharmaceutical companies to add products to their pipelines and manufacturing capabilities and for certain CDMOs/CMOs to add capabilities.

Among recent key deals were: Roche’s $4.3-billion acquisition of Spark Therapeutics, a commercial gene-therapy company based in Philadelphia, in 2019; Novartis’ acquisition in 2019 of CELLforCURE, a CDMO of cell and gene therapies in Europe, from LFB, a French pharmaceutical company, which included a cell and gene manufacturing facility located outside of Paris in Les Ulis, France and the related adjacent land; Novartis’ $8.9-billion acquisition in 2018 of AveXis, a gene-therapy company, and subsequent FDA approval of the gene therapy, Zolgensma (onasemnogene abeparvovec-xioi), for treating pediatric patients with spinal muscular atrophy, a rare neuromuscular disorder; Gilead Sciences’ $11.9-billion acquisition of Kite Pharma in 2017 and subsequent manufacturing expansion at its facilities in California.

Among CDMOs key recent deals were Catalent’s $1.2-billion acquisition of Paragon Bioservices, a Baltimore, Maryland-based contract provider of viral vector development and manufacturing services for gene therapies, and its $315-million acquisition earlier this year of MaSTherCell, a CDMO of cell and gene therapies and Thermo Fisher Scientific’s $1.7-billion acquisition of Brammer Bio, a CDMO of viral vector manufacturing for gene and cell therapies. See related story for further expansion activity of CDMOs/CMOs in this area.

9. Advances in biomanufacturing. Key trends include: (1) wider acceptance of single-use technologies; (2) a transition to smaller bioreactor tank sizes due to lower product volumes as biopharmaceutical companies target smaller patient populations and cell-line expression is improving; and (3) the adoption of next-generation production technologies, which include in-line media and buffer preparation, single-pass tangential flow filtration, and continuous multi-column chromatography technologies.

Emerging technology advances include: (1) continuous bioprocessing; (2) related process-intensification strategies with the aim of designing smaller volume processes and increasing manufacturing flexibility; (3) at-line/in-line process monitoring to enable continuous bioprocessing and improve analytics; and (4) modular bioprocessing facilities to reduce manufacturing footprints and also to increase flexibility.

10. Live biotherapeutic products: a new opportunity. Last year (2019) also saw the entry of new CDMOs/CMOs focusing on a niche modality, live biotherapeutic products. A live biotherapeutic product contains a live microorganism that is used for the prevention, treatment, or cure of a disease or condition, and their potential use has increased with better understanding of the link between human health and the human microbiome. Many of the microorganisms identified for the manufacture of live biotherapeutic products are obligate or strict anaerobes and spore-forming organisms and require specialized expertise in handling and cultivating the organism as well as specialized facilities and equipment.

Last year (2019), Arranta Bio, a new CDMO that focuses on the human microbiome, was formed to provide live biotherapeutic products for microbiome developers by bacterial fermentation, isolation, drying and encapsulation. Arranta is establishing late clinical-stage and commercial-ready capacity at a new facility in Watertown, Massachusetts, which the company expects to come on line in 2020. Arranta Bio was founded by Mark Bamforth, founder and former CEO of Brammer Bio, a CDMO focusing on cell and gene therapies, which Thermo Fisher Scientific acquired for $1.7 billion in May 2019. Arranta Bio has since raised $82 million in financing, formed a strategic partnership with Thermo Fisher, acquired Captozyme, a clinical CDMO for microbiome biotherapeutics, and established a Center of Excellence for microbiome development and clinical supply.

Also in 2019, Lonza and Chr. Hansen Holding, a bioscience company, announced an investment of EUR 90 million ($99 million) for funding a new joint venture for a new CDMO in the live biotherapeutic product market. The joint venture, BacThera, is headquartered in Basel, Switzerland with production facilities in Denmark and Switzerland.

Reference

- Tung Thang Le, et al., “The COVID-19 Vaccine Development Landscape,” Nature Reviews Drug Discovery, April 9, 2020, doi: 10.1038/d41573-020-00073-5.