The Year in Review: 2020

The COVID-19 pandemic dominated the headlines in 2020 and will again in 2021 as vaccines and treatments move through development, regulatory approval, and distribution. But what have been the other key developments thus far in 2020? How have new product approvals fared, what were noteworthy deals, and what else made the news?

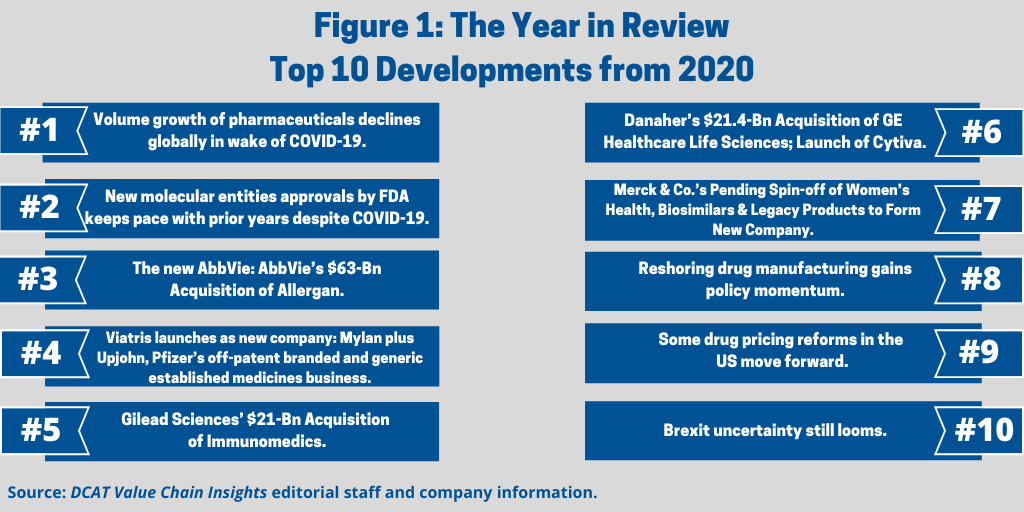

2020 in Review: The Top 10 Developments

Without question, the novel coronavirus (COVID-19) pandemic was the leading issue for 2020, globally and across all industries. Its impact on healthcare systems, the global economy, and individuals cannot be underestimated. The pharmaceutical industry continues to work to develop vaccines and treatments against COVID-19, and this remains the major focus for the industry as a whole. But there were other important developments. This year in review examines the other leading developments thus far in 2020 as outlined below (see Figure 1).

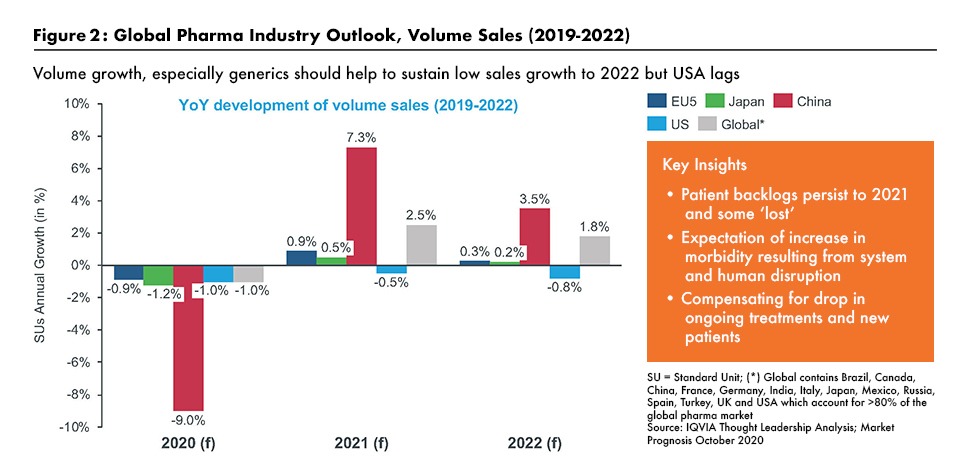

1. Volume growth of pharmaceuticals declines globally in wake of COVID-19. The pharmaceutical industry has been negatively impacted by the COVID-19 pandemic in terms of volume growth, as outlined by Graham Lewis, Vice President of Global Pharma Strategy, IQVIA, in a recent DCAT webinar (1). IQVIA expects low single-digit growth in pharma sales at net prices (i.e., after rebates and discounts) for the next two years. As outlined in Figure 2 (see further below in article), drug-product volumes declined in 2020 as visits to physicians and hospitals dropped as a result of the pandemic. While he expects some rebound in 2021/2022, especially in Asia, volume growth is likely to remain subdued in the US and Europe although the availability of a COVID-19 vaccine would improve growth in volumes.

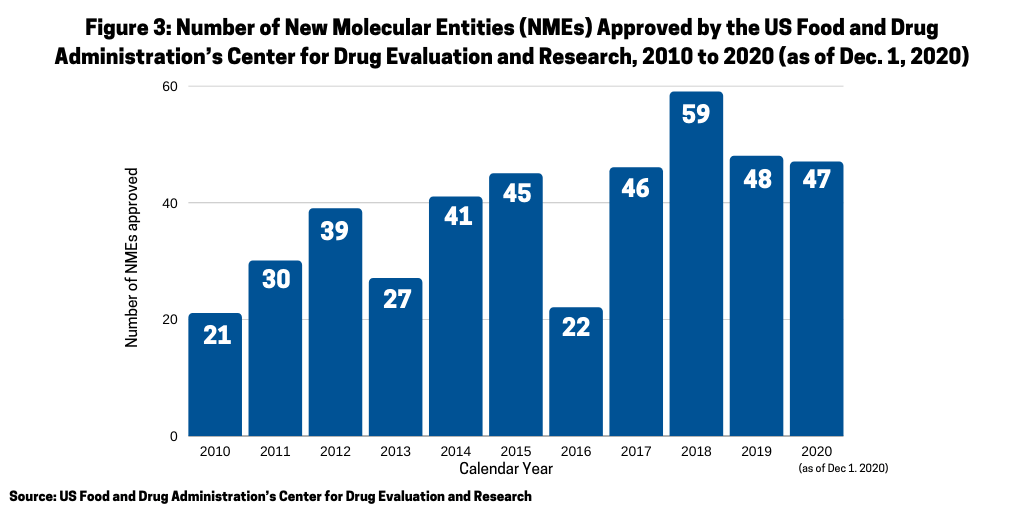

2. New molecular entities approvals by FDA keeps pace with prior years despite COVID-19. One of the key questions for the industry this year (2020) was whether the number of new drug approvals would be impacted by the COVID-19 pandemic. In looking at the number of approvals of new molecular entities (NMEs) by the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER), the answer seems to be no. As of December 1, 2020, 47 NMEs had been approved by the FDA, which is only one drug off the level of NMEs approved in 2019, when 48 NMEs were approved (see Figure 3 further below in article) and which is on par with prior years.

3. The new AbbVie: AbbVie’s $63-Bn acquisition of Allergan. The mega deal of 2020 was AbbVie’s completion of its $63-billion acquisition of Allergan in May (May 2020). The deal, which was first announced in June 2019, positions AbbVie as it faces near-term biosimilars competition for its top-selling drug, Humira (adalimumab), a drug to treat autoimmune diseases in multiple indications. Humira had 2019 sales of approximately $19.2 billion, which accounted for 58% of AbbVie’s 2019 total revenues of $33.27 billion.

The deal secured both AbbVie’s and Allergan’s previous efforts for a mega deal. Facing biosimilar competition for Humira, AbbVie over the past several years has made acquisitions or tried to make acquisitions to diversify its product portfolio with near-term biosimilars competition for Humira. Chief among them was its $21-billion acquisition of Pharmacyclics, a Silicon Valley, California-based company developing small-molecule medicines for the treatment of cancers and immune-mediated diseases. That deal, which was completed in 2015, provided AbbVie with Imbruvica (ibrutinib), co-developed with Johnson & Johnson, and now one of AbbVie’s top-selling products with 2019 global sales of $4.67 billion. Both Allergan and AbbVie had previously been involved in recent mega mergers that did not come to fruition and which were both called off due to uncertainty at the time of US policy for corporate inversions, a practice by which a US-based multinational company restructures so that the US parent is replaced by a foreign corporation as a means to achieve a lower tax rate. The potential of lower corporate tax rates was part of the rationale for Pfizer’s proposed $160-billion merger with Dublin, Ireland-headquartered Allergan in 2015, and in AbbVie’s proposed $55-billion acquisition of Jersey, UK-incorporated Shire in 2014. In 2016, Pfizer called off its proposed $160-billion merger with Allergan, which would have been the largest merger in the history of the pharmaceutical industry, and AbbVie called off its merger with Shire in 2014; Shire was later acquired by Takeda for $63 billion in a deal completed in January 2019.

4. Viatris launches as new company: Mylan plus Upjohn, Pfizer’s off-patent branded and generic established medicines business. Viatris is the new company formed from the combination of Upjohn, Pfizer’s off-patent branded and generic established medicines business, and Mylan. The companies had announced the deal in July 2019, and closed the deal and launched the company last month (November 2020).

For both Mylan and Pfizer, the deal represented the execution of strategic decisions to address performance in their respective businesses. In August 2018, Mylan, a generic-drug company, formed a strategic review committee to evaluate alternatives for its businesses following weak performance in its North American segment. Mylan, like other large generic-drug companies, faced increased pricing pressure and competition, particularly in the US market. For its part, Pfizer had been evaluating possible separation of its generics and established product business dating back to when the company was led by Ian Read, who stepped down as Chief Executive Officer (CEO) in January 2019, with Albert Bourla, formerly the Chief Operating Officer of Pfizer, taking the role of CEO. Pfizer then re-organized into three main areas: the Biopharmaceutical Group, which includes its prescription, innovator products; Upjohn, which includes its off-patent branded and generic established medicines business; and Consumer Healthcare, which includes its over-the-counter business. Viatris is led by Robert Coury, Executive Chairman, formerly Executive Chairman of Mylan, and Michael Goettler, CEO, formerly Group President, Upjohn.

Viatris is now composed of Upjohn, Pfizer’s off-patent branded and generic established medicines business, and Mylan. Upjohn, which primarily consists of off-patent, oral, solid-dosage legacy products, posted 2019 revenues of $10.2 billion, representing approximately 20% of Pfizer’s 2019 revenues of $51.75 billion. Mylan posted 2019 revenue of $11.5 billion, a 1% gain over 2018. The portfolio of Viatris now comprises more than 1,400 approved molecules for generic, complex generic and branded medicines, biosimilars, and over-the-counter consumer products.

5. Gilead Sciences’ $21-Bn acquisition of Immunomedics. Another large deal completed in 2020 was Gilead Sciences’s $21-billion acquisition of Immunomedics, a Morris Plains, New Jersey-based clinical-stage biopharmaceutical company focused on antibody-drug conjugates (ADCs). Gilead had announced the acquisition in September (September 2020) and completed the deal in October (October 2020). Immunomedics’ lead product is Trodelvy (sacituzumab govitecan-hziy), an ADC that was granted accelerated approval by the US Food and Drug Administration (FDA) earlier this year (April 2020) for treating adult patients with metastatic triple-negative breast cancer who received at least two prior therapies for metastatic disease. Immunomedics says it plans to submit a supplemental biologics license application (BLA) to support full approval of Trodelvy in the US in the fourth quarter of 2020. Immunomedics is also on track to file for regulatory approval in Europe in the first half of 2021.

6. Danaher’s $21.4-Bn acquisition of GE Healthcare Life Sciences and launch of Cytiva. On the supply side, the largest deal of 2020 was Danaher’s completion of its $21.4-billion acquisition of GE Healthcare Life Sciences in April (April 2020) and the subsequent re-branding of the former GE business to a new company, Cytiva. Danaher Corporation, a global science and technology company, headquartered in Washington D.C., announced the deal in February 2019. Cytiva, which is now a standalone company in Danaher’s life-sciences segment, had nearly 7,000 employees and operations in 40 countries with sales of approximately $3.3 billion at the time of the deal closing earlier this year (2020). Cytiva is a provider of instruments, consumables, and software that support the research, discovery, process development and manufacturing workflows of biopharmaceuticals. The business is comprised of process chromatography hardware and consumables, cell-culture media, single-use technologies, development instrumentation and consumables, and services.

7. Merck & Co.’s pending spin-off of women’s health, biosimilars & legacy products to form a new company. Another important announced deal in 2020 was Merck & Co.’s plans, announced in February (February 2020), to spin off products from its Women’s Health, Legacy Brands, and Biosimilars businesses to form a new, independent, publicly traded company (to be called Organon & Co.) and retain higher growth products in Merck & Co. The spin-off will reduce Merck’s Human Health manufacturing footprint by approximately 25% and the number of Human Health products it manufactures and markets by approximately 50%. The move would enable Merck to achieve in excess of $1.5 billion in operating efficiencies by 2024, as reported on the time of the announced spin-off.The spin-off is expected to be completed in the second quarter of 2021, subject to market and certain other conditions.

8. Reshoring drug manufacturing gains policy momentum. One of the impacts of the COVID-19 pandemic has been a move by governments, including the US, the European Union (EU), and others to either require or incentivize the onshoring of some drug manufacturing domestically. These proposals/actions have largely been focused on medicines deemed “essential” and apply to certain generic drugs and are seen as a way to mitigate vulnerabilities in the drug supply chain that have been exposed during the COVID-19 pandemic. The extent to which these proposals/actions move forward in the US with a new President/Administration and Congress taking office later in January (January 2021) has yet to be determined. In general, policy for re-shoring drug manufacturing domestically has bipartisan support although its extent and measures to implement remain subject to debate.

In the US, President Donald Trump issued several executive orders in 2020 to authorize US federal departments and agencies to evaluate ways to re-shore drug manufacturing. The latest executive order was issued in October (October 2020), which directed the US Food and Drug Administration (FDA), in consultation with federal partners, to identify a list of essential medicines, medical countermeasures, and critical inputs (inclusive of active pharmaceutical ingredients [APIs]) that are medically necessary to have available at all times in an amount adequate to serve patient needs and in the appropriate dosage forms. The FDA issued such a list, subject to public comment, compromised of 223 drugs and biological products. This executive order followed another executive order issued in August (August 2020), which put forth the policy goals and authorization for certain federal departments and agencies, including the US Department of Health and Human Services (HHS) and the FDA, to increase US-based production and federal procurement of essential medicines, medical countermeasures, and critical inputs.

Outside the US government, in late April (April 2020), the Association for Accessible Medicines, which represents generic-drug companies and manufacturers, issued its proposal for re-shoring drug manufacturing of designated essential medicines in the US through various measures, such as providing tax incentives, grants, and volume guarantees to incentivize drug manufacturers and make re-shoring drug manufacturing economically feasible.

Other countries have also proposed or launched plans to reshore drug manufacturing. A reduction of reliance on offshore drug manufacturing is on the policy table in the European Union (EU) as part of the European Commission’s Pharmaceutical Strategy for Europe, which the European Commission (EC) adopted late last month (November 2020). It includes a plan for initiating a structured dialogue with and between stakeholders in pharmaceutical manufacturing and public authorities to identify vulnerabilities in the global supply chain of critical medicines and shape policy options to strengthen the continuity and security of supply in the EU.

Earlier this year (2020), the UK government began developing a strategy, Project Defend, as a means to increase supply-chain resilience, including for pharmaceuticals, by identifying vulnerabilities and reducing dependence on offshore sources. Also, earlier this year (2020), the Indian government launched a multi-year plan where financial incentives would be offered for domestic production of certain eligible products. It seeks to reduce import dependence for critical starting materials, intermediates, and APIs of those products.

9. Some drug pricing reforms in the US move forward. Last month (November 2020) the US Department of Health and Human Services Secretary Alex Azar announced two actions to address the cost of prescription drugs in the US that followed up on executive orders issued by President Donald Trump earlier this year (2020). The first measure, known as the Most Favored Nation (MFN) model, is a drug-payment model through the Center for Medicare and Medicaid Innovation at the Centers for Medicare & Medicaid Services that will lower Medicare Part B payments for certain prescription drugs to the lowest price for similar countries. Starting in January (2021), the MFN model will test a way for Medicare, the US federal healthcare program for people over 65 years of age, to pay no more for physician-administered Medicare Part B drugs than the lowest price charged in other similar countries. The model will apply to 50 drugs and biologicals, and the test will run for seven years.

The second measure puts forth a final rule that would limit rebates paid to pharmacy benefit managers (PBMs) by drug makers under Medicare Part D, the outpatient prescription drug program under Medicare. Specifically, the rule ends protections that allow pharmacy benefit managers (PBMs) to pass along Medicare Part D prescription rebates to insurers, excludes safe harbor protections under the Anti-Kickback Statute for rebates paid by drug manufacturers to PBMs, and creates new safe harbor protections for these rebates to be passed directly to consumers at the point of sale. Further drug pricing reforms will likely be considered with the new US President/Administration and new Congress taking office next month (January 2021).

10. Brexit uncertainty still looms. The UK and the European Union (EU) are facing a December 31, 2020 deadline to reach a deal or not that would define the UK’s future relationship with the EU post Brexit. As the clock winds down to reach a deal or not, the pharma industry is asking that the EU and the UK prioritize medicines in trade talks, including measures for manufacturing. After a multi-year process to exit the EU, the UK officially exited the EU earlier this year on January 31, 2020 and entered into a 11-month transition period until the end of 2020 to work out or not its future relationship with the EU. During the transition period, EU law and rules are still applicable across the UK, and the UK remains part of the EU single market and custom union until the end of the year (2020). But how the UK will leave the EU is the question both parties are now facing. As of press time on December 2, 2020, it has yet to be seen if the EU and the UK will be able to work out a new trade deal as both parties continue to negotiate.

Reference

1. J. Miller, “Challenging Years Are Ahead for the Biopharma Industry,” DCAT Value Chain Insights, November 10, 2020.