Euroapi Announces Restructuring Plan

Euroapi, the spin-out CDMO business of Sanofi, now a stand-alone entity, announced a restructuring plan this week and appointed a new CEO as a means to improve company performance. What challenges and opportunities does the CDMO face? DCAT Value Chain Insights takes an inside look.

Leadership change and major restructuring plan

Euroapi, a supplier/CMDO of active pharmaceutical ingredients (APIs) that was previously spun off from Sanofi in 2022, announced a major restructuring plan this week (February 28, 2024) and named Ludwig de Mot, currently Executive Vice President and Chief Transformation Officer, as the company’s new CEO, effective March 1, 2024. He joined Euroapi in those roles this past January (January 2024). He will succeed Viviane Monges, who has served as the company’s interim CEO since October 2023, and who will continue as Chair of the company’s Board of Directors.

In taking over the helm of Euroapi, de Mot faces the challenge of improving the profitability of the company. Sanofi first announced its plan to form the stand-alone API supplier/CDMO in February 2020 with the strategic aim that the new European company will help balance “the industry’s heavy reliance on API sourced from other regions” while simplifying Sanofi’s industrial footprint. Euroapi launched as a stand-alone, separate publicly traded company in 2022, and has since faced profitability issues in 2022, and which continued in 2023.

Although the company reported revenue gains in 2023, its net loss increased. The company reported 2023 net sales of EUR 1.013 billion ($1.096 billion), up 3.8% over 2022, but a net loss of EUR 189.7 million ($205.2 million) in 2023 compared to a net loss of EUR 15 million ($16.2 million) in 2022.

Euroapi has two main businesses: its API Solutions business and its CDMO business, primarily of small-molecule APIs. In 2023, net sales in its API business increased 2.6% to EUR 727.5 million ($787 million), which reflected sales to both Sanofi (a decline of 1.5%) and other clients (an increase of 7.1%) with 46 new clients added in 2023. CDMO sales grew 6.8% to EUR 285.8 million ($309.2 million), reflecting both sales to Sanofi (up 6.3%) and sales to other clients (up 7.2%). In its CDMO business, the number of requests for proposals (RFPs) received in 2023 declined compared to 2022: 211 incoming RFPs were received in 2023, compared to 230 in 2022, of which 57% were early-stage projects and 43% were late-stage projects. Overall, the company had 69 CDMO projects as of the end of 2023, of which 15 were for large molecules, six for highly potent compounds, eight in biochemistry-derived fermentation, and 40 for complex chemical synthesis. Throughout 2023, the company signed 23 new contracts, of which 12 were in the pre-approval or commercial phase, spurred by the increasing demand for peptides and oligonucleotides, complex chemistry regulatory starting materials, or API re-shoring and dual sourcing with European players. Sixteen projects were stopped, paused, or delayed by customers, including two in late-stage development with Sanofi, and 12 in early-stage development.

Launch of major restructuring plan

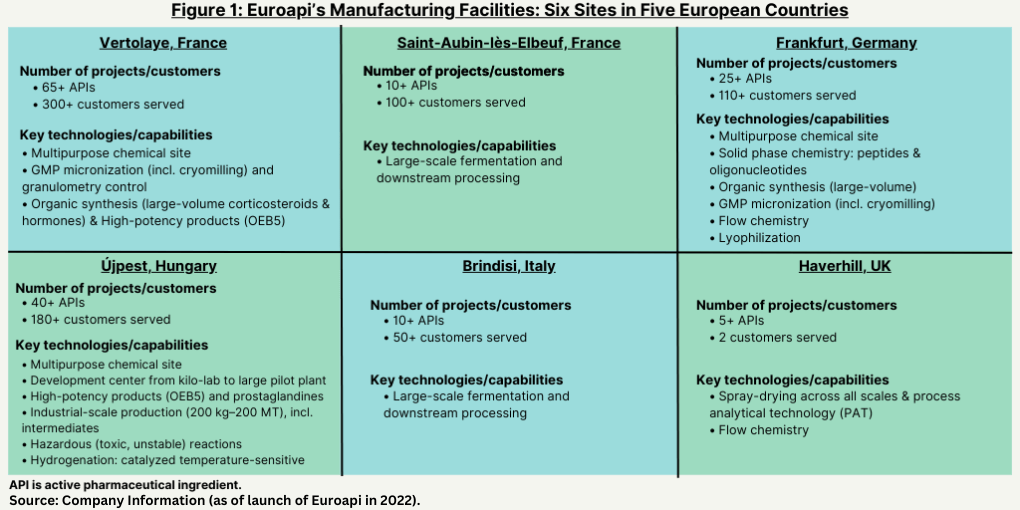

In response to lower returns and the need to improve its financial performance, the company has announced a major restructuring plan, Focus-27, a four-year plan to improve the company’s profitability. The plan involves four key elements: (1) creating a streamlined value-added API portfolio by discontinuing 13 APIs with low or negative margins and shifting its focus to highly differentiated, profitable products such as vitamin B12, prostaglandins, peptides, and oligonucleotides; (2) a more focused CDMO offering; (3) a rationalized industrial footprint prioritizing high-return capital expenditures (CAPEX)—see Figure 1 below for its facilities; and (4) a leaner organization with more efficient ways of working, which includes reduction of headcount.

The restructuring plan follows a strategic and operational review of the company over the past four months. With respect to its API business, the company said that the strategic review confirmed the potential of several highly differentiated and profitable products, mostly sold to clients other than Sanofi. The commercial strategy will be refocused on these APIs to foster profitable growth, notably: large molecules, including peptides and oligonucleotides; high-potency APIs (HPAPIs), including prostaglandins, corticosteroids, and hormones; vitamin B12 and its derivatives; and opiates. The company has decided to discontinue 13 APIs with low or negative margins, including certain complex small molecules manufactured at its site in Frankfurt, Germany, and in Brindisi, Italy, which, represented 8% of the company’s 2023 net sales. To take into account the company’s contractual commitments and regulatory constraints, they will be phased out gradually between 2026 and 2027.

Euroapi says its CDMO business will remain the main driver for its growth and profitability, pending adjustments to enhance the organization’s responsiveness and agility. The company says its portfolio will be progressively shifted toward more customized and high-value CDMO segments, with a focus on complex small molecules and complex “tides” (i.e., peptides and oligonucleotides). The commercial strategy will be geared toward Large Biotech and Big Pharma companies, which accounted for 91% of the company’s requests for proposals (RFPs) received in 2023. The company said its goal is to increase the average value of its projects and de-risk its pipeline through late-stage projects while strengthening the company’s capabilities in HPAPIs, fermentation, and complex tides through value-added and customized offers.

In terms of its manufacturing activities, the company’s plan involves rationalizing its industrial footprint by prioritizing high-return CAPEX. The company says that the rationalization of its industrial footprint will allow for an increase in capacity utilization, with a targeted average utilization rate of 80% to 85%, in line with industry standards. It will impact the company’s site in Frankfurt, Germany, and two workshops could be mothballed to right-size its small-molecule complex chemistry capacities. In light of the company’s refocused commercial strategy on value-added APIs and the significant decrease in volumes sold to Sanofi, its Haverhill, UK, and Brindisi, Italy, sites are being considered for divestment. The company says it will continue to invest to ensure the required maintenance and compliance of its CAPEX as well as ongoing CMO activities while working on a potential divestment.

Prioritizing high-return projects, the company says it will invest between EUR 350 ($379 million) and EUR 400 million ($433 million) in CAPEX between 2024 and 2027, with a focus on strategic growth initiatives, including increased capacities for peptides and oligonucleotides, vitamin B12, and prostaglandins. To foster profitable growth, the company said its future CAPEX will be focused on: (1) dedicated growth investments in biochemistry fermentation capabilities at its site in Elbeuf, France, where a steam generation biomass boiler is to be built to reduce carbon dioxide emissions to achieve the company’s 2030 decarbonation plan; (2) the multi-production capabilities of its site in Vertolaye, France, to boost corticosteroids and hormones sales through innovative processes and acceleration of its CDMO roadmap; (3) the large-molecules platform of its site in Frankfurt, Germany, to grow the company’s tides capacities; and (4) at is site in Budapest (Újpest District), Hungary, the company will continue to increase its prostaglandin capacities.

With respect to overall organizational transformation, the company’s restructuring plan includes reducing headcount across all functions. In addition to optimizing its portfolio and rationalizing its industrial footprint, the company says it intends to implement a leaner operating model. All functions, including industrial operations, quality, R&D, and support functions, will contribute to the cost-savings initiatives, which could lead to headcount reduction across the organization. The project will be presented to the company’s social partners, local employee representatives, and European Works Council according to legal and social procedures.

Other organizational initiatives underway

Several other organizational initiatives are underway as well. The organization of the company’s commercial teams will be redesigned to increase synergies and efficiencies and support future growth. The R&D teams will be reprioritized on innovative platforms and late-stage projects to support the company’s CDMO activities. The transformation of the company’s procurement organization, initiated in March 2023, will be accelerated, and a new indirect procurement strategy implemented. In addition strengthened end-to-end processes will seek to improve supply-chain efficiency, increase capacity, and drive lead-time and inventory reductions.