Orphan Drugs: Still Showing Market Strength or Not?

Orphan drugs have accounted for more than 50% of new drug approvals over the past five years and are projected to account for 20% of the global Rx drug market by 2030, but are market prospects slowing?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

New drug approvals and orphan drugs

The question before the industry is has the growth of orphan drugs reached an inflection point? Attracted by regulatory advantages and market exclusivity, orphan drugs have been an important piece of bio/pharma companies’ development and commercialization strategies. Market growth for orphan drugs has outperformed that of non-orphan drugs, but a key question is whether that will continue.

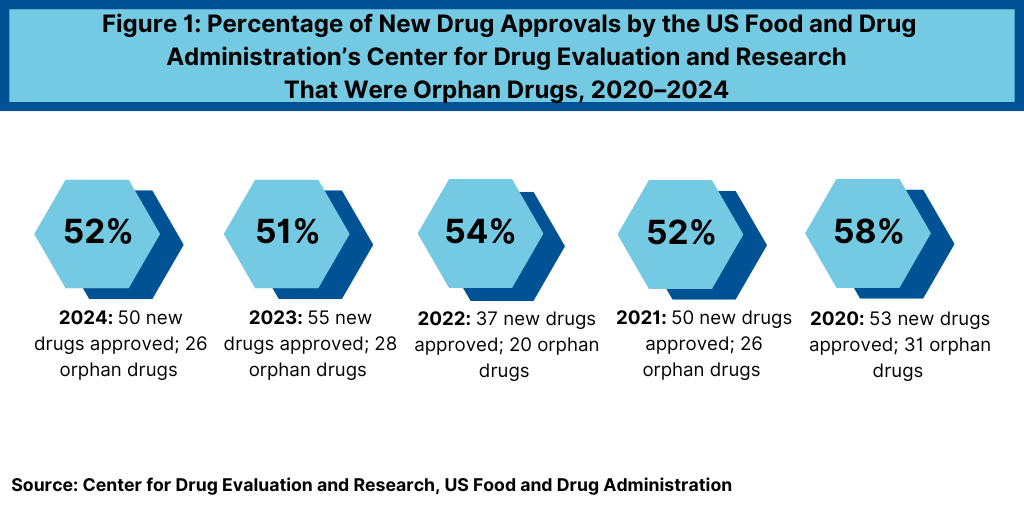

One facet to those answer those questions is to look a new product development as measured by new drug approvals. Orphan drugs continue to account for a large percentage of new drug approvals. Over the past five years (2020–2024), orphan drugs have accounted for more than half of new drug approvals (new molecular entities and biological therapeutics) from the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) (see Figure 1). Other biologic-based products, including blood products, vaccines, allergenics, tissues, and cellular and gene therapies, are reviewed and approved by a separate center within FDA, the Center for Biologics Evaluation and Research (CBER), and are not included in this analysis.

In 2024, 26 of CDER’s 50 novel drug approvals (52%), were approved to treat rare or orphan diseases (defined as diseases that affect fewer than 200,000 people in the US). which continues a recent trend in which more than half of new drug approvals were for orphan drugs. In 2023, 28 of CDER’s 55 novel rug approvals (51%) received orphan drug designation. In 2022, 20 of 37, or 54% of novel drug approvals by FDA’s CDER were for rare diseases. In 2021, 26 of CDER’s 50 new drug approvals (52%) were approved to treat rare or orphan diseases, and in 2020, 58%, or 31, of the 53 novel drug approvals were orphan drugs.

The large share of orphan-drug approvals is in part due to the regulatory and market exclusivity advantages provided by regulatory authorities to incentivize development of drugs to treat rare diseases. In the US, that is seven years of market exclusivity for the first company to have a drug approved for the orphan indication, and in the European Union (EU), it is 10 years of market exclusivity, with the EU defining orphan drugs affecting not more that five in 10,000 people among other criteria.

Orphan versus non-orphan drugs

Although a niche area in terms of the patient populations served, orphan drugs are an important part of the growth strategy of both large bio/pharmaceutical companies as well as smaller companies. The orphan drug market has been outpacing growth comparative to non-orphan drugs, but the differential in growth rates is narrowing.

A recent analysis, 2025 Orphan Drug Report: Are Orphans That Different?, by Evaluate Ltd., a business intelligence firm serving the bio/pharmaceutical industry, estimates that by 2030, orphan drugs will make up one-fifth of the forecast $1.6 trillion in worldwide prescription drug sales, a share that has doubled over the last decade.

The Evaluate Ltd. report points out that although the compound annual growth rate (CAGR) of orphan drug will continue to outperform the CAGR of non-orphan drugs through 2030, the growth gap between them is lessening: a CAGR of 10% for the 2025–2030 forecast period for orphan drugs versus 7.5% for non-orphan prescription drugs, with orphan drugs’ growth advantage closing to just 1% by the end of the decade.

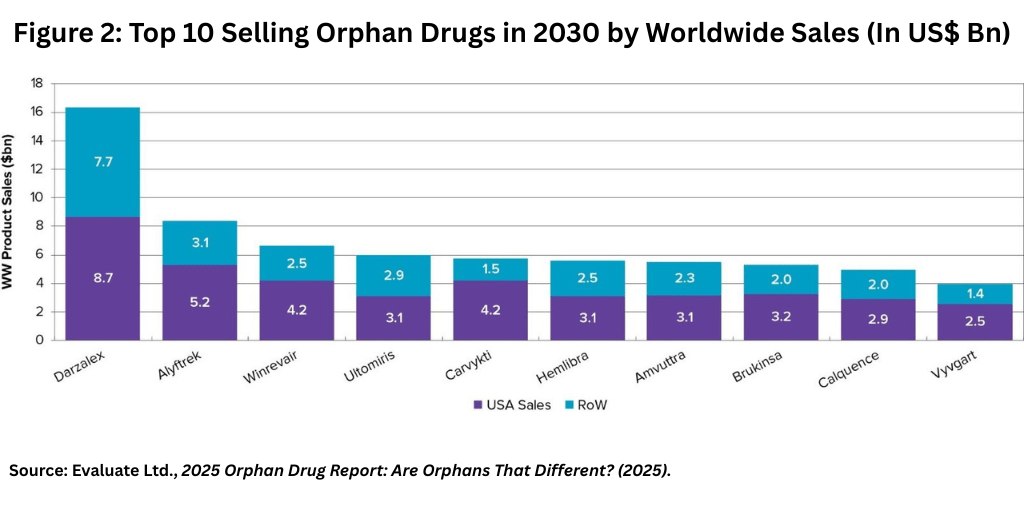

Among companies and products, the top-selling orphan drug, Johnson & Johnson’s (J&J) Darzalex (daratumumab), indicated to treat multiple myeloma and AL amyloidosis, is projected to keep its number one position among orphan drugs by 2030, reaching sales of more than $16 billion, according to the Evaluate Ltd. report (see Figure 2).

The other top-selling orphan drugs/therapies, based on forecast 2030 global sales are outlined below (see Figure 2 above):

- Vertex’s Alyftrek (vanzacaftor/tezacaftor/deutivacaftor) for treating certain forms of cystic fibrosis;

- Merck & Co.’s Winrevair (sotatercept) for treating pulmonary arterial hypertension, one form of a broader condition known as pulmonary hypertension, which refers to high blood pressure in the lung;

- AstraZeneca’s Ultomiris (ravulizumab-cwvz) for treating paroxysmal nocturnal hemoglobinuria, a rare blood disease;

- J&J’s/Legend Biotech’s Carvykti (ciltacabtagene autoleucel), a cell therapy for treating multiple myeloma;

- Roche’s Hemlibra (emicizumab) for treating hemophilia A;

- Alnylam Pharmaceuticals’ Amvuttra (vutrisiran) for treating polyneuropathy of hereditary transthyretin-mediated amyloidosis, a rare disease which leads to the buildup of abnormal amyloid protein deposits in organs and tissues;

- BeOne’s Brukinsa (zanubrutinib) for treating certain blood cancers;

- AstraZeneca’s Calquence (acalabrutinib) for treating certain blood cancers; and

- Argenx’s Vyvgart (efgartigimod alfa) for treating certain forms of generalized myasthenia gravis, a neuromuscular disease.

The strategic importance of orphan drugs is seen in the portfolio of the leading bio/pharmaceutical companies. Among the top 10 companies in orphan drug sales, eight companies had orphan drug sales account for between 17% and 36% of their estimated overall 2024 pharmaceutical sales, according to the Evaluate report. Vertex Pharmaceuticals, the only non-Big Pharma company in the Top 10 companies of orphan products, had all of its 2024 revenue attributed to orphan products, and Merck & Co. had only 4%, but its share is expected to rise (see Table I).

Table I: Top 10 Companies of Orphan Drugs (2024/2030), Based on Global Sales

| Ranking | Company | % of Sales from Orphan Drugs (2024) | % of Sales from Orphan Drugs (Forecast, 2030) |

| 1 | Johnson & Johnson | 36% | 47% |

| 2 | AstraZeneca | 32% | 29% |

| 3 | Roche | 17% | 27% |

| 4 | Novartis | 23% | 26% |

| 5 | Vertex Pharmaceuticals | 100% | 81% |

| 6 | Sanofi | 20% | 19% |

| 7 | Amgen | 23% | 26% |

| 8 | Merck & Co. | 4% | 14% |

| 9 | Bristol-Myers Squibb | 29% | 25% |

| 10 | Pfizer | 19% | 17% |

Looking forward, J&J is projected to continue to lead among the large bio/pharma companies in orphan drug sales as a percentage of the company’s overall pharmaceutical sales, according to the Evaluate report. Orphan drugs will account for close to half of J&J’s prescription drug sales by 2030, considerably higher than the 25% or so at AstraZeneca, Roche, Novartis, Bristol-Myers Squibb, and Amgen. J&J, Merck & Co., and Roche each are projected to see 10% CAGR in their orphan drugs sales by 2030, and smaller gains are projected by Novartis and Amgen (+3% CAGR in orphan drug 2024 sales versus forecast 2030 sales). Bristol-Myers Squibb and Pfizer, with shrinking orphan sales, may fall out of the Top 10 companies of orphan drug products as a percentages of their total pharma sales beyond 2030, according to the Evaluate report (see Table 1 above).

New orphan drug approvals in 2024

Although the large bio/pharma companies continued to make inroads in new orphan drugs approvals, mid-to-small bio/pharma companies still dominate new orphan drug approvals. Of the 26 orphan drugs that were approved by FDA’s CDER in 2024, eight, or 31%, were from the large bio/pharma companies, and 18, or 69%, were from mid-to-smaller companies.

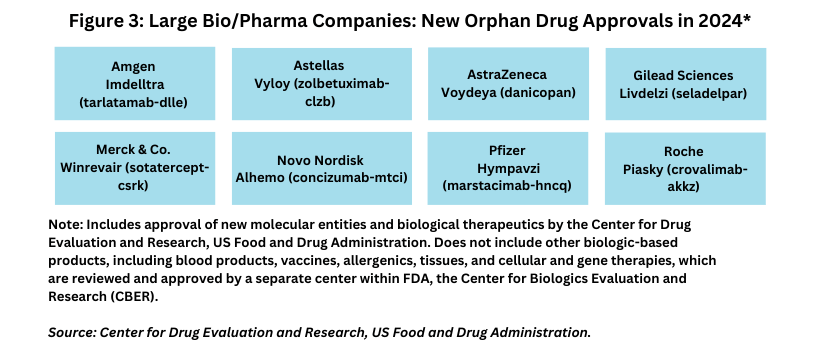

Eight large bio/pharma companies—Amgen, Astellas, AstraZeneca, Gilead Sciences, Merck & Co., Novo Nordisk, Pfizer, and Roche–each had one new orphan drug approval in 2024 (see Figure 3).

New drug approvals from the large bio/pharmaceutical companies in 2024 were:

- Amgen’s Imdelltra (tarlatamab-dlle) for treating extensive stage small-cell lung cancer;

- Astellas’s Vyloy (zolbetuximab-clzb) in combination with fluoropyrimidine- and platinum-containing chemotherapy as a first-line treatment of adults with locally advanced unresectable or metastatic HER2-negative gastric or gastroesophageal junction adenocarcinoma;

- AstraZeneca’s Voydeya (danicopan) for treating extravascular hemolysis with paroxysmal nocturnal hemoglobinuria, a rare blood disease;

- Gilead Sciences’ Livdelzi (seladelpar) for treating primary biliary cholangitis, a liver disease where the body’s immune system attacks the small bile ducts in the liver;

- Merck & Co.’s Winrevair (sotatercept-csrk) for treating pulmonary arterial hypertension;

- Novo Nordisk’s Alhemo (concizumab-mtci) for preventing or reducing the frequency of bleeding episodes in patients with hemophilia A or B;

- Pfizer’s Hympavzi (marstacimab-hncq) also for preventing or reducing bleeding episodes related to hemophilia A or B;

- Roche’s Piasky (crovalimab-akkz) for treating paroxysmal nocturnal hemoglobinuria, a rare blood disease that causes red blood cells to break down.

Eighteen mid-to-small bio/pharmaceutical companies had a new orphan drug approval in 2024. The companies and products are outlined below:

- Ascendis Pharma’s Yorvipath (palopegteriparatide) for treating hypoparathyroidism, a rare disease where the parathyroid glands behind the thyroid do not produce enough parathyroid hormone;

- BeOne’s Tevimbra (tislelizumab-jsgr) for treating esophageal squamous cell carcinoma;

- BridgeBio Pharma’s Attruby (acoramidis) for treating cardiomyopathy of wild-type or variant transthyretin-mediated amyloidosis, a progressive heart condition where misfolded transthyretin proteins accumulate as amyloid deposits in the heart muscle;

- Day One Biopharmaceuticals’ Ojemda (tovorafenib) for treating relapsed or refractory pediatric low-grade glioma (i.e., a brain tumor);

- Geron’s Rytelo (imetelstat) for treating low- to intermediate-1 risk myelodysplastic syndromes, a group of progressive bone marrow disorders;

- Incyte’s Niktimvo (axatilimab-csfr) for treating chronic graft-versus-host disease after failure of at least two prior lines of systemic therapy;

- IntraBio’s Aqneursa (levacetylleucine) for treating Niemann-Pick disease type C, a rare genetic disease resulting in progressive neurological symptoms and organ dysfunction;

- Ionis Pharmaceuticals’Tryngolza (olezarsen) for treating familial chylomicronemia syndrome, a rare genetic disorder that prevents the body from breaking down fats;

- Ispen’s Iqirvo (elafibranor) for treating primary biliary cholangitis (a rare liver disease) in combination with ursodeoxycholic acid;

- ITF Therapeutics’ (Italfarmaco) Duvyzat (givinostat) for treating Duchenne muscular dystrophy, a severe, inherited disease that causes progressive muscle weakness and degeneration;

- Jazz Pharmaceuticals’ Ziihera (zanidatamab-hrii) for treating previously treated, unresectable or metastatic HER2-positive (IHC 3+) biliary tract cancer, a rare and aggressive type of cancer that affects the organs of the biliary system, which includes the gallbladder and bile ducts;

- Merus’ Bizengri (zenocutuzumab-zbco) for treating certain forms of unresectable or metastatic non-small cell lung cancer and pancreatic cancer in patients with a rare genetic alteration, NRG1 fusion;

- Neurocrine Biosciences’ Crenessity (crinecerfont) for treating classic congenital adrenal hyperplasia, a group of hereditary genetic disorders affecting the adrenal glands;

- Servier’s Voranigo (vorasidenib) for treating Grade 2 astrocytoma or oligodendroglioma, two types of low-grade brain tumors;

- Syndax Pharmaceuticals’ Revuforj (revumenib) for treating relapsed or refractory acute leukemia;

- Vertex Pharmaceuticals’ Alyftrek (vanzacaftor, tezacaftor, and deutivacaftor) for treating cystic fibrosis;

- X4 Pharmaceuticals’ Xolremdi (mavorixafor) for treating WHIM syndrome (warts, hypogammaglobulinemia (low levels of immunoglobulins), infections, and myelokathexis (a reduction of circulating white blood cells); and

- Zerva Therapeutics’ Miplyffa (arimoclomol), for treating Niemann-Pick disease type C, a rare neurodegenerative disorder.

A look ahead

On a pipeline basis, orphan drug candidates are projected to make up 20% of global pipeline forecast sales over the rest of this decade – in line with the category’s share of 2030 prescription pharmaceutical sales, according to the Evaluate report.

However, as the Evaluate report points out, there are certain policy uncertainties in the US that may affect forecasts for bio/pharmaceuticals overall and orphan drugs specifically. These relate to staffing and funding levels at the US Food and Drug Administration to facilitate product development and reviews, US government funding under the National Institutes of Health and other programs that support early drug research and development, and potential changes to drug pricing measures under the Inflation Reduction Act (IRA), which included the creation of the Medicare Prescription Drug Negotiation Program, which authorized the US government to negotiate prices for certain prescription drugs under Medicare, the US federal health insurance program for people 65 or older.