Mid-Year Review: New Drug Approvals Thus Far in 2022

As we move past the mid-way mark in 2022, how has the industry fared with new drug approvals? Is the industry keeping pace with prior years’ innovation levels? What do the numbers show, including the mix between small molecules and biologics?

Approvals of new molecular entities thus far in 2022

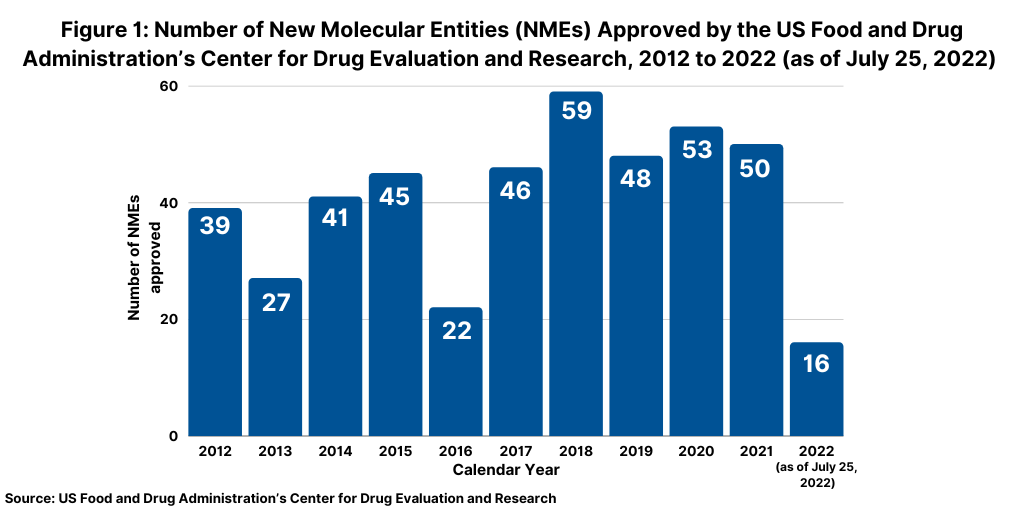

Although not following a strictly chronological path, examining the pace of approvals of new molecular entities (NMEs) is an important measure of product innovation in the bio/pharmaceutical industry. At the halfway point of 2021 (as of July 25, 2022), the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) had approved 16 NMEs thus far in 2022, below the pace set in 2021, in which 32 NMEs had been approved by the end of July 2021 en route to a total of 50 NMEs approved in the full-year 2021 (see Figure 1). A similar strong pace on NME approvals was seen in 2020, when 30 NMEs were approved by the end of July 2020 en route to a total of 53 NMEs approved for the full-year 2020. The 53 NMEs approved in 2020 represented the second highest level of NMEs approved in the past decade, except for 2018 when 59 NMEs were approved (see Figure 1). Table I at end of article outlines the 16 NMEs approved thus far in 2022(as of July 25, 2022).

Small molecules versus biologics

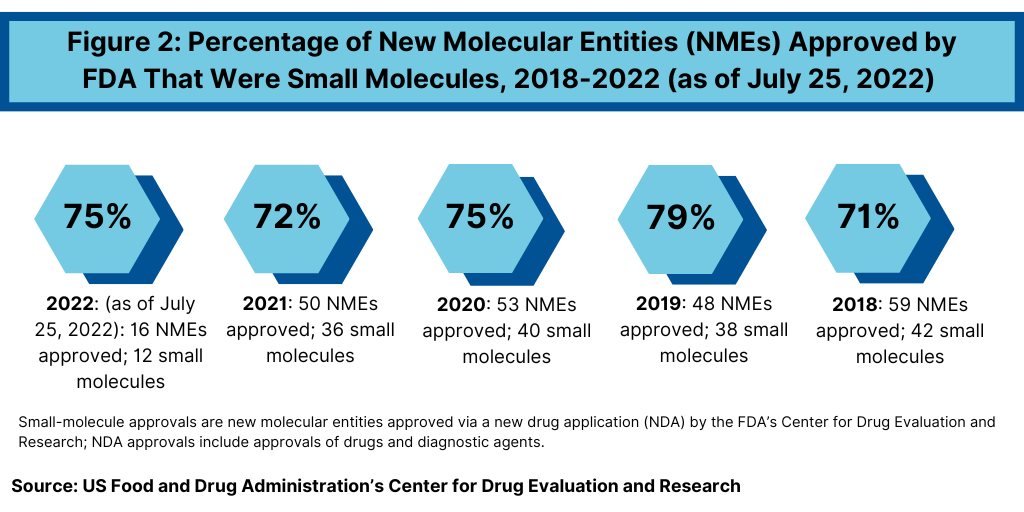

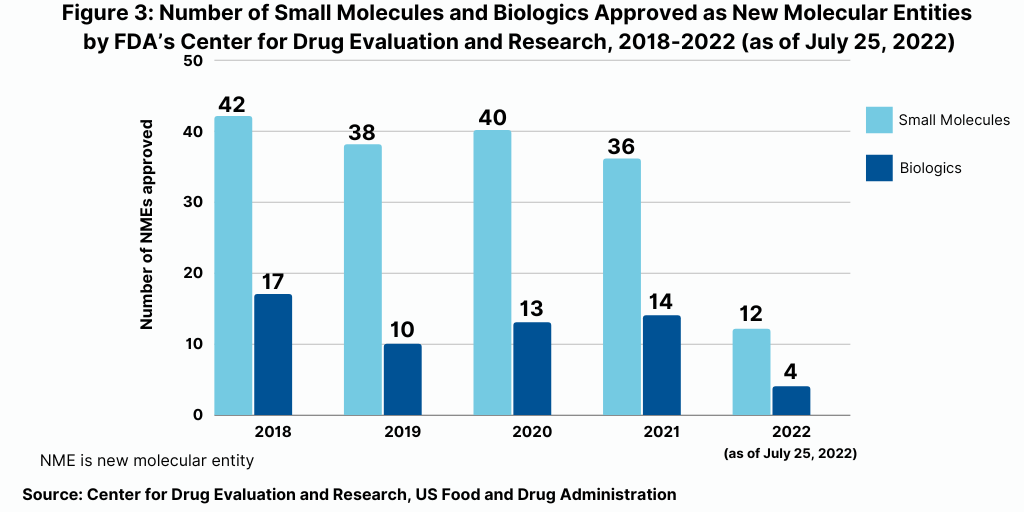

Continuing a trend, small-molecule drugs have thus far dominated NME approvals in 2021. Of the 16 NMEs approved as of the mid-point of 2022 (as of July 25, 2022), 75%, or 12 drugs, were small molecules, and 25%, or four were biologic-based drugs (see Figure 2). These levels continue a multi-year trend between 2018 and 2021 in which small molecules averaged 74% of NME approvals. In 2021, 72% or 36 of the 50 NME approvals were small molecules. In 2020, 75% or 40 of the 53 NMEs approved in 2020 were small molecules. In 2019, 79% of NME approvals were small molecules; in 2018, it was 71%. Table I at end of article identifies small molecules approved thus far in 2022 (as of July 25, 2022) (approved as new drug applications) and biologics (approved as biologics license applications). Figure 3 shows the annual totals of small molecules and biologics approved as NMEs from FDA’s CDER from 2018 to July 2022.

Large, mid-sized and small bio/pharmaceutical companies and NME approvals

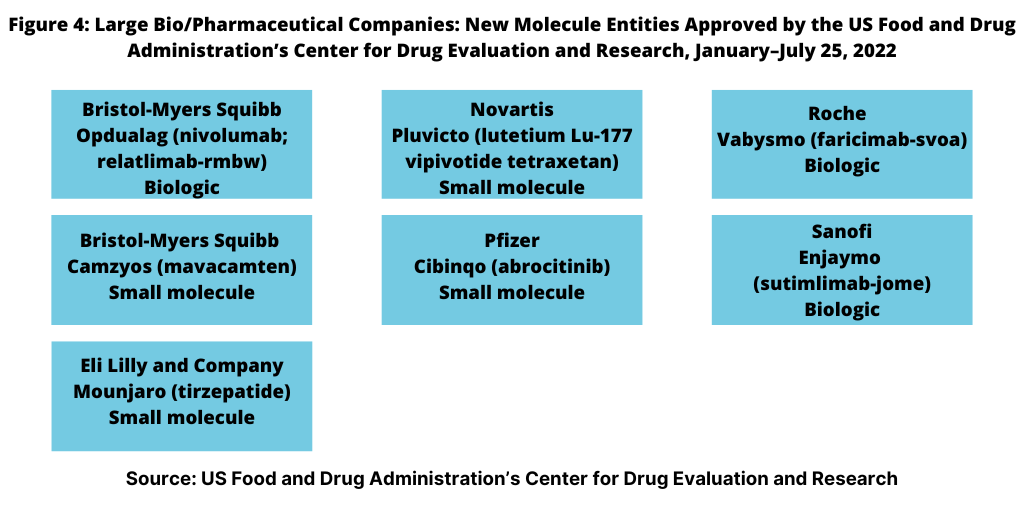

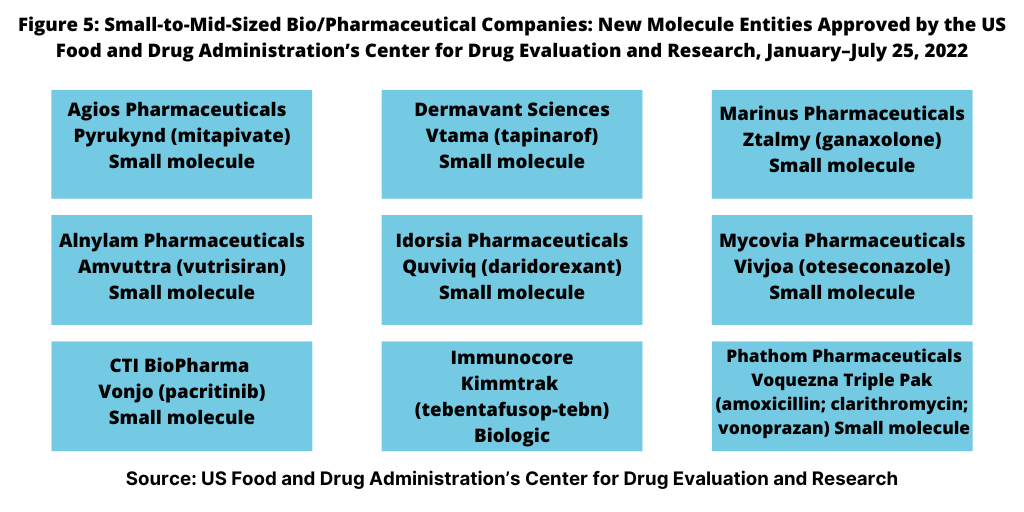

NME approvals are one measure of innovation and new product development in the bio/pharma industry. So how has the innovation bar fared between the large bio/pharmaceutical companies and small and mid-size companies thus far in 2022? Figure 4 outlines NME approvals by the large bio/pharmaceutical companies, defined for this analysis as those companies among the top 25 companies based on 2021 bio/pharmaceutical revenues. Using that as a criterion, the large bio/pharmaceutical companies accounted for seven or 44%, of the NME approvals thus far in 2022 and small-to-mid-sized companies, nine NME approvals, or 56% of the 16 NME approvals by the FDA thus far in 2022.

Leading among the large bio/pharma companies was Bristol-Myers Squibb, which had two NME approvals thus far in 2022: Opdualag (nivolumab; relatlimab-rmbw), treating unresectable or metastatic melanoma and Camzyos (mavacamten) for treating certain classes of obstructive hypertrophic cardiomyopathy, a condition in which the heart muscle becomes abnormally thick. Lilly, Novartis, Pfizer, Roche, and Sanofi each had one NME approval (see Figure 4).

Nine separate mid-to-small-sized bio/pharmaceutical companies accounted for the nine NME approvals thus far in 2022: Agios Pharmaceuticals, Alnylam Pharmaceuticals, CTI BioPharma, Dermavant Sciences (part of Roivant Sciences), Idorsia Pharmaceuticals, Immunocore, Marinus Pharmaceuticals, Mycovia Pharmaceuticals, and Phathom Pharmaceuticals (see Figure 5).

Table I below summarizes all 16 NMEs approved thus far in 2022.

Table I: New Molecule Entities Approved by the US Food and Drug Administration’s Center for Drug Evaluation and Research, January–July 25, 2022

| Company | Proprietary name (active pharmaceutical ingredient); NDA or BLA | Indication |

| Agios Pharmaceuticals | Pyrukynd (mitapivate); NDA | Hemolytic anemia in pyruvate kinase deficiency, condition in which red blood cells break down faster than they should. |

| Alnylam Pharmaceuticals | Amvuttra (vutrisiran); NDA | Polyneuropathy of hereditary transthyretin-mediated amyloidosis, rare disease characterized by multisystem extracellular deposition of amyloid, leading to dysfunction of different organs and tissue |

| Bristol-Myers Squibb | Opdualag (nivolumab; relatlimab-rmbw); BLA | Unresectable or metastatic melanoma |

| Bristol-Myers Squibb* | Camzyos (mavacamten); NDA | Certain classes of obstructive hypertrophic cardiomyopathy |

| CTI BioPharma | Vonjo (pacritinib); NDA | Intermediate or high-risk primary or secondary myelofibrosis in adults with low platelets |

| Dermavant Sciences** | Vtama (tapinarof); NDA | Plaque psoriasis |

| Eli Lilly and Company | Mounjaro (tirzepatide); NDA | To improve blood sugar control in Type 2 diabetes, in addition to diet and exercise |

| Idorsia Pharmaceuticals | Quviviq (daridorexant); NDA | Insomnia |

| Immunocore | Kimmtrak (tebentafusop-tebn); BLA | Unresectable or metastatic uveal melanoma |

| Marinus Pharmaceuticals | Ztalmy (ganaxolone); NDA | Seizures in cyclin-dependent kinase-like 5 deficiency disorder |

| Mycovia Pharmaceuticals | Vivjoa (oteseconazole); NDA | To reduce the incidence of recurrent vulvovaginal candidiasis (RVVC) in females with a history of RVVC who are not of reproductive potential |

| Novartis*** | Pluvicto (lutetium lu-177 vipivotide tetraxetan); NDA | Metastatic castration-resistant prostate cancer |

| Pfizer | Cibinqo (abrocitinib); NDA | Refractory, moderate-to-severe atopic dermatitis |

| Phathom Pharmaceuticals | Voquezna Triple Pak (amoxicillin; clarithromycin; vonoprazan); NDA | Helicobacter pylori infection, a type of bacteria that infects the stomach |

| Roche | Vabysmo (faricimab-svoa); BLA | Neovascular (wet) aged-related macular degeneration and diabetic macular edema |

| Sanofi**** | Enjaymo (sutimlimab-jome); BLA | To decrease the need for red blood cell transfusion due to hemolysis in cold agglutinin disease, a rare autoimmune disorder characterized by the premature destruction of red blood cells. |

*Bristol-Myers Squibb acquired MyoKardia in 2020 for $13.1 billion and with it, Camzyos (mavacamten).

** Dermavant Sciences is a subsidiary of Roviant Sciences.

***Novartis acquired Advanced Accelerator Applications for $3.9 billion in 2018 and with it, Pluvicto (lutetium lu-177 vipivotide tetraxetan).

****Sanofi acquired Bioverativ in 2018 for $11.6 billion and with it, Enjaymo (sutimlimab-jome).

Source: US Food and Drug Administration’s Center for Drug Evaluation and Research.