Small-Molecule Drugs & Product Innovation

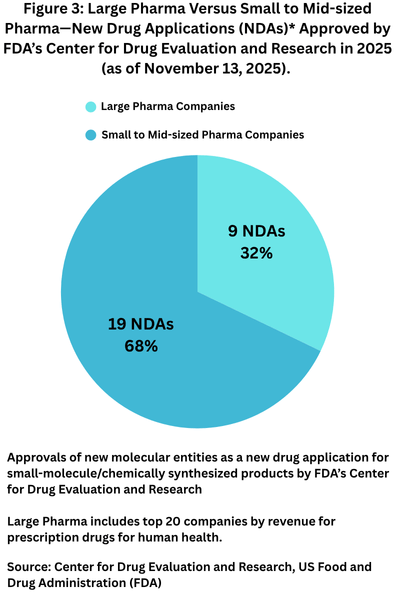

Small-molecule and chemically synthesized drugs continue to the dominate new drug approvals by FDA, with about 75% of such approvals in 2025 coming from small-to-medium-sized pharma companies.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

FDA: New drug approvals in 2025

The number of new drug approvals by the US Food and Drug Administration (FDA) is an important barometer of the level of product innovation in the bio/pharma industry, but this year has presented some challenges on the regulatory front. First, staffing and budgetary cuts at the agency, changes in FDA leadership, and a 43-day shutdown of the US government in which reviews of new drug filings were limited have made this year (2025) a different environment. The funding impasse began with the change in the fiscal year on October 1, 2025, after Congress failed to pass legislation to fund the US government. That impasse ended this week when Congress passed and the President signed into law on November 12, 2025, legislation that funds the US government. With respect to new drug reviews, during the 43-day government shutdown, FDA continued to operate with activities that were funded through carryover user fees and other unlapsed funding. User fee funds specifically support the review and marketing authorization of new medical products. During the funding lapse, FDA was not able to accept new drug applications (NDAs) and biologics license applications (BLAs) that required payment of a user fee although reviews of applications for which a user fee had already been submitted prior to the shutdown could continue. To what extent that this pause will have on the overall number of new drug approvals for 2025 has yet to be seen.

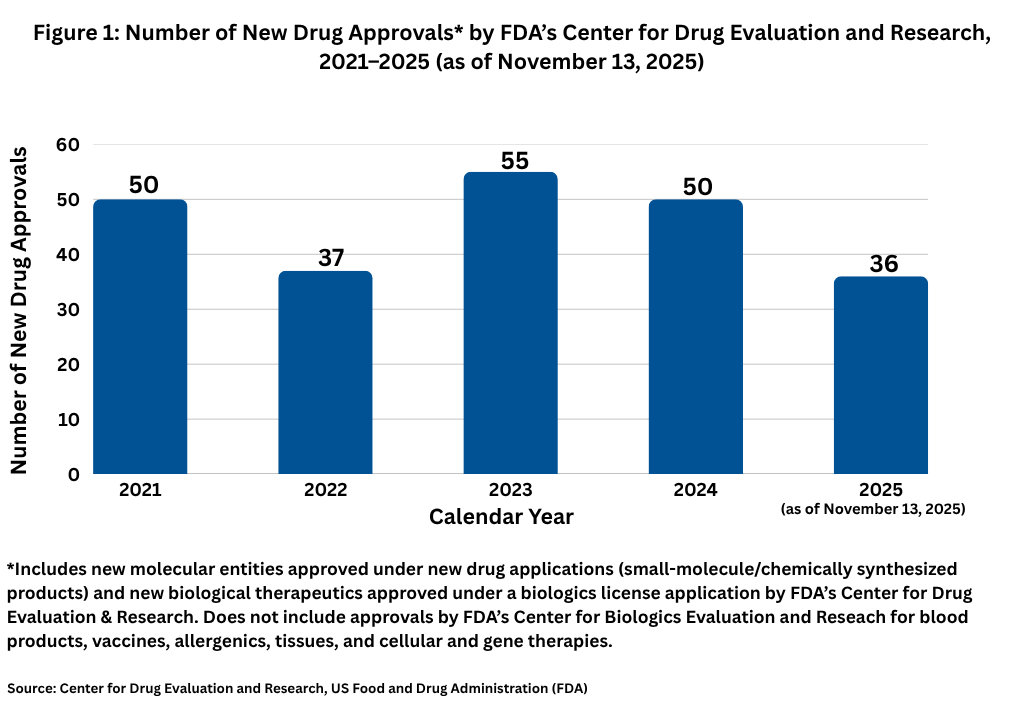

For now, through November 13, 2025, FDA’s Center for Drug Evaluation and Research (CDER) has approved 36 new molecular entities approved under new drug applications (small-molecule/chemically synthesized products) and new biological therapeutics, such as recombinant proteins and monoclonal antibodies, approved under a BLA. Other biologic-based products, including blood products, vaccines, allergenics, tissues, and cellular and gene therapies, are reviewed and approved by a separate center within FDA, the Center for Biologics Evaluation and Research (CBER), and are not part of this analysis. Although new drug approvals do not follow a strictly chronological path, with approximately six weeks months left in 2025, the level of new drug approvals is off the pace from recent years. Figure 1 shows full-year drug approvals from 2021 to the present, and with the exception of 2022, there have been 50 or more new drug approvals in a given year.

Small molecules versus biologics

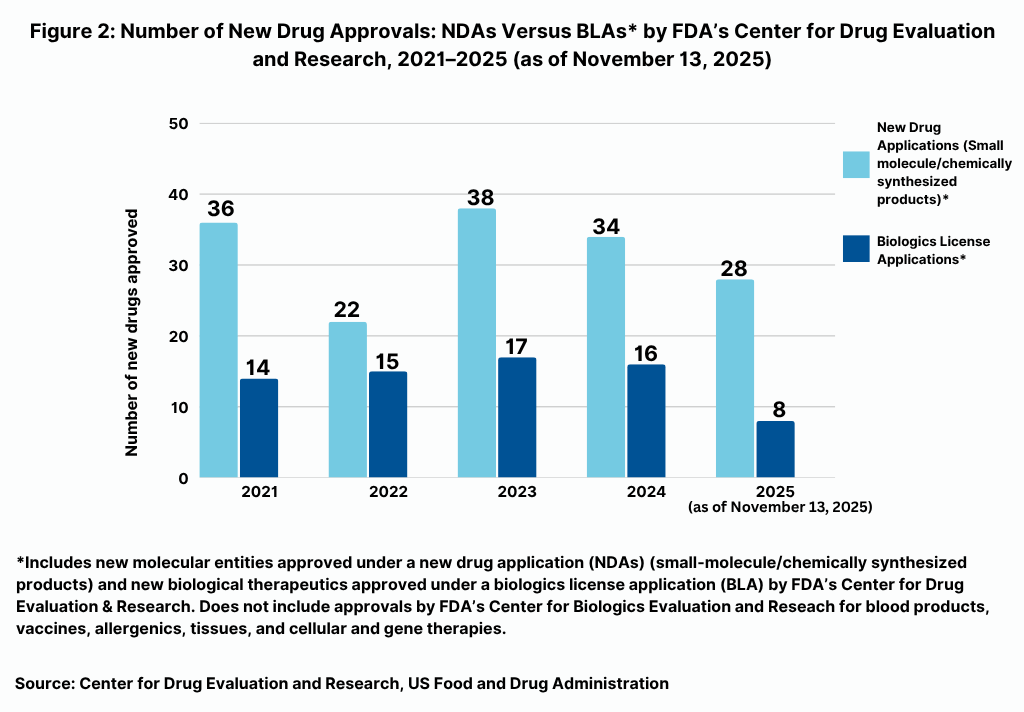

Table I at the end of the article shows the 36 new drugs approved by FDA’s CDER thus far in 2025 (as of November 13, 2025). As has been the recent trend, small-molecules/other chemically synthesized products have dominated new drug approvals comparative to approvals of biological therapeutics by FDA’s CDER (see Figure 2).

In terms of product mix, of the 36 new drugs approved by FDA’s CDER thus far in 2025 (as of November 13, 2025), small molecules/other chemically synthesized drugs (i.e., drugs approved as NDAs) accounted for 28, or 78%, of new drug approvals and biologics (which included two antibody drug conjugates) accounted for eight new approvals, or 22%, of new drug approvals by FDA’s CDER.

Those numbers are in line and slightly higher comparative to recent years. In looking at prior year trends, of the 50 new drug approvals by FDA’s CDER in 2024, 34, or 68%, were for NDA approvals (i.e., small molecules/other chemically synthesized products) (31 drugs and three diagnostic/imaging agents), and 16, or 32%, were biologics. That was on par with the mix in 2023, when FDA’s CDER approved 38 small-molecules/other chemically synthesized products, or 69% of new drug approvals and 17 new biological therapeutics, which represented 31% of new drug approvals. However, small-molecule drugs/other chemically synthesized product approvals in 2024 and 2023 dipped and were below recent historical levels when such drug approvals averaged 75% of new drug approvals between 2019 and 2021, with 2022 being an outlier with only 37 new drug approvals overall and only 59% being for NDA approvals.

Big Pharma versus mid-sized and small companies

In looking at new drug approvals of NDAs by company type, small-to-mid-sized companies have dominated NDA approvals thus far in 2025. In defining the large pharma companies as the top 20 companies based on 2024 revenues for prescription drugs for human health, large companies have accounted for nine NDA approvals, or 32% of NDAs approved thus far in 2025 compared to 19 NDAs, or 68% of NDAs approved by small to mid-sized pharma companies (see Figure 3).

Boehringer Ingelheim (BI), Novartis, and Sanofi each had two NDA approvals, and Bayer, Eli Lilly and Company, and GSK, each had one NDA approval. BI received approval for Hernexeos (zongertinib) for treating certain forms of unresectable or metastatic non-squamous non-small cell lung cancer and for Jascayd (nerandomilast) for treating idiopathic pulmonary fibrosis. Novartis received approval for Vanrafia (atrasentan) for reducing proteinuria (protein in the urine) in adults with primary immunoglobulin A nephropathy and for Rhapsido (remibrutinib) for treating chronic spontaneous urticaria (i.e., hives) in adults who remain symptomatic despite H1 antihistamine treatment.

Sanofi and Alnylam Pharmaceuticals received approval for Qfitlia (fitusiran), a RNAi therapeutic for treating hemophilia A and B, with or without inhibitors. It was developed as part of an RNAi therapeutics rare-disease alliance between Sanofi and Alnylam Pharmaceuticals. The small interfering RNA (siRNA) therapy works by inhibiting SerpinPC1 mRNA, reducing antithrombin levels, promoting thrombin generation, and helping to rebalance hemostasis to prevent bleeds and uses Alnylam’s ESC-GalNAc conjugate technology. Sanofi also received approval for Wayrilz (rilzabrutinib) for treating certain forms of persistent or chronic immune thrombocytopenia (low blood platelet counts).

Eli Lilly and Company, GSK, and Bayer each had one NDA approval. Lilly received approval for Inluriyo (imlunestrant) for treating certain forms of advanced or metastatic breast cancer. GSK received approval for Blujepa (gepotidacin), an oral antibiotic for treating uncomplicated urinary tract infections. Bayer received approval for Lynkuet (elinzanetant) for treating moderate-to-severe vasomotor symptoms due to menopause.

Among mid-sized companies, just outside the top 20 pharma companies based on 2024 revenues, Merck KGaA received approval for Gomella (mirdametinib) for treating adult and pediatric patients 2 years of age and older with neurofibromatosis Type 1, a genetic condition that causes changes in skin pigment and tumors on nerve tissue. Merck KGaA gained Gomella through its $3.4-billion acquisition, of SpringWorks Therapeutics, a Stamford, Connecticut-based commercial-stage bio/pharmaceutical company focused on certain rare diseases.

The other small-to-mid-sized companies with NDA approvals thus far in 2025 (as of November 13, 2025) were Alcon, Crinetics Pharmaceuticals, Dizal (Jiangsu) Pharmaceutical, Insmed, Ionis Pharmaceuticals, Jazz Pharmaceuticals, Kalvista Therapeutics, Kyowa Kirin/Kura Oncology, Lenz Therapeutics, Leo Pharma, Nuvation Bio, Medexus, Ono Pharmaceutical, PTC Therapeutics, Stealth Biotherapeutics, UCB, Verastem, and Vertex Pharmaceuticals.

The NDA approvals from these companies included: Alcon’s Tryptyr (acoltremon ophthalmic solution) for treating dry-eye disease; Crinetics Pharmaceuticals’ Palsonify (paltusotine) for treating in adults acromegaly (a condition characterized by overgrowth of bone and soft tissues); Dizal (Jiangsu) Pharmaceutical’s Zegfrovy (sunvozertinib) for treating certain forms of locally advanced or metastatic non-small cell lung cancer; Insmed’s Brinsupri (brensocatib) for treating non-cystic fibrosis bronchiectasis, a chronic lung condition; Ionis Pharmaceuticals’ Dawnzera (donidalorsen) for treating hereditary angioedema; and Jazz Pharmaceuticals’ Modeyso (dordaviprone) for treating diffuse midline glioma (a certain type of brain tumor).

Other NDA approvals from small to mid-sized companies thus far in 2025 included: Kalvista Therapeutics’ Ekterly (sebetralstat) for treating hereditary angioedema; Kyowa Kirin’s/ Kura Oncology’s Komzifti (ziftomenib) for treating relapsed or refractory acute myeloid leukemia with a susceptible nucleophosmin 1 mutation; Lenz Therapeutics’ Vizz (aceclidine ophthalmic solution) for treating presbyopia (gradual loss of the eyes’ ability to focus on nearby objects); Leo Pharma’s Anzupgo (delgocitinib) for treating moderate-to-severe chronic hand eczema; Nuvation Bio’s Ibtrozi (taletrectinib) for treating locally advanced or metastatic ROS1-positive non-small cell lung cancer; Medexus’ Grafapex (treosulfan), a reparative regimen for allogeneic hematopoietic stem cell transplantation for acute myeloid leukemia and myelodysplastic syndrome; Ono Pharmaceutical’s Romvimza (vimseltinib) for treating symptomatic tenosynovial giant cell tumor (a rare non-malignant tumor that forms within or near joints); PTC Therapeutics’ Sephience (sepiapterin) for treating hyperphenylalaninemia (a metabolic disorder characterized by elevated levels of phenylalanine in the blood); Stealth Biotherapeutics’ Forzinity (elamipretide) for treating Barth syndrome, a rare genetic disorder causing cardiovascular issues, muscle weakness, and an increased risk of infection; UCB’s Kygevvi (doxecitine and doxribtimine) for treating tymidine kinase 2 deficiency in patients who start to show symptoms when they are 12 years old or younger; Verastem’s Avmapki Fakzynja Co-Pack (avutometinib and defactinib) for treating KRAS-mutated recurrent low-grade serous ovarian cancer; and Vertex Pharmaceuticals’ Journavx (suzetrigine) for treating moderate-to-severe acute pain.

Table I: New Drug Approvals* by the Center for Drug Evaluation and Research, US Food and Drug Administration’s Center for Drug Evaluation and Research (as of November 13, 2025)

| Company | Brand name (active pharmacerutical ingredient) | Application Type | Indication |

| AbbVie | Emrelis (telisotuzumab vedotin-tllv) | BLA | Locally advanced or metastatic, non-squamous non-small cell lung cancer with high c-Met protein overexpression after prior systemic therapy |

| Alcon | Tryptyr (acoltremon ophthalmic solution) | NDA | Dry eye disease |

| Akeso | penpulimab-kcqx | BLA | Recurrent or metastatic non-keratinizing nasopharyngeal carcinoma |

| AstraZeneca/Daiichi Sankyo | Datroway (datopotamab deruxtecan-dlnk) | BLA | Unresectable or metastatic, HR-positive, HER2-negative breast cancer |

| Bayer | Lynkuet (elinzanetant) | NDA | Moderate-to-severe vasomotor symptoms due to menopause |

| Boehringer Ingelheim | Hernexeos (zongertinib) | NDA | Certain forms of unresectable or metastatic non-squamous non-small cell lung cancer |

| Boehringer Ingelheim | Jascayd (nerandomilast) | NDA | Idiopathic pulmonary fibrosis |

| Crinetics Pharmaceuticals | Palsonify (paltusotine) | NDA | Acromegaly in adults who had an inadequate response to surgery and/or for whom surgery is not an option |

| CSL | Andembry (garadacimab-gxii) | BLA | Hereditary angioedema |

| Dizal (Jiangsu) Pharmaceutical | Zegfrovy (sunvozertinib) | NDA | Certain forms of locally advanced or metastatic non-small cell lung cancer |

| Eli Lilly and Company | Inluriyo (imlunestrant) | NDA | Certain form of advanced or metastatic breast cancer |

| GSK | Blujepa (gepotidacin) | NDA | Uncomplicated urinary tract infections |

| Insmed | Brinsupri (brensocatib) | NDA | Non-cystic fibrosis bronchiectasis |

| Ionis Pharmaceuticals | Dawnzera donidalorsen) | NDA | Hereditary angioedema |

| Jazz Pharmaceuticals | Modeyso (dordaviprone) | NDA | Diffuse midline glioma (a certain form of a brian tumor) |

| Johnson & Johnson | Imaavy (nipocalimab-aahu) | BLA | Generalized myasthenia gravis |

| Kalvista Therapeutics | Ekterly (sebetralstat) | NDA | Hereditary angioedema |

| Kyowa Kirin/ Kura Oncology, | Komzifti (ziftomenib) | NDA | Relapsed or refractory acute myeloid leukemia with a susceptible nucleophosmin 1 mutation |

| Lenz Therapeutics | Vizz (aceclidine ophthalmic solution) | NDA | Presbyopia |

| Leo Pharma | Anzupgo (delgocitinib) | NDA | Moderate-to-severe chronic hand eczema |

| Nuvation Bio | Ibtrozi (taletrectinib) | NDA | Locally advanced or metastatic ROS1-positive non-small cell lung cancer |

| Medexus | Grafapex (treosulfan) | NDA | Preparative regimen for allogeneic hematopoietic stem cell transplantation for acute myeloid leukemia and myelodysplastic syndrome |

| Merck & Co. Inc. | Enflonsia (clesrovimab-cfor) | BLA | Respiratory syncytial virus lower respiratory tract disease in neonates and infants |

| Merck & Co. Inc. | Keytruda Qlex (pembrolizumab and berahyaluronidase alfa-pmph) | BLA | Solid tumor indications approved for the IV formulation of pembrolizumab |

| Merck KGaA* | Gomekli (mirdametinib) | NDA | Neurofibromatosis Type 1 |

| Novartis | Vanrafia (atrasentan) | NDA | Protein in the urine (proteinuria) in adults with primary immunoglobulin A nephropathy |

| Novartis | Rhapsido (remibrutinib) | NDA | Chronic spontaneous urticaria (i.e., hives) in adults who remain symptomatic despite H1 antihistamine treatment |

| Ono Pharmaceutical | Romvimza (vimseltinib) | NDA | Symptomatic tenosynovial giant cell tumor |

| PTC Therapeutics | Sephience (sepiapterin) | NDA | Hyperphenylalaninemia |

| Regeneron Pharmaceuticals | Lynozyfic (linvoseltamab-gcpt) | BLA | Relapsed or refractory multiple myeloma |

| Sanofi | Qfitlia (fitusiran) | NDA | Prevent or reduce the frequency of bleeding episodes in hemophilia A or B |

| Sanofi | Wayrilz (rilzabrutinib) | NDA | Certain forms of persistent or chronic immune thrombocytopenia |

| Stealth Biotherapeutics | Forzinity (elamipretide) | NDA | Barth syndrome |

| UCB | Kygevvi (doxecitine and doxribtimine) | NDA | Tymidine kinase 2 deficiency |

| Verastem | Avmapki Fakzynja Co-Pack (avutometinib and defactinib) | NDA | KRAS-mutated recurrent low-grade serous ovarian cancer after prior systemic therapy |

| Vertex Pharmaceuticals | Journavx (suzetrigine) | NDA | Moderate-to-severe acute pain |

Merck KGaA acquired SpringWorks Therapeutic in July 2025 and with the acquisition, Gomekli (mirdametinib).

Source: Center for Drug Evaluation and Research, US Food and Drug Administration