Manufacturing Fallout of Novo’s $16.5-Billion Acquisition of Catalent

The CDMO/CMO sector had a major shakeup with Novo Holdings, the parent company of Novo Nordisk, announcing it had agreed to acquire Catalent for $16.5 billion. What is the strategy behind the deal and the implications on a manufacturing basis?

A mega deal driven by manufacturing

This week (February 5, 2024), a mega deal was announced with Novo Holdings, the parent company of Novo Nordisk, agreeing to acquire the CDMO Catalent for $16.5 billion. Novo’s interest to increase manufacturing capacity, particularly for its diabetes and obesity drugs, was the major impetus behind the deal. Novo Holdings says it intends to sell three Catalent fill–finish sites and related assets being acquired to Novo Nordisk for $11 billion. These three sites are in Anagni, Italy; Bloomington, Indiana; and Brussels, Belgium. The three sites employ more than 3,000 people, and all have ongoing collaborations with Novo Nordisk.

The acquisition of the fill–filling sites is aligned with Novo Nordisk’s strategy of increasing production for its diabetes and obesity drugs and is the latest move by the company to incease manufacturing capacity for these products, with the company announcing last year (2023) several moves to increase its internal manufacturing capacity (see Table I at end of article for current listing on Novo’s production sites). The Catalent acquisition is expected to gradually increase Novo Nordisk’s filling capacity from 2026 and onwards. After closing of the acquisition, Novo Nordisk says it will honor all customer obligations at the three Catalent sites that it is acquiring.

Under the agreement, Novo Holdings will acquire all outstanding shares of Catalent for $63.50 per share in cash, for a total value of $16.5 billion. The merger is expected to close toward the end of 2024, subject to customary closing conditions, including approval by Catalent stockholders and receipt of required regulatory approvals.

For Novo, the deal brings much needed manufacturing capacity for its diabetes and obesity drugs, which saw dramatic sales growth in 2023: Ozempic (semaglutide) for treating Type 2 diabetes, Wegovy (semaglutide), the same active pharmaceutical ingredient as Ozempic but for treating obesity, and Saxenda (liraglutide). Sales within its Diabetes and Obesity care franchise increased 38% in 2023 to DKK 215.1 billion ($31.1 billion), mainly driven by GLP-1 diabetes sales growth of 48% and Obesity care growth of 147% to DKK 41.6 billion ($5.9 billion), driven by strong revenue gains of Wegovy. In it’s third year after launch,, sales of Wegovy in 2023 grew more than 400% to DKK 31 billion ($4.48 billion).

Hand-in-hand with the product success of Novo Nordisk’s diabetes and obesity drugs is increased demand for manufacturing capacity. In addition to its pending acquisition of Catalent, the company is advancing one of the largest manufacturing expansions announced last year (2023).

Novo Nordisk is investing DKK 16 billion ($2.3 billion) over the next several years to expand its production site in Chartres, France, by adding aseptic production and finished production capacity and expanding the company’s current quality-control laboratory. The investment includes capacity for glucagon-like peptide-1 (GLP-1) products. Novo’s GLP-1 products include the diabetes drug, Ozempic (semaglutide), and obesity drug, Wegovy. The new facilities will more than double the footprint of the site. The construction project has begun and will gradually be finalized from 2026 to 2028.

That was the second major investment by Novo to increase production capacity for products in its chronic disease portfolio, including GLP-1 products. Last November (November 2023), the company announced an investment of more than DNK 42 billion ($6.1 billion), started in 2023, to expand existing manufacturing facilities in Kalundborg, Denmark, for additional capacity across the value chain from manufacturing of APIs to packaging, with the vast majority invested in API capacity. The new API facility will be designed as a multi-product facility. The facility will have a footprint of 170,000 m2. The construction projects will be finalized gradually from the end of 2025 through 2029.

Catalent: a move to turn its fortunes

For Catalent, its pending acquisition by Novo follows a difficult year for the company, which reported a net loss of $256 million (for the fiscal year ending June 30, 2023), which was in part due to manufacturing issues and a resulting decline in revenues. The company reported that productivity issues and higher-than-expected costs experienced at three of its drug-product and drug-substance manufacturing facilities in Bloomington, Indiana, and Brussels, Belgium, materially and adversely impacted the company’s financial results for fiscal year 2023.

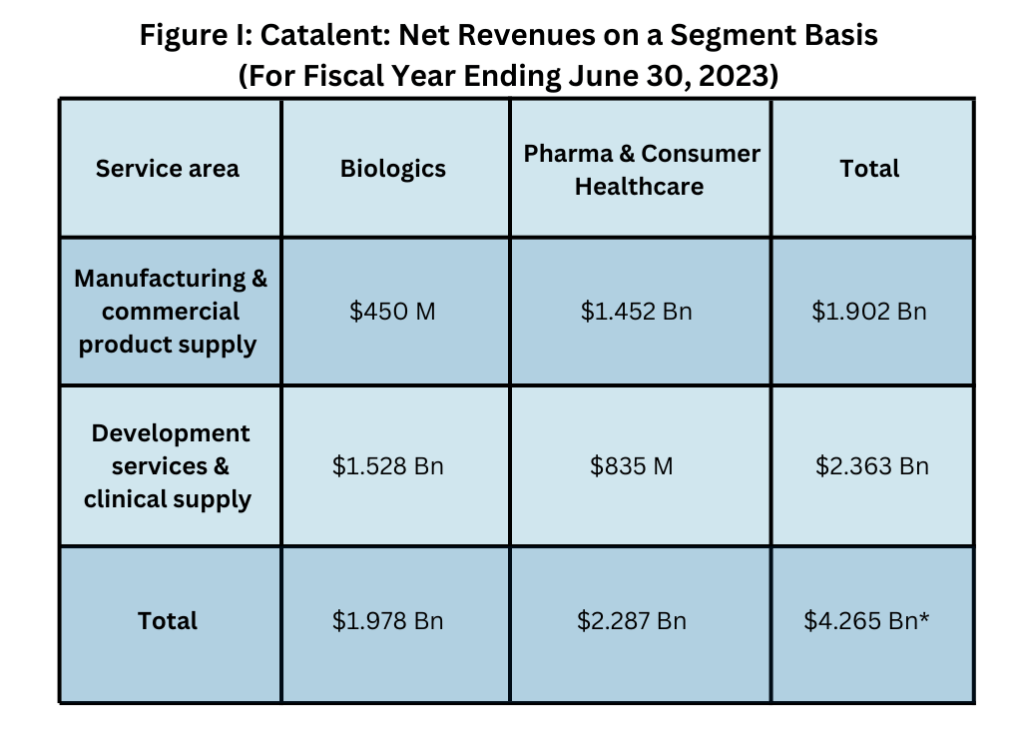

Catalent has two main segments: Biologics and Pharma & Consumer Healthcare (see Figure I below). It Biologics segment provides development & manufacturing for: biologic proteins; cell, gene- and other nucleic-acid-based therapies; plasmid DNA; induced pluripotent stem cells; oncolytic viruses; and vaccines. It also provides formulation, development, & manufacturing for parenteral dose forms, including vials, prefilled syringes, & cartridges, and provides analytical development & testing for large molecules. In fiscal year 2023, its Biologics segment saw a $525-million decline in revenues, or 21%, compared to fiscal year 2022. The decline was due to a fall in revenues from COVID-19 products, inventory write-offs, lower utilization levels across its Biologics segment, and the negative financial impact related to remediation costs at its sites in Bloomington, Indiana, and Brussels, Belgium.

*Note: an inter-segment revenue elimination of $2 million results in total revenues of $4.263 billion

Biologics segment provides development & manufacturing for: biologic proteins; cell, gene- and other nucleic-acid-based therapies; plasmid DNA; induced pluripotent stem cells; oncolytic viruses; and vaccines. Also provides formulation, development, & manufacturing for parenteral dose forms, including vials, prefilled syringes, & cartridges; Also provides analytical development & testing for large molecules.

Pharma & Consumer Healthcare segment serves oral solids, softgels, fast-dissolving products, gummies, soft chews & lozenges; provides formulation, development & manufacturing for orals, nasal, inhaled, & topical dosage forms; and provides clinical trial development & supply services

Source: Catalent

Catalent’s Pharma & Consumer Healthcare, which consits of its offerings for oral solids, softgels, fast-dissolving products, gummies, soft chews & lozenges, posted a 4% gain in revenues in fiscal year 2023 to $2.287 billion (see Figure I above). The segment provides formulation, development & manufacturing for orals, nasal, inhaled, & topical dosage forms and clinical trial development & supply services. This segment reflects two major recent acquisitions by Catalent: its $475-million acquisition of Metrics Contract Services, a Greenville, North Carolina-based CDMO of oral solid dosage forms, including high-potency products, in 2022, and its $1-billion acquisition in 2021 of Bettera, a Plano, Texas-headquartered manufacturer of gummies, soft chews, and lozenges for the nutritional supplement market. The acquisition of Metrics Contract Services netted Catalent Metrics’ 330,000-square-foot facility in Greenville, North Carolina, which provides formulation development, analytical testing, commercial manufacturing, and packaging. The Bettera acquisition added four new dietary supplement manufacturing sites to Catalent’s existing consumer health network.

What’s next

With Novo’s $16.5-billion pending acquisition of Catalent expected to close by the end of 2024, a key question is what will be next in terms of the manufacturing assets Novo is gaining. The acquisition was led by Novo Nordisk’s interest (representing $11 billion of the $16.5-billion deal) in gaining Catalent’s three fill-finish sites (Anagni, Italy; Bloomington, Indiana; and Brussels, Belgium) to support Novo Nordisk’s diabetes and obesity drugs. The acquisition is expected to gradually increase Novo Nordisk’s filling capacity from 2026 and onwards. After closing of the acquisition, Novo Nordisk says it will honor all customer obligations at the three Catalent sites that it is acquiring.

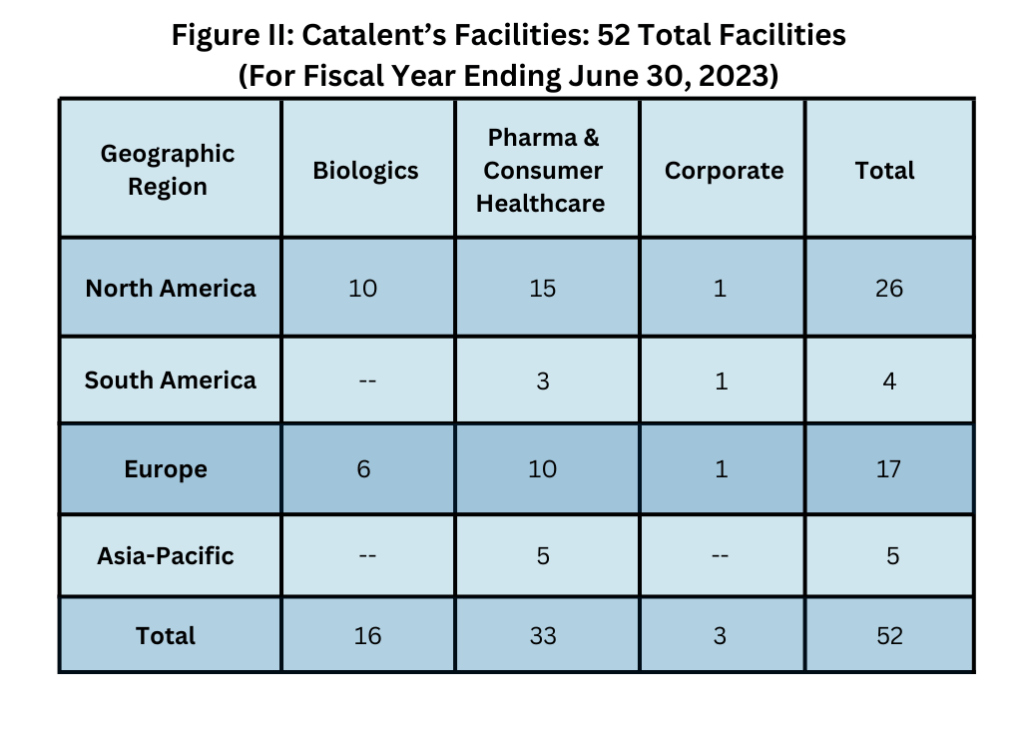

But what will happen next? A key issue is the impact of taking that fill–finish capacity out of the CDMO market as the capacity transitions to Novo Nordisk. Also, what about Catalent’s other manufacturing facilities? Catalent has a total of 52 sites (see Figure II below), of which 16 are in its Biologics segment and 36 in its Pharma & Consumer Health segment, with those 36 sites seemingly not a strategic fit for Novo Nordisk. A key question is whether these assets will become the target of future divestment by Novo either on a site-by-site basis or through a separation of these assets into a separate CDMO business focused on the dosage forms that Catalent’s Pharma & Consumer Health segment now serves: orals, nasal, inhaled, and topical dosage forms.

Pharma & Consumer Healthcare segment serves oral solids, softgels, fast-dissolving products, gummies, soft chews & lozenges; provides formulation, development & manufacturing for orals, nasal, inhaled, & topical dosage forms; and provides clinical trial development & supply services

Source: Catalent

Table I: Novo Nordisk’s Major Production Facilities

| Location | Size of production area (square meters) | Production Activities |

| Kalundborg, Denmark | 168,300 | APIs for diabetes, obesity & hemophilia; Diabetes care products; Products for rare diseases |

| Hillerød, Denmark | 156,900 | Durable devices & components for disposable devices; Products for diabetes& obesity; APIs for hemophilia |

| Bagsværd, Denmark | 111,200 | Products for diabetes & obesity |

| Clayton, North Carolina | 89,000 | APIs for diabetes & obesity (purification); Products for diabetes & obesity |

| Gentofte, Denmark | 70,800 | APIs for glucagon & growth hormone therapy; Products for growth hormone therapy, glucagon & hemophilia |

| Tianjin, China | 67,200 | Products for diabetes; Production of durable devices |

| Måløv, Denmark | 60,900 | Products for hormone replacement therapy; Products for oral antidiabetic treatment; products for oral diabetes treatment |

| Chartres, France | 58,700 | Products for diabetes |

| Montes Claros, Brazil | 56,200 | Products for diabetes; Gel production for APIs. |

API is active pharmaceutical ingredient

Source: Novo Nordisk