CDMO Outsourcing Trends: Cell and Gene Therapies

Facing limited industry capacity, both large and small CDMOs continue to expand capacity for cell and gene therapies, but will demand for outsourced services by bio/pharma companies stay strong in the near term?

Outsourcing trends for cell and gene therapies

Representing a niche but growing market on a product basis, both bio/pharma companies and CDMOs continue to invest in development and manufacturing capabilities for cell and gene therapies. With limited capacity for these new modalities on an industry basis, both large and small CDMOs continue to invest in development and manufacturing capacity, but a key question is what is the near-term outlook for CDMOs in this area.

A recent report, The Cell & Gene Therapies Market Outlook, by Industry Standards Research (ISR), a provider of primary market research for the bio/pharmaceutical industry, shows some interesting findings as it relates to outsourcing trends for cell and gene therapies.

The research analyzed current and future outsourcing needs for cell and gene therapies of bio/pharma companies now and five years from now. Data was collected in the third quarter 2021 and included responses from 101 outsourcing decision-makers at biopharma companies who had responsibility for cell and/or gene therapies within the past 18 months. Many of these respondents are also members of the ISR Health Panel, a community of industry professionals that provides insight into drug development trends and outsourcing behavior.

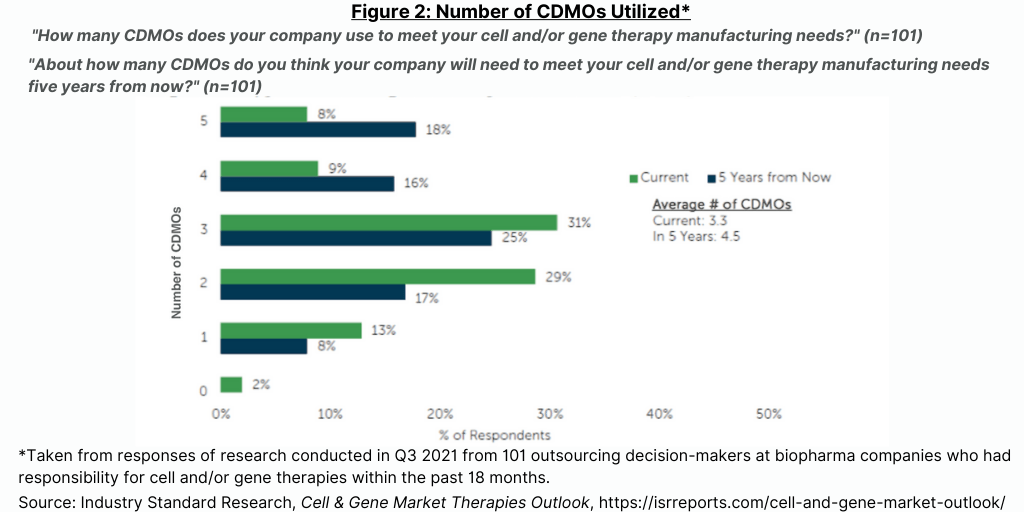

Currently, 44% of bio/pharma companies in this study outsource most or all of their activities for cell and gene therapy manufacturing (see Figure 1), but that number is expected to drop by half over the next five years as sponsor companies invest in their own facilities (see Figure 1). The high level of current outsourcing is reflective of sponsor companies either waiting to invest in in-house capabilities until products progress closer to commercialization or wait for planned investments in internal capacity to come on line. The level of outsourcing for cell and gene therapies is projected to decrease over the next five years as the internal capacity of sponsor companies come on line (see Figure 1).

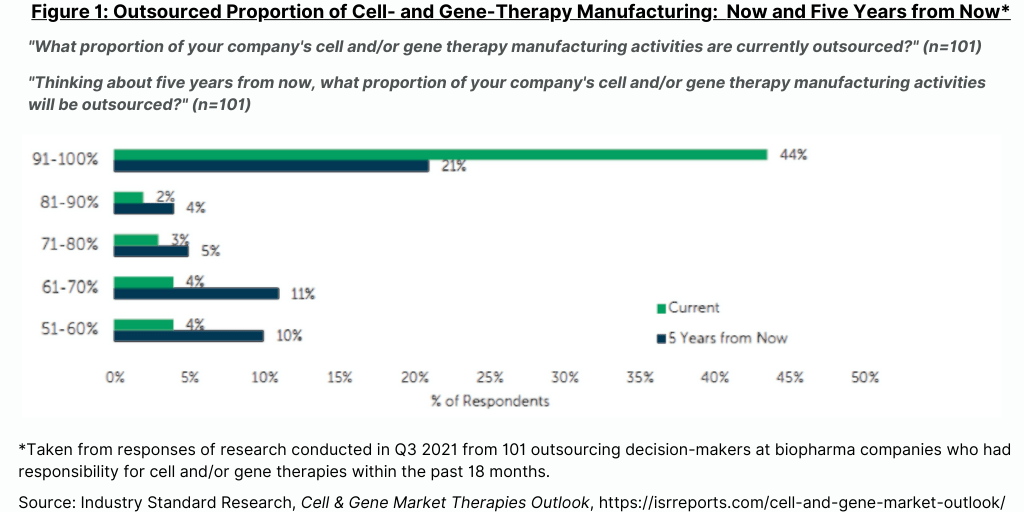

The ISR study also examined how many CDMOs of cell and gene therapies do bio/pharma companies now use and are projected to use over the next five years. The report points out that as more of these types of products are approved, more CDMOs will be required, particularly if product approvals are in multiple regions given the unique manufacturing requirements for cell and gene therapies and the need for local supply chains. The current average of CDMOs of cell and gene therapies that the bio/pharma companies in this study report that they now use is about three, and that number is expected to increase by one in the next five years (see Figure 2).