The EU and Medicines Shortages: Root Causes and Mitigation

The European Commission released a new report detailing medicines shortages in the EU, with manufacturing and quality a leading cause. What’s the solution?

Drug shortages and the EU

The problem of drug shortages has received significant public and political attention in the European Union (EU), most recently with the European Commission’s Pharmaceutical Strategy for Europe. In October (October 2021), the European Commission put out a public consultation, which will be open until December 21, 2021, to gather views from stakeholders and the public on revisions to the EU’s pharmaceutical legislation, including measures impacting supply and manufacturing. The consultation is part of the Structured Dialogue process to identify the causes and drivers of potential supply-chain vulnerabilities, including EU dependencies on offshore sources for raw materials, active pharmaceutical ingredients (APIs), and intermediates, as a means to improve pharmaceutical supply-chain resilience and mitigate drug shortages. In addition, since 2019, the EU’s Task Force on the Availability of Authorized Medicines has been running a pilot program on establishing a single point of contact (SPOC) network on shortages to improve information sharing between EU member states, the European Medicines Agency, and the European Commission to coordinate actions to help prevent and manage shortages.

Late last month (November 2021), the European Commission released the results of a study, Future-proofing Pharmaceutical Legislation—Study on Medicine Shortages, which examined more specifically the root causes of shortages, the types of products involved, and recommendations to mitigate such shortages. The study shows that medicines shortages most often involve older, off-patent, and generic medicines. The causes were found to be multifactorial with bottlenecks identified along the entire pharmaceutical value chain, from manufacturing of raw materials to national pricing and procurement practices. The study focused on the situation in the EU and the European Economic Area, which includes EU member states and Iceland, Liechtenstein, and Norway, in the period 2004-2020.

Extent of the problem

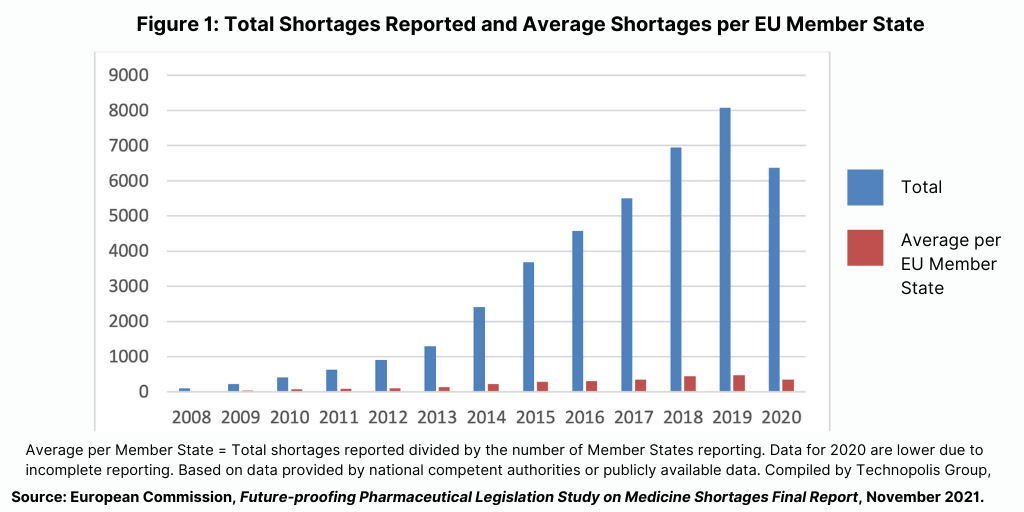

Since 2007, notifications of shortages of medicines have steadily increased across the EU (see Figure 1). Part of that increase is due to more EU member states reporting shortages and improved systems for reporting, but the data also show increases in medicines shortages overall. Although around 70% of the increase over 2008-2020 can be attributed to the increase in the number of EU member states reporting shortages, even after this adjustment, there is still a notable increase in notifications.

Notified shortages most frequently concerned medicines used to treat conditions of the nervous system; these medicines had a 55% increased probability of going in shortage. Other classes of medicines frequently notified as being in shortage are cardiovascular medicines, anti-infectives, medicines to treat conditions of the alimentary tract and metabolism, and oncology drugs. Cardiovascular medicines and anti-infectives had respectively 32% and 48% increased probability of being in shortage. Oncology medicines had a 39% increased probability of being in shortage. By contrast, although they form the fourth largest group of products in shortage, medicines acting on the alimentary tract and metabolism had a 40% reduced probability of a shortage.

Studies of shortages in the US report greatest supply problems with sterile solutions, emergency medicines, antibacterial medicines, vaccines, and immunoglobulin products. This suggests that, although there is some overlap between the situations in the EU and in the US, there are also some notable differences, according to the EU study. These include very substantial differences in market characteristics between these regions, such as pricing and procurement policies or the greater fragmentation of the European market, or by differences in the structure of the pharmaceutical supply chain (e.g., production location of APIs and finished products).

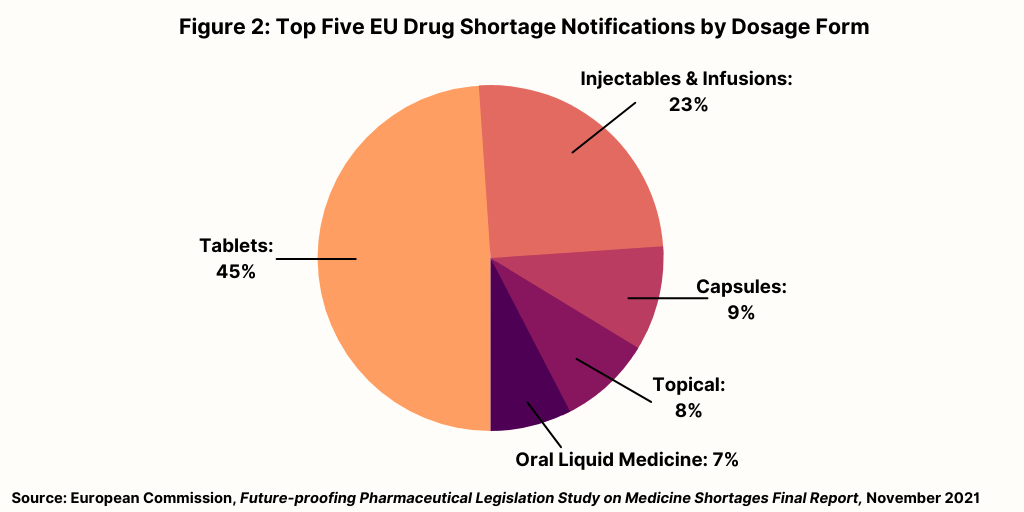

Figure 2 breaks down medicines shortages in the EU based on dosage form. Nearly half (45%) of all reported shortages concern medicines in tablet form while around a quarter (23%) concern medicines that are administered as injectables or infusions. Other formulations make up relatively small volumes of overall notifications.

Manufacturing and quality leading cause of drug shortages

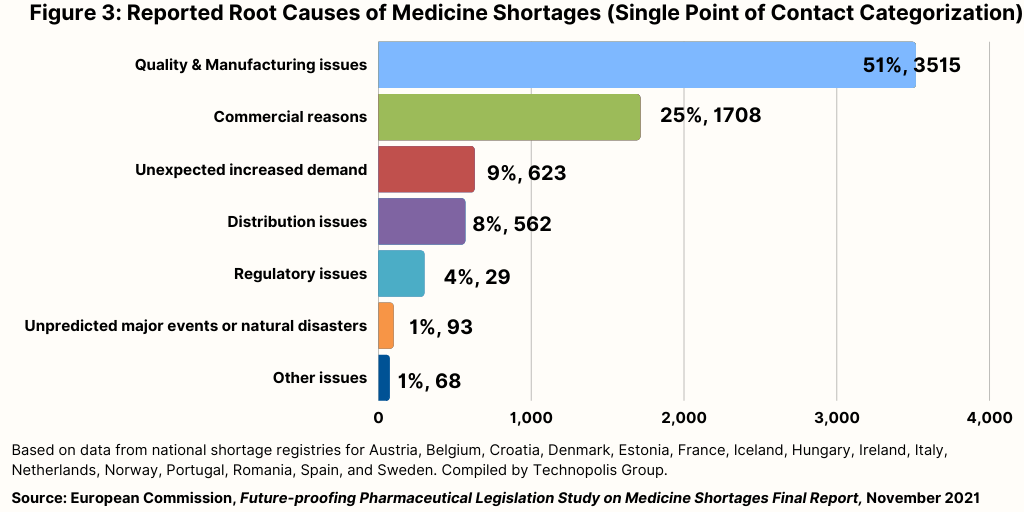

Figure 3 provides information on the root cause for 6,863 shortages, which shows that the most often recorded cause relates to quality and manufacturing issues (51%). Commercial reasons were the second most common reported root cause (25%).

Further analysis using information obtained from stakeholders via interviews and surveys also identified manufacturing and quality as the leading causes of shortages. Nearly all (90%) of survey respondents from national competent authorities, as well as pharmaceutical wholesalers or distributors (96%), report manufacturing issues as one of the three main reasons for product shortages. Their views are shared, albeit to a somewhat lesser extent, by many (60%) of pharmaceutical manufacturers.

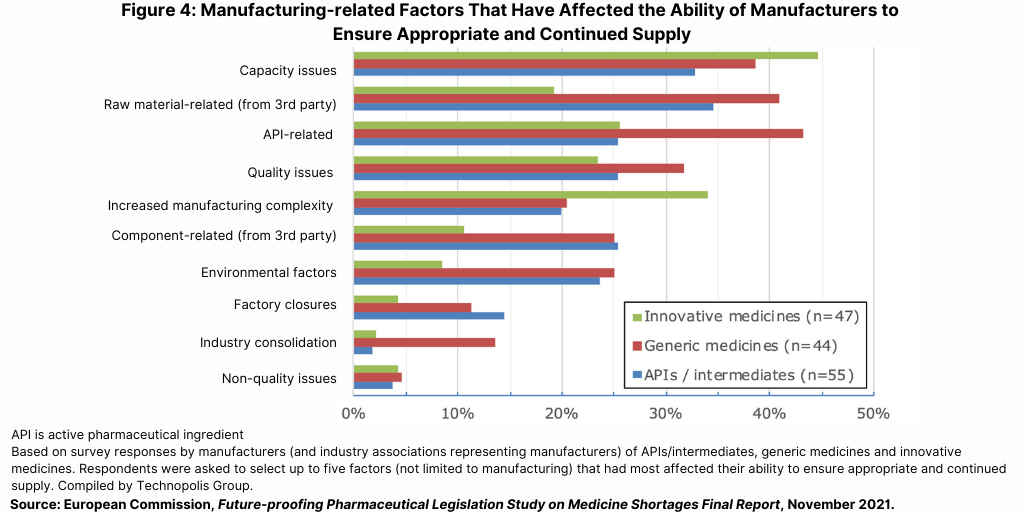

The study showed that many pharmaceutical manufacturers report having experienced problems with manufacturing capacity as well as with sourcing of APIs, raw materials, and other components (see Figure 4). These latter problems are reported more with the production of generic medicines than of innovative medicines, indicative of different structures of the respective supply chains. A recent analysis performed for the European Fine Chemicals Group indicates that most of the innovative APIs are still manufactured in Europe but that price pressures on generic manufacturers have pushed these companies toward lower-priced API suppliers, most of which are based outside of Europe. For purposes of the EU study, most countries did not provide data on where APIs for products in shortage were sourced; consequently, the study could not independently assess the association between location of API production and shortages.

In addition, producers of innovative medicines more often reported supply problems due to increased manufacturing complexity, according to the EU study. Significant supply disruptions due to non-quality related issues (e.g., mechanical or software failure during manufacturing) or factory closures appear to be relatively uncommon.

Most (70%) of national competent authorities’ representatives have linked shortages also to quality issues and batch recalls. This view is shared by a significant number of manufacturers: 40% of API/finished products manufacturers, 45% of generics manufacturers, and 37% of innovative manufacturers.

The EU study notes that the pronounced role of manufacturing issues as a cause of shortages raises the question of whether there is a relation between specific types of products and the cause of their shortage. A proper understanding of such a relationship could inform the design of more targeted solutions. If, for instance, manufacturing issues are most closely associated with shortages of injectable medicines, this would lead to additional scrutiny of the manufacturing of these types of products. Alternatively, if shortages of anti-infective medicines show a clear link to problems with sourcing of APIs, the study says that would make a case for diversifying sourcing of APIs for this group of medicines.

Recommendations

In all, the European Commission’s study proposed 16 recommendations to address medicines shortages in the EU. One suggestion involves localizing production for pharma ingredients in the EU. The study notes that at present, a large part of all APIs and raw materials are produced in non-EU countries, which leads to limited oversight and control over supply chains. Non-EU based production also means that the supply of medicines to the EU is at increased risk from export restrictions or from events and policies that affect operations elsewhere. This was illustrated by the COVID-19 pandemic when API production in China was suspended due to local lockdowns.

A possible strategy to reduce the risk of shortages, as provided in the study, is to introduce measures that incentivize the diversification of the production of APIs, raw materials, and medicines. “These measures could be both economic and legislative in nature,” noted the study. “Economic measures may involve subsidies, grants or tax breaks while regulations could be introduced to mandate marketing authorization holders to source materials from multiple suppliers.”