New Executive Orders on Drug Pricing in the US: The Impact

President Donald Trump signed executive orders this week to require the use of most-favored-nation drug pricing in the US for Medicare drugs. What does it mean for the pharma industry?

Inside the latest executive orders on drug pricing

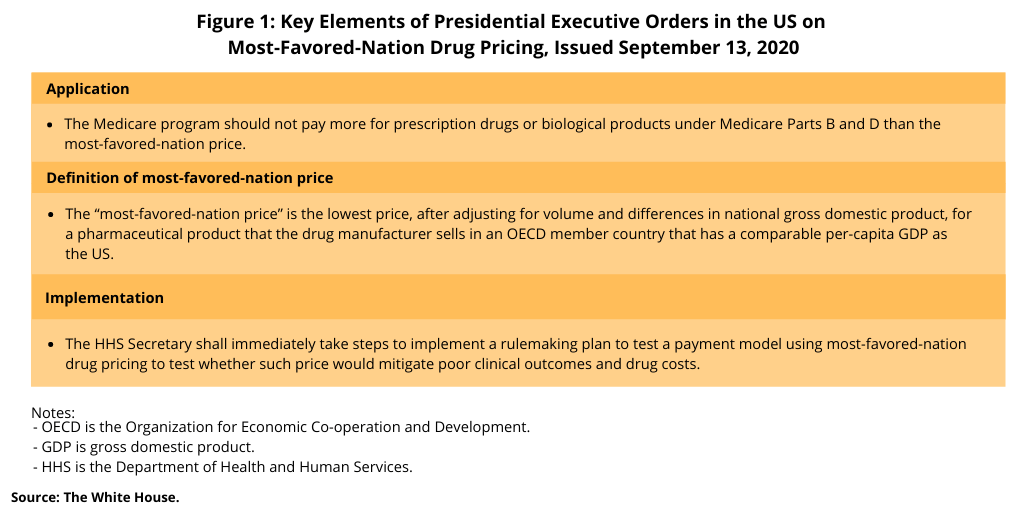

This week (September 13, 2020), President Donald Trump signed two executive orders that would require the application of most-favored-nation drug pricing in the US for prescription drugs under Medicare, the US federal healthcare program for people over the age of 65 (see Figure 1). Under the executive orders, the Medicare program would not pay more for prescription drugs or biological products than the most-favored-nation price. The measure would apply to prescription drugs under Medicare Part B, which covers medical services and supplies and includes prescription drugs administered at hospitals, physicians, and other clinical settings, and to prescription drugs under Medicare Part D, which is the prescription drug program and includes drugs obtained through outpatient sources, such as pharmacies.

For purposes of the executive orders, “most-favored-nation” is defined as the lowest price, after adjusting for volume and differences in national gross domestic product (GDP), for a pharmaceutical product that the drug manufacturer sells in a member country of the Organisation for Economic Co-operation and Development (OECD) (which consists of 37 developed countries) that has a comparable per-capita GDP as the US.

Linking US drug pricing to international drug pricing is a hot topic

Linking US drug pricing to international drug prices is a hotly debated issue. In issuing the executive orders, President Trump in the orders said that such measures are necessary to equalize drug pricing between the US and other developed countries, which the Administration says pay lower costs for prescription drugs, thereby in practice making the US assume a larger share of the cost of biopharmaceutical/pharmaceutical innovation. “Other countries’ governments regulate drug prices by negotiating with drug manufacturers to secure bargain prices, leaving Americans to make up the difference—effectively subsidizing innovation and lower-cost drugs for the rest of the world,” said the executive orders issued on September 13, 2020. “…When the Federal Government purchases a drug covered by Medicare—the cost of which is shared by American seniors who take the drug and American taxpayers—it should insist on, at a minimum, the lowest price at which the manufacturer sells that drug to any other developed nation,” specified the executive orders.

Drug-pricing reform has been on the policy agenda with both a plan from the White House and several legislative proposals over the past several years. In May 2018, the Trump Administration and the US Department of Health and Human Services (HHS) put forth a plan, a Blueprint to Lower Drug Prices and Reduce Out-of-Pocket Costs, which laid out four strategies: boosting competition, enhancing negotiation, creating incentives for lower list prices, and bringing down out-of-pocket costs. Congress, too, has taken some action with the introduction of legislation although no legislation has been passed by both houses of Congress. Perhaps the most prominent bill is the Elijah E. Cummings Lower Drug Costs Now Act (H.R.3), which was passed by the US House of Representatives in December 2019. The bill, which was referred to the Senate, where it still sits, would establish a fair price negotiation program, put in protections from excessive price increases under the Medicare program (the US federal healthcare program for people over the age of 65), and establish an out-of-pocket maximum for enrollees of Medicare Part D (the prescription drug program under Medicare).

In the US Senate, Senator Chuck Grassley (R-UT), Chairman of the US Senate Finance Committee, introduced into the committee the Prescription Drug Pricing Reduction Act of 2020 (S. 4199), which alters several programs and requirements relating to the prices of prescription drugs under Medicare and Medicaid although it does not specifically address linking US drug pricing to international drug pricing. Among other things, the bill would do the following: (1) require drug manufacturers to issue rebates to the Centers for Medicare & Medicaid Services (CMS) for certain drugs covered under Medicare for which the average manufacturer price increases faster than inflation; (2) require drug manufacturers to issue rebates to the CMS for discarded amounts of certain single-dose drugs covered under Medicare; (3) reduce the annual out-of-pocket spending threshold and eliminate beneficiary cost-sharing above this threshold under the Medicare prescription drug benefit; (4) increase transparency relating to drug discounts and rebates and payments between pharmacy benefit managers, health plans, and pharmacies; and (5) require pass-through pricing models and other requirements regarding rebates.

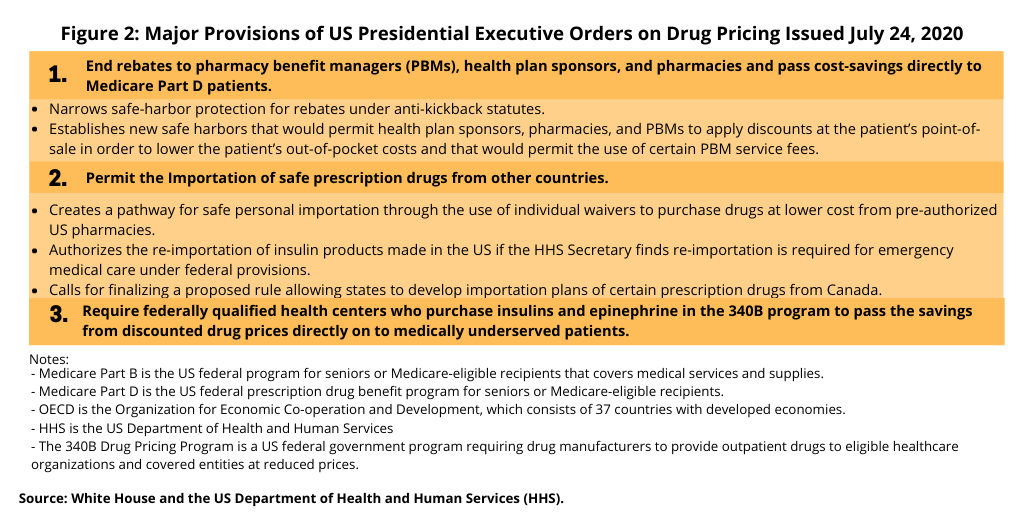

The executive orders issued by the President this week (September 13, 2020) follow four executive orders issued earlier this summer (July 2020) that brought elements of both the Administration’s earlier blueprint and Congressional proposals with some new measures (see Figure 2). One of the executive orders issued in July 2020 called for comparable US pricing to OECD drug pricing under Medicare Part B, which covers medical services and supplies, including prescription drugs administered in a clinical setting. The new executive order issued this week (September 13, 2020) extends that to prescription drugs under Medicare Part D, the program’s prescription drug benefit covering prescription drugs from outpatient sources, such as pharmacies.

Industry feedback

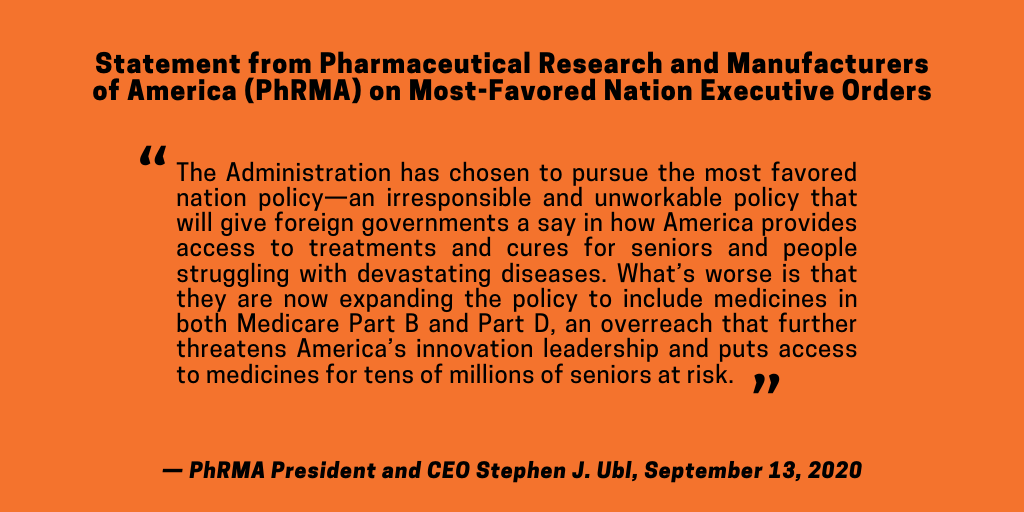

Of the executive orders issued earlier this summer (summer of 2020), the one that drew the sharpest rebuke from the industry was the one linking US drug pricing to international drug pricing, Now with the new executive orders extending the linking of US drug pricing to international drug pricing to include drugs under Medicare D, the industry’s criticism has again been strong.

“The Administration has chosen to pursue the most favored nation policy—an irresponsible and unworkable policy that will give foreign governments a say in how America provides access to treatments and cures for seniors and people struggling with devastating diseases, said Stephen J. Ubl, President and CEO of the Pharmaceutical Research and Manufacturers of America (PhRMA), which represents innovator drug companies in the US, in a September 13, 2020 statement. “What’s worse is that they are now expanding the policy to include medicines in both Medicare Part B and Part D, an overreach that further threatens America’s innovation leadership and puts access to medicines for tens of millions of seniors at risk.”

The rebuke was equally strong by the Biotechnology Innovation Organization (BIO), which represents, large, mid-sized, and emerging biopharmaceutical companies. “With scientists and researchers at America’s biopharmaceutical companies working around the clock to fight a deadly pandemic, it is simply dumbfounding that the Trump administration would move forward with its threat to import foreign price controls and the inevitable delays to innovation that will follow,” said Dr. Michelle McMurry-Heath, President and CEO of BIO in a September 13, 2020 statement. “This reckless scheme will eliminate hope for vulnerable seniors and other patients waiting for new treatments by drastically reducing investment in cutting-edge scientific research and development. That is why we will use every tool available–including legal action if necessary–to fight this risky foreign price control scheme. America’s patients, families, scientists and researchers deserve nothing less.”

Implementation and what is next

The implementation plan specified in the executive orders this week (September 13, 2020) authorizes the Secretary of the US Department of Health and Human Services to immediately take steps to implement a rulemaking plan to test a payment model using most-favored-nation drug pricing. Such testing for the payment model would be applied to certain prescription drugs and biological products covered by Medicare Part B (drugs administered in a clinical setting) and for drugs and biological products under Medicare Part D (the prescription drug benefit) to evaluate whether, for patients who require pharmaceutical treatment, whether paying no more than the most-favored-nation price would mitigate poor clinical outcomes and drug costs. No further details of the implementation plan, process for implementation, or schedule for implementation were provided in the executive orders.