Clinical Trial Material Supply: Key Trends Pre and Post Pandemic

Clinical trial activity rebounded in 2021 following a dip in 2020 related to the pandemic, but how is the industry’s pipeline positioned for 2022 and beyond. A look at key trends impacting clinical trial material supply.

The industry’s pipeline

In 2021, the total number of products in active development in human trials globally (Phase I to regulatory submission) was 6,085, up 67% from 2016 levels but up only less than 1% compared to 2020, according to a recent analysis, Global Trends in R&D: Overview Through 2021, by the IQVIA Institute for Human Data Science. The slowing growth in 2021 was likely due to slowing activity from prolonged uncertainty as a result of impacts of new variants on activity during the ongoing pandemic. Pipeline expansion was most significant in oncology, gastrointestinal (GI), and neurology. Prior to the pandemic, infectious diseases and vaccines had declining numbers of pipeline products but then rebounded with the rise of COVID-19-related therapeutics and vaccines.

Oncology remains the largest focus of the pipeline, comprising 37% or 2,226 products, according to the IQVIA Institute’s report. Neurology represents 10% of the industry’s pipeline, but the number of products in development declined slightly in 2021 to 616 from a peak of 629 in 2020. The therapy area with the highest compound annual growth rate (CAGR) since 2016 is eye and ear conditions (17.3%), which is increasingly focused on rare diseases. Vaccines have the second-highest CAGR since 2016 (15.3%), with a heavy focus on COVID-19 vaccines, followed by oncology (14.4%) and GI products (14.2%), which have seen advances in cell and gene therapies and rare diseases. In addition, there are 1,828 products (30% of pipeline) under development for rare diseases, with half of these for diseases outside of oncology. Discovery/pre-clinical development for drugs to treat rare diseases saw a substantial setback in 2021, likely as a result of pauses in work from 2020 through 2021,

Clinical trial activity: impact of COVID-19 pandemic

A positive indicator for the industry was an increase in clinical trial starts in 2021 despite a decline in 2020 due to the pandemic. Overall clinical trial activity was sustained through the pandemic as the industry adapted to the disruption and developed new approaches to enable research to continue, according to the IQVIA Institute report. In 2021, 5,500 new planned clinical trial starts were reported, up 14% over 2020 and 19% higher than 2019. Although monthly clinical trial starts declined significantly in early 2020, they recovered from June 2020 through 2021 to levels higher than in 2019, driven by a surge of activity focused on COVID-19 vaccines and therapeutics.

Activity levels are at record levels, even excluding the surge of clinical trials related to COVID-19 vaccines and therapeutics. COVID-19 vaccines and therapeutics have accounted for more 1,200 industry-sponsored interventional trial starts since the beginning of 2020. By the end of 2021, the planned non-COVID-19 pipeline remained about 15% larger than just before the pandemic, and going forward, COVID-19-related trial starts are expected to be about 50% what they were at the peak of their activity in mid-2020, according to the IQVIA Institute report.

Overall, for the industry’s pipeline as a whole, planned Phase II trials increased by 19% in 2021 from 2020 while Phase III activity increased by 15%. Phase I trials increased 8% in 2021 after a slight contraction in 2020, according to the IQVIA Institute report, which offered some qualifications for the gains in 2021. The double-digit increases in planned trial starts in 2021 was likely at least partially linked to 2019 and 2020 trial delays driven by COVID-19 disruptions, notes the IQVIA Institute’s report. In addition, the report noted that it is likely not all of the planned trials reported for 2021 will have started by the end of 2021, so trial start trends should be interpreted with that consideration.

As the new number of COVID-19 trials continued, the aggregate number of clinical trial subjects grew to exceed 2 million for the first time in 2021. In addition to the large vaccine trials, new cancer trials in 2021 included a total of almost 300,000 subjects, up from 150,000 a decade ago. Clinical trial starts in other important disease areas largely rebounded in 2021 after the pandemic-driven dip in 2020 and, specifically, oncology trial starts reached historically high levels in 2021, up 70% from 2015 and mostly focused on rare cancer indications. In addition to the 1 million COVID-19 subjects, nearly 1 million subjects were planned to be enrolled across other therapeutic areas in 2021— an increase of 38% over 2020 for all non-COVID-19 trials. While the COVID-19 pandemic paused the past decade’s steady trial start growth across multiple therapeutic areas, most of the intended clinical trial start growth curves were restored to their pre-pandemic levels by the end of 2021, according to the IQVIA Institute’s report. Specifically, immunology, dermatology, metabolic disease, neurology, and GI all seem to be returning to higher than number of trial starts reported in 2019.

Pandemic aftermath: decreased clinical success rate

Although clinical trial activity rebounded in 2021, the composite success rate across all development phases and therapy areas declined to 5.0% in 2021, according to the IQVIA Institute report. The decline was attributed to several factors: (1) increased scientific risk in clinical development programs as the bar for efficacy and safety rises and (2) increased pauses in product development due to the pandemic. Across disease areas, probability of success varies considerably, and 2021’s composite success rate fell below the 10-year trend in all areas except for vaccines and cardiovascular products.

Another contributing factor from the pandemic was a decline in clinical trial complexity in 2021, predominately due to the reduced average number of sites and countries as sponsors limited trials due to the COVID-19 pandemic. The IQVIA Clinical Development Productivity Index, which combines success, complexity and duration indices, set to a value of 20 in 2010 fell to 13.5 in 2021, a decline of about 30% over the decade.

Overall, the composite success rate for the industry’s pipeline fell to a 10-year low in 2021, driven by drops in Phase I, II and III success rates while slightly offset by an increase in regulatory submission success rates, though still not a return to pre-pandemic levels, according to the IQVIA Institute’s report. Phase III success rates saw the greatest drop in 2021, declining to 48%, which is 19% below the 10-year pre-pandemic average. Some of this increase in attrition, according to the report, may be due to increasingly risky or aspirational research in the mechanism of action with increasing next-generation and first-in-class pipeline penetration. In addition, it is likely the pandemic contributed to this overall decline in 2020 and 2021 from continued pauses or delays in trials, notes the report.

A look ahead: remote, decentralized and hybrid trials

Another by-product of the pandemic was the increased use of decentralized, remote, or hybrid clinical trials as a way for sponsor companies to address limitations in patient recruitment and restrictions in onsite trials due to the pandemic. A key question for the industry will these types of trials continue with the easing of pandemic restrictions and what it means for clinical trial activity and related material supply.

Increased digitalization to enable decentralized and hybrid trials was already emerging prior to the pandemic, but this trend accelerated during the pandemic, when healthcare facility access was restricted, and trial participants were subject to movement restrictions. The use of connected medical device technologies has seen significant growth over time, with the percentage of all trials using these rising from 4% in 2016 to 8% of all trials in 2020, according to a recent analysis, Digital Health Trends 2021: Innovation, Evidence, Regulation and Adoption, by the IQVIA Institute for Human Data Science. Use in Phase II and III trials similarly doubled over the period, with 10% of Phase II and III trials using connected devices. During the COVID-19 pandemic, clinical trials rapidly shifted to decentralized (30%) or partially-decentralized “hybrid” models, with more than half (54%) of active trials using some remote monitoring during the pandemic, with various technologies being adopted by the 50 largest pharmaceutical companies, including telemedicine among more than 80%, according to the report. With 60% of investigative sites reporting no experience with remote processes before the pandemic, and smaller pharmaceutical firms similarly lacking experience running offsite trials, much of this work fell to contract research organizations to help support the shift, and still 25% of active trials were delayed or suspended.

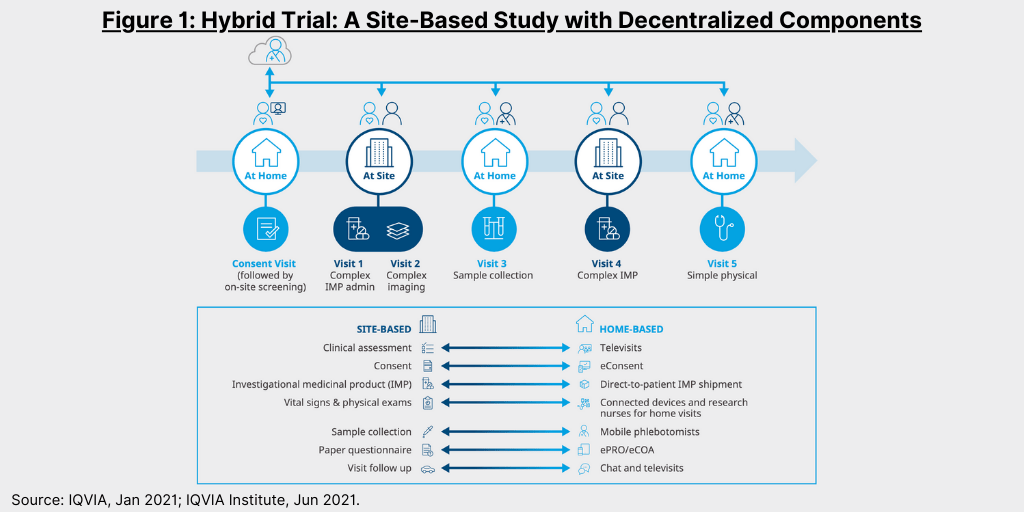

Figure 1 illustrates a hybrid trial, a site-based study with decentralized components. Such hybrid trials combine remote, home-based visits along with traditional site visits to reduce patient burden and streamline operational execution. For purposes of its analysis, IQVIA defines decentralized trials as trials focused on “bringing the trial to the patient” by using a platform or technology to communicate with remote study participants and collect data through means such as telemedicine, mobile or local healthcare providers, and mobile technologies such as connected devices. Remote patient visits are typically conducted at home through visits from clinical research nurses and mobile phlebotomists and occasionally at nearby medical facilities, and help reduce the burden on patients of participating in clinical trials. Much of the data collection is facilitated by digital devices, such as iPads to provide eConsent, mobile video to confirm medication use, and connected devices to collect vitals

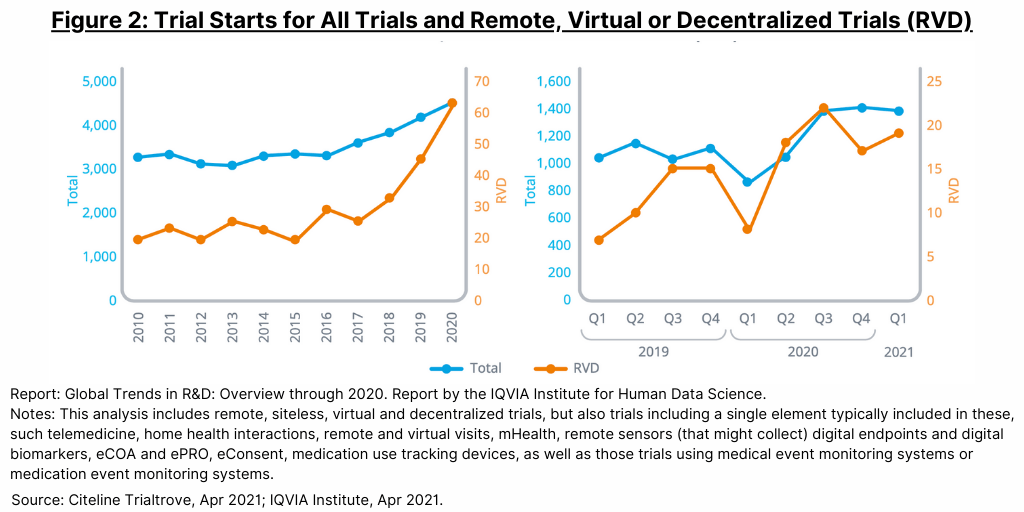

Trials which use technological elements for remote patient monitoring (such as telemedicine or digital health devices) or decentralized formats have been increasing and accelerated during the COVID-19 pandemic (see Figure 2).

The shift to decentralized and hybrid trials is likely to continue, according to the Institute’s report, as they provide greater convenience and access for patients and can therefore facilitate patient recruitment and retention and also provide a way for bio/pharma companies to mitigate risk against events that would disrupt onsite trials.

For clinical trial materials, to make their studies completely pandemic-proof in the future, sponsors have focused on managing shipments of drugs to participants with lower costs, however, these remain one of the key cost-drivers of hybrid trials and are often avoided, according to the Institute’s report. When the vendor decides to use direct-to-patient (DTP) shipments—where study drugs are shipped directly to participants via medical delivery services (e.g., Medspeed), curbside, or valet medication pickup, pharmacists and supporting staff may be completely replaced or activities reduced in their study

involvement. However, DTP may not be permitted in some countries, and in those cases, pharmacists will still be necessary to dispense the study drugs from the site itself although the COVID-19 pandemic has pushed countries to reassess their position on the matter.