Mid-Year Review: New Drug Approvals—Up or Down?

With budgetary and staffing cuts at FDA, have approvals of new drugs slowed? DCAT Value Chain Insights looks at the numbers and key trends in new drug approvals thus far in 2025.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

New drug approvals thus far in 2025

With staffing and budgetary cuts at the US Food and Drug Administration (FDA), an important question for the industry is have those cuts had an impact on drug approvals. Drug approvals do not follow a strict chronological path, so a comparison of the number of drug approvals at a given point in time has its limitations. That comparison, however, can serve as broad guidepost in measuring the health of the industry.

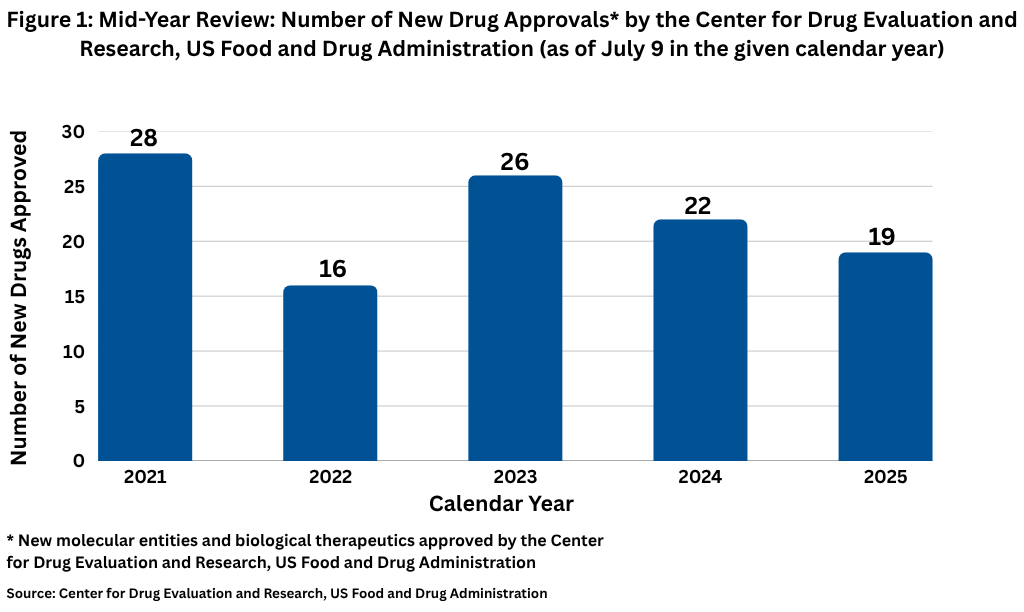

The verdict at the half-way mark for 2025 is that new drug approvals by FDA, while slightly down from the 2024 mid-year mark, are within a reasonable range. Through July 9, 2025, FDA’s Center for Drug Evaluation and Research had approved 19 new molecular entities and biological therapeutics, compared to 22 at the mid-year mark in 2024, which had 50 new drug approvals in the full-year, and 26 new drug approvals at the mid-year mark in 2023, when 55 new drugs were approved in the full year (see Figure 1). In looking at approvals over the past five years (2021–2025), the mid-year high mark of 28 in 2021 and the mid-year low mark of 16 in 2022, both corresponded with recent highs and lows for full-year approvals. In 2021, 28 new drugs had been approved at the mid-year mark en route to 50 approvals in the full year. Similarly, in 2022, which was a recent low in drug approvals, 16 new drugs had been approved at the mid-year mark en route to 37 in the full year.

Small molecules versus biologics

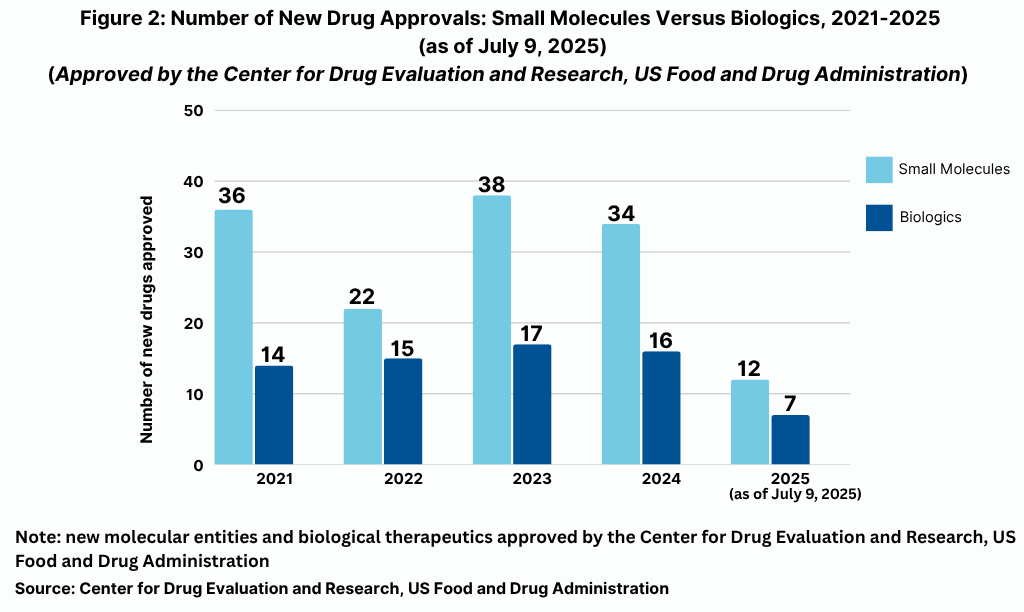

So, which drugs crossed the regulatory finish line thus far in 2025? Table I at the end of article details the 19 new drug approvals thus far in 2025. On a modality basis, of the 19 drugs approved thus far,12 were small molecules (63%) and seven were biologics (37%), which included two antibody drug conjugates (see Figure 2). The 63% of new drug approvals being small molecules is in line with prior years. In looking at the product mix of new drug approvals, of the 50 new drug approvals by FDA’s CDER in 2024, 34, or 68%, were small molecules (31 drugs and three diagnostic/imaging agents), and 16, or 32%, were biologics. That is on par with the mix in 2023, when FDA’s CDER approved 17 new biological therapeutics, which represented 31% of new drug approvals, and 38 small-molecule products, or 69% of new drug approvals. However, small-molecule approvals in 2024 and 2023 dipped and were below recent historical levels when small-molecule drug approvals averaged 75% of new drug approvals between 2019 and 2021, with 2022 being an outlier with only 37 new drug approvals overall and only 59% being small molecules.

The drugs making the mark in 2025

In looking at new drug approvals in 2025, two ADCs crossed the regulatory finish line: AbbVie’s Emrelis (telisotuzumab vedotin) and AstraZeneca’s/Daiichi Sankyo’s Datroway (datopotamab deruxtecan). AbbVie was granted accelerated approved by FDA for Emrelis in May (May 2025) for treating a certain form of locally advanced or metastatic non-squamous non-small cell lung cancer (NSCLC). Specifically, the drug was approved for patients with metastatic, non-squamous NSCLC with high c-Met protein overexpression who have received a prior systemic therapy.

Emrelis is AbbVie’s first internally developed solid tumor medicine, its first solid tumor FDA approval in lung cancer, and its second FDA-approved ADC. Its other commercial ADC, Elahere (mirvetuximab soravtansine-gyxn) for treating ovarian cancer, was gained by its $10.1-billion acquisition of ImmunoGen in early 2024.

In January (January 2025), AstraZeneca and Daiichi Sankyo received FDA approval for Datroway (datopotamab deruxtecan) for treating certain forms of breast cancer. Datroway is the second ADC approved from a collaboration between AstraZeneca and Daiichi Sankyo. The other ADC from that collaboration is Enhertu (trastuzumab deruxtecan) for treating HER2-positive breast cancer, which is one of the top-selling ADCs. In 2024, Enhertu’s combined sales by AstraZeneca and Daiichi Sankyo reached $3.75 billion.

Analysts are bullish on Sanofi’s and Alnylam Pharmaceuticals’ Qfitlia (fitusiran), a RNAi therapeutic for treating hemophilia A and B, with or without inhibitors. It was developed as part of an RNAi therapeutics rare-disease alliance between Sanofi and Alnylam Pharmaceuticals. The small interfering RNA (siRNA) therapy works by inhibiting SerpinPC1 mRNA, reducing antithrombin levels, promoting thrombin generation, and helping to rebalance hemostasis to prevent bleeds and leverages Alnylam’s ESC-GalNAc conjugate technology, according to Clarivate, a business intelligence firm, in its 2025 Drugs To Watch report, Fitusiran is the first antithrombin-lowering therapy based on a double-stranded RNA molecule. Clarivate projects sales of $1.00 billion in the G7 markets in 2030.

Earlier this month (July 2025), Merck KGaA netted a new drug approval when it completed its $3.4-billion acquisition of SpringWorks Therapeutics, a Stamford, Connecticut-based commercial-stage bio/pharmaceutical company focused on severe rare diseases and cancer. With the acquisition, Merck KGaA gained Gomella (mirdametinib) for treating adult and pediatric patients 2 years of age and older with neurofibromatosis Type 1, a genetic condition that causes changes in skin pigment and tumors on nerve tissue.

Big Pharma’s new drug approvals at the mid-year mark

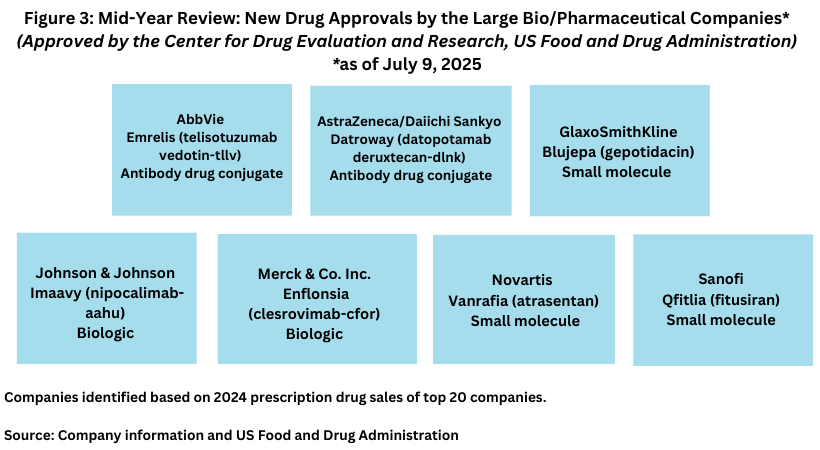

In addition to new drug approvals from AstraZeneca/Daiichi Sankyo with Datroway, AbbVie with Emrelis, and Sanofi with Qfitlia, GSK, Johnson & Johnson, Merck & Co., and Novartis each gained a new drug approval thus far in 2025 (see Figure 3). These included: GSK’s Blujepa (gepotidacin), an oral antibiotic for treating uncomplicated urinary tract infections; Johnson & Johnson’s Imaavy (nipocalimab-aahu) for treating generalized myasthenia gravis, a rare autoimmune disorder; Merck & Co.’s Enflonsia (clesrovimab-cfor) for the prevention of respiratory syncytial virus (RSV) lower respiratory tract disease in newborns and infants who are born during or entering their first RSV season; and Novartis’ Vanrafia (atrasentan) for reducing proteinuria (protein in the urine) in adults with primary immunoglobulin A nephropathy.

| Table I: Mid-Year Review 2025: New Drug Approvals by the Center for Drug Evaluation and Research, US Food and Drug Administration’s Center for Drug Evaluation and Research (as of July 9, 2025) | |||

| AbbVie | Emrelis (telisotuzumab vedotin-tllv) | Antibody drug conjugate; BLA | Locally advanced or metastatic, non-squamous non-small cell lung cancer |

| Alcon | Tryptyr (acoltremon ophthalmic solution) | Small molecule; NDA | Dry eye disease |

| Akeso | penpulimab-kcqx (penpulimab-kcqx) | Biologic; BLA | Recurrent or metastatic non-keratinizing nasopharyngeal carcinoma |

| AstraZeneca/Daiichi Sankyo | Datroway (datopotamab deruxtecan-dlnk) | Antibody drug conjugate; BLA | Unresectable or metastatic, HR-positive, HER2-negative breast cancer |

| CSL Behring | Andembry (garadacimab-gxii) | Biologic; BLA | Hereditary angioedema |

| Dizal (Jiangsu) Pharmaceutical | Zegfrovy (sunvozertinib) | Small molecule; NDA | Certain forms of locally advanced or metastatic non-small cell lung cancer |

| GlaxoSmithKline | Blujepa (gepotidacin) | Small molecule; NDA | Uncomplicated urinary tract infections |

| Nuvation Bio | Ibtrozi (taletrectinib) | Small molecule; NDA | Locally advanced or metastatic ROS1-positive non-small cell lung cancer |

| Johnson & Johnson | Imaavy (nipocalimab-aahu) | Biologic; BLA | Generalized myasthenia gravis |

| Kalvista Pharmaceuticals | Ekterly (sebetralstat) | Small molecule; NDA | Acute attacks of hereditary angioedema |

| Medexus | Grafapex (treosulfan) | Small molecule; NDA | Preparative regimen for allogeneic hematopoietic stem cell transplantation for acute myeloid leukemia and myelodysplastic syndrome |

| Merck & Co. Inc. | Enflonsia (clesrovimab-cfor) | Biologic; BLA | Respiratory syncytial virus lower respiratory tract disease in neonates and infants |

| Merck KGaA* | Gomekli (mirdametinib) | Small molecule; NDA | Neurofibromatosis Type 1 |

| Novartis | Vanrafia (atrasentan) | Small molecule; NDA | Protein in the urine (proteinuria) in adults with primary immunoglobulin A nephropathy |

| Ono Pharmaceutical | Romvimza (vimseltinib) | Small molecule; NDA | Symptomatic tenosynovial giant cell tumor |

| Regeneron Pharmaceuticals | Lynozyfic (linvoseltamab-gcpt) | Biologic; BLA | Relapsed or refractory multiple myeloma |

| Sanofi | Qfitlia (fitusiran) | Small molecule; NDA | Prevent or reduce the frequency of bleeding episodes in hemophilia A or B |

| Verastem | Avmapki Fakzynja Co-Pack (avutometinib and defactinib) | Small molecule; NDA | KRAS-mutated recurrent low-grade serous ovarian cancer (LGSOC) after prior systemic therapy |

| Vertex Pharmaceuticals | Journavx (suzetrigine) | Small molecule; NDA | Moderate-to-severe acute pain |

Source: Center for Drug Evaluation and Research, US Food and Drug Administration