Sanofi’s Euroapi Launches as Stand-alone $1-Bn CDMO

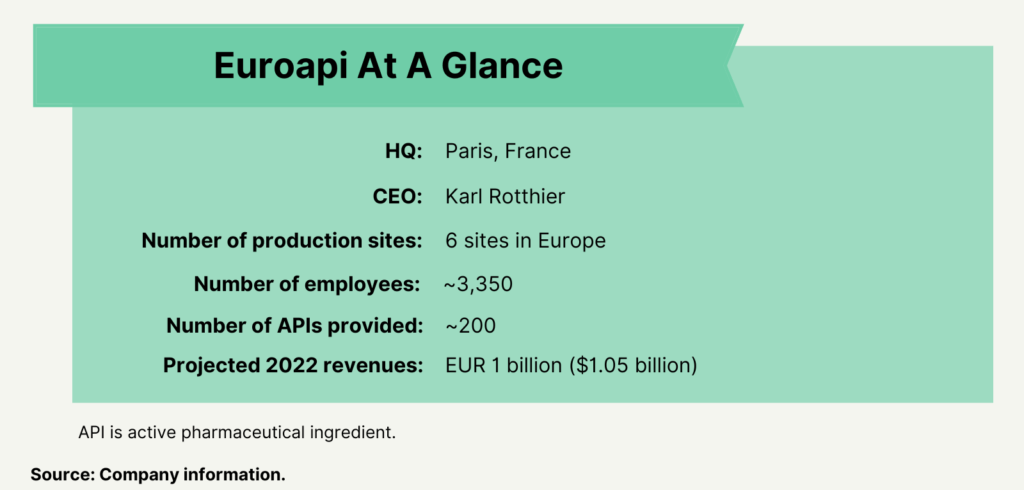

Euroapi, a CDMO of small-molecule APIs spun off from Sanofi, has launched as a stand-alone publicly traded company. The CDMO projects 2022 revenues of $1 billion. What’s behind the new company?

New small-molecule API CDMO

Euroapi, a CDMO of small-molecule active pharmaceutical ingredients (APIs) spun off from Sanofi, has launched as a stand-alone publicly traded company. The company begins trading on the Euronext Paris stock exchange on May 6, 2022. The company’s listing on Euronext Paris followed approval earlier this week (May 3, 2022) at Sanofi’s Ordinary and Extraordinary Shareholders’ Meeting of distribution of approximately 58% of Euroapi’s shares to Sanofi shareholders with a distribution ratio of one Euroapi shares per 23 Sanofi shares.

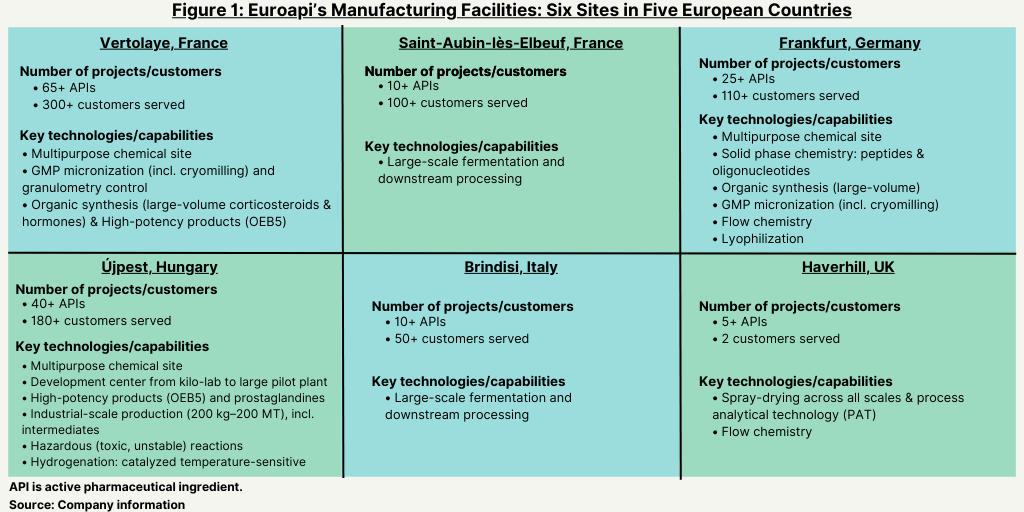

Sanofi had announced its plan to form the stand-alone CDMO in February 2020. The new company combines Sanofi’s API commercial and development activities from six of its European production sites: Brindisi, Italy; Frankfurt, Germany; Haverhill, UK; St. Aubin les Elbeuf, France; Vertolaye, France; and Újpest, Hungary (see Figure 1). Sanofi says it expects the new manufacturing company to bring in EUR 1 billion ($1.05 billion) in sales in 2022 and that the stand-alone company will rank number one in small-molecule APIs and number two in the global API market. The new company will have a portfolio of approximately 200 APIs over the six sites (see Figure 1). In 2021, the business posted net sales of EUR 892.8 million ($941.7 million). Karl Rotthier, formerly CEO Centrient Pharmaceuticals, a Rotterdam, the Netherlands-based manufacturer of intermediates and APIs, was named as CEO of Euroapi, effective January 2021.

Sanofi is furthering its support for the CDMO by establishing a long-term customer relationship with Euroapi and has committed to holding a minority stake of approximately 30% in the CDMO for a two-year lock-up period. In addition, EPIC Bpifrance, a French public investment bank owned by the French government, has agreed to purchase 12% of EuroAPI’s shares from Sanofi and has committed to a two-year lock-up period, and L’Oréal, Sanofi’s largest shareholder, has committed to a one-year lock-up period.

Euroapi and Sanofi’s industrial footprint

When first announcing the launch of the new CDMO in 2020, Sanofi said that the new European company will help balance “the industry’s heavy reliance on API sourced from other regions” while simplifying Sanofi’s industrial footprint.

At the end of 2021, Sanofi conducted industrial production at 67 sites in 31 countries as outlined below:

- 8 sites for its Specialty Care operations;

- 30 sites for its General Medicines operations;

- 6 sites for its Third-Party API operations;

- 12 sites for its Consumer Healthcare operations; and

- 11 sites for the industrial operations of Sanofi Pasteur in vaccines.

As of December 31, 2021, Euroapi represented approximately 1% of the total consolidated assets of Sanofi, mainly in the form of dedicated industrial facilities at the chemicals sites included in the spin-out and API inventories manufactured and commercialized by Euroapi.

Looking at Sanofi’s industrial footprint as a whole, as of December 31, 2021, Sanofi’s commitments for future capital expenditures amounted to EUR 769 million ($811 million). The principal locations involved were: for the Pharmaceuticals segment, the industrial facilities at Frankfurt (Germany); Le Trait, Maisons-Alfort, Compiègne, and Ambares (France); Cambridge (the US); Geel (Belgium); Origgio, Anagni, Brindisi, and Scoppito (Italy); and for the Vaccines segment, the facilities at Swiftwater (the US), Toronto (Canada), Marcy-l’Étoile, Neuville-sur-Saône, and Val-de-Reuil (France), and Singapore.

Sanofi’s Specialty Care industrial operations are organized around two end-to-end clusters around four dedicated biotechnology hubs: Paris/Lyon (France); Frankfurt (Germany); Geel (Belgium) and the Boston area (the US). The Bioatrium project, a joint venture between Sanofi and Lonza (Switzerland) set up in 2017 to increase bioproduction capacity, is proceeding on schedule. The Waterford (Ireland) and Le Trait (France) sites manufacture pre-filled Dupixent (dupilumab), Sanofi’s drug for treating allergic diseases such as eczema, asthma, and nasal polyps that result in chronic sinusitis.

Sanofi’s General Medicines industrial operations are organized through end-to-end clusters, with chemistry, pharmaceutical, and injectable sites organized through a network of over 31 regional and local industrial sites in 20 countries. The manufacturing for its General Medicines business encompasses a dedicated launch sites cluster from API manufacturing to finished goods packaging (Sisteron (France), Aramon (France), Ambarès (France), and Scoppito (Italy)). The Frankfurt facility is the principal site for the manufacture of diabetes treatments.

The pharmaceutical industrial operations of its Consumer Healthcare (CHC) business are spread across a dedicated network at Sanofi’s facilities in Compiègne (France) and Cologne (Germany). The company also brought in various manufacturing operations related to its 2017 acquisition of Boehringer Ingelheim’s consumer healthcare business in-house, mainly to its sites at Compiègne (France) and Suzano (Brazil).

The industrial operations of Sanofi Pasteur, Sanofi’s vaccines business, are in a major investment phase, preparing for upcoming growth in its influenza and polio/pertussis/Hib franchises, plus the mid-term growth linked to the company’s new vaccines pipeline. Major investments were announced in 2020 and 2021 with a new Evolutive Facility in France (Neuville-Sur-Saone) and a new facility in Singapore. Other major investments are underway in France (including construction of a new influenza vaccine building at Val-de-Reuil), in Canada (a new pertussis vaccine building), and investments in the US and Mexico.