A Shortage of Inspectors Curtailing FDA Inspections: The Impact on Pharma

FDA conducted 621 foreign and 444 domestic inspections in fiscal year 2023, which was up from pandemic levels when in-person inspections were paused, but 36% fewer than pre-pandemic levels. A shortage of inspectors is a major factor. What’s the impact on Pharma?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@contributed-author

A two-fold problem

The COVID-19 pandemic significantly disrupted the ability of the US Food and Drug Administration’s (FDA) to inspect drug manufacturing establishments in person. Beginning in March 2020, FDA largely paused foreign and domestic drug inspections. In response to these disruptions, FDA relied on the use of alternative inspection tools. Such tools included the review of inspection reports from other trusted foreign regulators and the remote assessment of information from manufacturing establishments. While FDA generally had the authority to use these tools prior to the pandemic, it had not used them extensively.

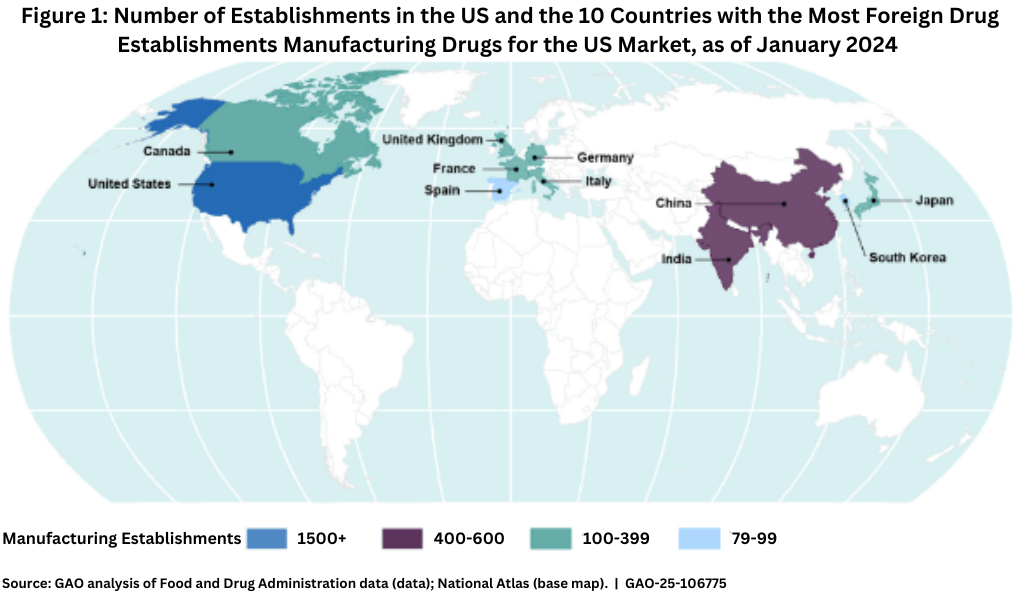

Prior to the pandemic, however, inspection responsibilities were already complicated by a manufacturing supply chain that has become increasingly global. As of September 2023, 58% of establishments registered with FDA to manufacture drugs for the US market were located overseas, according to a recent analysis by the US Government Accountability Office (GAO) (GAO is an independent, nonpartisan government agency within the legislative branch that provides auditing, evaluative, and investigative services for the United States Congress). These include establishments making both active pharmaceutical ingredients and finished dosage forms. As of January 2024, FDA data showed that India and China had the most foreign establishments manufacturing drugs for the US market, with nearly 40% of all foreign establishments in these two countries (see Figure 1).

Inspections of domestic versus foreign manufacturing facilities

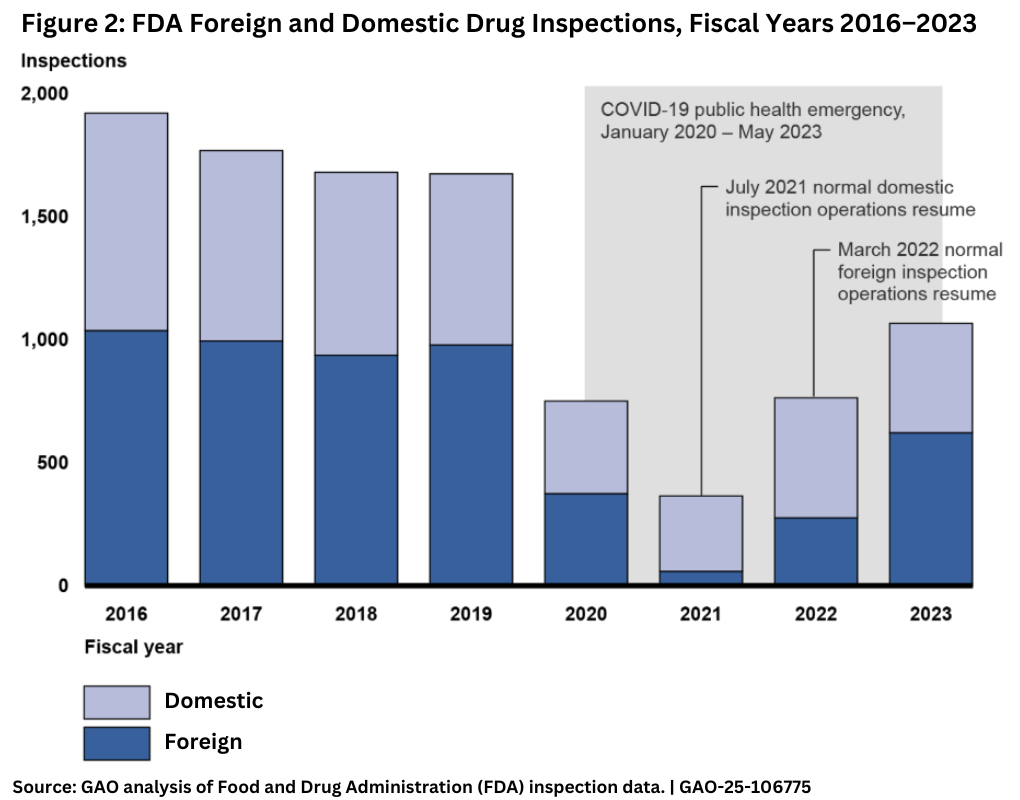

By the start of fiscal year 2023, FDA had resumed conducting in-person inspections paused during the pandemic, but inspection totals remained below pre-pandemic totals due to reduced investigator capacity. As a part of resuming in-person inspections, FDA implemented several pilot measures to facilitate the inspection of foreign drug establishments, including a pilot program for unannounced inspections of foreign facilities and finalized the design of the independent interpreter pilot. In fiscal year 2023, FDA conducted more drug inspections than it had since pausing most inspections in March 2020, at the start of the COVID- 19 pandemic, but did not reach pre-pandemic inspection totals. These data show FDA conducted 1,065 total inspections in fiscal year 2023, a 40% increase from fiscal year 2022. However, this total was 36% below the 1,671 inspections conducted in fiscal year 2019, the last full year before the start of the pandemic (see Figure 2).

The number of inspections FDA conducted was limited by reduced investigator capacity, according to FDA officials. In its report, GAO said that FDA officials told the GAO that they anticipate that fiscal year 2024 inspection totals will be higher than fiscal year 2023 but will remain below pre-pandemic levels due to continued reduced investigator capacity.

FDA’s inspection workforce

To understand this inspector shortage, it is first important to know how FDA staffs its inspection workforce. FDA has three groups of investigators who conduct domestic and foreign drug manufacturing inspections.

• General pool of investigators. Investigators based in the US who primarily conduct domestic inspections, but who also conduct foreign inspections.

• Dedicated foreign drug cadre. A US-based group of investigators who specialize in foreign inspections.

• Foreign office investigators. Investigators based in FDA’s India or China offices.

GAO previously identified persistent vacancies among these three groups of investigators and recommended that FDA develop strategies focused on the recruitment and retention of investigators who specialize in foreign inspections. FDA agreed with GAO’s recommendation and in response, in December 2021, FDA formed the GAO Recruitment and Retention Action Plan Work Group, which developed six tailored strategies to recruit, develop, and retain investigators for the foreign drug cadre and the foreign offices. For example, FDA participated in recruiting events and outreach to individuals with interest in or skills relevant to travel, such as former Peace Corps volunteers. FDA also increased the cash incentive for completed foreign trips and launched a three-part training series on foreign travel. As a result of these efforts, GAO determined that FDA had partially implemented its recommendation. As of July 2024, FDA stated that it planned to form a work group to address recruitment challenges specific to the foreign offices but had not done so., according to GAO report. However, FDA stated that its Office of Regulatory Affairs and the Office of Global Policy and Strategy continued to work together to address challenges related to the recruitment and retention of foreign office investigators.

Further examining the problem

To examine vacancies in FDA’s drug investigator workforce and the agency’s efforts to address them, GAO analyzed FDA data on the number of authorized, filled, vacant, newly hired, and departing investigator positions for fiscal years 2022 through June 30, 2024 (partial fiscal year 2024). Fiscal year 2022 was the first full fiscal year since GAO last reported on FDA’s efforts to address investigator vacancies; partial fiscal year 2024 was the most recently available data when GAO conducted its analysis. GAO also interviewed officials about their efforts to maintain a sufficient pool of drug investigators, and it reviewed FDA documents related to workforce planning and investigator recruitment and hiring. In addition, GA interviewed investigators regarding their experiences conducting in-person inspections, including challenges related to inspection staffing. GAO compared FDA’s efforts and action plans to maintain its drug investigator workforce against selected leading practices for retention previously identified by GAO.

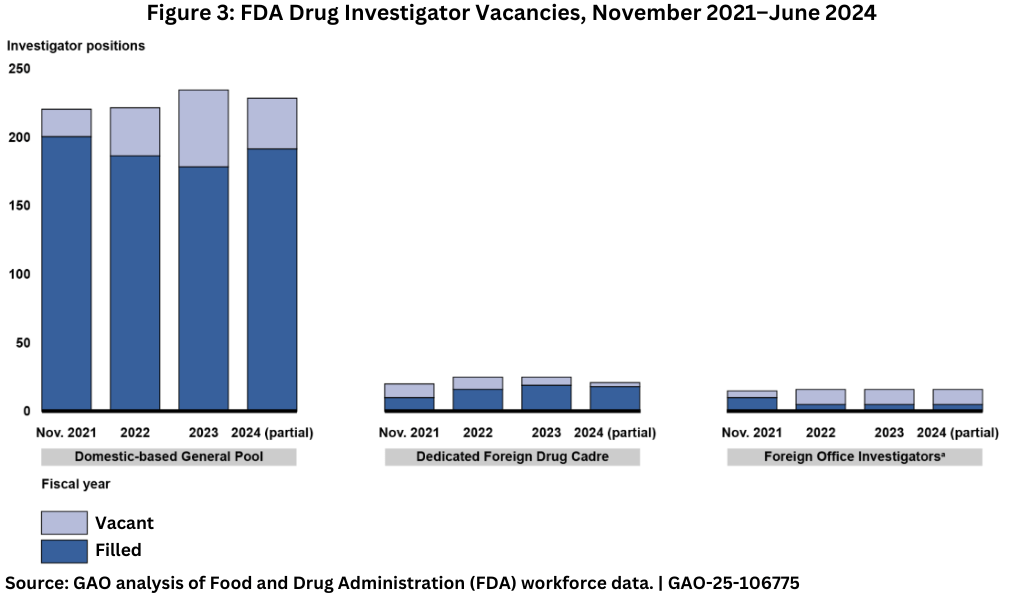

General pool of investigators based in the US. Most of the current drug investigator vacancies are in the general pool of investigators, which is the largest group of investigators and conducts the majority of domestic and foreign inspections. There are about 230 total authorized investigator positions in this pool, according to the GAO analysis. GAO previously reported that from December 2019 to November 2021, FDA made progress in hiring for the general pool of investigators. According to FDA, in November 2021, there were 20 vacancies in this pool (a 9% vacancy rate). However, as of June 2024, the number of vacancies had increased to 37, a 16% vacancy rate (see Figure 3).

Dedicated foreign drug cadre investigators. FDA recruited more investigators into the dedicated foreign cadre and expanded the number of possible positions, though vacancies remain, according to the GAO analysis. As of June 2024, 18 of the 21 cadre positions were filled, compared to 10 of 20 positions as of November 2021. Although FDA has not yet filled every vacancy, according to officials, FDA increased the total number of positions in the cadre because of funding received to conduct inspections under the unannounced inspections pilot, which were expected to largely be conducted by cadre investigators, according to the GAO analysis.

Foreign office investigators. Vacancies increased among foreign office nvestigators, particularly in China, according to GAO’s analysis. FDA data show that, in November 2021, there was one vacancy among six positions in India and four vacancies among nine positions in China. As of June 2024, four of seven positions in India were vacant and seven of nine positions in China.

Investigator attrition and impact on inspections

FDA has continued to recruit and hire investigators, but vacancies persist due to challenges with investigator attrition, according to the GAO analysis. According to FDA data, from the start of fiscal year 2022 to June 2024, FDA’s Office of Regulatory Affairs (ORA) hired 105 new investigators into the general pool of approximately 230 authorized investigators and lost 105. Of these 105 drug investigator losses, 61% left for other FDA positions, including other positions in ORA; 29% left FDA; and 10% retired. The turnover rate for ORA investigators in the general pool was more than twice as high as the ORA-wide turnover rate in fiscal years 2022 and 2023. As of June 2024, hiring for fiscal year 2024 has been greater than attrition, according to the GAO analysis.

High rates of attrition in the general pool of investigators limit FDA’s ability to fill positions in the foreign cadre and the foreign offices, which are filled by more experienced investigators from the general pool. Officials told GAO that new investigators typically need two to three years of experience before they can conduct foreign inspections independently, and they must have experience conducting foreign inspections before they are qualified for a position in the foreign cadre or for an assignment as a foreign office investigator. As of June 2024, 36% of investigators in the general pool did not have the necessary experience to conduct independent foreign inspections. Officials told GAO that the limited pool of qualified investigators was one of the top challenges in recruiting investigators to fill foreign office investigator positions.

Investigator attrition has reduced the total number of inspections FDA can conduct, according to the GAO analysis. Having a less-experienced investigator workforce has also reduced inspection capacity. In its analysis, GAO said that FDA officials noted that newly hired investigators do not have the same capacity to complete inspections as experienced investigators. In addition, experienced investigators are less efficient in completing inspections because they are training newer staff. According to GAO’s review of FDA data and information about 63% of current investigators were hired within the last five years, as of May 2024. GAO noted that in its analysis, officials stated that, even if the total number of drug investigators currently on board was similar to past years, it is a large challenge to maintain a similar number of inspections to previous years with so many new investigators.