Small-Molecule Drugs: Top 10 Market, Sourcing, and Supply-Chain Trends

What are key trends and issues that are on the industry’s radar impacting sourcing for small-molecule drugs? DCAT Value Chain Insights examines market share, growth rates, product innovation, and API supply chains.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

Market share and growth rates of small-molecule drugs

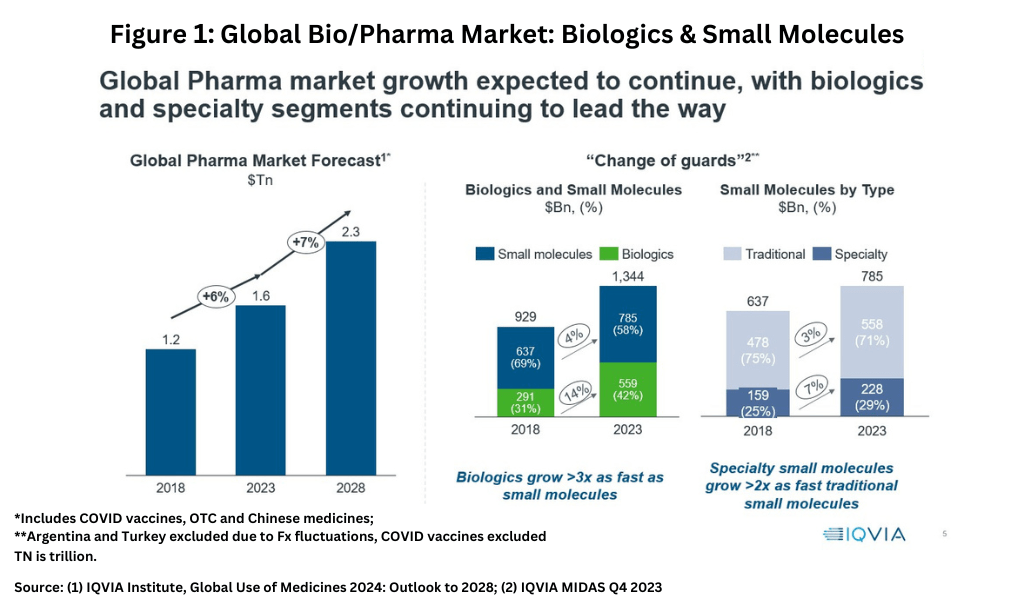

In looking at market share and growth rates on a modality basis, small-molecules drugs versus biologics, there is a mixed story for small-molecule drugs. Although small-molecules still account for the largest market share in 2023 globally, biologics are growing more than three times faster, according to information from IQVIA (1). In 2023, small-molecules drugs accounted for $785 billion (58% of the market) and biologics $559 billion (42% of the market) compared to a 69% share for small-molecules and a 31% market share for biologics in 2018 (see Figure 1).

Within small molecules, specialty small-molecule drugs are growing more than twice as fast as those of traditional small-molecule drugs (see Figure 1). However, traditional small-molecule drugs still dominate the small-molecule sector, accounting for 71% of small-molecule drugs in 2023 (see Figure 1). Specialty medicines, as defined by the IQVIA, are those medicines that treat specific, complex diseases with four or more of the following attributes: initiated only by a specialist; administered by a practitioner; requires special handling; unique distribution; high cost; warrants intensive patient care; or requires reimbursement assistance.

Small-molecule new drug approvals

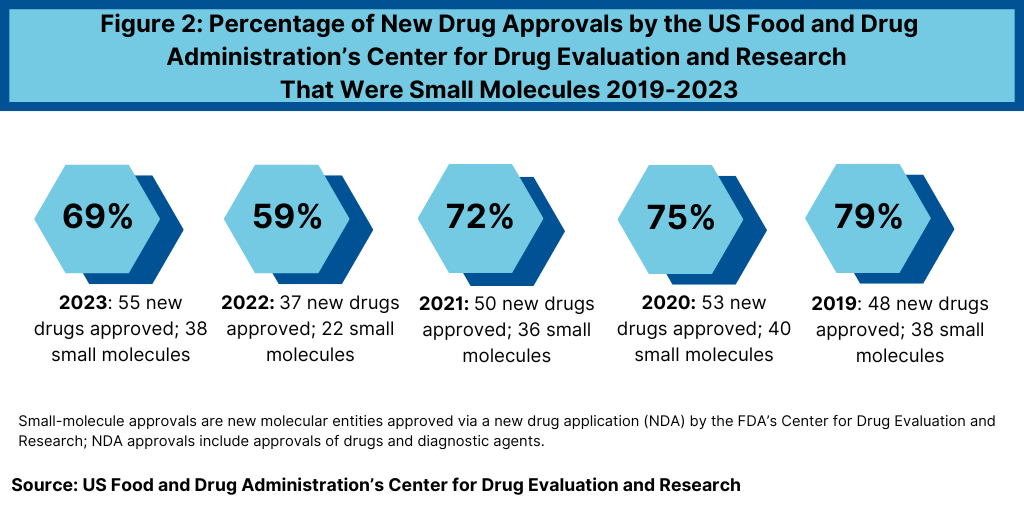

In 2023, the US Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved 38 small-molecule products, representing 69% of new drug approvals (see Figure 2). The percentage of small-molecule approvals in 2023 was in line with recent year, except in 2022, which represented a recent low. In 2022, 59% of the new drug approvals by FDA’s CDER were small molecules or 22 of the 37 new drug approvals, Between 2018 and 2021, small molecules averaged 74% of new drug approvals. In 2021, small molecules represented 72% of new drug approvals, 75% in 2020, and 79% in 2019.

The 69% of new drug approvals being small molecules in 2023 was an improvement over 2022 levels, which represented a recent low in small-molecule drug approvals. The decrease in small molecules’ share of new drug approvals in 2022 was largely due to the overall decline in new drug approvals in 2022 and a corresponding decline in small-molecule drug approvals and a rise in new biologic drug approvals. In 2022, FDA’s CDER approved 22 new small-molecule drugs and 15 new biologics. The 17 new biologics approvals in 2023 surpassed 2022 levels and matched a recent high in 2018, when 17 new biologics were also approved by FDA’s CDER. The 17 new biologic drug approvals in 2023 far exceeded approvals of new therapeutic biologics by FDA’s CDER of 14 in 2021, 13 in 2020, and 10 in 2019.

Product innovation: small-molecules and first-in-class drugs

Aside from just the overall number of new drug approvals, product innovation can also be evaluated by the number of new drug approvals classified as “first-in-class,” which FDA’s CDER characterizes as drugs with a different mechanism of action than existing drugs. In 2023, FDA’s CDER approved 20 new drugs that it characterized as first-in-class, which represented approximately 36% of new drug approvals.

Of these 20 first-in-class new drug approvals, 17 were small molecules, representing 85% of first-in-class new drug approvals in 2023 by FDA’s CDER. Of these 17 first-in-class, small-molecule new drug approvals in 2023, eight were from large to mid-sized bio/pharma companies. These eight drugs were: Astellas’ Veozah (fezolinetant) for reducing moderate-to-severe vasomotor symptoms due to menopause; AstraZeneca’s Truqap (capivasertib) for treating advanced HR-positive breast cancer; Bausch and Lomb’s Miebo (perfluorohexyloctane ophthalmic solution) for treating dry-eye disease; Biogen’s Qalsody (tofersen) for treating amyotrophic lateral sclerosis (ALS, i.e., Lou Gehrig’s disease); GlaxoSmithKline’s Jesduvroq (daprodustat) for treating anemia due to chronic kidney disease; Novartis’ Fabhalta (iptacopan) for treating paroxysmal nocturnal hemoglobinuria, a rare blood disorder; Novo Nordisk’s Rivfloza (nedosiran) for treating primary hyperoxaluria, a rare condition characterized by recurrent kidney and bladder stones; and Pfizer’s Paxlovid (nirmatrelvir tablets; ritonavir tablets, co-packaged) for treating COVID-19.

Although small-molecule drugs were well represented with 85% of the first-in-class new drug approvals in 2023, more than half of these drugs were for niche indications. Of the 17 small-molecule first-in-class drug approvals in 2023, nine, or 53%, were for treating orphan/rare diseases, defined as a disease affecting 200,000 individuals or less in the US.

Small-molecule generic drugs

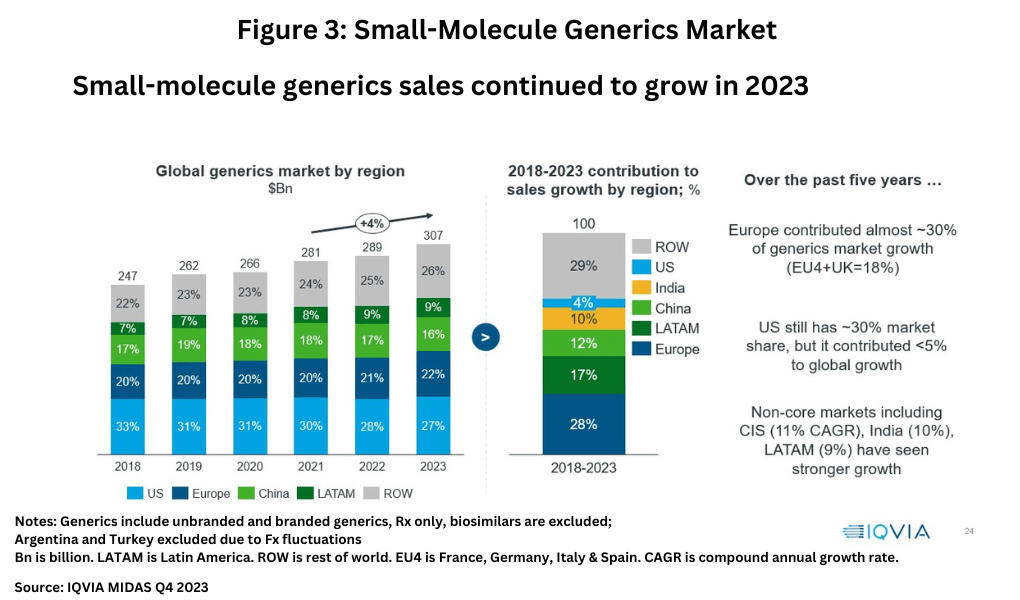

In turning to the generics market, the market for small-molecule generic drugs continues to grow with global sales reaching $307 billion in 2023, growing at a compound annual growth rate (CAGR) of 4% between 2021-2023 (see Figure 3), according to information from IQVIA (1). On a regional basis, the US accounts for the largest market share with 27% of the market, followed by Europe at 22%, and China at 18%. Over the past five years (2018-2023), Europe as a whole contributed almost 30% of generics market growth, which includes 18% combined growth in the EU4 (France, Germany, Italy, and Spain) and the UK, while the US has contributed less than 5% to global growth. Non-core markets have experienced stronger growth than the US, including the Commonwealth of Independent States (CIS) with a CAGR of 11%, India with a CAGR of 10%, and Latin America with a CAGR of 9% (see Figure 3).

Small-molecule API supply lines

A key issue potentially impacting fine chemical producers and CDMOs in the Europe Union (EU) relates to policy moves to increase manufacturing in the EU and reduce dependence on other countries for active pharmaceutical ingredients (APIs) and related inputs for critical medicines. Earlier this year (April 2024), the European Commission launched the Critical Medicines Alliance. First announced by the European Commission in October 2023, the Alliance will focus on industrial policy and complements the reform of the EU’s pharmaceutical legislation as proposed by the European Commission. Set up as a consultative mechanism to policy-makers, the Alliance seeks to work to enhance security of supply, strengthen availability of medicines, and reduce EU supply-chain dependencies. The recommendations made by the Alliance will serve as a basis for a multi-year strategic plan containing milestones and corresponding deadlines for their implementation.

Key factors being analyzed include an over-dependency on a limited number of external suppliers, limited diversification possibilities, and limited production capacities. This will build on the European Commission’s vulnerability analysis of supply-chain bottlenecks of critical medicines on the Union list of critical medicines. The Union list of critical medicines, which was published by the European Medicines Agency last December (December 2023), refers to a list of critical medicines for the EU/European Economic Area, which contains more than 200 active substances of medicines considered critical for healthcare systems across the EU/European Economic Area, for which continuity of supply is a priority and for which shortages should be avoided. The list contains active substances of innovator and generic drugs covering a wide range of therapeutic areas and includes vaccines and medicines for rare diseases. It reflects the outcome of a review of 600 active substances taken from six national lists of critical medicines. The goal is update that list on an annual basis.

The European Commission carried out an analysis of supply-chain vulnerabilities for a first tranche of 11 critical medicines on the Union list, published in April 2024. The outcome of this work will inform the scope of the mandate of the Critical Medicines Alliance. In addition, the European Commission will proceed with evaluating the remaining medicines in the Union list. It will then recommend priority actions for the near future and propose new tools to address the challenges it has identified. In particular, the recommendations will focus on mitigating structural risks, reinforcing supply by making demand more predictable, encouraging diversification, and boosting manufacturing in the EU.

Those efforts will also be part of discussions in the Alliance, which will help the European Commission to identify what it terms as “pipeline investment projects,” which could benefit from EU and national funding to strengthen manufacturing in the EU. The Alliance will also look at how market incentives, such as capacity reservation contracts and joint procurement, can be used to enhance security of supply of critical medicines. In addition, the Alliance is taking a holistic view of the supply chain, and its members will seek to identify new synergies to work with each other more effectively, including creating new partnerships. Given the global nature of the supply chain, these new partnerships could bring the diversification of the supply chain of critical medicines.

The European Chemical Industry Council (Cefic), which represents EU chemical manufacturers, is a member of the Critical Medicines Alliances, and through its sector group, the European Fine Chemicals Group (EFCG), supports potential policy moves to advance fine chemical manufacturing in the EU.

Cefic’s EFCG issued a set of recommendations last November (November 2023), which included fostering supportive legislative policies for EU API manufacturers that emphasized sustainable growth and reshoring initiatives while investing in innovation and shifting procurement focus on supply security and social-environmental standards. In making those recommendations, EFCG pointed to the continued decline of European-based API production with respect to the supply of critical medicines. From a global production share of 53% in 2000, the EU’s share of API production in 2020 fell to 25% due to increased competition from lower-cost countries and EU pricing and procurement policies not favorable to EU-based domestic manufacturing, according to information from EFCG.

Reference

1. P. Van Arnum, “Global Pharma Industry Outlook: The Ups and Downs & Projections Near Term,” DCAT Value Chain Insights, May 30, 2024.