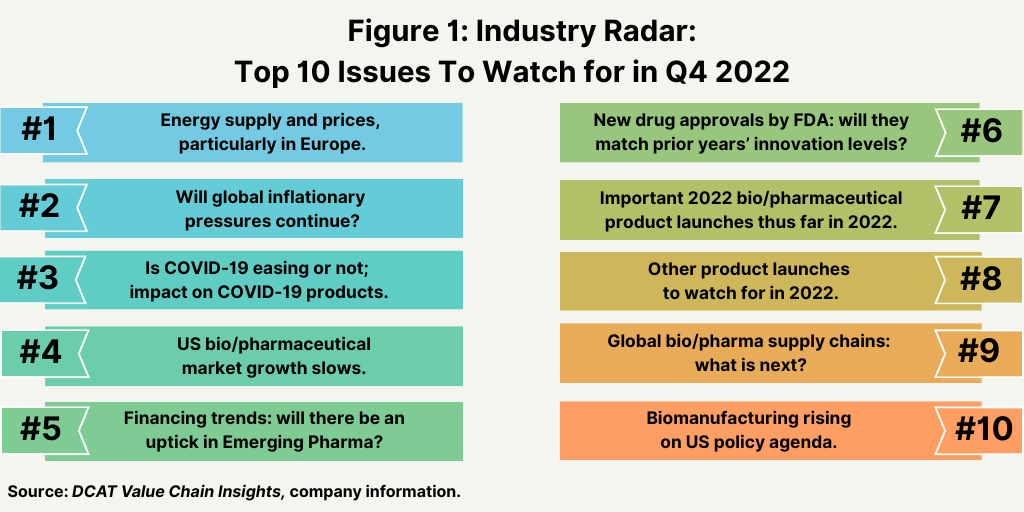

Industry Radar: Top 10 To Watch For Rest of 2022

What are the key issues and trends in play for the rest of 2022? From energy supply to inflationary pressures to new bio/pharmaceutical products launches, DCAT Value Chain Insights takes an inside look of what may be next.

Top 10 things to watch for in rest of 2022

1. Energy supply and prices, particularly in Europe. Uncertainty in energy supply and rising energy costs in Europe continue to be a major issue as Europe deals with reduced energy supply from Russia. The European Commission proposed this week (September 14, 2022) an emergency intervention in Europe’s energy markets to address the recent dramatic price rises. The EU is confronted with the effects of a severe mismatch between energy demand and supply. To ease the increased pressure this puts on European businesses and households, the Commission is taking a next step in tackling this issue by proposing exceptional electricity demand reduction measures, which it says will help reduce the cost of electricity for consumers (both businesses and households), and measures to redistribute the energy sector’s surplus revenues to final customers.

The new proposal follows previously agreed measures on filling gas storage and reducing gas demand to prepare for the upcoming winter. The Commission is also continuing its work to improve liquidity for market operators, bring down the price of gas, and reform the electricity market design for the longer term. The Commission says it will deepen its discussion with EU member states about the best ways to reduce gas prices, analyze various ideas for price caps, and enhance the role of the EU Energy Platform, a voluntary coordination mechanism supporting the purchase of gas and hydrogen for the EU, in facilitating lower price agreements with suppliers through voluntary joint purchasing. The Commission says it will also keep working on tools to improve liquidity on the market for energy utilities and review the Temporary State aid Crisis Framework, designed to support the EU economy in the context of Russia’s invasion of Ukraine, to ensure that it continues to enable EU member states to provide necessary and proportionate support to the economy. At the Extraordinary Energy Council Meeting on September 9, 2022, Energy Ministers of EU member states endorsed the Commission’s ongoing work in these areas.

2. Global inflationary pressures. Rising energy prices, along with higher costs from existing supply-chain issues that arose from the global pandemic and other higher cost inputs, has made an inflation a key issue in 2022, and the key question is whether relief is on the way. In the US, inflation ticked back up in August (August 2022), despite declining gasoline prices, according to data from the US Bureau of Labor Statistics released earlier this month (September 2022). In the US, the Consumer Price Index, which measures a basket of consumer goods and services, rose 0.1% in August (August 2022) on a seasonally adjusted basis. The annual inflation rate (based on the last 12 months ending August 2022) remains high, with prices up 8.3% year-on-year, a slight decline from the annual inflation rate of 8.5% rate reported in July (July 2022) and down from a 40-year high of 9.1% reported in June (June 2022). In the US, the slight decline in the annual inflation rate was mainly due to a 10.6% decline in the gasoline index.

Another inflation indicator in the US, the Producer Price Index, which measures the average change over time in the selling prices received by domestic producers for their output (goods and services), fell 0.1% in August (August 2022), seasonally adjusted, according to the US Bureau of Labor Statistics. On annual basis, inflation for producer prices was up 8.7% in the 12 months ended in August (August 2022), down from 9.8% in July (July 2022), marking a second consecutive month that the pace of increase slowed although the overall annual rate still remains high.

As central banks across the world simultaneously hike interest rates in response to inflation, the global economy may be edging toward a global recession in 2023, according to a recent analysis by the World Bank. It says investors expect central banks to raise global monetary-policy rates to almost 4% through 2023—an increase of more than 2 percentage points over their 2021 average. Unless supply disruptions and labor-market pressures subside, those interest-rate increases could leave the global core inflation rate (excluding energy) at about 5% in 2023—nearly double the five-year average before the pandemic, according to the World Bank analysis. To cut global inflation to a rate consistent with their targets, a World Bank model suggests that central banks may need to raise interest rates by an additional 2 percentage points. If this were accompanied by financial-market stress, global GDP growth would slow to 0.5% in 2023—a 0.4% contraction in per–capita terms that would meet the technical definition of a global recession.

3. Tracking COVID-19 and the impact on COVID products. Earlier this month (September 2022), the World Health Organization (WHO) reported that the number of weekly reported deaths from COVID-19 was the lowest since March 2020, leading Tedros Adhanom Ghebreyesus, WHO Director-General to comment in a news briefing this week (September 14, 2022): “We have never been in a better position to end the pandemic. We’re not there yet, but the end is in sight.” WHO recorded around 11,000 deaths for COVID-19 globally for the week of September 5-11, 2022, a 22% decrease from the previous week, and new weekly cases fell by 28% in that time, from nearly 4.2 million during the week of August 29 to September 4, 2022 to around 3.1 million the prior week. The WHO released six policy briefs this week (September 14, 2022) that outline key actions for governments to take to end the pandemic: continued testing, treatment and vaccinations, infection control in healthcare facilities, steps to combat misinformation and clear public communication. The briefs are based on the evidence and experience of the past 32 months.

Dr. Maria Van Kerkhove, WHO’s technical lead on COVID-19, cautioned that the virus is still “intensely circulating” around the world. “We expect that there are going to be future waves of infection, potentially at different time points throughout the world caused by different subvariants of Omicron or even different variants of concern,” she said, reiterating that the more the virus circulates, the more opportunities it has to mutate. However, she said, these future waves do not need to translate into “waves or death” because there are now effective tools such as vaccines and antivirals specifically for COVID-19.

4. US bio/pharmaceutical market growth. After reaching growth of 12% in 2021, in large measure due to COVID-19 products, the US bio/pharma market is projected to see growth moderate to pre-pandemic levels. Spending on medicines in the US, at estimated net manufacturer prices, reached $407 billion in 2021, up 12.1% over 2020, as COVID-19 vaccines and therapeutics became widely available and added $29 billion in related spending, according to a report by the IQVIA Institute for Human Data Science, The Use of Medicines in the U.S. 2022: Usage and Spending Trends and Outlook to 2026, which was released earlier this year (April 2022). In 2021, the non-COVID medicines market in the US grew more slowly, at only 4.9%, with growth tempered from the growing impact of biosimilars, which increased significantly, offsetting increased use of branded medicines.

While spending growth slowed in 2020 to less than 1%, from a combination of impacts on volume and spending on newly launched medicines, the pandemic impact was reduced in 2021. Net spending in the past five years (2017–2021) grew at a compound annual growth rate (CAGR) of 4.6%, including for COVID-19 products, but only 3.1% for all other medicines, reflecting a slowing trend without these new treatments. Medicine spending in the US grew $82 billion over the past five years (2017–2021), with COVID-19 products contributing $29 billion. In the prior five-year period (2016–2020), US medicine spending increased by 4.3%. Although health services utilization returned to pre-pandemic levels by the end of 2021, it has yet to make up for the pandemic-induced backlog in missed patient visits, screenings and diagnostics, elective procedures, and new prescription starts, according to the IQVIA Institute report. However, prescription drug use in the US reached a record level of 194 billion daily doses in 2021 as new prescription starts for both chronic and acute care recovered from the slowdown recorded in 2020. Spending on medicines in the US is expected to return to pre-pandemic growth trend lines by 2023 despite year-to-year fluctuations and incremental spending on COVID-19 vaccines and therapeutics. The IQVIA Institute projects a compound average annual growth rate of 2.1% (range of 1-4%) for the US market through 2026, which is comparable to pre-pandemic levels, and total US market size in 2026 of about $450 billion on a net manufacturer price basis.

5. Financing trends in Emerging Pharma. Emerging Pharma companies are an important source of product innovation in the bio/pharmaceutical industry and a customer base for CDMOs/CMOs, so financing trends into this sector is one important barometer to track. A mid-year (June 2022) analysis of deal-making in the pharma and life-sciences industry by PwC showed a 58% decline in deal value in the first half of 2022 compared to the year-ago period with deals reaching on overall value of $61.7 billion. The number of deals also fell 33% in the first half of 2022 compared to the year-ago period to 137 deals. The PwC analysis says that increased scrutiny from the US Federal Trade Commission around larger deals could mean that 2022 will be a year of bolt-on transactions in the $5 billion to $15 billion range with large pharma companies targeting earlier-stage companies to fill pipeline gaps that are likely to start in 2024. Deal activity in the pharma industry alone (excluding life sciences) was down by 30% on a semi-annualized basis, but deal values dropped about 50% in that time period, reflecting interest for smaller deals around a single asset or bolt-on deals. In the biotech sector, there were 104 biotech initial public offerings (IPOs) in 2021 that raised nearly $15 billion in funds while through the first-half 2022, there 14 IPOs raising less than $2 billion collectively.

6. Trends in new product approvals. Although not following a strictly chronological path, examining the pace of approvals of new molecular entities (NMEs) and new therapeutic biological products is an important measure of product innovation in the bio/pharmaceutical industry. As we near the fourth quarter of 2022, the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) has approved 22 NMEs and new therapeutic biological products thus far in 2022 (as of September 14, 2022), below the pace set in 2021, in which 37 NMEs had been approved by mid-September en route to a total of 50 new drug approvals (NMEs and new therapeutic biological products) in the full-year 2021. A similar strong pace on new drug approvals by FDA’s CDER was seen in 2020, when 40 new drugs were approved by mid-September en route to a total of 53 NMEs approved for the full-year 2020. The 53 new drug approved in 2020 represented the second highest level of approvals in the past decade, except for 2018 when 59 new drugs were approved.

7 and 8. New product launches and blockbuster potential. As we near the fourth quarter of 2022, several products, launched and expected to launch in 2022 are projected for blockbuster status, defined as products with sales of $1 billion or more. Earlier this year (January 2022), Clarivate Analytics released a report, Drugs To Watch 2022, which identified seven potential blockbuster products by 2026. For purposes of the analysis, the candidates were in Phase II or Phase III trials, at pre-registration or registration stage, or already launched in 2021, including drugs launched for a new indication that could be particularly impactful on the industry; drugs launched prior to 2021 were excluded. Key products from this analysis included: adagrasib by Mirati Therapeutics and Zai Lab; faricimab by Roche and Chugai Pharmaceutical; tezepelumab by Amgen and AstraZeneca; tirzepatide by Eli Lilly and Company; vutrisiran by Alnylam Pharmaceuticals; and lecanemab by Eisai and Biogen and donanemab by Eli Lilly and Company.

Mirati’s/Zai Lab’s adagrasib is an anticancer drug that targets KRAS mutations, considered to play a key role in cancer. Scientists have known for decades about the role KRAS and other RAS genes play in cancer growth, but there have been challenges to develop drugs to target it. In February (February 2022), the US Food and Drug Administration (FDA) accepted Mirati’s new drug application for adagrasib for treating non-small cell lung cancer in patients harboring the KRASG12C mutation who have received at least one prior systemic therapy. The FDA’s targeted review date for adagrasib is December 14, 2022. Adagrasib is also being evaluated as a monotherapy and in combination with other anti-cancer therapies in patients with advanced KRASG12C-mutated solid tumors, including non-small cell lung cancer, colorectal cancer and pancreatic cancer.

Roche’s/Chugai Pharmaceutical’s Vabysmo (faricimab) was approved by the FDA earlier this year (January 2022) to treat two eye disorders: neovascular (wet) age-related macular degeneration and diabetic macular edema.

Amgen’s/AstraZeneca’s, Tezspire (tezepelumab-ekko) was approved in the US in December 2021 as an add-on maintenance treatment for severe asthma. Tezspire is also being evaluated for other potential indications, including chronic obstructive pulmonary disease, chronic rhinosinusitis with nasal polyps, chronic spontaneous urticaria and eosinophilic esophagitis.

Eli Lilly and Company’s Mounjaro (tirzepatide) was approved in the US in May (May 2022) for improving blood sugar control in adults with Type 2 diabetes as an addition to diet and exercise.

Alnylam Pharmaceuticals’ Amvuttra (vutrisiran), a RNAi therapeutic, was approved by the FDA in June (June 2022) for treating a rare disease, transthyretin-mediated amyloidosis, which results in the abnormal buildup of amyloid deposits in the body’s organs and tissues.

Eisai’s/Biogen’s lecanemab and Lilly’s donanemab are two drugs for treating Alzheimer’s disease, which had been projected for possible launch in 2022 and subsequent blockbuster status although the path forward is less certain. Both drugs are anti-amyloid drugs, and earlier this year (2022), another anti-amyloid drugs for treating Alzheimer’s disease, Eisai’s/Biogen’s Aduhelm (aducanumab), had a setback when the US Centers for Medicaid and Medicare Services (CMS) limited coverage of Aduhelm under Medicare, the US federal health insurance program for individuals over the age of 65, for Aduhelm and other future monoclonal antibody-based amyloid drugs for treating Alzheimer’s disease.

Aduhelm was approved under the FDA’s accelerated approval pathway in June 2021. The accelerated approval pathway allows for earlier approval of drugs that treat serious conditions and that fill an unmet medical need but requires post-approval confirmatory trials. The CMS issued a national policy for coverage of Aduhelm and any future monoclonal antibodies directed against amyloid for treating Alzheimer’s disease that are approved under FDA’s accelerated approval pathway only to patients taking part in approved clinical trials, which includes post-approval confirmatory trials. If the post-approval trials confirm clinical benefit, then the drug may receive traditional approval. The narrow Medicare reimbursement policy for Aduhelm and other factors contributed to weak sales; the drug posted second-half 2022 sales of only $2.9 million. During the fourth quarter of 2021, due to reduced future expected revenue associated with Aduhelm, which had been touted as a potential blockbuster, recorded a valuation allowance of approximately $390 million.

Despite the setback with Aduhelm, Biogen and Eisai are continuing development of another monoclonal antibody-based amyloid drug, lecanemab, although projected FDA review of the drug has been pushed to early 2023. In July (July 2022), the FDA accepted the biologics license application under the accelerated approval pathway for Biogen’s/Eisai’s lecanemab with an FDA review action date of January 6, 2023. Lilly, too, is progressing its monoclonal antibody-based amyloid drug for treating Alzheimer’s drug, donanemab. Last month (August 2022), Lilly received a priority review designation for donanemab under FDA’s accelerated approval pathway. Phase III trials are ongoing.

9. Global bio/pharmaceutical supply chains. A key issue to watch for is the European Commission’s next steps in advancing its Pharmaceutical Strategy for Europe, which was adopted in November 2020. The EU’s Pharmaceutical Strategy includes an ambitious agenda of legislative and non-legislative actions to be launched over the coming years, with four main objectives: (1) ensuring access to affordable medicines for patients and addressing unmet medical needs (e.g. in the areas of antimicrobial resistance, cancer, and rare diseases); (2) supporting competitiveness, innovation, and sustainability of the EU’s pharmaceutical industry and the development of high-quality, safe, effective, and greener medicines; (3) enhancing crisis preparedness and response mechanisms and addressing security of supply; and (4) ensuring a strong EU voice in the world by promoting a high level of quality, efficacy, and safety standards. The initial proposed changes to EU pharmaceutical legislation were expected by the end of 2022, and it is yet to be seen whether that targeted time frame will be met or whether it will be moved into 2023.

A key part of the Pharmaceutical Strategy for Europe relates to medicine supply and risk mitigation of supply-chains vulnerabilities, an issue that was underscored by the COVID-19 pandemic. To consider what policy changes may be needed to shore up pharmaceutical supply chains, the European Commission created a mechanism for a structured dialogue with relevant stakeholders that first focused on identifying the causes and drivers of potential vulnerabilities, including dependencies in global and complex supply chains of critical medicines, their raw materials, active pharmaceutical ingredients (APIs), and intermediates. As part of that process, the Commission opened up a public consultation, which concluded last December (December 2021). After closing knowledge gaps and gaining a better understanding of the current situation, the European Commission is considering possible solutions to address the issues identified. What those solutions may be, such as ways to increase EU-based manufacturing of pharmaceuticals to mitigate supply risk, is a key policy decision to be determined.

In the US, security of pharmaceutical supply chain also continues to be an issue in federal policy evaluation. The pharmaceutical industry was one of six industries in which President Joe Biden, through an executive order issued in February 2021, directed federal agencies and departments to conduct a long-term review of risks to supply chains and industrial bases to inform policy-making. The reviews were to identify critical goods and materials within supply chains, the manufacturing, or other capabilities needed to produce those materials, as well as a variety of vulnerabilities created by failure to develop domestic capabilities. Federal agencies and departments were also directed to identify locations of key manufacturing and production assets, the availability of substitutes or alternative sources for critical goods, the state of workforce skills and identified gaps for all sectors, and the role of transportation systems in supporting supply chains and industrial bases.

Separately, the FDA is advancing guidance to address supply vulnerabilities and potential drug shortages. In May (May 2022), the agency issued a draft guidance, Risk Management Plans to Mitigate the Potential for Drug Shortages, which builds on the agency’s efforts to mitigate drug shortages and supply-chain disruptions by assisting drug manufacturers and related manufacturers with the development, maintenance, and implementation of risk-management plans. The issuance of the draft guidance followed a 2019 report by the FDA’s Drug Shortages Task Force, which called for the adoption of risk-management plans to assess risk and to predict and prevent supply disruptions that could potentially lead to a drug shortage. In 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act to require certain manufacturers to develop, maintain, and implement, as appropriate, risk- management plans that identify and evaluate risks to a drug’s supply. The FDA recently concluded a public comment period for its draft guidance to gain feedback for finalizing the guidance.

10. Biomanufacturing rising on US policy agenda. Advancing biotechnology and biomanufacturing in the US took a major policy leap this week (September 12, 2022) when President Joe Biden issued an executive order to launch the National Biotechnology and Biomanufacturing Initiative. The executive order outlines key policy goals in biomanufacturing and biotechnology in support of further developing what the Administration calls the “bioeconomy.” Key objectives are to: (1) bolster and coordinate federal investment in R&D for biotechnology and biomanufacturing; (2) foster a biological data ecosystem that advances biotechnology and biomanufacturing innovation; (3) improve and expand domestic biomanufacturing production capacity and processes while also increasing piloting and prototyping efforts in biotechnology and biomanufacturing to accelerate the translation of basic research results into practice; and (4) train and support a diverse, skilled workforce to advance biotechnology and biomanufacturing.