The Next Wave of Biologics: What’s Trending

Which biologics have received approval by FDA’s Center for Drug Evaluation and Research thus far in 2025, and how are they positioned in the market? What other market contenders loom in the industry’s pipeline?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

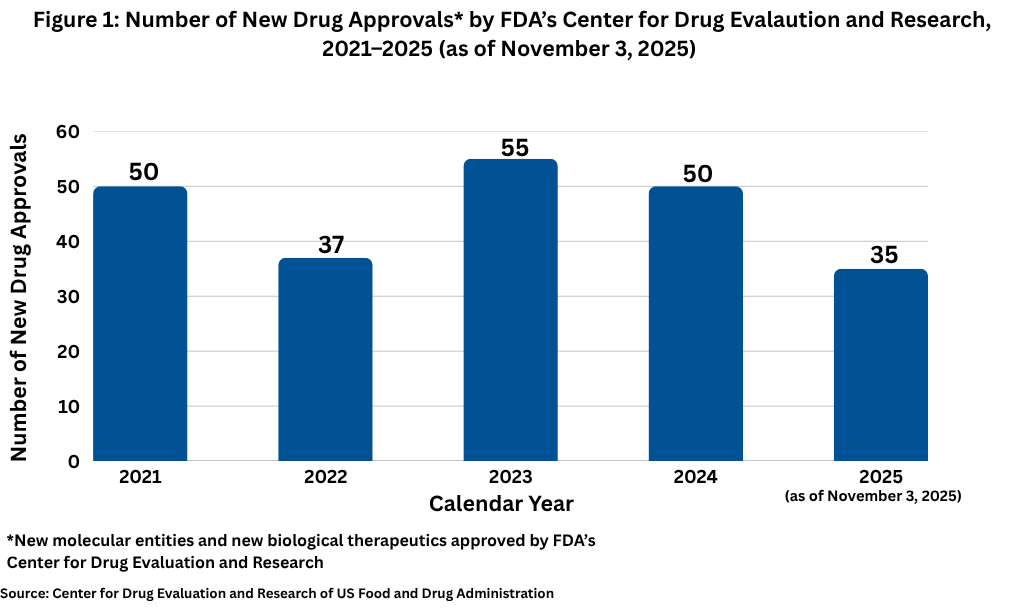

New drug approvals thus far in 2025

Overall, thus far in 2025 (as of November 3, 2025), the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) has approved 35 new molecular entities and biological therapeutics. Other biologic-based products, including blood products, vaccines, allergenics, tissues, and cellular and gene therapies, are reviewed and approved by a separate center within FDA, the Center for Biologics Evaluation and Research (CBER), and are not part of this analysis. Although new drug approvals do not follow a strictly chronological path, but with approximately two months left in 2025, this level of new drug approvals is off the path from recent years. Figure 1 shows full-year drug approvals from 2021 to the present, and with the exception of 2022, there have been 50 or more new drug approvals in a given year.

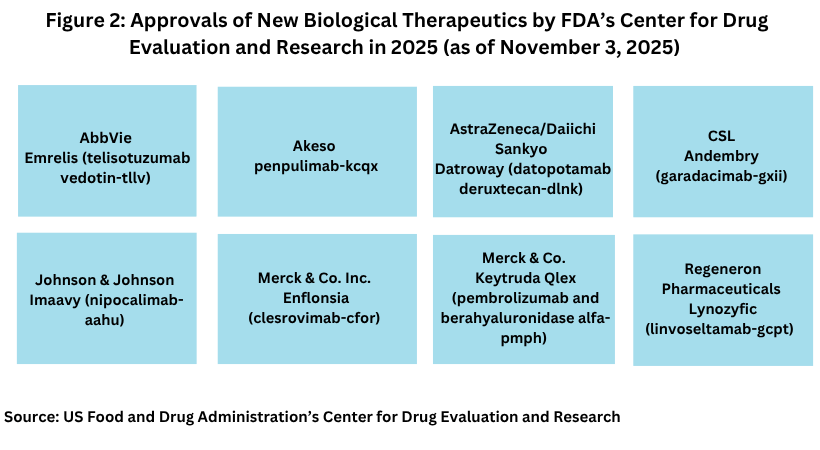

Biologics approvals thus far in 2025

In looking at the eight biologics approved thus far in 2025 by FDA’s CDER (see Figure 2), two were antibody drug conjugates (ADCs): AbbVie’s Emrelis (telisotuzumab vedotin) and AstraZeneca’s/Daiichi Sankyo’s Datroway (datopotamab deruxtecan). AbbVie was granted accelerated approved by FDA for Emrelis in May (May 2025) for treating a certain form of locally advanced or metastatic non-squamous non-small cell lung cancer (NSCLC). Specifically, the drug was approved for patients with metastatic, non-squamous NSCLC with high c-Met protein overexpression who have received a prior systemic therapy.

Emrelis is AbbVie’s first internally developed solid tumor medicine, its first solid tumor FDA approval in lung cancer, and its second FDA-approved ADC. Its other commercial ADC, Elahere (mirvetuximab soravtansine-gyxn) for treating ovarian cancer, was gained by its $10.1-billion acquisition of ImmunoGen in early 2024.

In January (January 2025), AstraZeneca and Daiichi Sankyo received FDA approval for Datroway (datopotamab deruxtecan) for treating certain forms of breast cancer. Datroway is the second ADC approved from a collaboration between AstraZeneca and Daiichi Sankyo. The other ADC from that collaboration is Enhertu (trastuzumab deruxtecan) for treating HER2-positive breast cancer, which is one of the top-selling ADCs. In 2024, Enhertu’s combined sales by AstraZeneca and Daiichi Sankyo reached $3.75 billion.

Merck & Co. has had two biologics approved thus far in 2025 by FDA’s CDER: Enflonsia (clesrovimab-cfor) for treating respiratory syncytial virus (RSV) lower respiratory tract disease in neonates and infants who are born during or entering their first RSV season and Keytruda Qlex (pembrolizumab and berahyaluronidase alfa-pmph) to treat adult and pediatric (12 years and older) in solid tumor indications approved for the subcutaneous administration formulation of pembrolizumab, the active ingredient in the company’s blockbuster immuno-oncology drug, Keytruda. The subcutaneous injection of Keytruda Qlex may provide added convenience compared to intravenous administration of the drug because it can be administered by healthcare providers in multiple settings from an infusion center to a doctor’s office or a local community-based clinic, providing more options where patients can receive their treatment and also provides flexibility in treatment administration in terms of time for administration, according to information from Merck in announcing the drug approval.

Another biologic approved thus far in 2025 by a large pharma company is Johnson & Johnson’s Imaavy (nipocalimab-aahu) for treating generalized myasthenia gravis, a rare autoimmune disorder characterized by loss of muscle function and severe muscle weakness. The drug is approved for treating adults and children 12 years of age and older with generalized myasthenia gravis who are anti-acetylcholine receptor or anti-muscle-specific tyrosine kinase antibody positive. It is a monoclonal antibody designed to bind with high affinity to block FcRn and reduce levels of circulating immunoglobulin G (IgG) antibodies that underlie generalized myasthenia gravis without additional detectable effects on other adaptive and innate immune functions. Nipocalimab also is being investigated across three key segments in the autoantibody space, including rare autoantibody diseases, maternal fetal diseases mediated by maternal alloantibodies, and rheumatic diseases. The company projects potential peak sales of the drug of $5 billion.

Smaller companies accounted for the other biologic approvals by FDA’s CDER thus far in 2025: Akeso’s penpulimab-kcqx for treating recurrent or metastatic non-keratinizing nasopharyngeal carscinoma; CSL’s Andembry (garadacimab-gxii) for treating hereditary angioedema; and Regeneron’s Lynozyfic (linvoseltamab-gcpt) for treating relapsed or refractory multiple myeloma.

Blockbuster contenders

Several biologics with full launch in 2025 or projected for near-term approval are projected for blockbuster status (defined as drugs with sales of $1 billion) or more (1). Amgen’s Imdelltra (tarlatamab-dlle) is a first-in-class immunotherapy for extensive-stage small cell lung cancer (ES-SCLC.). The drug was granted accelerated approval by FDA in May 2024 and was given orphan drug and breakthrough drug designation. The drug uses Amgen’s proprietary bispecific T cell engager (BiTE) molecules and targets CD3 on T cells and DLL3 on tumor cells, enabling T cells to attack and lyse the tumor. DLL3 is expressed on the surface of small-cell lung cancer cells in more than 85% of patients but is minimally expressed on healthy cells, thereby making it an attractive target. This mechanism positions it as a potential standard of care for previously treated ES-SCLC.

Eli Lilly and Company’s and Amirall’s Ebglyss (lebrikizumab), which was approved by FDA in September 2024, is the third biologic for treating atopic dermatitis (eczema) that targets the interleukin-13 (IL-13) pathway, considered important in addressing inflammatory diseases, such as atopic dermatitis. The other two IL-13 biologics for treating atopic dermatitis are Sanofi’s Dupixent (dupilumab) and Leo Pharma’s Adbry/Adtralza (tralokinumab). Ebglyss’s less-frequent dosing, more selective IL-13 inhibition, and strong efficacy and safety data position it as a likely first-line treatment for moderate-to-severe atopic dermatitis when topical corticosteroids are inadequate (1).

Novo Nordisk’s Awiqli (basal insulin icodec) for treating Type 2 diabetes mellitus is a once-weekly, subcutaneous insulin and offers potential advantages over daily basal insulin by reducing frequency of injections from daily to weekly injections. The drug is approved in the Europen Union, along with 12 additional countries, but approval in the US was delayed due to the company receiving a Complete Response Letter) in 2024 by FDA. The company resubmitted its BLA to FDA in September (September 2025) to include additional clinical data. If approved, it has the potential to be the first once-weekly basal insulin treatment available in the US for adult Type 2 diabetes

Reference

1. P. Van Arnum, “Blockbuster Contenders: Drugs to Watch in 2025,” DCAT Value Chain Insights, February 6, 2025.