Blockbuster Potential: Which New Contenders Launching in 2024 Lead the Pack?

What are the blockbusters of the future? A recent industry analysis points to the leading contenders from late-stage or newly approved drugs that are slated to launch in 2024 and that are poised for potential blockbuster status over the next five years. Which drugs are the leading contenders?

Blockbuster potential

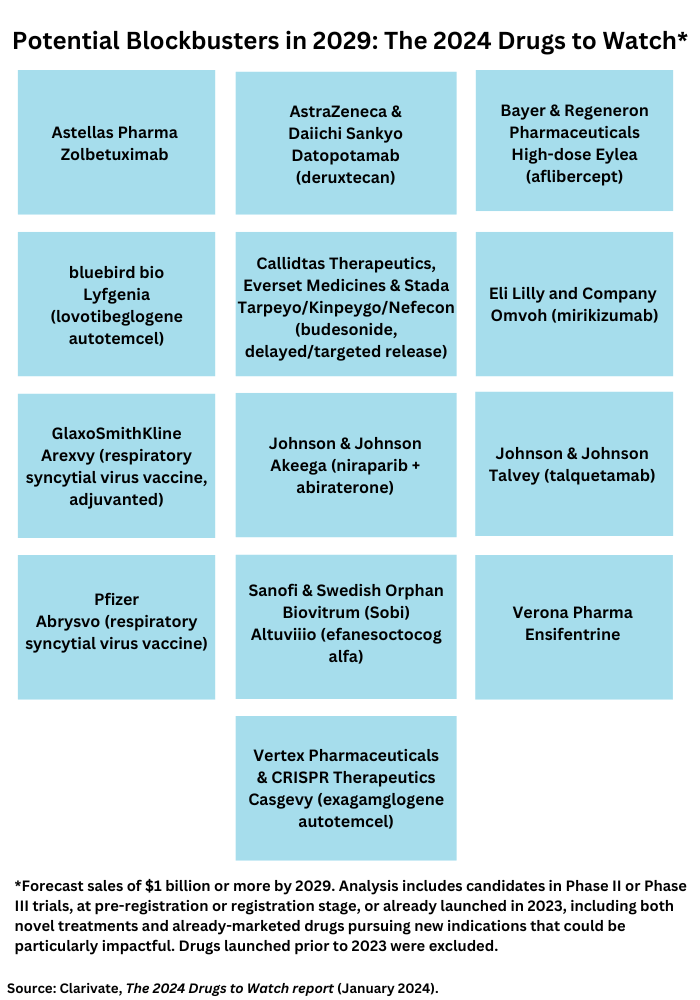

Clarivate, a business intelligence firm, in its 2024 Drugs To Watch report, identifies 13 new-to-market therapeutics and drugs poised to launch in 2024 that are projected to achieve blockbuster status (defined as sales of $1 billion or more) by 2029 (see Figure 1). The analysis includes candidates in Phase II or Phase III trials, at pre-registration or registration stage, or already launched in 2023, including both novel treatments and already-marketed drugs pursuing new indications that could be particularly impactful. Drugs launched prior to 2023 were excluded. Recently launched and soon-to-launch therapeutics set to significantly transform treatment paradigms, even if they are not forecast to be blockbusters within five years, were included in the analysis. The leading blockbuster contenders are outlined below.

High-dose Eylea (aflibercept) by Bayer and Regeneron Pharmaceuticals. Less-frequent administration is a key attribute of the high-dose version of Eylea (aflibercept) by Bayer & Regeneron Pharmaceuticals, the companies’ eye-care drug, poised for blockbuster status. Eylea is already a blockbuster for the companies, but the high-dose version is set to provide a defense against biosimilar competition for Eylea. The high-dose version of Eylea offers less-frequent administration for individuals with wet age-related macular degeneration, diabetic macular edema, or diabetic retinopathy whose treatment choices include invasive, burdensome administration that limits treatment uptake, according to Clarivate. The high-dose aflibercept offers less-frequent administration while achieving similar efficacy and safety as the current standard of care. The high-dose version of Eylea is expected to be challenged by other agents currently approved or in active late-phase development, including Roche’s Vabysmo (faricimab), biosimilars of aflibercept, and Oculis’ pipeline candidate, OCS-01.

Tarpeyo/Kinpeygo/Nefecon (budesonide, delayed/targeted release) by Callidtas Therapeutics, Everset Medicines & Stada. Tarpeyo/Kinpeygo/Nefecon (budesonide, delayed/targeted release) is a second-generation, synthetic, non-halogenated form of the corticosteroid, budesonide. The delayed-release formulation of budesonide has shown greater efficacy for protein reduction and slowing the decline in kidney function in primary immunoglobulin A (IgA) nephropathy as well as a much better safety profile than conventional corticosteroids, according to Clarivate. Before the approval of Tarpeyo/Kinpeygo, IgA nephropathy treatment was based only on supportive therapy, which included long-standing genericized therapies, such as renin-angiotensin-aldosterone system inhibitors, diuretics, corticosteroids, and immunosuppressants. Calliditas Therapeutics is partnered with Stada to commercialize Kinpeygo in Europe and with Everest Medicines to commercialize Tarpeyo in Mainland China, Hong Kong, Macau, Taiwan, South Korea, and Singapore.

Datopotamab deruxtecan by AstraZeneca and Daiichi Sankyo. The antibody drug conjugate (ADC), datopotamab deruxtecan, by AstraZeneca and Daiichi Sankyo is poised to compete against another ADC, Gilead Sciences’ Trodelvy (sacituzumab goviteca) as a Trop-2-directed antibody and topoisomerase inhibitor drug conjugate. Datopotamab deruxtecan is set to be used for both HR-positive/HER2-negative and triple-negative breast cancer and to enter the non-small cell lung cancer (NSCLC) market. The collaboration between AstraZeneca and Daiichi Sankyo combines AstraZeneca’s strategic focus on NSCLC and breast cancers and investment in ADCs with Daiichi Sankyo’s proprietary DXd ADC technology.

Altuviiio (efanesoctocog alfa) by Sanofi and Swedish Orphan Biovitrum (Sobi). Efanesoctocog alfa is the first once-weekly factor VIII (FVIII) replacement intravenous infusion therapy, which will help reduce the burden associated with the injection frequency of other currently available FVIII therapies. For patients reluctant to receive novel therapies, such as monoclonal antibodies or gene therapy, efanesoctocog alfa will likely be an appealing option, notes Clarivate. Clinicians also view efanesoctocog alfa favorably given the attainable FVIIII levels, injection frequency, and safety profile demonstrated in clinical trials to date. Sanofi has development and commercialization rights for efanesoctocog alfa in the United States, and Sobi is responsible for developing and marketing the drug in Europe and other markets.

Ensifentrine by Verona Pharma. Ensifentrine is an inhaled dual phosphodiesterase (PDE)3 and PDE4 inhibitor that is expected to reduce exacerbations in moderate-to-severe chronic obstructive pulmonary disease (COPD) without the systemic side effects of current PDE inhibitors that are delivered orally. If approved, it would be a first-in-class treatment, as well as the first novel mechanism, which has become available for maintenance COPD treatment in more than 10 years, according to Clarivate. The clinical and safety profile of ensifentrine makes it a promising addition to the limited treatment class options available for this patient population. The drug combines bronchodilator and non-steroidal anti-inflammatory activities in one compound.

Two gene therapies: Casgevy (exagamglogene autotemcel) by Vertex Pharmaceuticals and CRISPR Therapeutics and Lyfgenia (lovotibeglogene autotemcel) by bluebird bio. Casgevy became the first FDA-approved treatment to use the genome-editing technology, CRISPR, with its approval by the US Food and Drug Administration (FDA) last December (December 2023). Casgevy is a gene therapy for treating sickle-cell disease in patients 12 years and older. CRISPR/Cas9 is a type of genome-editing technology under which patients’ hematopoietic (blood) stem cells are modified by genome editing. CRISPR/Cas9 can be directed to cut DNA in targeted areas, enabling the ability to accurately edit DNA where it was cut. The modified blood stem cells are transplanted back into the patient, where they engraft (attach and multiply) within the bone marrow and increase the production of fetal hemoglobin (HbF), a type of hemoglobin that facilitates oxygen delivery. In patients with sickle-cell disease, increased levels of HbF prevent the sickling of red blood cells.

The FDA also approved last December (December 2023), bluebird bio’s Lyfgenia, another gene therapy for treating sickle-cell disease. Lyfgenia uses a lentiviral vector (gene delivery vehicle) for genetic modification and is approved for the treatment of patients 12 years of age and older with sickle-cell disease and a history of vaso-occlusive events. Exagamglogene autotemcel and lovotibeglogene autotemcel are set to become the first disease-modifying therapies for sickle cell disease and beta-thalassemia, a blood disorder that reduces the production of hemoglobin, a significant achievement for a patient population that have limited symptomatic and curative treatments currently available, according to Clarivate.

Omvoh (mirikizumab) by Eli Lilly and Company. Lilly’s Omvoh (mirikizumab), a monoclonal antibody targeting the p19 subunit of IL-23, which plays a role in inflammation related to ulcerative colitis, was approved as a first-in-class therapy for ulcerative colitis by the European Medicines Agency and the FDA and will likely be the third in the class approved for Crohn’s disease.

Akeega (niraparib + abiraterone) by Johnson & Johnson. J&J’s Akeega (niraparib + abiraterone) is the first and only dual action (or fixed-dose combination) tablet combining a PARP inhibitor (niraparib) (PARP is a type of targeted cancer drug) and a next-generation hormonal therapy (abiraterone acetate). Its ability to serve as a treatment for patients with deleterious or suspected deleterious BRCA-mutated, metastatic castration-resistant prostate cancer should help to meet the need for more effective treatments in this area, according to Clarivate.

Two respiratory syncytial virus vaccines: Arexvy by GlaxoSmithKline and Abrysvo by Pfizer. Two vaccines for respiratory syncytial virus (RSV) infections also make the list of potential blockbusters. RSV continue to be a public health concern, particularly for infants and older adults (65 years and older), according to the Clarivate analysis. A common upper respiratory infection that can result in hospitalizations in severe cases, RSV infection tends to be seasonal and present with symptoms similar to those of influenza and COVID-19. The first approvals of RSV vaccines (GSK’s Arexvy and Pfizer’s Abrysovo), respectively indicated for older adults and infants, represent a significant public health milestone, notes Clarivate.

Talvey (talquetamab) by Johnson & Johnson. After receiving conditional and accelerated approval from the European Commission and FDA, respectively, talquetamab became the first-in-class bispecific antibody targeted to CD3 and GPRC5D to treat multiple myeloma. It was approved based for heavily pretreated patients with relapsed or refractory multiple myeloma. Ongoing Phase III trials are expected to provide confirmation of clinical benefit in talquetamab’s approved setting and lead to label expansions in other multiple myeloma patient populations, including in combination with other approved agents, according to Clarivate. Talquetamab is poised as an important addition to the treatment, armamentarium.

Zolbetuximab by Astellas Pharma. Astellas’ zolbetuximab targets a difficult-to treat disease, metastatic HER2-negative gastric and gastroesophageal junction (GEJ) adenocarcinoma (a rare type of cancer of the esophagus). In contrast to HER2-positive disease, for which HER2-targeted agents, such as Roche’s Herceptin (trastuzumab] and Daiichi Sankyo’s Enhertu (trastuzumab deruxtecan), are available, targeted treatment options are more limited for HER2-negative patients. Zolbetuximab would address some of that unmet need as a first-in-class claudin 18.2 inhibitor in oncology as well as a first-line treatment for metastatic HER2-negative gastric or GEJ adenocarcinoma, according to Clarivate.

In January (January 2024), Astellas had a setback for the drug when the FDA issued a Complete Response Letter due to unresolved deficiencies following its pre-license inspection of a third-party manufacturing facility for zolbetuximab. The company said that FDA did not raise any concerns related to the clinical data, including efficacy or safety, of zolbetuximab, and is not requesting additional clinical studies. Astellas said in a January 2024 statement that it is working with FDA and the third-party manufacturer to establish a timeline to resolve the agency’s feedback.