Taking the Pulse: The EU’s Action Plan for Revitalizing the Chemicals Industry

With all eyes on the tariff situation between the EU-US, what about the EU chemicals industry as a whole? The European Commission has released an action plan to revitalize the industry.

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

An action plan for the EU chemical industry

Earlier this month (July 2025), the European Commission presented an Action Plan for the Chemicals Industry to strengthen the competitiveness and modernization of the EU chemicals sector. The Action Plan addresses key challenges, namely high energy costs, global competition, and weak demand, while promoting investment in innovation and sustainability. The Action Plan is accompanied by a simplification omnibus to further streamline and simplify key EU chemicals legislation, alongside a proposal to strengthen the governance and financial sustainability of the European Chemicals Agency (ECHA), a regulatory agency of the EU, which helps companies comply with specific EU legislation on chemicals and is overall responsible for ensuring the safe use of chemicals.

Establishing the Critical Chemical Alliance

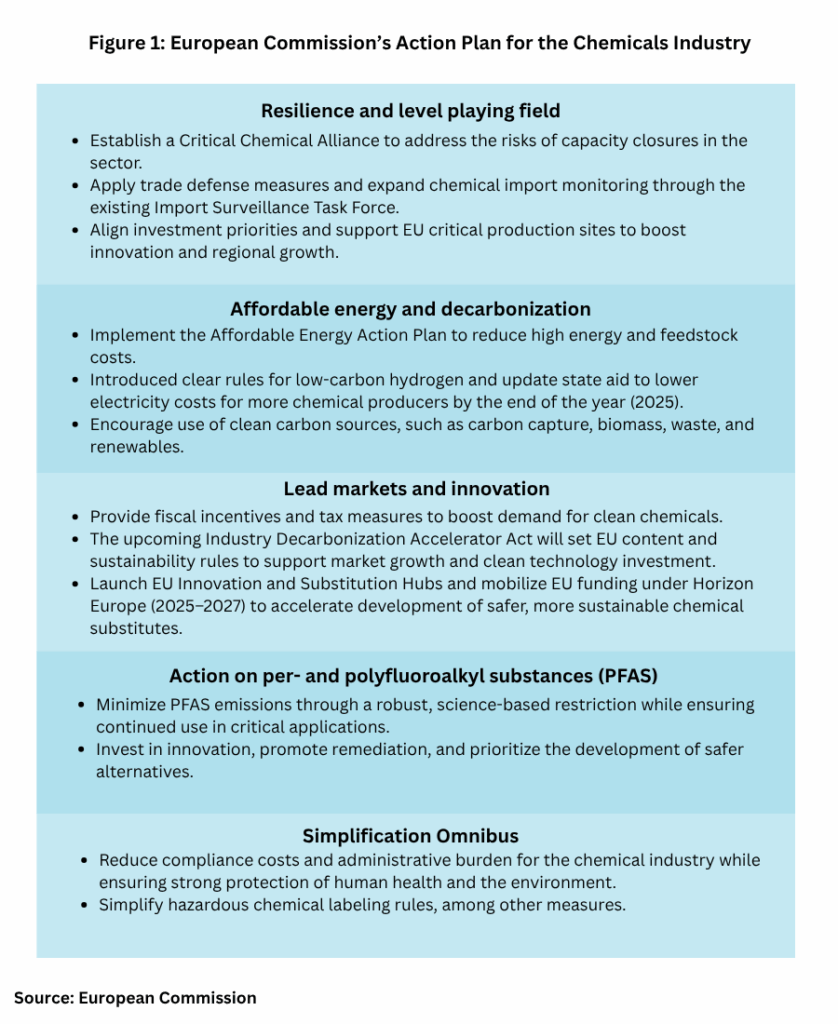

The Action Plan proposes a series of measures (see Figure 1) to address the challenges facing the EU chemicals industry. Chief among them is the establishment of the Critical Chemical Alliance to address the risks of capacity closures in the EU chemicals sector. The Alliance, to be established by the European Commission with EU member states and other stakeholders, would identify critical production sites needing policy support and tackle trade issues, such as supply chain dependencies and distortions.

The European Commission will also apply trade defense measures to ensure fair competition while expanding chemical import monitoring through the Import Surveillance Task Force, which was created in April (April 2025). The purpose of the Import Surveillance Task Force is to inform decisions and actions to protect the EU internal market and address harmful imports into the EU. Part of that effort draws on the results of an automated dashboard, based on data from the customs surveillance system, which monitors import trends closely.

The Critical Chemical Alliance will also align investment priorities, coordinate EU and national projects, including Important Projects of Common European Interest, which are large-scale, collaborative projects that aim to foster innovation, technological development, and economic growth across the EU. The Alliance will also support EU critical production sites to boost innovation and regional growth.

Affordable energy and decarbonization

Another key plank of the plan to boost the competitiveness of the EU chemicals industry is to implement the Affordable Energy Action Plan, which was announced in February (February 2025), to help reduce high energy and feedstock costs. The plan includes clear rules for low-carbon hydrogen and updating state aid to lower electricity costs for more chemical producers by the end of the year (2025). The plan also encourages using clean carbon sources, such as carbon capture, biomass, and waste, alongside support for renewables. A public consultation on improving chemical recycling was also launched earlier this month (July 2025).

Boosting innovation in clean chemicals

The European Commission’s Action Plan for the Chemicals Industry highlights fiscal incentives and tax measures to boost demand for clean chemicals. The Industry Decarbonization Accelerator Act, which is a proposed EU initiative designed to accelerate the decarbonization of energy-intensive industries while maintaining their global competitiveness, will set EU content and sustainability rules to support market growth and clean technology investment. Other measures under the proposed Bioeconomy Strategy and Circular Economy Act will boost the EU’s resource efficiency, chemicals recycling, and strengthen the market for bio-based and recycled alternatives to fossil-based inputs. The European Commission will also launch EU Innovation and Substitution Hubs and mobilize EU funding under Horizon Europe (2025–2027), EU’s key funding program for research and innovation, to accelerate the development of safer, more sustainable chemical substitutes.

Taking action on per- and polyfluoroalkyl substances (PFAS)

The European Commission’s Action Plan for the Chemicals Industry also reaffirms the Commission’s commitment to minimize emissions of per- and polyfluoroalkyl substances (PFAS), a large, complex group of synthetic chemicals that have been long used in consumer products, through a science-based restriction, while ensuring continued use in critical applications under strict conditions where no alternatives are available, will be proposed after ECHA’s opinion.

Simplification omnibus

As part of its ongoing efforts to boost the EU’s competitiveness, the European Commission adopted a sixth simplification omnibus to reduce compliance costs and administrative burden for the chemical industry while ensuring strong protection of human health and the environment. This includes simplifying hazardous chemical labelling rules, clarifying EU cosmetics regulations, and easing registration for EU fertilizing products by aligning information requirements with standard REACH rules for chemicals. These measures are expected to save at least EUR 363 million ($426 million) annually for the industry.

In addition, the proposal for the ECHA Basic Regulation equips ECHA with the resources, flexibility, and structural adaptations required to fulfil the duties under its growing mandate, which now includes responsibilities under multiple EU regulations, namely spanning classification and labeling, biocidal products, import and export of hazardous chemicals, waste management and water.