Drug Shortages on the Rise; US Gov’t Proposes New Actions to Address

The number of drug shortages in the US has reached a new all-time high, with more than 320 drugs in shortage, according to an analysis by a pharmacist trade group. Earlier this month, the White House proposed new actions to address the problem, including additional requirements for manufacturers.

White House takes action

With the problem of drug shortages continuing in the US, earlier this month (April 2024), the US Department of Health and Human Services (HHS) highlighted steps HHS has taken to prevent and mitigate drug shortages thus far and proposed additional measures for policymakers to consider to mitigate drug shortages. Among the proposals by HHS is a multi-billion dollar plan for developing and implementing a Manufacturer Resiliency Assessment Program (MRAP) and a Hospital Resilient Supply Program (HRSP), aimed at improving supply-chain resiliency in the drug supply chain, with a first target for generic sterile injectable drugs.

Actions taken to date

Through the Assistant Secretary for Planning and Evaluation (ASPE), Administration for Strategic Preparedness and Response (ASPR), the Food and Drug Administration (FDA), the Centers for Medicare & Medicaid Services (CMS), and other US government bodies, HHS says it has been working to improve how the department monitors the pharmaceutical supply chain and responds to disruptions. Among key actions taken thus far by HHS is to establish a new Supply Chain Resilience and Shortage Coordinator role to strengthen implementation of strategies to enhance supply-chain resilience for pharmaceuticals and other medical products. HHS has also issued guidance to increase supply-chain transparency. FDA, an agency under HHS, discloses certain inspection information to provide the public with an understanding of actions the agency is taking and is also developing a Quality Management Maturity framework that may support adoption of manufacturing practices that are more resilient. HHS has also collaborated with other government agencies. For example, last month (March 2024), HHS and the Federal Trade Commission jointly issued a Request for Information to better understand the causes and potential solutions of generic drug shortages.

HHS says it has also taken steps to increase resilience and redundancy within the market. This work includes supporting domestic manufacturing of key ingredients and drugs to address various vulnerabilities. ASPR has invested $500 million to date (April 2024) to support active pharmaceutical ingredient (API) manufacturing and is exploring how it can utilize new authorities authorized by the President last year (2023) to promote the onshoring of essential medicines, medical countermeasures, and their critical ingredients. Moreover, HHS says it is developing policies to foster resiliency by considering payments under Medicare (the US government healthcare program for individuals 65 years or older) and additional requirements, to support a more diverse supply chain.

New proposals to address drug shortages

Despite these actions, HHS says that effective longer-term solutions may require additional authorities and resources to align market incentives in order to reward investment in supply-chain resilience. In support of that, HHS issued a white paper early this month (April 2024) to outline these proposals, which include developing and implementing a Manufacturer Resiliency Assessment Program (MRAP) and a Hospital Resilient Supply Program (HRSP). The white paper outlines how these programs could operate and help address the broader market issues that lead to drug shortages. Although the white paper and its proposals focus on generic sterile injectable drugs that form the basic layer of hospital care and that make up the majority of drug shortages, HHS says the same challenges affect other medical products and that the concepts and solutions that the white paper discusses may be relevant for other markets as well.

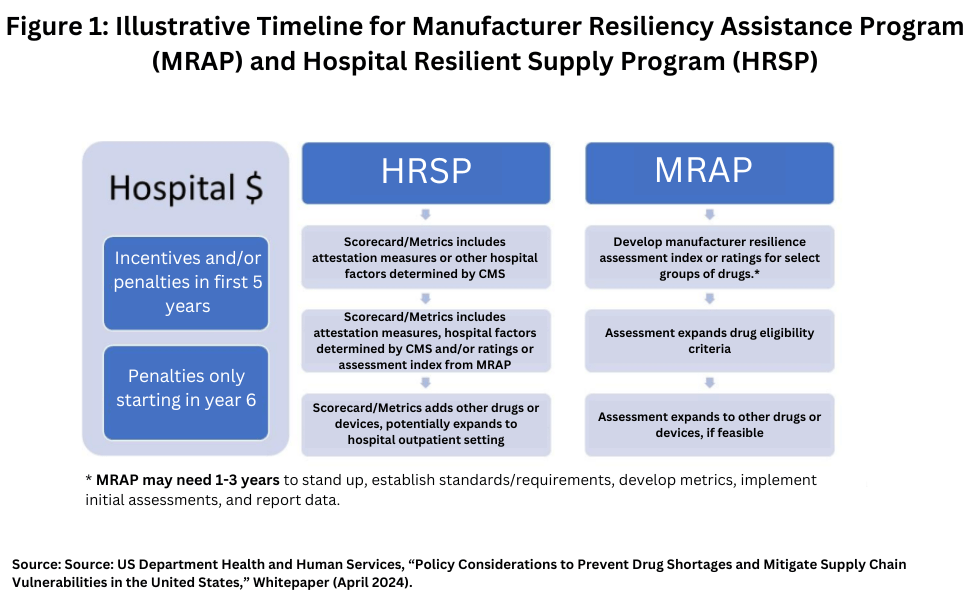

One proposal by HHS is for Congress to create new authorities and provide additional funding to develop and implement a Manufacturer Resiliency Assessment Program (MRAP) and a new Hospital Resilient Supply Program (HRSP). (see Figure 1). Through a public-private partnership, the MRAP would measure manufacturer resilience practices and assign manufacturers scores based on their performance (i.e., develop a reliable manufacturer metric). The HRSP would establish financial incentives and/or penalties to hospitals based on a combination of meeting certain requirements and performance on a hospital scorecard. The hospital scorecard would be developed by the HRSP and could include reliant manufacturer metrics developed by the MRAP and hospital pro-resilience purchasing behavior metrics developed by the HRSP using attestations or other information reported to CMS by hospitals.

A Manufacturing Resiliency Assessment Program

Under its proposal, the HHS says that a Manufacturing Resiliency Assessment Program (MRAP) would measure resilience of manufacturers and bring transparency to the prescription drug supplier base. It says that actors throughout the supply chain could use this information to better inform drug development, purchasing, production, and other activities. Through a public-private partnership, a private entity administering the MRAP would assign resilience scores to manufacturers of generic drugs, based on an assessment of manufacturer practices and past performance. The MRAP could develop new manufacturing resilience metrics (e.g., manufacturer and/or product ratings) and a process to assess manufacturers’ practices to address market-information failures and promote improvements in manufacturing performance.

While specific metrics have not yet been developed, and would be developed in collaboration with external organizations, MRAP metrics could reflect manufacturers’ quality management maturity, manufacturing redundancy, and sourcing diversity in active pharmaceutical ingredients/key starting materials, among other resilience-related metrics. These metrics would be intended to enhance transparency about manufacturer management practices. The MRAP would provide oversight of a nongovernmental national accreditation body and conduct core activities, including establishing accreditation standards, collecting data, conducting analyses, developing and submitting reporting requirements, and consulting with a new or established group of experts. The national accreditation body would be established by external nonprofit organizations that meet HHS standards and requirements for accreditation; these include, but are not limited to, annual audits, personnel qualifications, recordkeeping. and reporting. The national accreditation body would conduct manufacturer assessments based on criteria developed by the MRAP and report the ratings to HHS. Manufacturer assessments would be paid by manufacturers.

Under the proposal, manufacturers would be incentivized to participate based on the expectations that hospitals would use this information in their purchasing decisions and would be willing to pay higher prices for drugs from more resilient manufacturers and supply chain systems. The expected term of the nonprofit organization serving as the national accreditation body is to be determined; it would need to be long enough to ensure efficiency and continuity as well as accountability to HHS. After expiration of the term, the nonprofit organization(s) must seek renewal and approval to operate as part of the accreditation body. HHS says that this governance model enables accountability of a non-government body to HHS and leverages capability and expertise in HHS and industry. HHS says it also fosters transparency and participation from industry.

Hospital Resilient Supply Program

The second HHS proposal seeks to create a foundation for improved supply-chain resiliency to address prescription drug demand. Under the HHS proposal, a Hospital Resilient Supply Program (HRSP) would establish demand incentives and/or penalties by facilitating hospital purchasing that prioritizes supply-chain resilience, rather than the current structure, which the HHS generally prioritizes cost alone. To start, hospitals that provide inpatient services would need to consider quality management maturity and the reliability of drug supply in their purchasing practices.

At its core, the HRSP would draw on the same principles behind existing CMS programs, such as the Promoting Interoperability program (formerly the Medicare and Medicaid Electronic Health Record Incentive Program). More specifically, the HRSP would optimize new and existing authorities to link Medicare payments and/or penalties to hospitals based on a hospital scorecard that would be a combination of attestations and ratings reflecting the hospitals’ achievement and progress in adopting practices that promote supply-chain resilience or prevent shortages. Hospital attestations or other hospital resilience-oriented activities that could be considered include hospital inventory management practices (stockpiling or buffer stocks) and hospital contracting practices with middlemen (e.g., inclusion of effective failure-to-supply clauses, minimum purchasing volume requirements, long-term contracts) that promote supply-chain resilience. Attestation measures could also consider whether the hospital purchases from diverse sources, including domestic ones, thus supporting redundancy in the market. The attestation measures could be based on information that facilities already have available, which would enhance transparency about existing practices.

In addition, HHS says that the MRAP could provide the HRSP with information about the reliability of manufacturers that hospitals purchase from, thus expanding the hospital scorecard to base purchasing decisions on manufacturer resilience as well as price. As a whole, the scorecard developed by the HRSP could include lagging and leading indicators of practices that promote supply-chain resilience among hospitals, middlemen, and manufacturers. The HRSP could develop the scorecard for payments and/or incentives for an initial set of drugs that are considered eligible and eventually expand to other products prioritized by the MRAP or CMS.

Under the HHS proposal, the scorecard could be scaled based on various factors, including but not limited to hospital size, hospital attestations, and hospitals’ performance on the hospital scorecard. Incentives and/or penalties could be phased-in initially for reporting the attestation measures or other hospital information, and then could be expanded to include manufacturer resilience ratings. Similarly, the incentives and/or penalties could be based on the scorecard, or could be based on achieving a certain rating or improvements in scorecard ratings or other factors such as size or volume of the hospital, with attention to smaller hospitals that lack the purchasing power of larger hospitals or health systems. The HRSP payment and/or penalty amounts would have to be large enough to incentivize change and cover the cost and benefits of engaging in practices that promote supply-chain resilience, while being fiscally responsible to the program. If successful, the HRSP could be expanded to the outpatient setting or to include medical devices. “Ultimately, this would promote investment in resiliency at the manufacturer level, and facilitate market participation or support market entry for multiple or more diversified producers,” said HHS in its white paper.

Timeline for implementation

Under the HHS proposal, The MRAP and HRSP could be implemented in stages as a long-term approach, starting with hospitals that provide inpatient services (see Figure 1 above) for certain types of drugs. HHS says this phased-in approach is intended to optimize existing resources and expertise in a timely manner while allowing HHS and industry to adapt to changes in a way that ensures long-term success.

Under the HHS proposal, MRAP implementation would begin by developing manufacturer resilience assessment metrics for an initial set of drugs, such as the drugs in ASPR’s list of critical medicines, or a slightly larger set to include other critical drugs such as chemotherapy, and establishing the standards and necessary requirements for the program, e.g., requirements for accreditation, and ratings informed in part by FDA’s Quality Management Maturity program, which aims to encourage drug manufacturers to implement quality management practices that go beyond cGMP. Under the proposal, the MRAP could assess the feasibility of metrics at the drug product level, or other medical products, including, medical devices.

Under the HHS proposal, in the first five years, HRSP could develop and apply payment incentives and/or penalties in multiple ways: (1) apply penalties and incentives simultaneously; (2) introduce penalties first and then incentives; or (3) introduce incentives first and then penalties. This would allow HHS to share in the upfront cost to invest in supply-chain resilience. The HHS points out that the Electronic Health Records Incentive Program used incentives first, then turned to penalties after three and five years of implementation when 87% and 95% of hospitals, respectively, were participating.

Cost of the programs

While the combined 10-year budget impact would vary depending on the particular policy choices made, HHS’ initial estimate is that such a program would cost between $3.26 billion and $5.11 billion. This reflects operational costs of about $750 million for the MRAP and $2.51-$4.36 billion for the HSRP.