Industry Radar: Potential Blockbusters Launching in 2022

Which drugs projected to launch in 2022 are slated for blockbuster potential? A look at the 10 biggest potential product launches in 2022 and other high-valued drug candidates.

Blockbuster potential

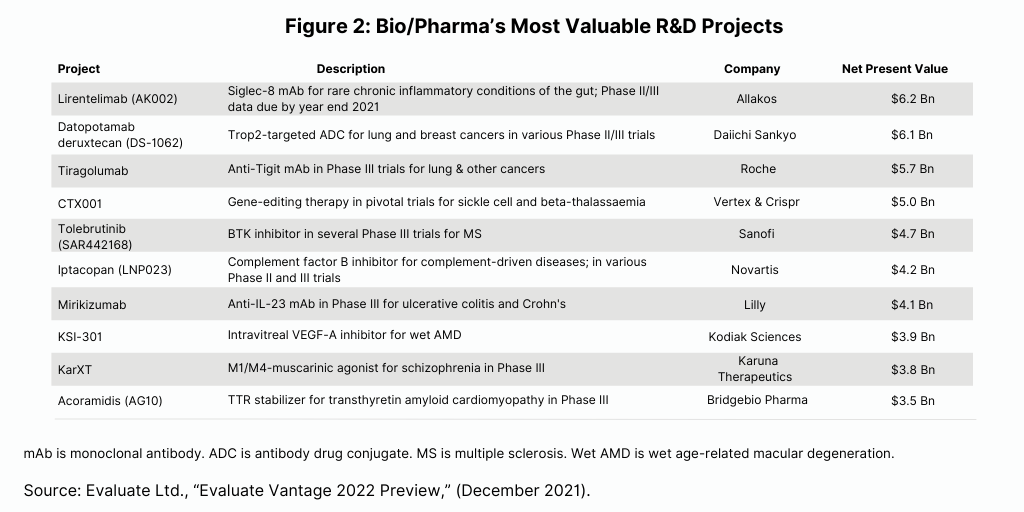

Each year brings new product launches, and with those launches, the prospect of potential blockbusters (defined as products with sales of $1 billion or more). A recent analysis by Evaluate Ltd, Evaluate Vantage 2022 Preview, points to several products launching in 2022 with potential blockbuster status by 2026 (see Figure 1).

The top prospect among 10 projected product launches in 2022 is Eli Lilly and Company’s donanemab, a drug to treat Alzheimer’s disease, with projected 2026 sales of $6.0 billion, according to the Evaluate Vantage analysis. The company began a rolling submission for the drug in the third quarter 2021, with plans to complete the submission in the first quarter of 2022. The company has since deferred its timeline to complete the application later in 2022 as reported on the company’s fourth-quarter/full-year 2021 earnings call on February 3, 2022.

The news follows an earlier draft decision by the US Centers for Medicaid and Medicare Services (CMS) to restrict coverage for Biogen’s Alzheimer’s drug, Aduhelm (aducanumab) only to patients taking part in approved clinical trials. The drug was approved under the accelerated approval pathway by the US Food and Drug Administration in June 2021. The accelerated approval pathway provides patients with a serious disease earlier access to drugs when there is an expectation of clinical benefit despite some uncertainty about the clinical benefit.

Accelerated approval is based upon the drug’s effect on a surrogate endpoint—an endpoint that reflects the effect of the drug on an important aspect of the disease—where the drug’s effect on the surrogate endpoint is expected, but not established, to predict clinical benefit. The accelerated approval pathway requires the company to verify clinical benefit in a post-approval trial. If the sponsor cannot verify clinical benefit, the FDA may initiate proceedings to withdraw approval of the drug.

Biogen’s Aduhelm is an amyloid beta-directed antibody indicated to treat Alzheimer’s disease. The CMS’ final coverage terms, due later this year (2022), may apply to all drugs in this class, including Lilly’s donanemab as well as other Alzheimer’s drugs being developed by Roche and Eisai. Roche’s gantenerumab, an anti-amyloid-beta monoclonal antibody, is also among the potential product launches in 2022 with projected blockbuster status (see Figure 1). Moving these drugs forward depends on the FDA’s review and related data provided by the companies.

Lilly is also advancing tirzepatide, a drug to treat Type II diabetes and potentially obesity, which has projected 2026 revenues of $4.5 billion. Tirzepatide is a dual GIP/GLP-1 agonist and would compete against Novo Nordisk’s Ozempic (semaglutide).

Other potential project launches in 2022 with blockbuster potential among the large bio/pharmaceutical companies include two drugs by Bristol-Myers Squibb: deucravacitinib for treating psoriasis and other autoimmune conditions and mavacamten for treating cardiomyopathy. In November 2021, the FDA extended the review of the new drug application for mavacamten for the treatment of patients with symptomatic obstructive hypertrophic cardiomyopathy (oHCM) to April 28, 2022 (see Figure 1).

Amgen/AstraZeneca are also advancing tezepelumab for treating severe asthma. Johnson & Johnson is progressing a chimeric antigen receptor T cell (CAR-T) therapy, ciltacabtagene autoleucel (cilta-cel), in partnership with Legend Biotech, a Somerset, New Jersey-based bio/pharmaceutical company. Cilta-cel is a BCMA-directed CAR-T therapy being investigated for the treatment of adults with relapsed and/or refractory multiple myeloma. In November 2021, the FDA moved the action date under the Prescription Drug User Fee Act to February 28, 2022. (see Figure 1).

Other high-valued drug candidates

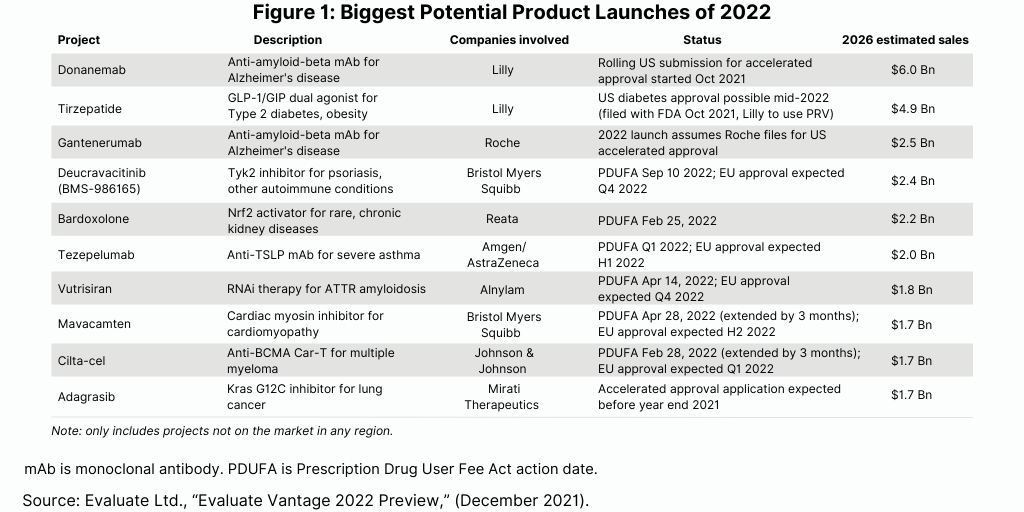

The Evaluate Vantage analysis also looked at other strong drug candidates based on the net present value of their associated R&D programs (see Figure 2). Among the large pharma companies with high-value drug candidates are: Roche’s tiragolumab for treating lung and other cancers; Sanofi’s tolebrutinib for treating multiple sclerosis; Novartis’ iptacopan for treating complement-driven diseases; and Lilly’s mirikizumab for treating ulcerative colitis and Crohn’s disease.