President Trump Issues Executive Order for Most-Favored Nation Drug Pricing

President Donald Trump issued an Executive Order this week to lay out a plan to implement most-favored-nation drug pricing as a way to reduce differentials in drug pricing between the US and foreign countries as means to lower the cost of Rx drugs in the US. What’s the impact of pharma manufactuers?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Seeking drug pricing reforms

An important US policy move occurred this week (May 12, 2025) with President Donald Trump signing an Executive Order to put into motion a plan to implement most-favored-nation drug pricing in the US as a way to lower the cost of prescription drugs in the US. The premise behind the Executive Order is that the US pays higher prescription drug costs comparative to other developed countries and therefore assumes a larger share of the costs of drugs and that measures should be taken to reduce the differential in the prices of prescription drugs in the US compared to other developed countries, where prescription drug prices are lower.

“Americans should not be forced to subsidize low-cost prescription drugs and biologics in other developed countries and face overcharges for the same products in the United States,” said the May 12, 2025, Executive Order. “Americans must therefore have access to the most-favored-nation price for these products.”

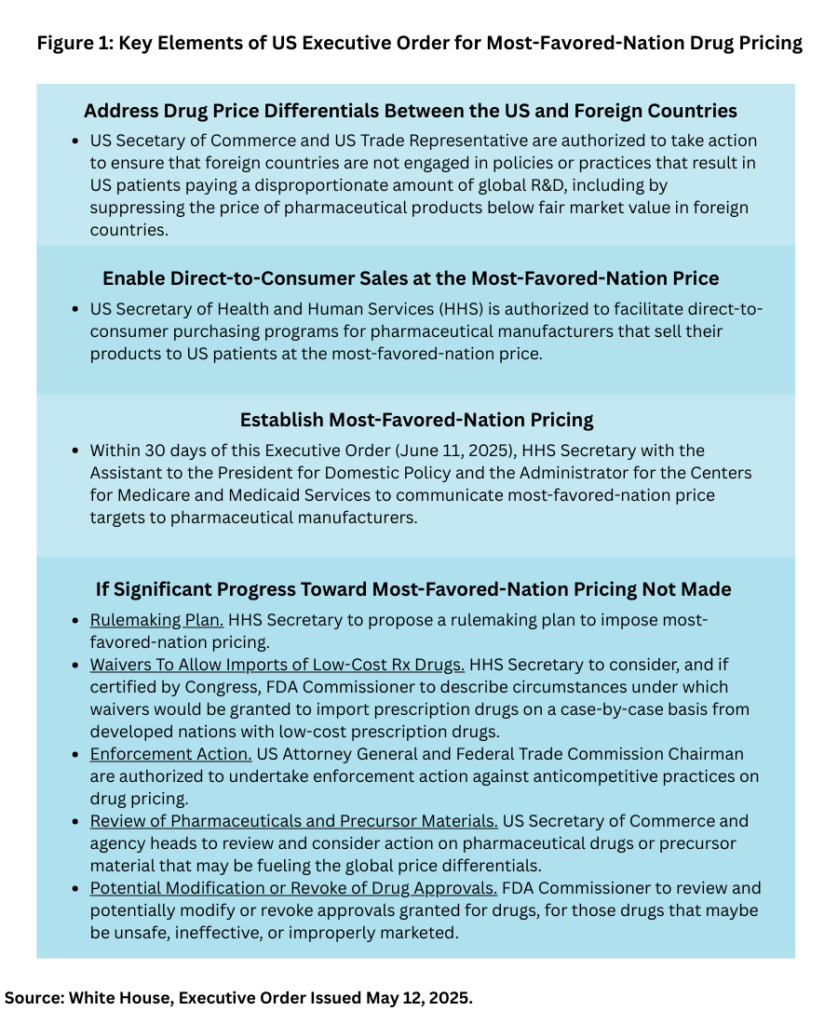

The Executive Order directs several US federal government officials—the Secretary of Commerce, the US Trade Representative, the Secretary of the Department of Health and Human Services (HHS), and the Commissioner of the Food and Drug Administration—to take certain actions to put into motion most-favored-nation drug pricing (see Figure 1). Most-favored-nation-drug pricing means that the price of a drug in the US would be set no higher than the price of that drug in comparable countries, mostly developed nations. The Executive Order first seeks voluntary price concessions from pharmaceutical manufacturers for lower drug pricing and then outlines a series of steps that the Administration would take if such voluntary price concessions are not made, including allowing for importation of lower-cost drugs into the US and a rulemaking plan to implement mandatory most-favored-nation drug pricing (see Figure 1).

The Executive Order does not specify what drugs would be subject to most-favored-nation drug pricing, but it calls on the HHS Secretary, with the Assistant to the President for Domestic Policy and the Administrator for the Centers for Medicare and Medicaid Services, to communicate most-favored-nation price targets, in line with comparably developed nations, to pharmaceutical manufacturers within 30 days of the issuance of the Executive Order or by June 11, 2025. If “significant progress” toward most-favored-nation pricing is not made, the Executive Order directs a series of actions to implement the pricing reforms (see Figure 1 above). These include the following: a rulemaking plan by the HHS Secretary to impose most-favored-nation pricing; waivers to allow imports from developed countries of low-cost prescription drugs, as certified by Congress and implemented by the FDA Commissioner on a case-by-case basis; enforcement actions relating to anticompetitive practices on drug pricing; and authorizing the US Secretary of Commerce and agency heads to review and consider action on pharmaceutical or precursor materials that may be contributing to global price differentials (see Figure 1 above).

Other policy moves for most-favored-nation drug pricing

This is not the first time that US policymakers have proposed a plan for most-favored-nation drug pricing. The first Trump Administration had proposed a plan for most-favored-nation drug pricing model that was later rejected by the courts. Under that proposal, most-favored-nation drug pricing would have applied to high-cost biologicals and Medicare Part B drugs (Medicare is the US government healthcare program for individuals 65 years and older and Part B drugs refer to limited outpatient prescription drugs). That model would have tested paying comparable amounts to the lowest price, adjusted for purchasing power, paid by any country in the Organization for Economic Co-operation and Development that has a gross domestic product (GDP) per capita that is at least 60% of the US GDP per capita. The model also would have tested a single add-on payment per dose and waive beneficiary cost sharing for this payment. The model would have operated for seven years, from January 1, 2021, to December 31, 2027. However, in December 2020, a US federal district court issued a preliminary injunction against the implementation of the proposed most-favored-nation drug pricing plan and as result, it was not further implemented.

Industry reaction

Both the Pharmaceutical Research and Manufacturers of America (PhRMA), which represents innovator drug companies in the US, and the Biotechnology Innovation Organization (BIO), which represent the biotechnology industry in the US, criticized a plan for most-favored-nation drug pricing although both organizations issued support for the larger policy goal of seeking ways to lower prescription drug costs in the US.

PhRMA pointed to the need to address drug pricing through higher costs associated with prices provided by pharmacy benefit managers (PBMs), which act as intermediaries between consumers and drug manufacturers, as well as other parties in the healthcare system. “To lower costs for Americans, we need to address the real reasons US prices are higher: foreign countries not paying their fair share and middlemen driving up prices for US patients,” said Stephen J. Ubl, President and CEO of PhRMA, in a May 12, 2025, statement. “The Administration is right to use trade negotiations to force foreign governments to pay their fair share for medicines. US patients should not foot the bill for global innovation. The US is the only country in the world that lets PBMs, insurers and hospitals take 50% of every dollar spent on medicines. The amount going to middlemen often exceeds the price in Europe. Giving this money directly to patients will lower their medicine costs and significantly reduce the gap with European prices.“

BIO pointed to the chilling effect that most-favored-nation drug pricing would have on product innovation, particularly among smaller bio/pharmaceutical companies, which it says is already facing headwinds with proposed tariffs. “Most favored nation is a deeply flawed proposal that would devastate our nation’s small- and mid-size biotech companies – the very companies that are the leading drivers of medical innovation in the United States and the cornerstone of America’s biotechnology leadership,” said John F. Crowley, President and CEO, BIO, in a May 12, 2025, statement. “…Patients and families are not a bargaining chip in a trade war, but that’s exactly how they are being treated – first through proposed tariffs on our nation’s medicines, now with foreign reference pricing in the name of fairness. Researchers that spend years developing cures and breakthrough treatments are being penalized and the US is falling behind in the 21st century biotech race. Meanwhile, US medication prices prop up middlemen that prevent cost savings from being passed on to patients. The solution is investments that ensure the US continues to lead the world in medical innovation and policies that simplify the system.”