Manufacturing & Supply Lines: Small-Molecule APIs

Small-molecule drugs still dominate new drug approvals, as measured by the number of new molecular entities approved by the FDA’s Center for Drug Evaluation and Research, but are they translating into market success? DCAT Value Chain Insights takes a look on the market for drugs with small-molecule active pharmaceutical ingredients and related supply–demand fundamentals.

Overall new drug approvals in 2023

Last year (2023) saw an uptick in new drug approvals compared to 2022, which was a recent dip in new drug approvals. The US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved 55 new molecular entities (NMEs) and new therapeutic biologics in 2023, a 49% increase in the number of new drug approvals compared to 2022, when 37 new drugs were approved. The 55 new drugs approved in 2023 by FDA’s CDER was in line with recent years. In 2021, 50 NMEs and new therapeutic biologics were approved by FDA’s CDER and 53 in 2020. The 55 new drugs approved in 2023 represented the second highest level of approvals in the past decade, except for 2018 when 59 new drugs were approved.

Small-molecule new drug approvals

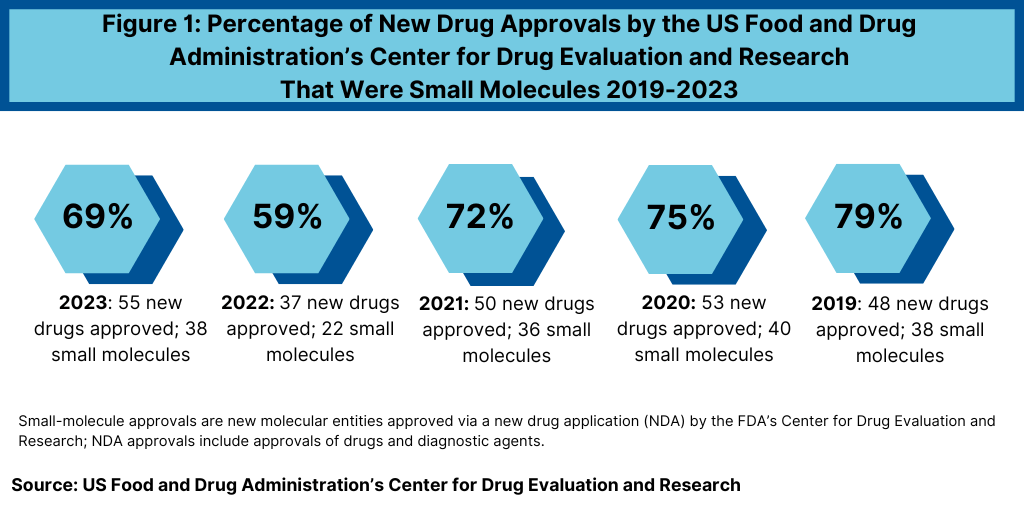

In 2023, FDA’s CDER approved 38 small-molecule products, representing 69% of new drug approvals (see Figure 1). The percentage of small-molecule approvals in 2023 was in line with recent year, except in 2022, which represented a recent low. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules or 22 of the 37 new drug approvals, Between 2018 and 2021, small molecules averaged 74% of new drug approvals. In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, and 79% in 2019.

The 69% of new drug approvals being small molecules in 2023 was an improvement over 2022 levels, which represented a recent low in small-molecule drug approvals. The decrease in small molecules’ share of new drug approvals in 2022 was largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics. The 17 new biologics approvals in 2023 surpassed 2022 levels and matched a recent high in 2018, when 17 new biologics were also approved by FDA’s CDER. The 17 new biologic drug approvals in 2023 far exceeded approvals of new therapeutic biologics by FDA’s CDER of 14 in 2021, 13 in 2020, and 10 in 2019.

Small-molecules and first-in-class drugs

Aside from just the overall number of new drug approvals, product innovation can also be evaluated by the number of new drug approvals classified as “first-in-class,” which FDA’s CDER characterizes as drugs with a different mechanism of action than existing drugs. In 2023, FDA’s CDER approved 20 new drugs that it characterized as first-in-class, which represented approximately 36% of new drug approvals.

Of these 20 first-in-class new drug approvals, 17 were small molecules, representing 85% of first-in-class new drug approvals in 2023 by FDA’s CDER. Of these 17 first-in-class, small-molecule new drug approvals in 2023, eight were from large to mid-sized bio/pharma companies. These eight drugs were: Astellas’ Veozah (fezolinetant) for reducing moderate-to-severe vasomotor symptoms due to menopause; AstraZeneca’s Truqap (capivasertib) for treating advanced HR-positive breast cancer; Bausch and Lomb’s Miebo (perfluorohexyloctane ophthalmic solution) for treating dry-eye disease; Biogen’s Qalsody (tofersen) for treating amyotrophic lateral sclerosis (ALS, i.e., Lou Gehrig’s disease); GlaxoSmithKline’s Jesduvroq (daprodustat) for treating anemia due to chronic kidney disease; Novartis’ Fabhalta (iptacopan) for treating paroxysmal nocturnal hemoglobinuria, a rare blood disorder; Novo Nordisk’s Rivfloza (nedosiran) for treating primary hyperoxaluria, a rare condition characterized by recurrent kidney and bladder stones; and Pfizer’s Paxlovid (nirmatrelvir tablets; ritonavir tablets, co-packaged) for treating COVID-19.

Although small-molecule drugs were well represented with 85% of the first-in-class new drug approvals in 2023, more than half of these drugs were for niche indications. Of the 17 small-molecule first-in-class drug approvals in 2023, nine, or 53%, were for treating orphan/rare diseases, defined as a disease affecting 200,000 individuals or less in the US.