Geographic Supply Lines: API Manufacturing

What countries lead in API manufacturing facilities for generic drugs? The location of manufacturing facilities is an important consideration as policymakers evaluate ways to mitigate supply-chain vulnerabilities.

Mapping the supply chain

The issue of supply-chain security and mitigation of supply risk is always an important issue in the bio/pharmaceutical industry, but its importance was further underscored with the COVID-19 pandemic as supply chains across all industrial sectors have been challenged. The issue of supply-chain resiliency has become an important policy consideration globally, including in the US, European Union, and elsewhere as policymakers evaluate to ways to improve supply chains for essential drugs.

Last month (March 2022), the US Pharmacopeia (USP), an independent scientific organization, announced the USP Medicine Supply Vulnerability Insights Series sourced from USP’s global Medicine Supply Map. The first of its kind, the USP Medicine Supply Map uses insights derived from the use of USP quality standards in more than 22 thousand locations around the world, spanning 92% of generic medicines approved in the US.

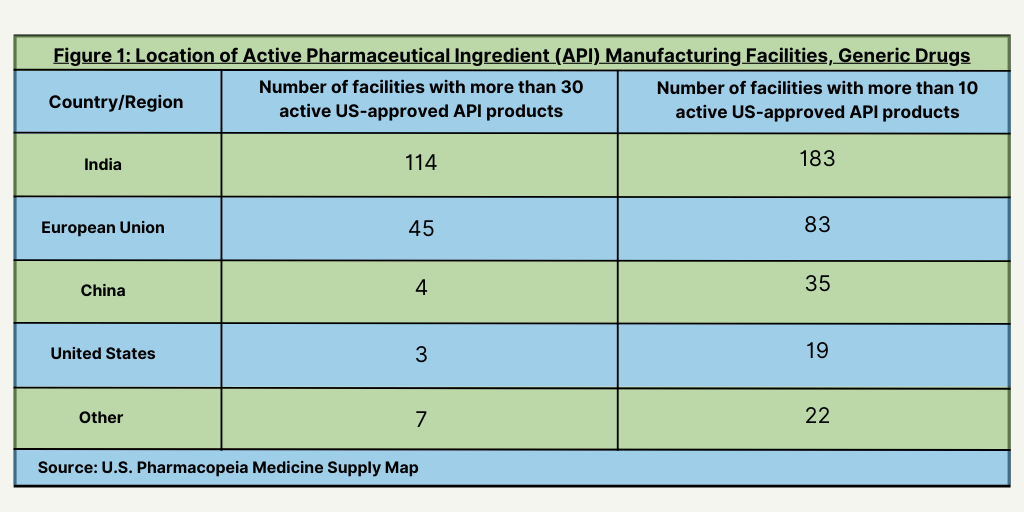

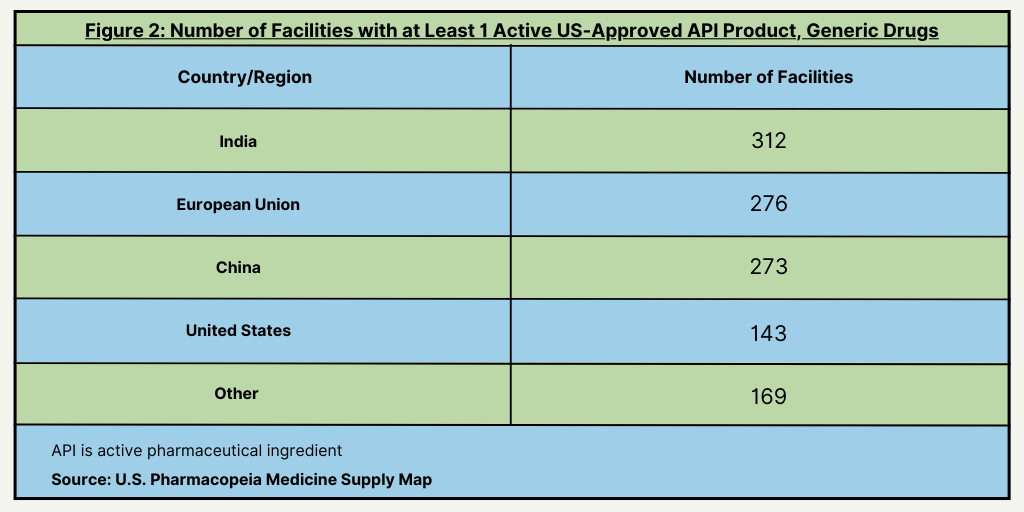

The first findings in the USP Medicine Supply Map Vulnerability Insights Series show the significance of large Indian facilities in the manufacturing of active pharmaceutical ingredients (APIs). India leads all countries with the most facilities with more than 30 active US-approved API products and with facilities with more than 10 active-US approved products for generic drugs (see Figure 1) followed by the European Union. India and the European Union also lead with the most facilities having at least one-US approved API product for generic drugs (see Figure 2).

USP’s Medicine Supply Map aggregates more than 40 external datasets and 250 million data points to quantify risk and resilience in the upstream pharmaceutical supply chain. It is intended as a tool to help inform regulatory and industry actions on drug supply chains, reduce disruptions, and inform public investment and policy reforms that build more supply-chain resilience.

The USP Medicine Supply Vulnerability Insights Series will look at the global distribution of APIs and risks associated with specific drug classes, from broadly used medicines, such as antimicrobials and statins, to those that are needed in small populations, such as pediatric oncology medications. Future findings will identify potential supply-chain risks that could impact the availability of critical medicines.

USP’s Medicine Supply Map will be discussed in upcoming USP Convention meetings to identify specific solutions to increase supply-chain resilience, develop recommendations to improve the continuous cycle of preparedness, including implications for national stockpiles, and increase international cooperation among supply-chain partners such as governments and manufacturers.

USP will also engage with its partners and stakeholders to inform the Medicines Supply Map to further identify vulnerabilities in the upstream pharmaceutical supply chain, deliver insights that can guide risk- mitigation strategies and investments, and help inform policy changes that advance supply-chain resilience.