Rare-Disease Drugs: Is the Market Still Trending Upward?

FDA plans to establish a Rare Disease Innovation Hub to spur product development and commercialization of rare-disease drugs, which have been a strategic priority for many companies, with overall market growth in the double-digits. Will that growth continue?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

FDA’s plan for the Rare Disease Innovation Hub

Last month (July 2024), the US Food and Drug Administration (FDA) announced plans to establish a Rare Disease Innovation Hub as a means to apply cross-agency expertise and enhance the agency’s inter-center connectivity to spur the development of treatments for rare diseases. Although the FDA already has in place mechanisms to incentivize the development of therapeutics for rare diseases through market-exclusivity and regulatory-review measures, the Hub is intended to further facilitate the agency’s role in this area. For purposes of regulatory review, orphan drugs are defined as prescription medicines developed for rare diseases and conditions, which, in the US, affect fewer than 200,000 people. FDA estimates that an estimated 10,000+ rare diseases affect more than 30 million people in the US, approximately one out of every 10 people.

“Recent rapid advances in the identification of promising drug targets and development of gene therapies offer momentum and potential to meet the needs of patients with rare diseases,” said Patrizia Cavazzoni, MD, Director, Center for Drug Evaluation and Research (CDER), and Peter Marks, MD, PhD, Director, Center for Biologics Evaluation and Research (CBER), FDA, in a July 17, 2024, posting on FDA’s website, in announcing the Hub. In 2023, over half of all the novel drugs and biologics approved by FDA’s CDER and CBER were to prevent, diagnose, or treat a rare disease or condition.

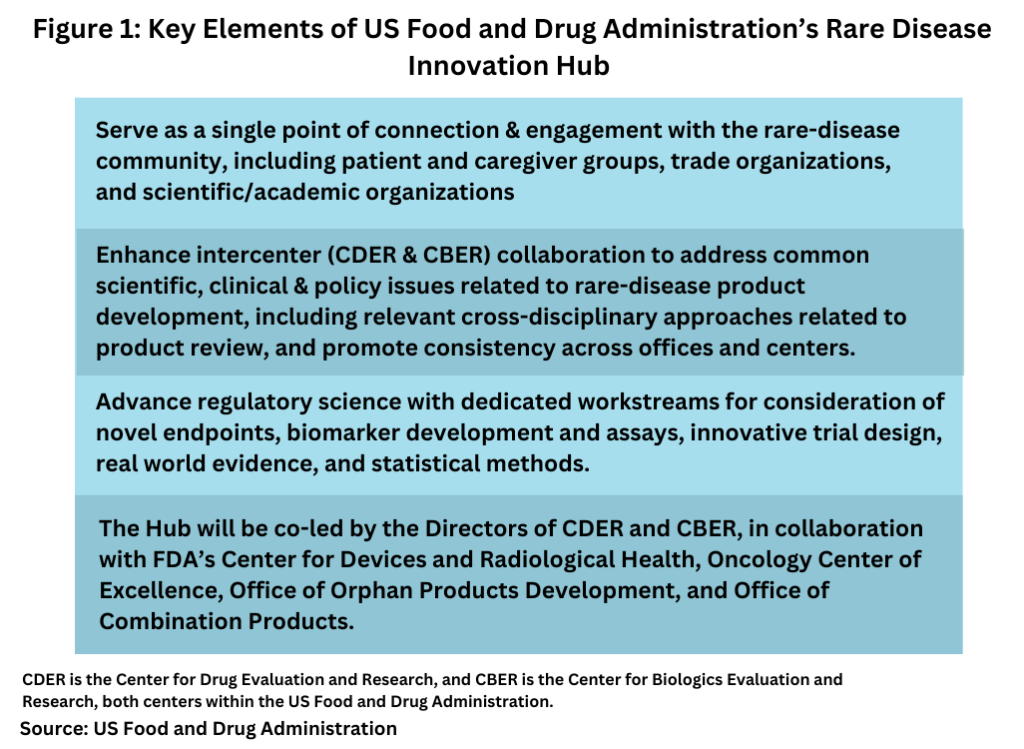

FDA says the Hub will work across rare diseases but will especially focus on products intended for smaller populations or for diseases where the natural history is variable and not fully understood. The Hub would have three primary functions as outlined below (see Figure 1):

- Serve as a single point of connection and engagement with the rare-disease community, including patient and caregiver groups, trade organizations, and scientific/academic organizations, for matters that intersect CDER and CBER. The Hub will help the larger rare-disease community navigate intersections across the FDA that affect patients with rare diseases, such as medical devices, including diagnostic tests, and combination products.

- Enhance inter-center collaboration to address common scientific, clinical and policy issues related to rare-disease product development, including relevant cross-disciplinary approaches related to product review, and promote consistency across FDA offices and Centers.

- Advance regulatory science with dedicated workstreams for consideration of novel endpoints, biomarker development and assays, innovative trial design, real world evidence, and statistical methods.

The Hub will be co-led by the Directors of CDER and CBER, in collaboration with FDA’s Center for Devices and Radiological Health, Oncology Center of Excellence, Office of Orphan Products Development, and Office of Combination Products. In addition, the Hub will leverage the activities of the CDER Accelerating Rare disease Cures (ARC) program and CBER Rare Disease Program and will enhance existing cross-center collaborations. In addition, a newly created senior leadership position, Director of Strategic Coalitions for the Hub (Associate Director for Rare Disease Strategy), will act as a single point of connection and engagement with outside parties on behalf of the Hub on cross-cutting rare disease-related issues. The Director will develop approaches to ensure appropriate FDA staff involvement or appropriate settings for further external engagement and will seek input from the community to inform the priorities of the Hub.

“This collaborative Hub model will advance a shared vision to facilitate rare-disease product development,” said FDA’s CDER Director Peter Cavazzoni and FDA’s CBER Director Peter Marks in their statement. “It will leverage the skills of staff within their respective Centers while staff will retain their existing decision-making authorities within their current organizations. This model will allow our reviewers to benefit from the deep expertise that resides within the many therapeutically aligned review divisions touched by rare-disease indications. At the same time, the Hub will bring together scientific, clinical, and policy leaders from CDER and CBER under a shared vision to address common challenges in rare-disease drug development.”

FDA says the Hub will lead to further collaboration among the FDA’s existing programs in the rare-disease space, including the CDER Accelerating Rare disease Cures (ARC) Program and CBER Rare Disease Program. It will also provide a forum to understand and leverage what the agency has learned from pilot programs currently being implemented across the agency, including the Rare Disease Endpoint Advancement (RDEA) Pilot Program and the Support for Clinical Trials Advancing Rare disease Therapeutics (START) Pilot Program.

FDA says it anticipates holding an open public meeting this fall (fall 2024), which will include the establishment of a public docket, to provide further information about the agency’s vision for the Hub and receive feedback from the community to help shape the Hub’s priorities and initiatives.

Rare-disease drugs lead product innovation

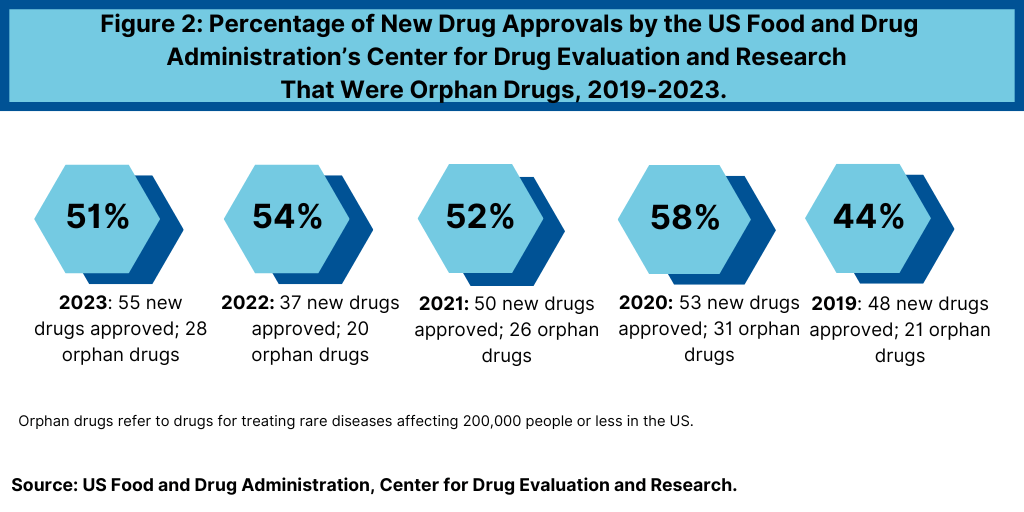

Although a niche area in terms of the patient populations served, orphan drugs (i.e., drugs to treat rare diseases) are an important part of the growth strategy and product innovation of both large bio/pharmaceutical companies and smaller companies. Over the last five years (2019-2023), orphan drugs have accounted, on average, of more than half (52%) of new molecular entities and new therapeutic biologics approved by FDA’s CDER (see Figure 2).

In 2023, more than half of the novel drug approvals by FDA’s CDER were drugs to treat rare or orphan diseases, which continued a recent trend in which more than half of new drug approvals were for orphan drugs. In 2023, 28 of CDER’s 55 novel drug approvals (51%) received orphan drug designation. In 2022, 20 of 37, or 54% of novel drug approvals by FDA’s CDER were for rare diseases. In 2021, 26 of CDER’s 50 new drug approvals (52%) were approved to treat rare or orphan diseases, and in 2020, 58%, or 31, of the 53 novel drug approvals were orphan drugs. In 2019, 44%, or 21 or 48 of the new drugs approved by FDA’s CDER were orphan drugs (see Figure 2).

Market outlook for orphan drugs

For more than a decade, growth has been strong in orphan drugs, where the orphan drug market’s growth has outpaced that of non-orphan prescription drugs, with sales growth averaging almost 11% in the 10 years leading up until 2023, according to Evaluate, a London-based business and market intelligence firm, in its 2024 Orphan Drug Report, which was released earlier this year (April 2024). Orphan drugs doubled their market share in global prescription drug sales, climbing from less than 10% of the global prescription drug market in 2014 to nearly 20% in 2023. However, Evaluate anticipates that the market for orphan drugs, although still projecting good growth, will slow, resulting in a narrowing growth gap between orphan and non-orphan prescription drugs. In 2024, orphan drugs are on track to generate revenues of $185 billion and are projected to reach $270 billion by 2028.

Despite the anticipated slowdown in growth, orphan drugs remain a strategic and competitive priority. Evaluate projects that the top 10 orphan drugs will collectively generate revenues of more than $57 billion in 2028, with the top three orphan drugs rounding out as Johnson & Johnson’s blood-cancer drug, Darzalex (daratumumab), Vertex Pharmaceuticals’ Trikafta felexacaftor/tezacaftor/ivacaftor) for treating cystic fibrosis, and Roche’s Hemlibra (emicizumab) for treating hemophilia A.

“Even with the anticipated moderation in growth, orphan drugs continue to punch above their weight class in terms of value,” said Daniel Chancellor, Director, Thought Leadership at Evaluate, in commenting on the firm’s recent report. “It’s not surprising that we’d see this moderation as orphan drugs become a mainstream business; sales within the category were $168 billion in 2023. The entire oncology therapeutic category, for context, was $194 billion. It’s a highly productive pipeline dealing with the same mainstream challenges as the rest of the industry,” Chancellor added. “It’s important to understand that the slowdown of orphan drugs is relative. As the overall prescription drug market continues to grow, so will that for rare disease drugs. High prices, small trials, and well-defined populations and development incentives will continue to buoy this important sector.”