Novartis CEO Targets 20 Key Drugs as Potential Blockbusters

Novartis CEO Vasant Narasimhan is banking on six drugs in the near term and 20 pipeline assets longer term as potential blockbusters. What are the key products?

CEO

Novartis

Novartis’ growth strategy

Novartis CEO Vasant Narasimhan outlined the company’s near- and long-term growth strategy for its Innovative Medicines business at the company’s R&D Day on December 2, 2021. In the near term, the company is seeking to achieve a compound annual growth rate (CAGR) of 4%+ through 2026, led by six key products. He also outlined up to 20 pipeline assets, with possible approval by 2026, with potential blockbuster status (defined as drugs with sales of $1 billion or more). Beyond 2030, the company is seeking to increase its product development in biologics and products with advanced technology platforms, which include cell and gene therapies, RNA-based therapies, radioligand therapies, and targeted protein degraders used for undruggable small-molecules drugs.

Novartis’ near-term growth strategy

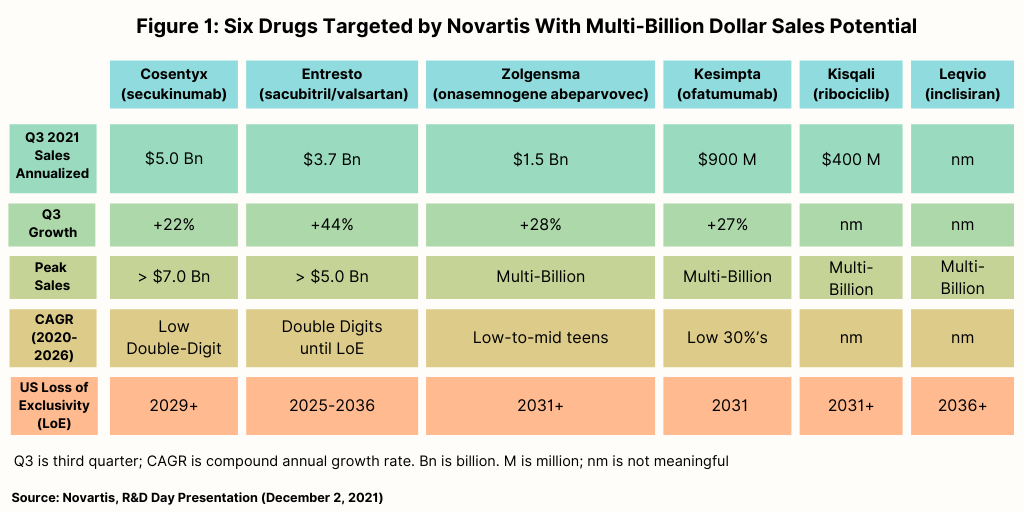

In the near term, Novartis is targeting six products, three of which have reached blockbuster status, and three which have potential for blockbuster status (see Figure 1). Of the three current blockbusters, one is a biologic—Cosentyx (secukinumab)—one is a small molecule—Entresto (sacubitril/valsartan)—and one is a gene therapy, Zolgensma (onasemnogene abeparvovec).

Cosentyx, used to treat psoriasis, ankylosing spondylitis, and psoriatic arthritis, has projected 2021 global revenues of $5.0 billion and forecasted peak sales through 2026 of more than $7.0 billion, according to information from Novartis. Entresto, used to treat heart failure, has projected 2021 global revenues of $3.7 billion and forecasted peak sales through 2026 of more than $5.0 billion. Zolgensma, used to treat a rare disease, spinal muscular atrophy, has projected 2021 global revenues of $1.5 billion and forecasted peak sales through 2026 in the multi-billion range (see Figure 1 above).

The three other drugs Novartis is targeting for blockbuster status in the near term consist of a biologic, a small molecule, and a small interfering RNA (siRNA) therapy, one of the advanced technology platforms being targeted by Novartis. On the precipice for blockbuster status is the biologic, Kesimpta (ofatumumab), for treating relapsing forms of multiple sclerosis, with projected 2021 revenues of $900 million and forecasted peak sales through 2026 in the multibillion-dollar range, according to information from Novartis. Kisqali (ribociclib), a small-molecule drug used to treat certain types of breast cancer, and Leqvio (inclisiran), a chemically synthesized siRNA therapy to reduce low-density lipoprotein cholesterol, also are projected by Novartis to achieve blockbuster status by 2026 (see Figure 1 above). Leqvio is approved in 50 countries, including the European Union and the UK, and is under regulatory review in the US. Novartis gained inclisiran in its $9.7-billion acquisition of The Medicines Company in 2020.

The company’s near-term strategy seeks to not only drive growth but to compensate for a projected $9-billion loss in revenue through 2026 due to generic-drug competition for key products. Products with future generic-drug impact up to 2026 include: Entresto (sacubitril/valsartan) for treating heart failure, assuming loss of exclusivity in the US in 2025; Lucentis (ranibizumab) for treating macular degeneration (the drug was developed by Roche and is marketed by Novartis in Europe); Gilenya (fingolimod) for treating multiple sclerosis; Tasigna (nilotinib) for treating chronic myeloid leukemia; Promacta (eltrombopag) for treating immune thrombocytopenia and severe aplastic anemia; Sandostatin (octreotide) for treating carcinoid tumors and acromegaly; Xolair (omalizumab) for treating severe allergic asthma and chronic spontaneous urticaria; Afinitor (everolimus) for treating breast cancer and giant cell astrocytoma; the Q-Family of certain respiratory products; and Votrient (pazopanib) for treating late-stage kidney cancer and advanced soft tissue sarcoma.

Novartis’ longer-term growth strategy

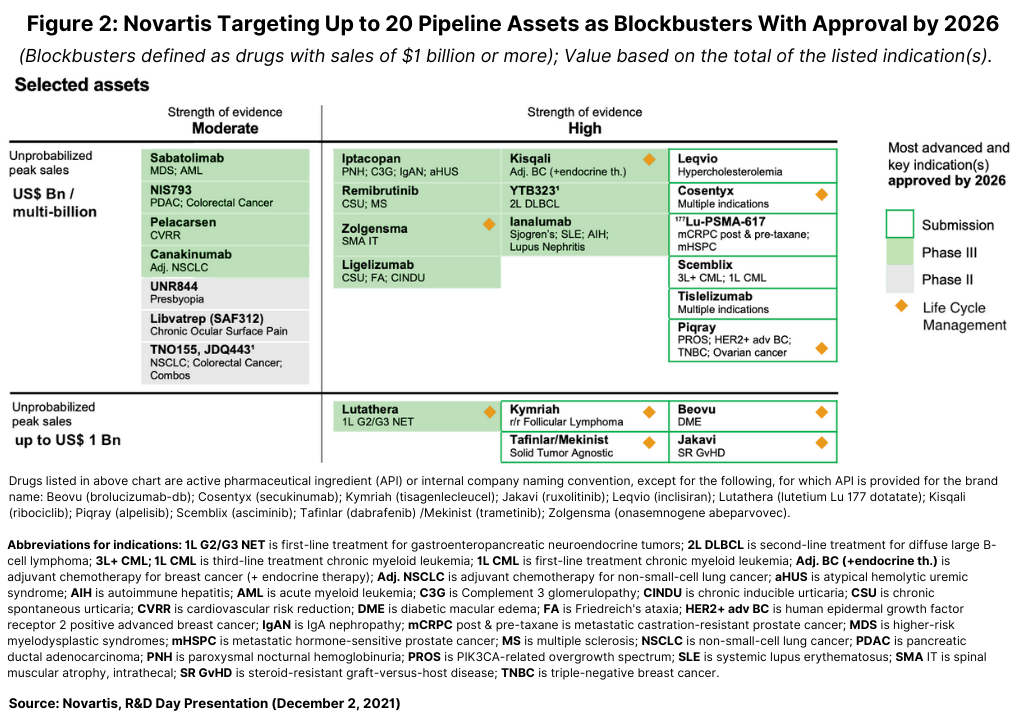

Longer term, Novartis’ Narasimhan highlighted up to 20 pipeline assets, with possible approval by 2026 in key indications, with the potential to achieve blockbuster status (see Figure 2). These assets include new pipeline candidates and new indications for existing drugs.

Two important product launches for 2022 include those for Scemblix (asciminib) for treating chronic myeloid leukemia (CML) and 177 Lu-PSMA-617, a radioligand therapy for treating metastatic castration-resistant prostate cancer. Scemblix was approved by the US Food and Drug Administration in October 2020 for treating CML in two distinct indications: adult patients with Philadelphia chromosome-positive CML in chronic phase (Ph+ CML-CP) previously treated with two or more tyrosine kinase inhibitors and full approval for adult patients with Ph+ CML-CP with the T315I mutation. Novartis gained 177Lu-PSMA-617 from its $2.1-billion acquisition of Endocyte, a Lafayette, Indiana-based bio/pharmaceutical company, in 2018. The drug is under regulatory review in the US and European Union with decisions expected in the first half of 2022.

Beyond 2030: portfolio shifts to biologics and advanced technology platforms

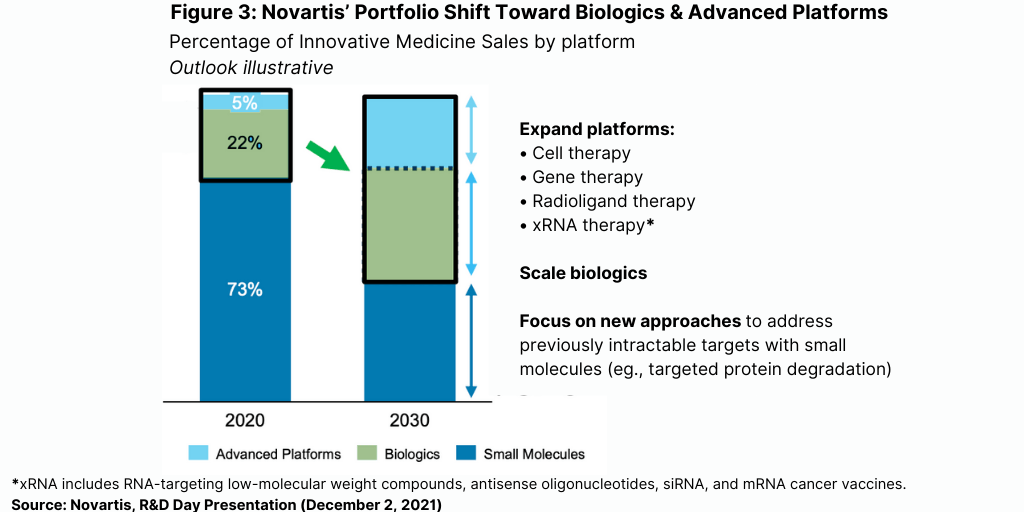

Longer term beyond 2030, Novartis says it will seek to drive growth by scaling up its product development in biologics and advanced technology platforms for newer modalities, such as cell and gene therapies and RNA-based products. At the same time, it will decrease its share in small molecules but will use approaches, such as targeted protein degradation, to address previously intractable targets with small molecules (see Figure 3). Currently, the majority of Novartis’ product portfolio (based on sales) is in small molecules (73%) with biologics accounting for 22% and products with advanced technology platforms only 5%. By 2030, Novartis sees small molecules, biologics, and advanced technology holding more equalized shares in its portfolio (see Figure 3)

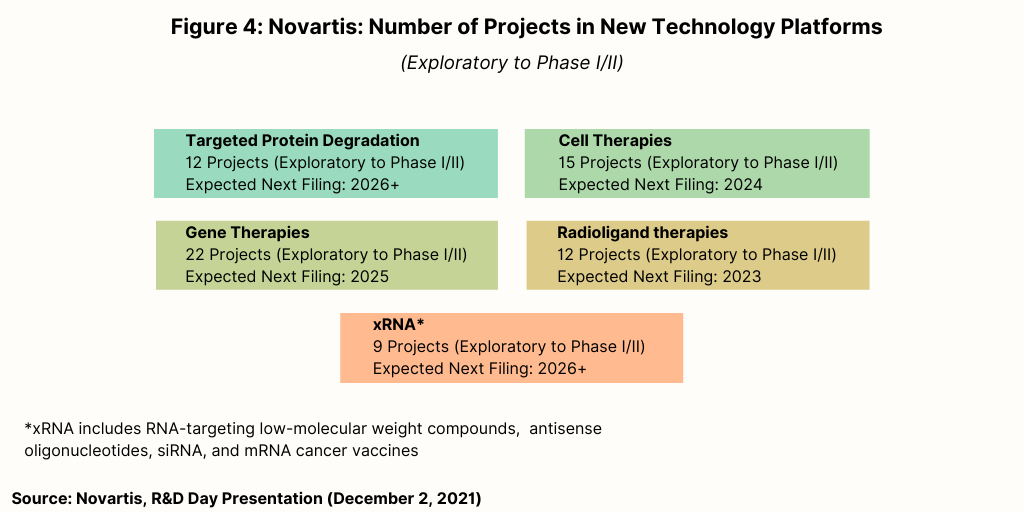

Figure 4 breaks down Novartis’ early-stage (i.e., exploratory to Phase I/II development) portfolio for products with advanced technology platforms. In addition to cell and gene therapies and RNA-based therapies, this area also includes radioligand therapies and small molecules with targeted protein degradation. Novartis increased its presence in these areas with recent acquisitions. For radioligand therapies, in addition to its $2.1-billion acquisition of Endocyte in 2018, Novartis made its first large play in radioligands in 2018 with its $3.9-billion acquisition of Advanced Accelerator Applications, a Saint-Genis-Pouilly, France-based bio/pharmaceutical company

This year (2021), Novartis further enhanced that position. In March (March 2021), the company acquired development and commercial rights to two radioligand therapies targeting fibroblast activation proteins on the surface of tumor cells from iTheranostics, a Sarnen, Switzerland-based company. Earlier this month (December 2021), Novartis signed a $580 licensing deal ($20 million upfront and $560 million in milestone payments) with Molecular Partners, a Zurich-based bio/pharmaceutical company, to develop, manufacture, and commercialize DARPin-conjugated radioligand therapies for oncology. DARPins refer to “designed ankyrin repeat proteins,” which are genetically engineered antibody mimetic proteins typically exhibiting highly specific and high-affinity target protein binding.

For targeted protein degradation therapies, Novartis inked a $1.3-billion deal with Dunad, a Cambridge, UK-based bio/pharmaceutical company to develop orally bioavailable covalent and protein degrading small- molecule drugs. The deal consists of $24 million in an upfront payment, equity investment, and initial research funding plus up to $1.3 billion in discovery, development, regulatory, and sales-based milestones in addition to royalty payments.

Targeted protein degradation is a growing area of interest for bio/pharmaceutical companies as a means to develop previously undruggable small molecules. In August (August 2021), Eli Lilly and Company formed a $1.6-billion collaboration ($35 million upfront and up to $1.6 billion in milestone payments) with Lycia Therapeutics, a San Francisco-based company, to use Lycia’s lysosomal targeting chimera (LYTAC) protein degradation technology for up to five targets in Lilly therapeutic areas that include immunology and pain. In July (July 2021), Pfizer formed a $2.4-billion collaboration ($650 million upfront, $350-million equity investment, and $1.4 billion in milestone payments) with Arvinas, a New Haven, Connecticut-based company, to develop and commercialize Arvinas’ ARV-471, an investigational oral estrogen receptor protein degrader to treat breast cancer.