The Pharma Pulse: Precision Medicine and Manufacturing

What may the future hold for manufacturing lower-volume drugs created by personalized medicines and more targeted therapies? Are smaller batch runs simply the answer or how may manufacturing evolve to maintain sound production economics? DCAT Value Chain Insights examines the issues.

Is continuous manufacturing a solution?

One solution, which has ongoing interest in the industry, is continuous manufacturing. By offering a reduced manufacturing footprint and greater flexibility to scale production, continuous manufacturing is considered a potential solution to achieve improved production economics overall and when working with lower-volume products. Although batch manufacturing is the dominant mode of manufacturing in the bio/pharmaceutical industry, continuous manufacturing remains an option, though longer term, particularly as the regulatory framework for it becomes more defined.

The US Food and Drug Administration (FDA) has encouraged the adoption of innovation and new manufacturing technologies, including continuous manufacturing, a position that the FDA first put forth in 2002 with the agency’s initiative, Pharmaceutical Current Good Manufacturing Practices for the 21st Century, as a means to modernize pharmaceutical manufacturing and enhance product quality. This initiative included putting forth a science- and risk-based approach to pharmaceutical manufacturing and regulatory oversight through a quality-by-design approach as well as by encouraging new technologies, such as process analytical technology (PAT) and continuous manufacturing.

Support by the FDA and other regulatory agencies for continuous manufacturing is crucial. With the industry’s installed manufacturing base still in batch manufacturing and further investment required in equipment, analytical technology, such as PAT, and technical training for continuous manufacturing, the industry has been proceeding on a measured basis in adopting continuous manufacturing. However, with the potential for improved process control and reduced and more flexible manufacturing footprints, bio/pharmaceutical companies continue to evaluate continuous manufacturing for the production of both active pharmaceutical ingredients (APIs) and drug products.

A key step going forward will be the adoption of a new guideline, Q13, Continuous Manufacturing of Drug Substances and Drug Products, by the International Conference for Harmonization (ICH) of Technical Requirements for Pharmaceuticals for Human Use. ICH is a non-binding body that engages regulatory authorities and the bio/pharmaceutical industry to discuss scientific and technical aspects of drug registration, including quality considerations and good manufacturing practice (GMP), as a means to harmonize pharmaceutical regulation among regulatory bodies. Its membership includes the regulatory authorities from the US (the FDA), the European Union (European Commission), and Japan (Japan’s Ministry of Health, Labor and Welfare and Japan’s Pharmaceuticals and Medical Devices Agency). Its members further include regulatory authorities from Canada, Switzerland, China, Brazil, Singapore, and the Republic of Korea as well as industry associations, the Pharmaceutical Research and Manufacturers of America, the Biotechnology Innovation Organization, the European Federation of Pharmaceutical Industries and Associations, and Japan Pharmaceutical Manufacturers Association.

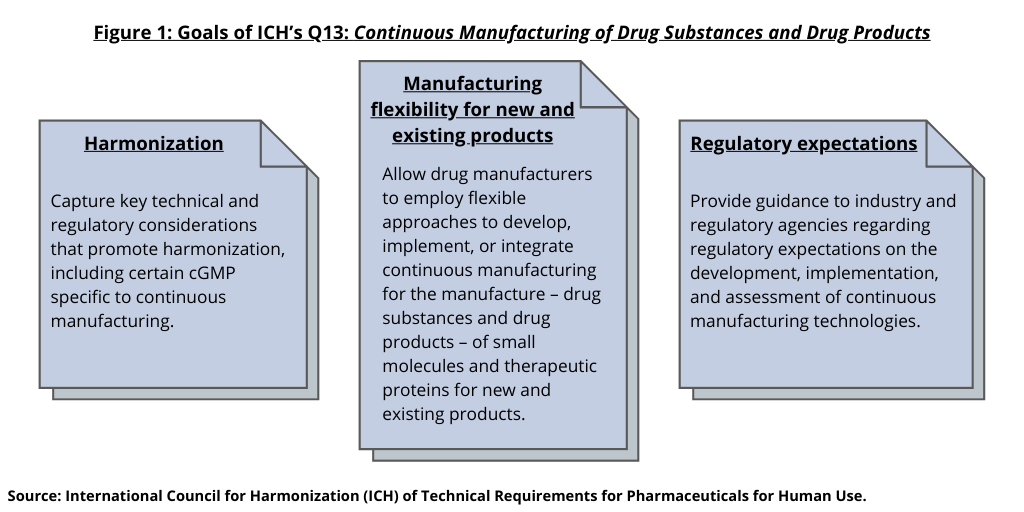

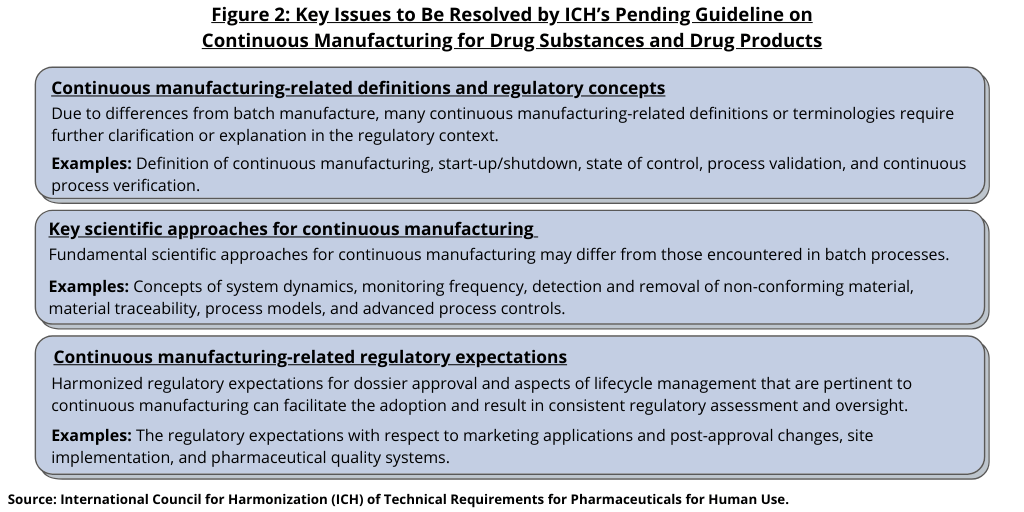

In 2018, ICH endorsed the development of a guideline on continuous manufacturing and since then, it has been working to develop the guideline. In July (July 2021), it moved to Step 2 of the ICH process, with making the draft guideline available for public input. The ICH has a goal of reviewing public input by June 2022 and issuing a final guideline in November 2022. The new ICH guideline seeks to address several main issues (see Figure 1), such as capturing key technical and regulatory considerations that promote harmonization, including certain cGMP elements specific to continuous manufacturing. It also seeks to allow drug manufacturers to employ flexible approaches to develop, implement, or integrate continuous manufacturing for the manufacture of both drug substances and drug products for small molecules and therapeutic proteins for new and existing products. The ICH guideline also seeks to provide guidance to industry and regulatory agencies regarding regulatory expectations on the development, implementation, and assessment of continuous manufacturing technologies used in the manufacture of drug substances and drug products. Figure 2 further specifies key items that ICH is seeking to resolve with the guideline: (1) continuous manufacturing-related definitions and regulatory concepts; (2) key scientific approaches for continuous manufacturing; and (3) regulatory expectations.

Once an ICH guideline is issued, its implementation depends on the adoption of the guideline by the participating regulatory agencies in ICH. The FDA issued a draft guidance, Quality Considerations for Continuous Manufacturing, in 2019, to specify key quality considerations and provide recommendations for how applicants should address these considerations in new drug applications (NDAs), abbreviated new drug applications (ANDAs), and supplemental NDAs and ANDAs for small-molecule, solid oral drug products that are produced via a continuous manufacturing process. The FDA’s draft guidance clarifies the agency’s current thinking regarding continuous manufacturing approaches to help resolve potential issues some companies may have as they consider implementation, such as concerns that the use of new continuous manufacturing technology might impact the time the FDA takes to assess applications for new products and what is required from a regulatory view for switching from a batch to a continuous-manufacturing process for existing products.

In issuing the draft guidance, the FDA also outlined other steps it is taking to support the adoption of continuous manufacturing, which includes involvement of ICH’s guideline on continuous manufacturing. A final guidance on continuous manufacturing by the FDA is still under consideration and likely will be on hold pending the finalization of the ICH guideline.