The Biotech Landscape in 2025 and Beyond: Is a Rebound in the Making or Not?

As we move forward in the fourth quarter of 2025, the biotech industry stands at a crossroads, grappling with both unprecedented challenges and remarkable opportunities. The interplay between innovation, policy changes, and pricing challenges will shape the future of biotech, influencing how companies navigate funding, research, and product development.

By Arda Ural, PhD, EY Americas Life Sciences Leader, Ernst & Young LLP (EY)

The current state of biotech: a reflection on 2025

The biotech landscape in 2025 has been characterized by a complex web of macroeconomic factors, declining public market valuations, legislative changes, and disruptive market conditions. The industry has witnessed a conservative shift in venture capital funding, questions around valuations, and an almost complete drying up of initial public offerings (IPOs), raising questions about the “invest-ability” of the sector. With large pharmaceutical companies facing a growth gap, the question arises: Will they leverage their financial strength to engage in mergers and acquisitions (M&A) to bridge this gap?

Weakening fundamentals and the growth gap

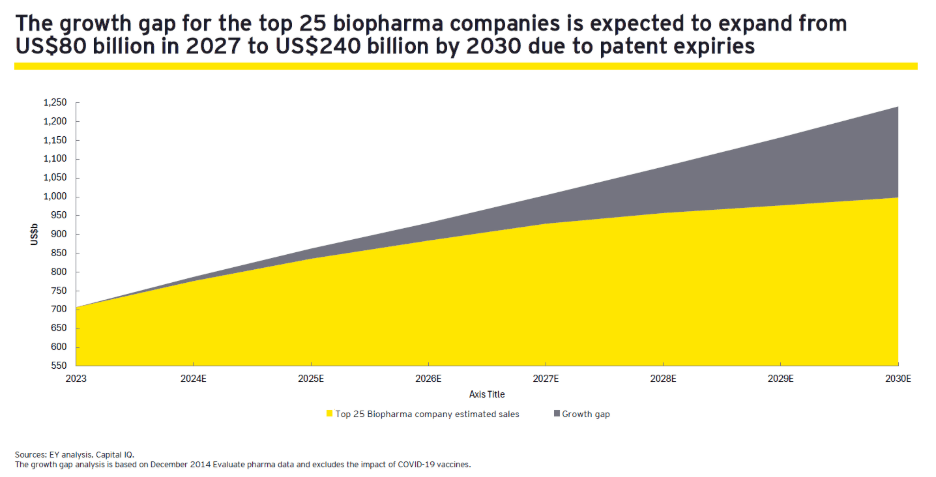

The biopharma industry has experienced a tumultuous period marked by macroeconomic challenges and legislative hurdles. According to EY research (1), the loss of exclusivity for biologics, which began in earnest in 2023, has put an estimated US$300 billion in revenue at risk between 2023 through 2028. This patent cliff threatens to erode the top line of major players in the industry, particularly as the current pipeline is heavily skewed toward earlier phases of development (see Figure 1 below).

Figure 1: The Growth Gap, Top 25 Biopharma Companies

The Inflation Reduction Act (IRA), enacted in August 2022, introduced drug-pricing negotiations that further complicate the commercial prospects for pharmaceutical companies. In parallel, companies face pricing uncertainty with the current Administration exploring most favored nation (MFN) drug pricing, which would peg US drug prices to those of other developed countries. Commercial drug launches are already under increased strain as more products fail to attain their consensus peak sales projections, requiring pharmaceutical companies to find novel ways to get the compelling message about improved outcomes to patients and physicians.

Pricing pressures coupled with geopolitical uncertainties, such as the ramifications of tariff policy, create a perfect storm of challenges for the industry.

A shift in biotech financing

The biotech funding environment has faced significant challenges since the artificial boost that we call a “sugar high” during the pandemic, primarily due to macroeconomic pressures that have created a cautious atmosphere among investors. Early-stage biotech companies, particularly those that are pre-revenue, have relied heavily on non-dilutive funding sources, such as the National Institutes of Health (NIH), the Defense Advanced Research Projects Agency (DARPA), and angel investors, to support their development until they can attract venture capital investment. However, with NIH, historically the largest source of venture capital globally with more than US$40 billion at its disposal but the proposed FY 2026 President’s Budget requests (2) reducing that to $27.9 billion, the flow of capital into these early-stage ventures is taking its effect. This situation has led to a more challenging fundraising landscape, where companies must navigate a complex evaluation process to justify their valuations to potential investors.

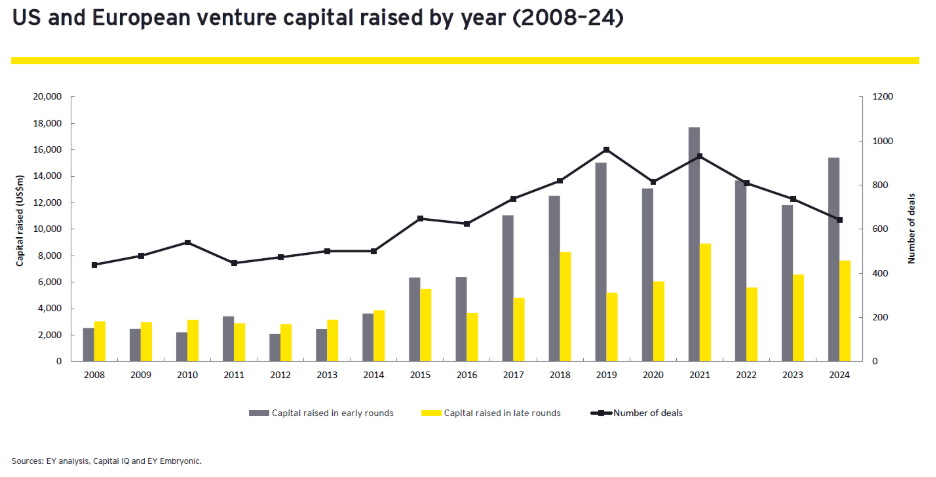

Despite these challenges, there is a glimmer of hope in the venture capital sector, which has shown signs of recovery. In 2024, according to EY research, biotech funding through venture capital surpassed pre-pandemic levels, with early venture rounds reaching US$15.5 billion and late-stage rounds bringing in US$7.6 billion (see Figure 2). This funding activity indicates a rebound from the lows experienced in previous years, with amounts exceeding those raised in 2019. However, the nature of this funding has shifted, with fewer companies receiving larger amounts of capital. In 2024, the average size of funding rounds increased significantly, reflecting a trend where investors are opting for larger bets on fewer companies, seeking certainty in strong scientific foundations and experienced management teams.

Figure 2: US and European Venture Capital Funding Trends

Per EY research, the IPO market in 2024 saw a modest increase, with 30 companies raising approximately US$4 billion, a notable rise from the US$2.9 billion raised by 18 companies in 2023. However, this uptick is overshadowed by the stark reality that IPO activity remains significantly below the 10-year average of 54 annual offerings from 2010 to 2020. Initially, there was optimism that the anticipated wave of IPOs would follow the Federal Reserve’s interest rate cuts in September 2024, but this surge never materialized. Even after the US Presidential election in November 2024, the expected influx of IPOs failed to occur, leading to a growing backlog of companies waiting to go public. Many firms are now opting for late-stage financing instead of risking the volatility of the public market, further indicating a closing IPO window amid ongoing uncertainty.

The performance of the IPOs that did occur in 2024 was disheartening, with only eight of the 30 companies finishing the year above their initial offering prices while others saw their values plummeting by more than 80%, according to EY research. This trend aligns with the previous two years, where more than half of publicly traded biotech firms ended 2024 with less than two years of cash runway. While a select few companies have managed to secure ample funding, the majority are forced to conserve cash and explore alternative financing avenues. Many are seeking partnerships with larger pharmaceutical companies or turning to royalty transactions, which have emerged as a viable source of capital. These royalty deals, estimated to generate around US$14 billion annually, provide a non-dilutive funding option that is less susceptible to the fluctuations of the broader capital markets, highlighting the challenges and shifting strategies within the biotech sector as the IPO window continues to close.

The current funding landscape illustrates a dichotomy where traditional funding sources are tightening, yet venture capital is adapting to the new normal by concentrating on larger investments in fewer firms. This shift is indicative of the broader economic uncertainty, prompting investors to be more selective and strategic in their funding choices. As biotech companies continue to grapple with existential questions regarding asset valuation and the long-term implications of regulatory changes, the reliance on robust scientific rationale and proven leadership will be critical in attracting the necessary capital to advance their innovations.

Building an ecosystem of partnerships

Partnerships and alliances are emerging as a vital strategy for driving innovation in the life sciences sector. Instead of relying solely on traditional M&A, companies are increasingly collaborating to share resources, reduce costs, and enhance efficiency. This collaborative approach enables a more agile response to market demands while mitigating the risks associated with product development. As the industry undergoes a renaissance of innovation, particularly in areas such as cell and gene therapies, personalized medicine, and data analytics, companies that strategically invest in these technologies are positioning themselves for long-term growth and sustainability. We should also feel very optimistic about the advances artificial intelligence (AI) will bring about in the industry’s capacity to accelerate discovery as well as development processes.

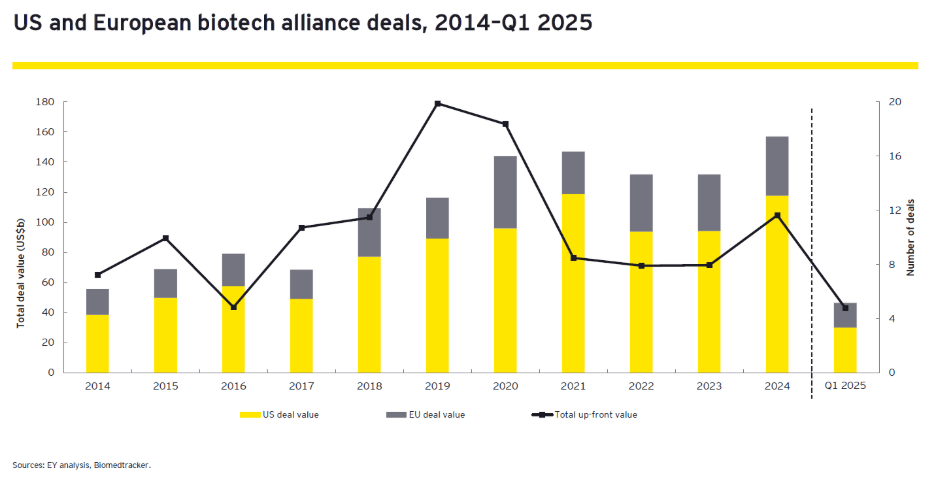

Recent trends indicate a shift toward “bolt-on” acquisitions, where large pharmaceutical companies enhance their pipelines with targeted assets rather than pursuing transformative megadeals. This strategy not only allows for incremental growth but also fosters collaboration among industry players, creating a more robust innovation ecosystem. However, the current market conditions, characterized by high volatility as indicated by the Chicago Board Options Exchange’s Volatility Index (the VIX), have made companies hesitant to engage in large-scale M&A activities. With the VIX fluctuating significantly, firms are increasingly cautious about valuations and the potential liabilities associated with overpaying for assets, leading to a buyer’s market where only the most complementary assets are pursued. Figure 3 below outlines US and European biotech alliance deals over the last decade.

Figure 3: US and European Biotech Alliance Deals, Funding Trends

In 2024, alliances became the preferred deal-making strategy, with pharmaceutical companies executing 220 alliances potentially worth US$144 billion in biobucks (biobucks refers to the potential, not-yet-realized future value of a bio/pharmaceutical deal, consisting of milestone payments and royalties), the highest value seen in the last decade, according to EY research. This surge in alliance activity reflects a growing recognition of de-risking the deals but also underscores the value of collaboration as these partnerships allow large pharma firms to access innovative technologies while assuming less risk. However, the structure of these deals often places significant pressure on smaller biotech firms as up-front payments account for only a small percentage of total deal value and cash infusion to get them to their next value-inflection point with not much flexibility. Consequently, the success of these alliances heavily depends on achieving clinical or regulatory milestones, which can jeopardize funding for smaller companies in the event of a clinical misstep.

The current landscape presents a tale of two cities for biotech firms. While larger companies are actively seeking partnerships to bolster their portfolios, per EY research, a significant portion of smaller biotechs face financial instability, with 39% reported to have less than one year of cash to sustain operations. This number continued to creep up from 31% over the last four years. This precarious situation has led to an increase in reverse mergers, bankruptcies, and portfolio rationalization as companies strive to preserve cash. As the industry navigates these challenges, forming strategic alliances will be crucial for smaller biotechs to access the funding and expertise needed to thrive in a competitive environment, ultimately balancing risk and return while enhancing the value of their innovations.

The regulatory landscape: navigating the challenges ahead

The regulatory and policy landscape for the life sciences is currently at a pivotal inflection point, with several key factor that could further shape 2025 and beyond. One of the primary concerns has been the impact of tariffs on the pharmaceutical industry, which has historically faced significant challenges during periods of heightened tariffs. The localized manufacturing strategy adopted by some large pharmaceutical companies, aimed at reducing risks and optimizing access to local talent, may serve as a model for navigating a more de-globalized world. As the industry adapts to these evolving regulatory and policy landscapes, executives must take proactive steps so that their businesses remain on a growth trajectory amid ongoing changes.

Another critical factor influencing the landscape is the Federal Reserve’s monetary policy, which started easing rates at its September 17, 2025, meeting and indicated two more cuts in the near to mid-term. Lowering the cost of capital would have positive downstream implications for capital costs, IPOs, M&A, and overall valuations in the life-sciences sector. A reduction in rates will provide much-needed relief to companies grappling with high operating costs and enable them to pursue growth opportunities more aggressively. However, the Federal Reserve’s dual mandate of maintaining stable prices and maximum employment is facing challenges due to the potential expected inflationary consequences of any new tariffs levied.

Another factor impacting the future of the sector is the renewal of the Tax Cuts and Jobs Act (TCJA), originally enacted in 2017 and extended on July 4, 2025, as part of recently enacted reconciliation legislation. As a result, corporate tax rates will remain stable at 21%, likely boosting the overall investment climate as well as the life sciences sector.

In addition, with potential cuts to the Food and Drug Administration of about 20% of its workforce, companies will need to closely monitor if the Prescription Drug User Fee Act (PDUFA) commitments are executed in a timely manner.

A landscape of opportunity

The biotech landscape in 2025 and beyond is poised for transformation. While challenges abound, the potential for innovation and growth remains strong. By leveraging financial resources, fostering partnerships and embracing technological advancements, biotech companies can navigate the complexities of the industry and emerge as leaders in the quest for groundbreaking therapies.

As we move forward, the collaboration between small biotechs and large pharmaceutical companies will be essential in bridging the innovation gap and confirming that the next generation of therapies reaches patients in need. The future of biotech is bright, and those that adapt to the changing landscape will be well positioned to thrive in the years to come.

The interplay of external factors, including tariffs and macroeconomic conditions, will continue to shape the industry’s trajectory, making it imperative for companies to remain agile and responsive to change.

References

- EY research referenced in the article refers to the EY Biotech Beyond Borders Report 2025.

- National Institutes of Health Budget, accessed via NIH website, July 2025.

The views reflected in this article are the views of the author and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.