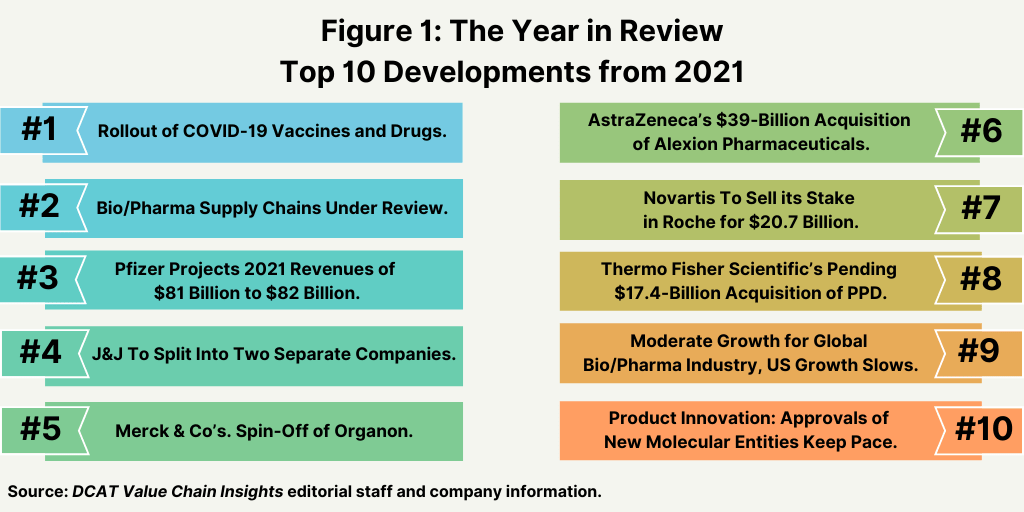

2021 in Review: Top 10 Bio/Pharma Developments

From the rollout of COVID-19 vaccines and drugs, to re-examining bio/pharma supply chains, to key dealmaking, we look back at the top 10 developments from 2021.

Top 10 Bio/Pharma Developments in 2021

Which news developments in the bio/pharmaceutical industry from 2021 were of greatest significance? A review of the top 10 news developments from 2021 are outlined below.

1. Rollout of COVID-19 Vaccines and Drugs. Without question, the most important news development in 2021 was the rollout of COVID-19 vaccines, with four main vaccines from Pfizer/BioNTech, Moderna, Johnson & Johnson (J&J), and AstraZeneca. Three of the vaccines—Pfizer/BioNTech, Moderna, and J&J—are authorized in the US.

Leading the way were two mRNA COVID-19 vaccines from Pfizer/BioNTech and Moderna, which were the first COVID-19 vaccines to receive emergency use authorization (EUA) in the US in December 2020: individuals 16 years or older (Pfizer/BioNTech vaccine) and individuals 18 years or older (Moderna vaccine). These vaccines have since received authorization globally for their respective two-dose regimens. In August 2021, Pfizer’s/BioNTech’s COVID-19 vaccine was the first COVID-19 vaccine to receive full approval by the US Food and Drug Administration (FDA) for individuals 16 years of older, and Moderna’s request for full FDA approval is under review.

Both companies received EUA for third (booster) doses of their vaccines in the US and European Union in 2021. Pfizer also received EUA for its vaccine in adolescents and in children ages 5 to 11 in the US and in certain other countries globally. The FDA is evaluating Moderna’s filing for authorization in children 12 to 17 years of age, and the company reported that a review may not be completed until January 2022. Moderna is delaying filing a request for EUA in the pediatric population (6-11 years of age) while the FDA completes its review of the adolescent EUA request. Moderna has received authorization for its COVID-19 vaccine for use in adolescents in the UK, European Union (EU), Japan, Canada, Switzerland, Taiwan, Saudi Arabia, Australia, and the Philippines.

On the supply side, Pfizer/BioNTech expects to manufacture 3 billion doses of its COVID-19 vaccine in total by the end of December 2021, as reported in their third-quarter 2021 earnings release, and Moderna expects to manufacture 700 million to 800 million doses (at the 100-μg dose) in 2021.

J&J received EUA for its COVID-19 vaccine as a single primary vaccination dose in individuals 18 years of age and older in the US in February 2021 and as a single booster dose in people 18 years of age and older in October 2021. The company also received authorization for its vaccine in the EU and other countries globally.

In meeting the immense challenge of developing and manufacturing their COVID-19 vaccines in unprecedented timelines, vaccine makers and the world at large now face a new challenge: a response to a newly emerging variant of concern, the Omicron variant, first discovered in South Africa last month (November 2021) and which is beginning to surface elsewhere. The degree to which the variant may spread and the effectiveness of current vaccines against has become an important issue as current vaccines are now being tested (as reported on December 1, 2021) to determine their efficacy .

Aside from vaccines, the bio/pharmaceutical industry has advanced drugs to treat COVID-19 at various stages of the disease and in various patient groups. Two oral antiviral drugs for treating COVID-19 are progressing. Pfizer is advancing an investigational COVID-19 oral antiviral candidate, Paxlovid, and last month (November 2021), the company signed a supply pact with the US government for 2021 and 2022 in a deal worth up to $5.29 billion. Late last month (November 2021), Merck & Co. received a recommendation from an FDA advisory committee for authorization of its investigational COVID-19 oral drug, molnupiravir, which it developed with Ridgeback Biotherapeutics, a Miami, Florida-based bio/pharmaceutical company.

Examples of COVID-19 drugs that have received EUA in the US include: Eli Lilly and Company’s bamlanivimab and etesevimab, co-administered; Regeneron Pharmaceuticals’ antibody cocktail of casirivimab and imdevimab; GlaxoSmithKline’s and Vir Biotechnology’s sotrovimab; and Roche’s Actemra (tocilizumab). Gilead Sciences’ remdesivir received full FDA approval in May 2020.

2. Bio/Pharma Supply Chains Under Review. Aside from the development of new vaccines and treatments for COVID-19, another consequence of the pandemic has been a re-examination of bio/pharmaceutical supply chains. On a governmental basis, this has taken shape in the form of reviews of pharmaceutical supply chains, particularly for certain generic drugs and those drugs deemed as “essential” or “critical” medicines.

As part of its Pharmaceutical Strategy for Europe, in October (October 2021), the European Commission put out a public consultation, which will be open until December 21, 2021, to gather views from stakeholders and the public on revisions to the EU’s pharmaceutical legislation, including measures impacting supply and manufacturing. The consultation is part of a structured dialogue process to identify the causes and drivers of potential supply-chain vulnerabilities, including EU dependencies on offshore sources for raw materials, active pharmaceutical ingredients (APIs), and intermediates.

In the US, the Biden Administration is proceeding with both short- and long-term measures to improve the resiliency of US pharmaceutical supply chains as part of a larger policy effort to evaluate industrial supply chains due to vulnerabilities exposed by the pandemic. In February (February 2021), President Joe Biden issued an executive order that directed an 100-day review of certain industrial supply chains, including pharmaceuticals, as part of an effort to identify near-term steps the Administration can take, including with Congress, to address vulnerabilities in supply chains. In June (June 2021), the findings from this review were released, which included recommendations specific to the industry and general trade measures to be achieved through executive and legislative action. These recommendations include ways to increase domestic production of essential medicines, facilitate manufacturing innovation, and improve trade and production of US supply chains. An additional one-year review, begun in February 2021, is also underway to provide further evaluation.

Like other industries, the bio/pharmaceutical industry is also subject to more immediate supply-chain challenges in the transportation/shipping sector caused by bottlenecks formed as the global economy emerged from the pandemic and responded to increased demand for products and shipping services. This current situation is in addition to companies’ own internal reviews of their supply chains as they evaluate potential adjustments to their supply chains in a post-pandemic environment.

3. Pfizer Projects 2021 Revenues of $81 Billion to $82 Billion. The financial impact of the pandemic on individual company performance is most dramatically illustrated by Pfizer, which has projected 2021 revenues of between $81 billion and $82 billion, which includes anticipated 2021 revenues of approximately $36 billion for Comirnaty, its COVID-19 vaccine developed in partnership with BioNTech. Revenues for non-COVID-19 products for the full-year 2021 are estimated at $45 billion to $46 billion. Pfizer provided the financial guidance as part of its third-quarter 2021 earnings release.

Pfizer’s estimated 2021 revenues for non-COVID-19 products of $45 billion to $46 billion puts Pfizer on par among the other top bio/pharma companies in terms of revenues, but its projected sales of its COVID-19 vaccine put the company at a new level. The projected 2021 revenues of $36 billion for its COVID-19 vaccine represents the largest annual revenue amount for a single product in the history of the bio/pharma industry. To put into perspective, the top-three selling pharmaceuticals from 2020 were: AbbVie’s Humira (adalimumab), an anti-inflammatory drug to treat multiple conditions, at $19.8 billion; Merck & Company’s anticancer drug, Keytruda (pembrolizumab), with sales of $14.4 billion; and Bristol-Myers Squibb’s (BMS) Revlimid (lenalidomide), an anticancer drug acquired from BMS’ $74-billion acquisition of Celgene in 2019, with 2020 revenues of $12.1 billion.

Unlike companies that partnered early in the pandemic with governments for the development of their COVID-19 vaccines, Pfizer and its Chairman and CEO Albert Bourla made a bold move by deciding to develop the vaccine independently, along with its partner, BioNTech, a Mainz, Germany-based bio/pharmaceutical company. Pfizer was already collaborating with BioNTech on the development of mRNA vaccines for influenza and re-directed efforts to the development of a mRNA COVID-19 vaccine. While the vaccine was still under development, Pfizer also put into place manufacturing the product “at-risk” while the product was still under development to enable to meet demand once the vaccine was authorized (a manufacturing strategy also done by other companies for their COVID-19 vaccines) and later signed purchase agreements with governments for the supply of the vaccine.

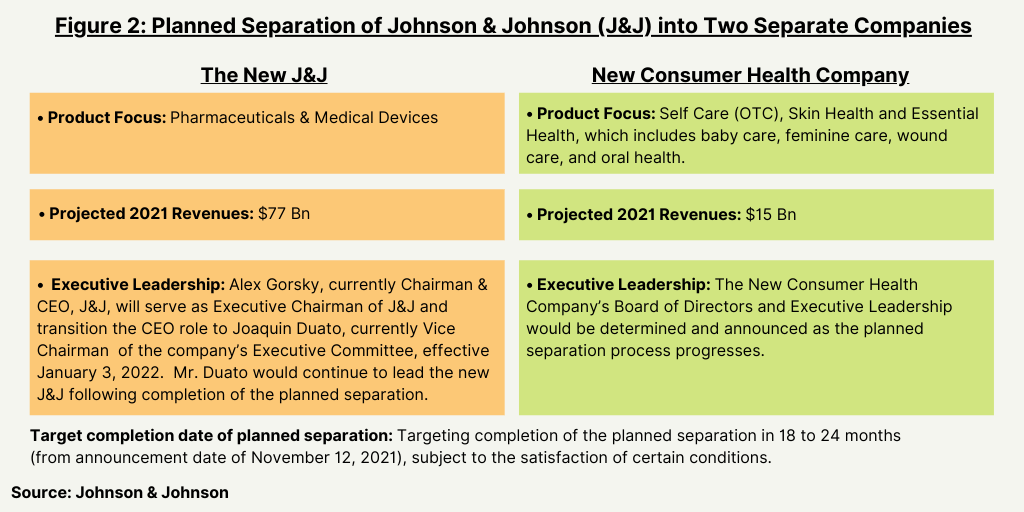

4. J&J To Split Into Two Separate Companies. Another important strategic company move in 2021 was the decision by Johnson & Johnson (J&J), announced in November 2021, to split the company into two separate, standalone, publicly traded companies, one focused on pharmaceuticals and medical devices, and the other on consumer health (see Figure 2). The new J&J, focused on pharmaceuticals and medical devices, is expected to have full-year 2021 revenues of approximately $77 billion, and the planned new Consumer Health company is projected to have full-year 2021 revenues of $15 billion.

Pharmaceuticals, J&J’s largest business segment, will continue to be the leading piece of the new J&J. In 2020, J&J posted global revenues of $82.6 billion, of which pharmaceuticals accounted for 55%, or $45.6 billion, and medical devices nearly 28%, or $23.0 billion. The company’s consumer health segment accounted for 17% of 2020 global revenues, or $14.1 billion.

In a leadership move announced earlier in 2021, Alex Gorsky, currently Chairman & CEO, J&J, will serve as Executive Chairman of J&J and transition the CEO role to Joaquin Duato, currently Vice Chairman of the company’s Executive Committee, effective January 3, 2022. Mr. Duato would continue to lead the new J&J following completion of the planned separation. The new Consumer Health company’s Board of Directors and executive leadership would be determined and announced in due course (as reported on November 12, 2021) as the planned separation process progresses.

The company is targeting completion of the planned separation in 18 to 24 months (as reported on November 12, 2021), subject to the satisfaction of certain conditions.

5. Merck & Co’s. Spin-Off of Organon. Another major reorganization of a large bio/pharmaceutical company was Merck & Co.’s spin-off of its women’s health, established brands, and biosimilars businesses to form a new, independent company, Organon, which launched in June 2021. Merck had announced its intention to spin off the company in February 2020 through a distribution of Organon’s publicly traded stock to company shareholders. In 2020, the products that comprise Organon had total sales of $6.5 billion.

In making the decision to spin off those three business (women’s health, established brands, and biosimilars), Merck stressed its commitment to what it deemed as its growth pillars in oncology, vaccines, hospital and specialty products, and animal health, which it expects will drive approximately 90% of Merck’s revenue growth going forward. Merck explained at the time of the announced spin-off in February 2020 and again in an investor presentation in May (May 2021) that the spin-off would reduce Merck’s human health manufacturing footprint by approximately 25% and the number of human health products it manufactures and markets by approximately 50% to allow for a more focused operating model in support of its growth products.

6. AstraZeneca’s $39-Bn Acquisition of Alexion Pharmaceuticals. On the mergers and acquisitions (M&A) front, the largest deal from 2021 was AstraZeneca’s completion of its $39-billion acquisition of Alexion Pharmaceuticals, a Boston-based bio/pharmaceutical company focused on rare diseases. The companies had announced the deal in December 2020 and closed it in July 2021. The acquisition marked AstraZeneca’s entry into rare diseases. With the closing of the deal, AstraZeneca formed a dedicated rare-disease group, Alexion, AstraZeneca Rare Disease, headquartered in Boston.

The acquisition gives AstraZeneca a further scientific presence in immunology and Alexion’s complement-biology platform and pipeline focused on rare diseases. Alexion posted 2020 net product sales of $6.07 billion. Its top-selling product is Soliris (eculizumab), which is approved to treat two rare blood disorders: (1) paroxysmal nocturnal hemoglobinuria (PNH), a disease that is characterized by destruction of red blood cells, blood clots, and impaired bone marrow function and (2) atypical hemolytic uremic syndrome (aHUS), a disease that causes abnormal blood clots to form in small blood vessels in the kidney. The drug posted 2020 revenues of $4.06 billion and accounted for 69% of the company’s 2020 net product sales.

7. Novartis To Sell its Stake in Roche for $20.7 Billion. Another large deal in 2021 was the decision made by Novartis to sell its approximately 33% stake in Roche for $20.7 billion in a bilateral transaction between the two companies. Novartis has been a stakeholder in Roche for 20 years. Novartis acquired its stake in Roche between 2001 and 2003 for a total consideration of approximately $5 billion as a long-term financial investment, which delivered recurring earnings contribution and cumulative dividends in excess of $6 billion. Novartis says it now does not consider the financial investment in Roche as part of its core business and therefore not a strategic asset. The closing of the repurchase transaction by Roche is expected to take place in early December 2021.

8. Thermo Fisher Scientific’s Pending $17.4-Billion Acquisition of PPD. In thecontract services sector of the bio/pharma industry the largest deal from 2021 is Thermo Fisher Scientific’s pending $17.4-billion acquisition of PPD, a contract research organization. Announced in April (April 2021), Thermo Fisher agreed to acquire PPD for $17.4 billion in cash plus the assumption of approximately $3.5 billion of net debt. The transaction, which is expected to be completed by the end of 2021, is subject to the satisfaction of customary closing conditions, including the receipt of applicable regulatory approvals.

PPD provides a range of clinical research and laboratory services for drug development. In 2020, the company generated revenue of $4.7 billion and has approximately 26,000 employees globally. Upon close of the transaction, PPD will become part of Thermo Fisher’s Laboratory Products and Services Segment, which houses its CDMO business, which includes development and manufacturing services for drug-products, drug-substances (small molecules and biologics), and cell and gene therapies.

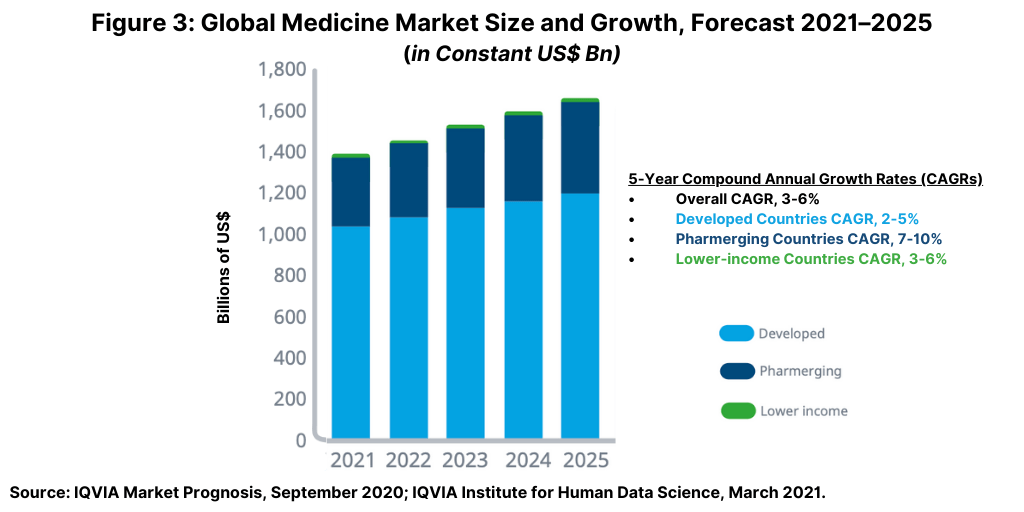

9. Moderate Growth for Global Bio/Pharma Industry, US Growth Slows. Near-term growth projections for the bio/pharma industry show moderate growth overall through 2025, but show flat-to-moderate growth in the US, increased biosimilars and generic competition in Europe, and slowing growth in major emerging markets such as China.

Global spending on medicines—using invoice price levels—is expected to grow at a compound annual growth rate (CAGR) of 3%–6% through 2025 to reach about $1.6 trillion by 2025, excluding spending of COVID-19 vaccines, according to a 2021 analysis by the IQVIA Institute for Human Data Science (1). The pre-pandemic drivers of medicine use and spending remain significant drivers of the outlook. Figure 3 above outlines the growth prospects in developed countries (defined as those countries with upper-middle or high incomes), “pharmerging” countries (defined as the most promising emerging market countries for medicines spending), and lower-income countries, which represent only a small fraction of global spending on medicines.

In developed countries, the adoption of new treatments, offset by patent lifecycles and competition from generics and biosimilars, is expected to continue as the main factor influencing medicines spending and growth. Medicines spending in developed countries is expected to grow 2%–5% from 2021 through 2025, similar by comparison to the past five years (2016–2020). Pharmerging countries will see slowing growth and volume declines across many markets with an overall CAGR in the forecast period (2021–2025) of 7%–10%, according to the IQVIA Institute analysis (1).

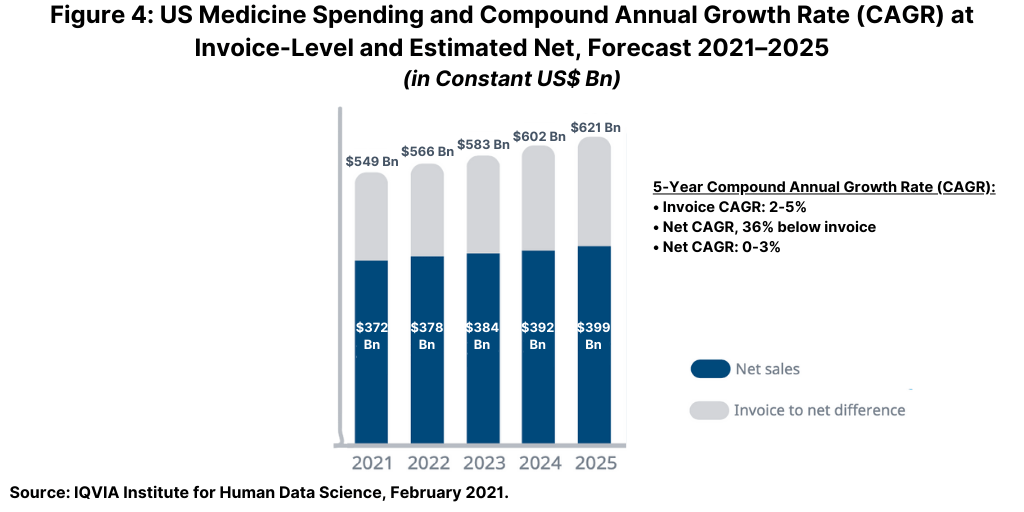

The US, the largest national market in the global bio/pharma market with an approximate 40% share, will see flat to low single-digit growth (0%–3%) at net levels from 2021 to 2025 (see Figure 4 above) as rising off-invoice discounts and rebates are expected to slow spending growth over time. In total, off-invoice discounts and rebates are projected to be 31% lower than the invoice level in 2020 and 36% lower than the invoice level projected in 2025. In addition to discounts and rebates, ongoing market dynamics around the use of medicines, the adoption of newer treatments, the impact of patent expiries, and new competition from generics or biosimilars will all contribute to historically slow market growth in the US for the next five years (2021–2025), according to the IQVIA Institute analysis (1).

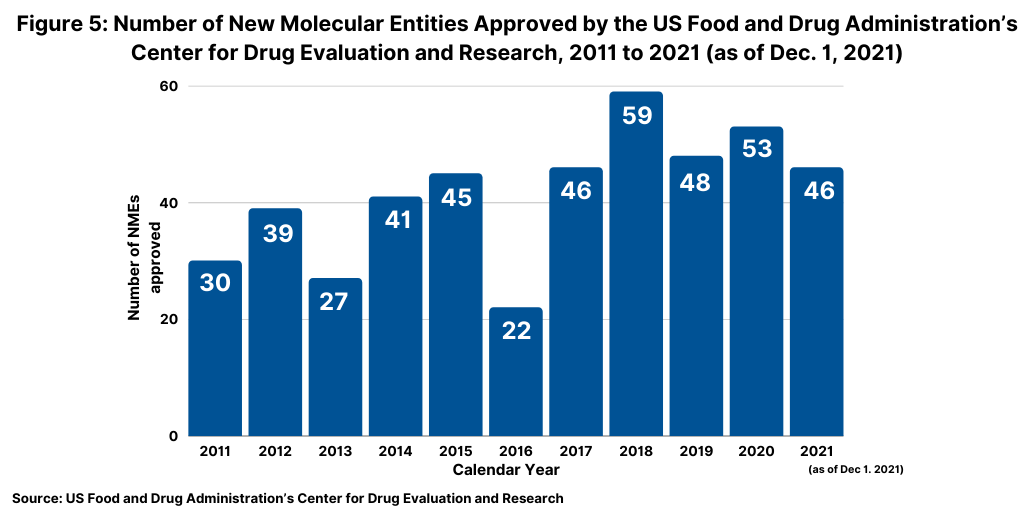

10. Product Innovation: Approvals of New Molecular Entities Keep Pace. Although not following a strictly chronological path, examining the pace of approvals of new molecular entities (NMEs) is an important measure of product innovation in the bio/pharmaceutical industry. As of December 1, 2021, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) had approved 46 NMEs, which kept pace with full-year 2020 and recent NME approvals (see Figure 5 above). In 2020, the FDA approved 53 NMEs, and as of this same time last year (December 1, 2020) had approved 47 NMEs, similar to 2021’s tally to date. The 53 NMEs approved in 2020 was the second highest level of NMEs approved in the past decade, except for 2018 when 59 NMEs were approved.