FDA & Foreign Mfg Inspections: Making Progress or Not?

Pre-pandemic, the FDA set a goal of increasing inspections of drug-manufacturing facilities located outside the US. Has the agency made progress? A look at what the numbers say.

Seeking parity in domestic and foreign manufacturing inspections

The frequency and number of inspections of drug-manufacturing facilities located outside the US is an important issue not only to improve regulatory oversight but is also considered important from a business view as a means to create a more competitive playing field among drug manufactures. Facilities that manufacture drugs for the US market have to be inspected by the US Food and Drug Administration (FDA), but there has been a long-standing difference in the level of domestic and foreign inspections.

Foreign inspections: looking at the numbers

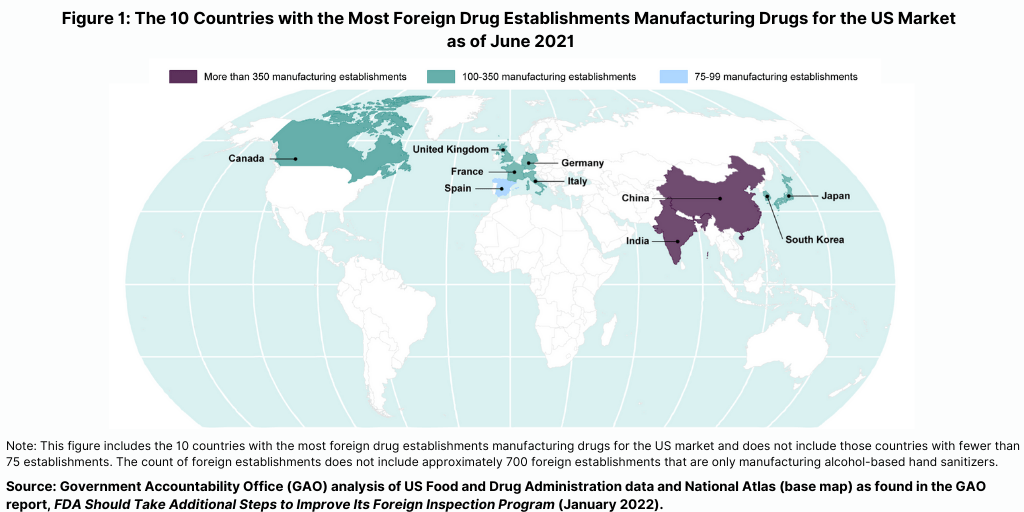

The importance of foreign inspections is underscored by the increased globalization of the pharmaceutical supply chain. As of March 2021, 73% of establishments registered with the FDA to manufacture active pharmaceutical ingredients (APIs) and 52% of establishments registered with the FDA to manufacture finished drugs for the US market were located outside the US, according to the US Department of Health and Human Services. The FDA conducts the largest number of foreign inspections in India and China, where more than one-third of foreign establishments supplying the US market are located (see Figure 1), according to recent report by the US Government Accountability Office (GAO) (see Reference 1), which evaluated the FDA’s program for foreign inspections and concluded that the FDA needs to do more to improve its oversight of foreign drug-manufacturing facilities. The GAO is a legislative branch government agency that provides auditing, evaluation, and investigative services for the US Congress.

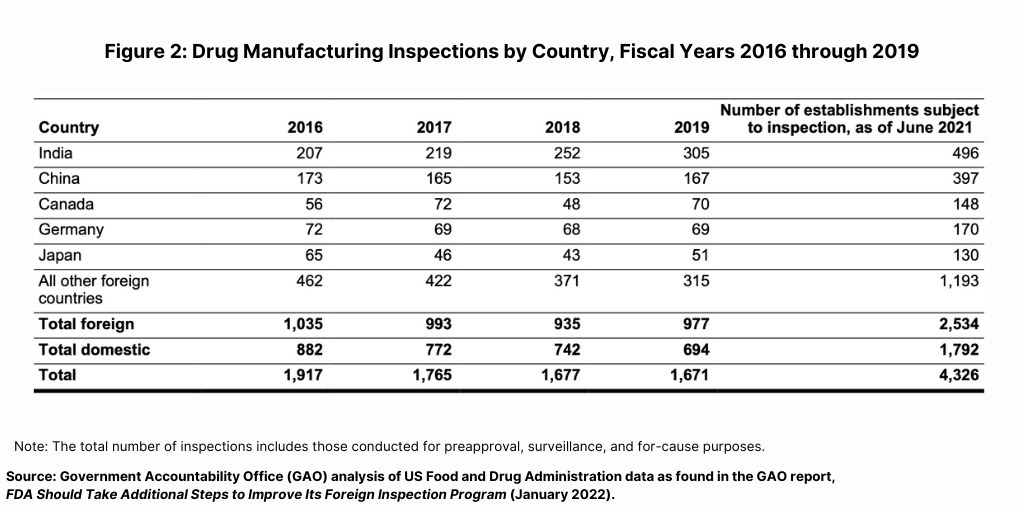

Prior to the COVID-19 pandemic, foreign drug inspections had begun to increase and the largest increase was in India (see Figure 2). In fiscal year 2019, the FDA began to increase the number of inspections of foreign drug-manufacturing establishments after decreases from fiscal years 2016 through 2018, according to the GAO report. In addition, the FDA continued to conduct more foreign than domestic inspections in each fiscal year from 2016 through 2019. In fiscal year 2019, the FDA continued to conduct the largest number of foreign inspections in India and China, with an increasing number of inspections conducted in India, where about 20% of foreign establishments subject to inspection were located in recent years (see Figure 2).

The FDA conducts three types of inspections: (1) preapproval inspections, which are conducted prior to when a drug is marketed in the US; (2) surveillance inspections, which are conducted after a drug is marketed in the US to evaluate continued GMP compliance; and (3) for-cause inspections, which are conducted to investigate particular issues, such as those arising from a consumer complaint, specific product-quality and manufacturing issues, and FDA follow-up on prior violations.

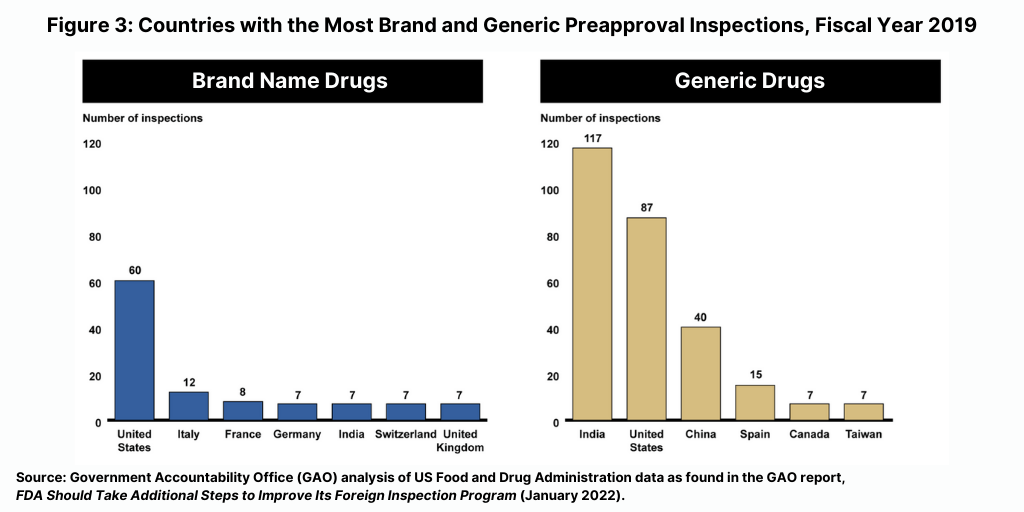

The majority of foreign inspections from fiscal year 2016 through 2019 continued to be routine surveillance inspections. For fiscal years 2016 through 2019, between 60% and 75% of the FDA’s foreign inspections were conducted for surveillance purposes, compared to about 20% in 1998, according to the GAO report. In addition, the FDA conducted more preapproval inspections in foreign countries than in the US from fiscal year 2016 through fiscal year 2019, although most foreign inspections were for surveillance purposes. For example, in fiscal year 2019, the FDA conducted about 300 preapproval inspections in foreign countries compared to about 150 in the US. The largest number of inspections related to brand drug applications were conducted in the US and the largest number of inspections related to generic drug applications were conducted in India (see Figure 3).

Foreign inspections and backlogs: the impact of the COVID-19 pandemic

One of the consequences of the COVID-19 pandemic has been the increase in the backlog of inspections. Although the FDA continued to conduct both foreign and domestic inspections deemed “mission-critical” during the pandemic, it postponed most inspections and used other tools to provide oversight, such as remote assessments. The combination of mission-critical FDA inspections and alternative tools allowed the FDA to complete its review of at least 90% of brand and generic-drug applications and supplements on or before their user fee goal date, as of the second quarter of 2021. While the FDA has been able to substitute alternative tools for a preapproval inspection, such tools are generally not a substitute for routine surveillance inspections, thereby resulting in an increasing backlog of surveillance inspections.

The FDA’s postponement of most foreign inspections due to the COVID-19 pandemic continued through fiscal year 2021, which increased the size of the surveillance inspection backlog. Beginning in March 2020, the FDA postponed most inspections because of pandemic-related travel restrictions and safety protocols, and conducted three foreign inspections from March to October 1, 2020. In comparison, the FDA conducted more than 600 foreign inspections over the same time period in each of the two prior years. From October 2020 to April 2021 (the most recent period for which data are available), the FDA conducted 18 high-priority foreign inspections—primarily in China, according to the GAO report. While the agency began to resume routine domestic inspections in July 2021, it continued to primarily conduct only mission-critical inspections in most foreign countries. Following postponement of domestic and foreign inspections due to the Omicron variant, except those deemed mission-critical, the FDA resumed domestic surveillance inspections earlier this month (February 2022).

The agency is proceeding with previously planned foreign surveillance inspections that have received country clearance and are within the travel recommendations (Level 1 or Level 2) by the US Centers for Disease Control and Prevention. Earlier this month (February 2022), the FDA reported that planning for additional foreign surveillance inspections is ongoing, with an anticipated goal of conducting foreign prioritized inspections starting in April (April 2022).

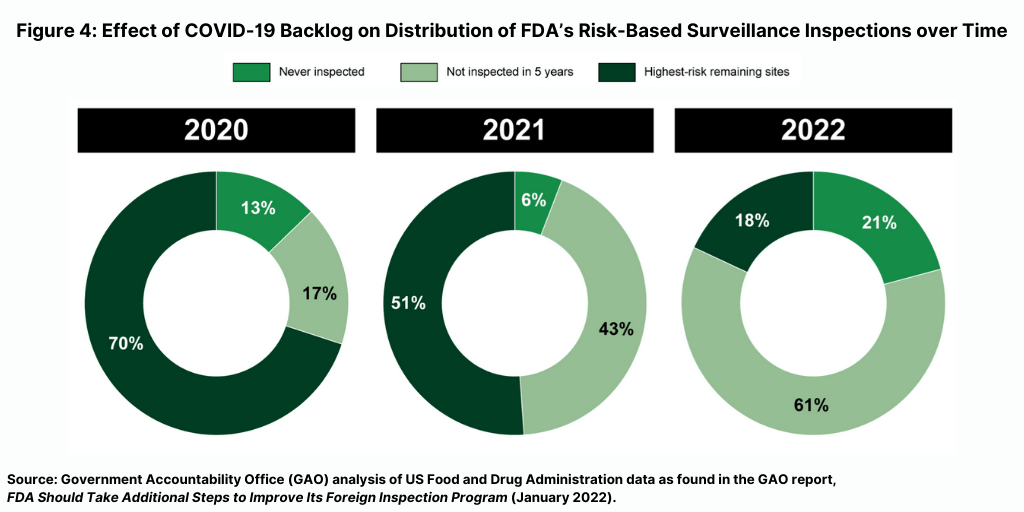

The FDA’s fiscal year 2022 inspection plan documents the increasing size of the backlog. Per the GAO analysis, more than 80% of FDA’s planned fiscal year 2022 surveillance inspections are of establishments never inspected or not inspected within five years—compared to 30% in fiscal year 2020 and 49% in fiscal year 2021 (see Figure 4).

How the FDA will address this backlog is important. “Given that the majority of establishments manufacturing drugs for the US market are located overseas, it will be important for FDA to continue to account for, and respond to, the backlog in its inspection plans for future fiscal years,” said the GAO report. “We will continue to monitor FDA’s inspection plans and progress toward addressing the backlog.”

Results from inspections: domestic versus foreign manufacturing facilities

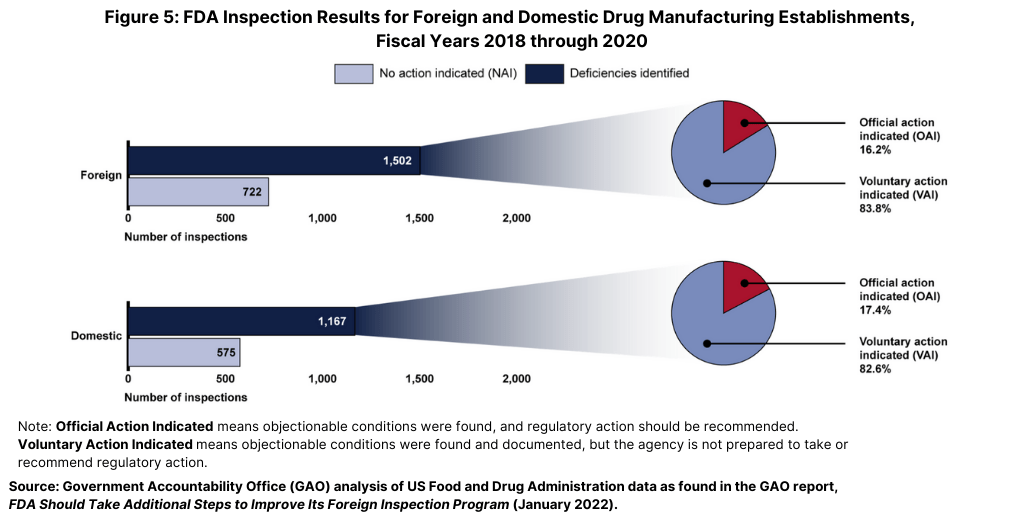

A key finding from the GAO report was that the level of deficiencies in facilities inspected—both domestic and foreign—were similar, with most facilities having deficiencies that did not warrant regulatory action. After each inspection, the FDA classifies the inspection into one of three categories based on its determination of whether any deficiencies identified during the inspection are serious enough to warrant regulatory action. The three categories are: (1) no action indicated (NAI); (2) voluntary action indicated (VAI), and (3) official action indicated (OAI).

From fiscal years 2018 through 2020, the FDA identified deficiencies in the majority of both foreign and domestic inspections, but, in most cases, the agency determined that the deficiencies did not warrant regulatory action (see Figure 5). Approximately 66% of all foreign inspections (1,502 of 2,286 inspections) identified deficiencies at the establishment (as identified by the percentage of inspections it classified as VAI or the more serious OAI), of which only 16% (244 of 1,502 inspections) had deficiencies serious enough to warrant regulatory action (an OAI classification). Similarly, FDA data showed that the agency determined that 64% of domestic inspections (1,167 of 1,812 inspections) it conducted during this same time period identified deficiencies, of which 17% (203 of 1,167 inspections) had deficiencies serious enough to warrant regulatory action (see Figure 5).

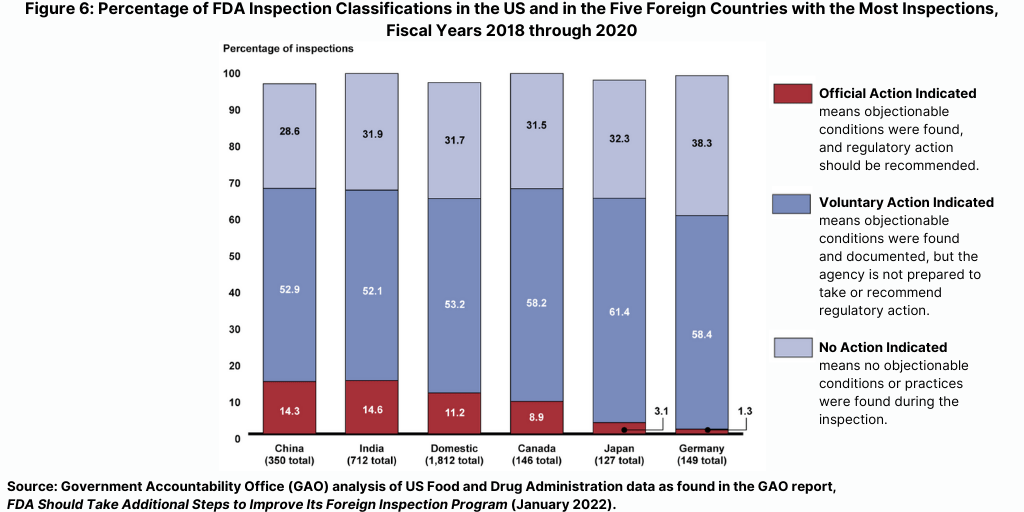

While the FDA identified serious deficiencies warranting regulatory action in relatively few inspections, such deficiencies were identified more frequently during inspections in China and India than during domestic inspections in the US or during foreign inspections in the other countries FDA inspected most frequently during this time period (see Figure 6).

Recommendations for FDA’s foreign inspection program

In its report, the GAO acknowledges that the FDA faces unique challenges for conducting foreign inspections compared to domestic inspections, such as having to preannounce foreign inspections due to travel and jurisdictional issues, language barriers, and maintaining an inspectional workforce for foreign inspections. The FDA is in the process of developing plans to conduct pilot programs intended to address these issues. The GAO identified five leading practices that it is recommending that the FDA follow for designing its pilot programs as follows:

- Establish well defined, appropriate, clear, and measurable objectives;

- Articulate an assessment methodology that details the type and source of the information necessary to evaluate the pilot and the methods for collecting that information;

- Develop an evaluation strategy that defines how the information collected will be analyzed to evaluate the pilot’s implementation and performance;

- Assess the scalability of the pilot design to inform whether and how to implement a new approach in a broader context; and

- Ensure appropriate stakeholder communication at all stages of the pilot.

The GAO’s three main recommendations are outlined below.

Addressing unannounced inspections: The Commissioner of FDA should ensure that the agency incorporates leading practices for designing a well-developed and documented pilot program as it finalizes its plans for implementing a pilot program to evaluate the effectiveness and efficiency of unannounced foreign inspections.

Addressing language barriers. The Commissioner of FDA should ensure that the agency incorporates leading practices we identified for designing a well-developed and documented pilot program as it finalizes its plans for implementing a pilot program to evaluate the costs and effects of using different types of translation services during foreign inspections.

Talent recruitment and retention. The Commissioner of FDA should ensure the agency fully develops tailored strategies—including detailing implementation steps and time frames—focused on recruiting new staff and developing and retaining current staff. The GAO report says that while the FDA has reduced vacancies among its general drug inspection workforce, FDA data showed that the agency still has persistent vacancies among those who specialize in foreign inspections. It reported that as of November 2021, eight of 20 positions were vacant in FDA’s cadre of drug investigators that conduct only foreign inspections, and five of 15 drug investigator positions were vacant in its foreign offices located in China and India.