Tracking Pharma Growth: Leading Therapeutic Sectors

Oncology continues to be the leading therapeutic sector in the global bio/pharma market on a value basis and in growth rates. What do the numbers show, and what other therapeutic sectors rank high in growth prospects?

Therapeutic sector growth

Spending on vaccines and therapeutics for COVID-19 contributed to strong growth in the global bio/pharmaceutical market in 2021, but the key question going forward is what are the growth prospects for non-COVID-19 products?

Global pharma sales (excluding vaccines), measured at ex-manufacturers’ prices, were above expectations in 2021 in every region, both on a value and volume basis. Overall, global pharma sales increased 8% in value and 4% in volume in 2021, according to information from IQVIA. In most regions, growth approximated to the average of 8%. The exception was Latin America, which grew by 20% (as measured at ex-manufacturers’ prices in US dollars). Overall, the global pharma market is projected to reach $1.7 trillion in 2025, excluding vaccines (at constant dollar, ex-manufacturers’ prices), with the US and China representing more than 50% of the global market (1).

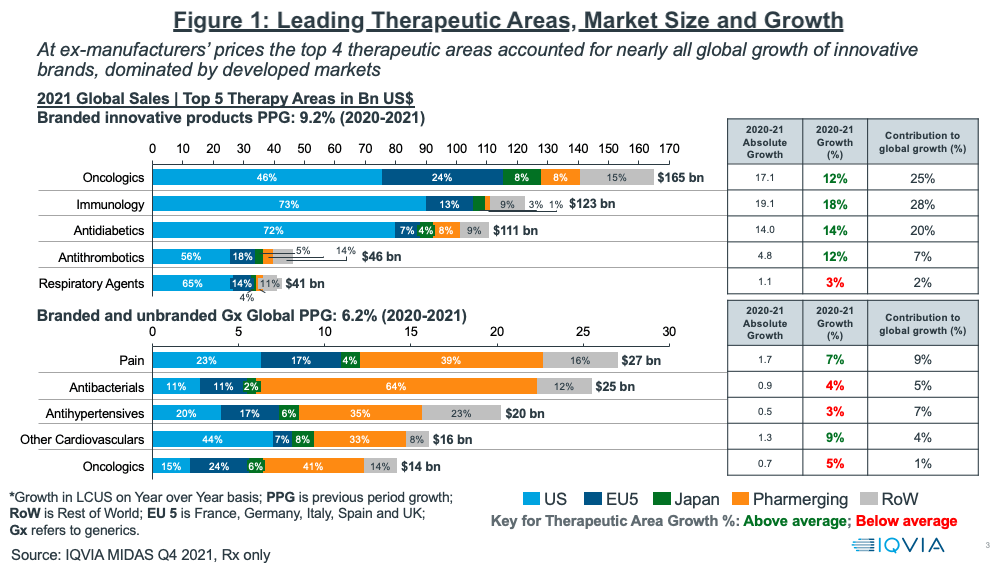

In looking at growth prospects on a therapeutic area basis, oncology continues to be the leading sector, both on an absolute level and growth basis (see Figure 1). Oncology and three other therapeutic areas (immunology, anti-diabetics, and anti-thrombotics) accounted for nearly all of global growth of innovative brands in 2020–2021, which was dominated by developed markets (as measured at ex-manufacturers’ prices). Combined, these four therapeutic areas accounted for 80% of the growth in innovative brands. Growing rebates, especially in the US, however, have been and will be a major challenge to growth in net sales. This is particularly noticeable in diabetes, where estimates suggest average rebates are above 50% (1).

For branded and unbranded generics, the top four therapeutics areas in 2020–2021 were pain management, anti-bacterials, anti-hypertensives, and other cardiovascular medicines. Combined, these four areas accounted for 25% of the growth in generics (see Figure 1 above).

US market aligns similarly

For the US market, which is the largest national market with an approximate 40% market share, oncology is the largest therapeutic sector driving growth in the US market. As in the global market, COVID-19 vaccines and therapeutics contributed strongly to US market growth in 2021, but growth is expected to return to pre-pandemic levels beginning in 2023 with a compound annual growth rate (CAGR) of 2.1% (with a range of 1-4%) through 2026 with the US market reaching about $450 billion on a net manufacturer price basis in 2026, according to a recent report by the IQVIA Institute for Human Data Science, The Use of Medicines in the U.S. 2022: Usage and Spending Trends and Outlook to 2026.

Spending on medicines in the US, at estimated net manufacturer prices, reached $407 billion in 2021, up 12.1% over 2020, as COVID-19 vaccines and therapeutics became widely available and added $29 billion in related spending, according to the IQVIA Institute report. In 2021, the non-COVID medicines market in the US grew more slowly, at only 4.9%, with growth tempered from the growing impact of biosimilars, which increased significantly, offsetting increased use of branded medicines.

While spending growth slowed in 2020 to less than 1%, from a combination of impacts on volume and spending on newly launched medicines, the pandemic impact was reduced in 2021. Net spending in the past five years (2017–2021) has grown at CAGR of 4.6%, including for COVID-19 products, but only 3.1% for all other medicines, reflecting a slowing trend without these new treatments. Medicine spending in the US grew $82 billion over the past five years (2017–2021), with COVID-19 products contributing $29 billion. In the prior five-year period (2016–2020), US medicine spending increased by 4.3%.

On a product basis, growth will be driven by adoption of newly launched innovative products, which are expected to occur at higher levels than in past years with an average of 50–55 new medicines launching per year over the next five years, including those in oncology or with specialty or orphan status. The IQVIA Institute projects an aggregate of $113 billion of new drug spending in the US over the next five years (2022–2026).

New brands in the next five years are expected to include large numbers of oncology, immunology, and neurology drugs as well as a significant proportion of rare disease treatments. Immunology, oncology, and neurology will drive the most growth in spending through 2026, representing the largest aggregate contributors to net growth in the US market over the next five years, predominately from a continued flow of new medicines and offset by losses of exclusivity, according to the IQVIA Institute report. US oncology medicines spending is expected to exceed $113 billion by 2026, with growth slowing to 9% from biosimilars penetration. Treatments for autoimmune disorders is projected to exceed $70 billion at net prices in the US by 2026, slowing after 2022 due to key biosimilars. Overall growth in neurology is expected to shift to positive in the next five years as continued innovation in wider population areas as well as significant potential upside related to Alzheimer’s and Parkinson’s therapies as well as rare neuromuscular disorders.

Reference

1. P. Van Arnum, “Pharma Industry Outlook: The Challenges and Opportunities,” DCAT Value Chain Insights, April 7, 2022.