Global Pharma Watchlist: India

Last month (June 2021), India’s Department of Pharmaceuticals issued operational guidelines for the country’s new production-linked incentive (PLI) scheme for starting materials, intermediates, and APIs. The PLI scheme is intended to increase India’s domestic production of starting materials, intermediates, and APIs. What is behind the plan?

Move to increase domestic API production

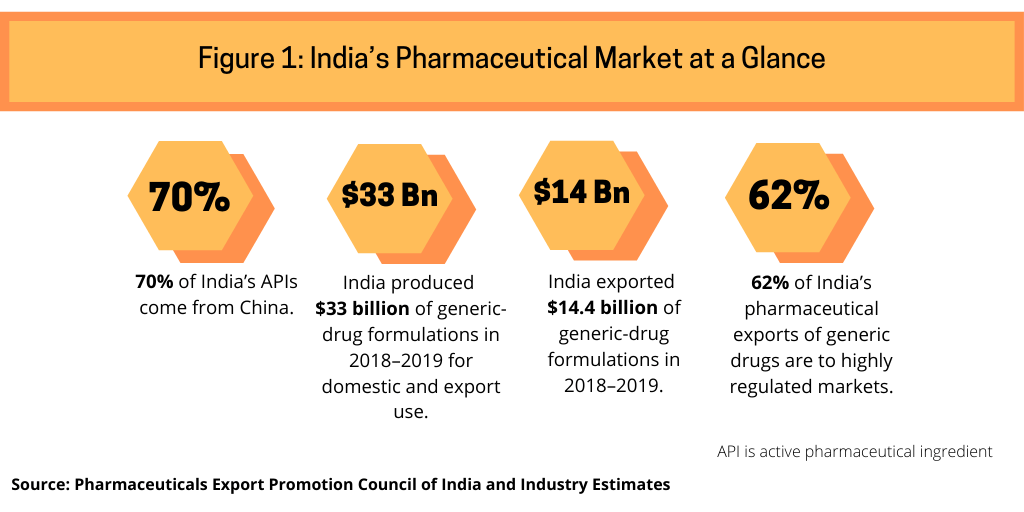

As much as India is a large exporter of generic drugs globally, it is a large importer of active pharmaceutical ingredients (APIs), particularly from China, from which it imports 70% of its APIs (see Figure 1), according to industry estimates. India uses these APIs to make drugs, particularly generic drugs, for domestic and export use. India’s pharmaceutical market in 2018–2019 totaled $40 billion (both domestic and export use), according to the Pharmaceuticals Export Council of India, the authorized agency of the government of India for promotion of pharmaceutical exports from India and supported by India’s Ministry of Commerce and Industry. India is self-sufficient in generic-drug formulations and produced $33 billion worth of generic-drug formulations in 2018–2019, of which it exported $14.4 billion, of which 62% of such exports went to highly regulated markets (see Figure 1).

As with other countries, the COVID-19 pandemic caused the Indian government to more fully examine its supply chains across multiple sectors, including pharmaceuticals. With its reliance on China for APIs and key starting materials, the Indian government approved a plan in March 2020 aimed at increasing domestic API production in India. One component of the plan is providing financing for common infrastructure facilities for three bulk drug parks in India over the next several years. Under the plan, the government of India will provide grants-in-aid to states. Parks will have common facilities such as solvent-recovery plants, distillation plants, power and steam units, and common effluent treatment plants.

Production-linked incentive scheme: starting materials, intermediates, and APIs

The plan also included production-linked incentive (PLI) schemes. The first plan is a PLI (PLI 1.0) for bulk drugs, which includes critical key starting materials, drug intermediates, and APIs. It provides funding of INR 69.4 billion ($929 million) to eligible applicants with greenfield projects supporting domestic manufacturing in India of key starting materials, intermediates and APIs, which include minimum annual production amounts for the targeted products.

Under the PLI scheme, financial incentives will be given to eligible manufacturers of 53 bulk drugs on their incremental sales over the base year (FY 2019-20). Out of 53 identified bulk drugs (covers 41 products and 53 APIs), 26 are fermentation-based, and 27 are chemically synthesized. For fermentation-based bulk drugs, the rate of incentive is 20% of incremental sales value for FY 2022-2026, 15% for FY 2026-27, and 5% for FY 2027-2028. For chemically synthesized drugs, the rate of incentive is 10% of incremental sales value for FY 2021-2027.

The goal of India’s government is clear, namely, to reduce the company’s dependence on imported APIs, which the government estimates for some specific bulk drugs can be as high as 80% to 100%. The Indian government said the plan is expected to reduce manufacturing costs of bulk drugs in the country and dependency on other countries for bulk drugs. The scheme is being implemented through a Project Management Agency (PMA), nominated by the Department of Pharmaceuticals. The PLI plan only applies to manufacturing of the 53 identified critical bulk drugs (i.e., key starting materials, drug intermediates and APIs). Applications for obtaining the incentives available under the scheme must be made via an online portal maintained by the PMA during a 60-day period from June 2, 2021 through July 28, 2021.

PLI scheme for pharmaceuticals

India also adopted earlier this year (2021) a PLI for pharmaceuticals (PLI 2.0) as a means to increase product diversification and higher-valued pharmaceutical production in India. In adopting the PLI for pharmaceutical, the Indian government pointed to that low-value generic drugs account for the major component of Indian exports, and a large proportion of domestic demand for patented drugs is met through imports. It pointed to a lack of high-value production along with the necessary pharma R&D in the country and the need to incentivize specific high-value goods such as biopharmaceuticals, complex generic drugs, patented drugs or drugs nearing patent expiry, and cell-based or gene-therapy products.

The PLI for pharmaceuticals applies to FY 2020-2021 to FY 2028-2029. Under the PLI scheme for pharmaceuticals, manufacturers of pharmaceutical goods registered in India are grouped based on their global manufacturing revenue (GMR) as follows:

Group A: GMR of at least INR 50 billion ($670 million);

Group B: GMR of at least INR 5 billion ($67 million) but less than INR 50 billion ($670 million); and

Group C: GMR less than INR 5 billion ($67 million). Micro, small, and medium enterprises (MSME) are a subgroup within Group C.

The total amount of incentives (inclusive of administrative expenditure) under the scheme is about INR 150 billion (approximately $2 billion). The incentive allocation among the target groups is as follows: (1) Group A: INR 110 billion ($1.47 billion); Group B: INR 22.5 billion ($301 million); and (3) Group C: INR 17.5 billion (234 million)

In terms of products, the PIL scheme covers pharmaceutical goods under three categories. The first category covers the following: biopharmaceuticals; complex generic drugs; patented drugs or drugs nearing patent expiry; cell-based or gene-therapy products; orphan drugs; special empty capsules (such as hydroxypropyl methylcellulose (HPMC) or enteric); complex excipients; phyto-pharmaceuticals: and other drugs as approved. The second category covers APIs, key starting materials, and drug intermediates. The rate of incentive on incremental sales (over base year) of pharmaceutical goods covered under Category 1 and 2 will be 10% for FY 2022-23 to FY 2025-26, 8% for FY 2026-2027 and 6% for 2027-2028.

The third category covers drugs not covered by the first two categories and includes the following: repurposed drugs; autoimmune drugs; anti-cancer drugs; anti-diabetic drugs; anti-infective drugs; cardiovascular drugs; psychotropic drugs and anti-retroviral drugs; in vitro diagnostic devices; other drugs as approved; and other drugs not manufactured in India. The rate of incentive on incremental sales (over base year) of pharmaceutical goods covered under Category-3 will be 5% for FY 2022-2023 to FY 2025-2026, 4% for 2026-2027 and 3% for 2027-2028.