Pharma Industry-Specific Tariffs: Industry Weighs In

The industry has weighed in on the US government’s potential plan to impose tariffs specific to the pharmaceutical industry. Where does the initiative stand, and what is the industry saying?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Pharma industry-specific tariffs: where they stand

A large issue looming for the pharma industry is whether the US government will proceed with imposing pharmaceutical-industry-specific tariffs. The groundwork for potential industry-specific tariffs was laid earlier this year (April 1, 2025), when the US Department of Commerce initiated an investigation to determine the effects on US national security of imports of pharmaceuticals and pharmaceutical ingredients. This includes both finished generic and non-generic drug products, medical countermeasures, critical inputs, such as active pharmaceutical ingredients (APIs) and key starting materials, and derivative products of those items.

The investigation was initiated under Section 232 of the Trade Expansion Act of 1962, as amended, which allows the President to impose import restrictions based on an investigation and affirmative determination by the US Department of Commerce that certain imports threaten to impair US national security. The Bureau of Industry and Security at the Commerce Department conducts the investigation. In general, a Section 232 investigation considers the following (1) existing domestic production of the product; (2) future capacity needs; (3) manpower, raw materials, production equipment, facilities, and other supplies needed to meet projected national defense requirements; (4) growth requirements, including the investment, exploration, and development to meet them; and (5) any other relevant factors.

A Section 232 investigation does not necessarily result in the imposition of tariffs, but the findings of the investigation are reported to the President. Depending on the findings of the investigation, the President can decide whether to impose tariffs or quotas to offset the adverse effect on national security, without limits on the duration of the tariffs and can apply them to specific products or countries. After a determination, the President must implement the action within 15 days, and submit a written statement to Congress explaining the action or inaction within 30 days.

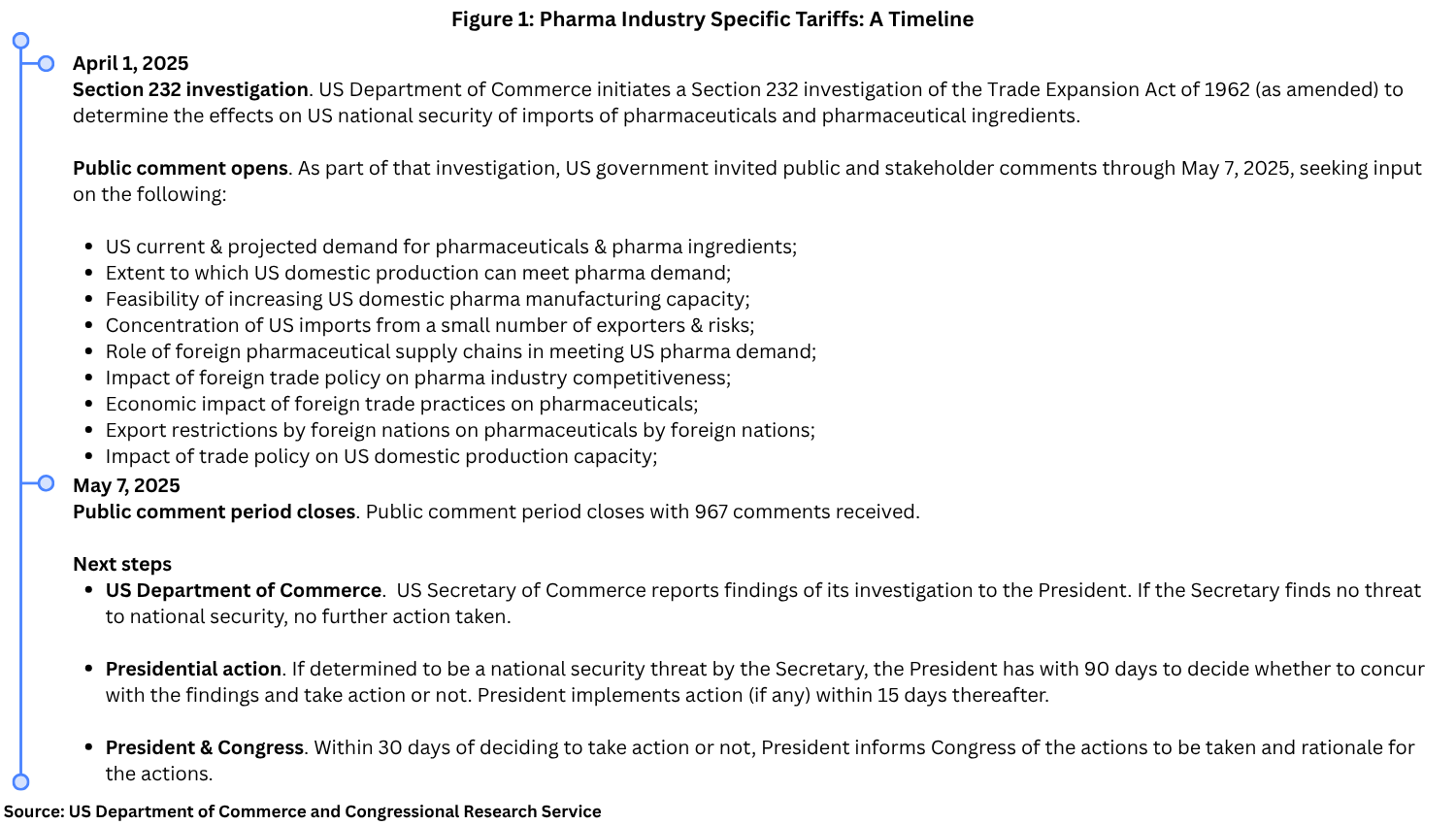

Figure 1 outlines the steps taken by the US government thus far and the steps to be taken if pharma industry-specific tariffs were to be imposed.

The US Department of Commerce provided public notice in the Federal Register of its Section 232 investigation into pharmaceuticals in Apriil (April 2025) and requested public comment by May 7, 2025. The notice identified several issues on which the US Department of Commerce was especially interested in gaining feedback on as outlined below:

- US pharmaceutical demand. The current and projected demand for pharmaceuticals and pharmaceutical ingredients in the United States;

- US domestic pharmaceutical production. The extent to which domestic production of pharmaceuticals and pharmaceutical ingredients can meet domestic demand;

- Foreign pharmaceutical supply chains. The role of foreign supply chains, particularly of major exporters, in meeting US demand for pharmaceuticals and pharmaceutical ingredients;

- US pharmaceutical imports. The concentration of US imports of pharmaceuticals and pharmaceutical ingredients from a small number of suppliers and the associated risks;

- Impact of foreign trade policy on pharmaceuticals. The impact of foreign government subsidies and trade practices on US pharmaceuticals industry competitiveness;

- Economic impact of foreign trade practices on pharmaceuticals. The economic impact of artificially suppressed prices of pharmaceuticals and pharmaceutical ingredients due to foreign unfair trade practices and state-sponsored overproduction;

- Export restrictions on pharmaceuticals. The potential for export restrictions by foreign nations, including the ability of foreign nations to exercise control over pharmaceuticals supplies;

- Feasibility on increasing US domestic manufacturing capacity. The feasibility of increasing domestic capacity for pharmaceuticals and pharmaceutical ingredients to reduce import reliance;

- Impact of trade policy on US domestic production capacity. The impact of current trade policies on domestic production of pharmaceuticals and pharmaceutical ingredients, and whether additional measures, including tariffs or quotas, are necessary to protect national security; and

- Other factors. Any other relevant factors.

Industry reaction

In all, 967 comments were received from 311 entities (individuals, organizations, and companies). Chief among them were comments from industry trade associations, the Pharmaceutical Research and Manufacturers of America (PhRMA), which represents innovator drug companies in the US, and the Association for Accessible Medicines (AAM), which represents generic and biosimilar producers in the US, both of which oppose the imposition of pharmaceutical-industry-specific tariffs.

In its comments, PhRMA pointed out distinctions in the manufacturing and supply chains of innovator drugs and essential medicines/generics and said that the imposition of tariffs on innovator drugs and their inputs would have a negative impact on US-based research, development, and manufacturing and would contribute to higher costs for drugs. It provided some key data on innovator drugs to support that position. Total US consumer sales of finished pharmaceutical products were $393 billion in 2023, with 64% ($251 billion) domestically produced and sold inside the US and 36% ($143 billion) imported. Europe is the largest supplier of pharmaceuticals and inputs imported into the US, accounting for 73% of total imports or $203.2 billion. By value, the European Union (EU) was the largest source of these imports, accounting for 62% of the total. Europe as a whole accounted for 73% of the total when the UK and Switzerland (which account for 3% and 8% of imports, respectively) are included. By value, Europe was the largest source of imports of both bio/pharmaceutical inputs and finished bio/pharmaceuticals, accounting for 88% of imports of bio/pharmaceutical inputs and 73% of imports of finished bio/pharmaceuticals. A 25% tariff scenario would increase the cost of imported pharmaceuticals by $50.8 billion annually, with tariffs on imports from Europe accounting for the majority of this cost. For innovator drugs, this cost breaks down as $15.1 billion annually for increased costs from imported APIs and $35.7 billion for imported finished pharmaceuticals, with 90% of the costs of imported APIs from the EU, Switzerland, the UK, and Canada, and 70% of the costs of imported finished products from these countries.

In addition, PhRMA pointed out that tariffs would not have the desired policy goal of increasing US-based pharma manufacturing of innovator drugs. “Tariffs on innovative biopharmaceutical products will not promote greater domestic production of these products,” said PhRMA in its comments of May 6, 2025. “On the contrary, every dollar collected in tariffs would be a dollar less that biopharmaceutical companies are able to invest in US R&D, manufacturing and infrastructure. Innovative biopharmaceutical products, by definition, are not commodities (unlike many of the other products that have been subject to Section 232 investigations), and their complex supply chains and associated regulatory requirements would make it impossible to move production in any timescale necessary to avoid imposed tariffs.”

Instead of imposing tariffs, PhRMA is calling on the Administration to adopt pragmatic solutions and targeted incentives, such as securing agreements with foreign governments for the elimination of unfair trade practices that inhibit US biopharmaceutical innovation, production, and exports. It is also calling on the Administration to pursue bilateral or sectoral trade agreements with trusted trading partners, such as the EU, Japan, Switzerland, and the UK, to formalize and affirm commitments to reciprocal, tariff-free trade in bio/pharmaceuticals, eliminate other trade barriers in the medical sector, and promote strong intellectual property, regulatory, and other standards

The Association for Accessible Medicines (AAM), which represents generics and biosimilar companies in the US, also points to the negative impact that tariffs would have on the generics industry by raising costs on already low-margin products and raising the potential of increasing drug shortages. “While tariffs can be a tool that drives the onshoring of manufacturing in other industries, tariffs in the generic and biosimilar industries would result in harm to patients and reduced availability of much- needed medicine[s]…” said AAM in its May 6, 2025, comments. “And crucially, without other significant reforms—such as addressing reimbursement for pharmaceuticals—tariffs are unlikely to benefit US manufacturing or exports of generic and biosimilar medicines given the economic dynamics in these industries. Instead, tariffs risk further incentivizing moves to lower-cost offshore destinations for production.”

AAM is recommending that finished generic and biosimilar pharmaceuticals, APIs, pharmaceutical ingredients, packaging, other components, and production machinery be exempted from the scope of any recommended tariff action through the Section 232 investigation. “To the extent that any tariffs are imposed, they should be carefully calibrated in the context of a larger approach to overturning the current market dynamics that disfavor US production of generic drugs,” AAM said in its comments.