The Battle of the Blockbusters: GLP-1 Agonists

GLP-1 agonist drugs, in the form of Novo Nordisk’s Wegvoy/Ozempic, and Lilly’s Mounjaro for weight management and treating Type II diabetes, were blockbuster winners in 2023, putting this therapeutic sector into high focus. What has been the impact on manufacturing and what are other contenders in this high-growth sector?

The battle of the GLP-1 agonists

Glucagon-like peptide 1 (GLP-1) agonists, which can be used to treat Type 2 diabetes and for weight management, are a rising class of blockbuster drugs (defined as drugs with sales of $1 billion or more). GLP-1 agonists work by promoting insulin secretion, which helps maintain blood sugar levels in patients with Type 2 diabetes. This class of drugs also may promote weight loss by reducing appetite and delay gastric emptying, thereby leading to reduced food intake.

Leading the charge in the GLP-1 market are Eli Lilly and Company and Novo Nordisk, each with blockbusters in this drug class. In 2023, Lilly had seven blockbuster drugs, led by its two top-selling products, Trulicity (dulaglutide) with revenues of $7.13 billion, and Mounjaro (tirzepatide) with sales of $5.16 billion, both GLP-1 drugs. Trulicity was first approved in 2014 in the US for treating Type 2 diabetes. Mounjaro was approved in the US for treating Type 2 diabetes in 2022, and in 2023, the same active ingredient, tirzepatide, was approved in the US for treating chronic weight management under the brand name, Zepbound.

Novo Nordisk has several GLP-1-based products for treating Type 2 diabetes: Ozempic (semaglutide, injection), Rybelsus (semaglutide, tablets), and Victoza (liraglutide). Combined, these drug posted 2023 sales of DKK 123,132 million ($17.7 billion), a 48% gain over 2022, as measured in Danish kroner, and by 52% at constant exchange rates. Ozempic accounted for the majority of these sales with 2023 sales of DKK 95,718 million ($13.8 billion), and Rybelsus accounted for sales of DKK 18,750 million ($2.7 billion).

Combined 2023 sales of two obesity-care GLP-1 products by Novo Nordisk, Wegovy (semaglutide) and Saxenda (liraglutide), were DKK 41,632 million ($6.0 billion). Wegovy has the same active ingredient, semaglutide, as Ozempic and Rybelsus, and Saxenda, the same active ingredient as Victoza.

Market outlook for GLP-1 drugs

The GLP-1 agonist market is poised for strong growth, with a compound annual growth rate (CAGR) of 19.2% from 2023 to 2029, reaching a market size of $105 billion in 2029, according to estimates (as of March 6, 2024) by GlobalData, a market research and business intelligence firm. It points to five key drugs: Lilly’s Mounjaro and four drugs by Novo Nordisk—Ozempic, Wegovy, CagriSema (semaglutide and cagrilintide) (now in late-stage development), and Rybelsus—which collectively are forecast to capture 83% of the GLP-1 agonist market by 2029. Eli Lilly’s Mounjaro is expected to lead in sales, with projected 2029 sales of $33.4 billion, according to estimates by GlobalData. With a large portfolio of products of GLP-1 drugs, Novo Nordisk is expected to capture 55% of the market share in 2029.

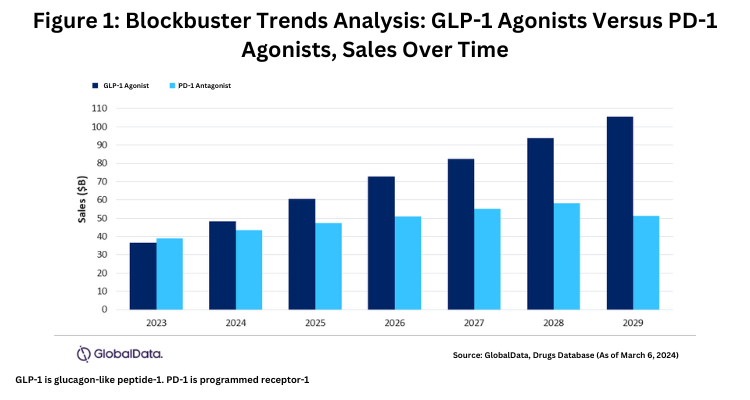

These strong growth projections for GLP-1 drugs are noteworthy when comparing growth rates of other blockbuster drug classes. For example, immuno-oncology drugs, in the form of programmed cell death protein-1 (PD-1) antagonists, have a slower growth rate, with projections of a CAGR of 4.7% and a market size of $51 billion in 2029, nearly half of the GLP-1 agonist market (see Figure 1),according to estimates from GlobalData. Key PD-1 drugs include Merck & Co.’s Keytruda (pembrolizumab) and Bristol-Myers Squibb’s Opdivo (nivolumab).

The rise of Lilly’s and Novo Nordisk’s GLP-1 drugs has given new life to the market for obesity drugs overall. Novo Nordisk’s Wegovy and Eli Lilly’s Mounjaro generated $9.7 billion globally in 2023, which represented a 239% increase from the total revenue generated from all obesity drugs in 2022, according to information from GlobalData. Starting in 2024, significant increases in the number of launches of new obesity drugs are expected per year, culminating in a peak of four launches in both 2027 and 2028, according to estimates by GlobalData. Novo Nordisk is looking to cement its position as an obesity front-runner, as it will account for six of the 13 estimated launches. Its lead pipeline drug, CagriSema (semaglutide and cagrilintide), is currently in Phase III development for obesity. This product is expected to launch in the US by the end of 2025, where it is forecast to generate $7.4 billion by 2029, according to estimates from GlobalData.

The rise of GLP-1 drugs: manufacturing implications

The strong demand for GLP-1 drugs has had impact on supply as companies seek to meet the rising demand. Lilly has noted supply pressures for its incretin products. In its annual filing in December 31, 2023, Lilly says it expects additional internal and contracted manufacturing capacity will become fully operational globally in the next several years as part of its ongoing efforts to meet the significant demand for its incretin medicines. For example, in 2023, the company began production at its Research Triangle Park site in North Carolina and says it expects to continue significant capacity expansion over time as the company increases production at this site and others.

Novo Nordisk also is investing in internal and external capacity to increase supply both short and long term. The most notable example is the pending $16.5-billion acquisition of the CDMO, Catalent, by Novo Holdings, the parent company of Novo Nordisk, which upon closing of the acquisition will net Novo three fill–finish sites and related assets in Anagni, Italy; Bloomington, Indiana; and Brussels, Belgium. The Catalent acquisition is expected to gradually increase Novo Nordisk’s filling capacity from 2026 and onwards. The merger is expected to close toward the end of 2024, subject to customary closing conditions, including approval by Catalent stockholders and receipt of required regulatory approvals. After closing, Novo Holdings plans to sell the three fill–finish sites to Novo Nordisk for $11 billion.