The Push To Onshore US Pharma Manufacturing: What’s on the Table?

Congress is moving forward with proposed legislation to increase both new and reshored pharma manufacturing in the US. What measures are being considered, and where do they stand?

By Patricia Van Arnum, Executive Director, DCAT, pvanarnum@dcat.org

The latest moves

Increasing US-based pharma manufacturing is a hot-button issue, and Congress took a step forward in advancing that goal by holding a hearing last week (June 11, 2025) to gain input from industry stakeholders on the challenges and ways to increase US-based pharma manufacturing as well as by introducing new legislation this week (June 17, 2025) to create incentives for domestic pharma manufacturing in the US.

The actions of Congress follows several moves by the Trump Administration to lay the groundwork to increase domestic pharmaceutical manufacturing in the US. Most notable is evolving and still-to-be-determined trade policy, in the form of tariffs, to create a financial case to locate manufacturing in the US as well as providing administrative support for domestic pharma manufacturing. Last month (May 2025). President Trump issued an Executive Order to provide the authority and direct federal entities to streamline the regulatory review by the US Food and Administration of pharmaceutical manufacturing facilities in the US, enhance the inspection process of foreign drug-manufacturing facilities to create a more balanced review process between US and non-US facilities, and streamline permitting of manufacturing facilities by the Environmental Protection Agency.

The Administration’s overall tariff policy has centered on increasing US manufacturing competitiveness, including for pharmaceuticals, and its Executive Order is focused on ways to provide regulatory support for locating, building, or expanding pharma manufacturing in the US. While Congress shares those goals, its discussions and proposed legislation to date have specifically focused on improving the supply-chain resiliency of “essential medicines,” largely generic drugs that are now produced outside the US and that are considered critical for health and national security purposes. Several factors have contributed to the policy momentum for increasing US-based pharma manufacturing, including addressing supply-chain vulnerabilities first surfacing during the COVID-19 pandemic and since, ways to mitigate shortages of certain drugs, and overall geopolitical uncertainty.

Generics industry view

John Murphy, III, President and Chief Executive Officer for the Association for Accessible Medicines (AAM), which represents US-based generic-drug and biosimilar companies and manufacturers, testified last week (June 11, 2025) at a hearing of the Health Subcommittee of the Energy and Commerce Committee of the US House of Representatives to explain the challenges facing the generics industry to increase US-based manufacturing.

“Generic drug manufacturers have been driven to offshore API and some generic drug manufacturing to other countries because manufacturing generic drugs is a highly competitive, low-margin industry in the US,” he said. “”….Generic manufacturers, far more so than brands, – face key challenges that include: (1) lack of significant US government financial incentives to encourage production of domestic APIs [active pharmaceutical ingredients] and generic drugs, (2) challenges with US reimbursement, (3) labor shortages, and (4) regulatory barriers. As a result, there lays dormant significant generic drug manufacturing capacity in the United States.”

That point was further underscored by Patrick Cashman, President of US Antibiotics, a Bristol, Tennessee-based producer of antibiotics, who also spoke at the House hearing. Cashman identified his company as the last remaining end-to-end domestic US manufacturer of the antibiotic, amoxicillin. He said that the company has the manufacturing capacity to meet 100% of US demand of the antibiotic but serves only 5% of the US amoxicillin market due to lower-cost production outside the US, mainly from India and China.

Supply of APIs and finished dosage forms: crunching the numbers

To provide insight into the supply lines of pharmaceuticals in the US, Ronald T. Piervincenzi, PhD, Chief Executive Officer of the United States Pharmacopeia (USP), an independent, scientific nonprofit organization that sets quality standards for pharmaceuticals and also provides data and analysis on medicines supply, who also spoke at the House hearing, provided data on US and ex-US manufacturing of APIs and finished dosage forms (FDFs). The data are based on USP’s Medicine Supply Map, a data intelligence platform that maps where 94% of US pharmaceutical drug products and their ingredients are made and which identifies, characterizes, and predicts supply-chain risk.

On the API side, the USP analysis showed that in 2024:

- Half of the APIs for prescription medicines in the US come from India and the EU.

- Generic drugs, which make up 90% of US prescription drug volume, primarily come from India.

- 43% of branded pharmaceutical APIs comes from the European Union (EU).

- The US accounts for 12% of total API volume in this analysis.

- China contributes 8% of the total volume of APIs analyzed.

On the FDF side, the USP analysis showed that:

- The US is the largest manufacturer of injectables, with 45% of production volume, followed by the EU with 19% of production volume.

- For solid oral dosage forms, India has 60% of production volume, followed by the US with 22% of production volume. Market shares have remained relatively unchanged over 2022 and 2024.

Proposals to increase US pharma manufacturing

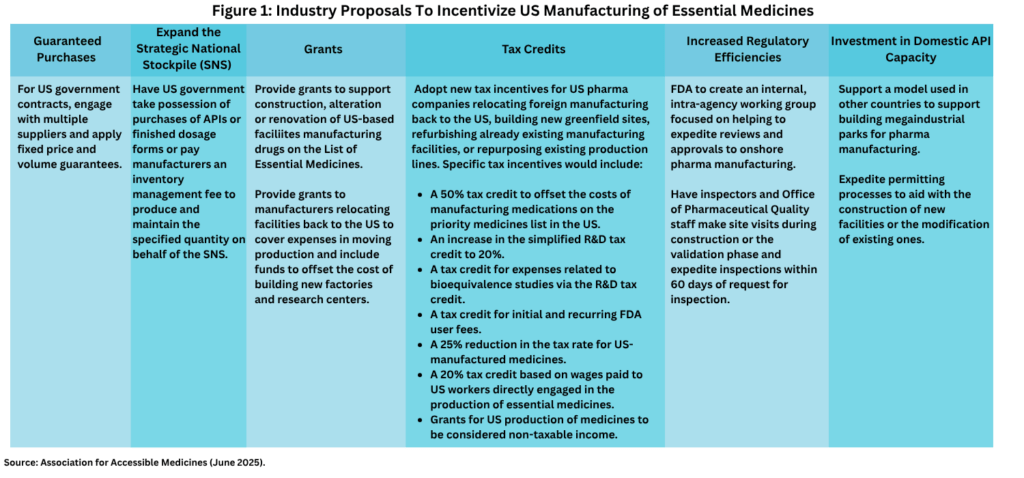

From the perspective of the generics industry, AAM’s Murphy detailed the ways in which the US government could support US-based pharma manufacturing of essential medicines, including financial incentives to reshore manufacturing as well as to build or expand existing US manufacturing capacity (see Figure 1).

The financial incentives include using fixed price and volume guarantees in government contracts to support US-produced generic drugs against lower cost imports. This would involve the US Department of Health and Human Services applying fixed price and volume guaranteed contracts when expanding the Strategic National Stockpile (SNS) and the Veterans Administration using fixed price and volume guarantees for national contracts to supply the Veterans Administration and the Department of Defense. With regard to US government stockpiling of essential medicines under the SNS, Murphy suggested that the US government take possession of purchases of APIs or finished dosage forms or pay manufacturers an inventory management fee to produce and maintain the specified quantity on behalf of the SNS.

AAM’s Murphy also suggested government grants to support construction, alteration, or renovation of US-based facilities manufacturing drugs on the List of Essential Medicines as well as providing grants to manufacturers relocating facilities back to the US to cover expenses in moving production and funding to offset the cost of building new factories and research centers.

These grants would be in addition to new tax incentives for US pharma companies relocating foreign manufacturing back to the US, building new greenfield sites, refurbishing already existing manufacturing facilities, or repurposing existing production lines. Specific tax incentives proposed would include:

- A 50% tax credit to offset the costs of manufacturing medications on the priority medicines list in the US;

- An increase in the simplified R&D tax credit to 20%;

- A tax credit for expenses related to bioequivalence studies via the R&D tax credit;

- A tax credit for initial and recurring FDA user fees;

- A 25% reduction in the tax rate for US-manufactured medicines; and

- A 20% tax credit based on wages paid to US workers directly engaged in the production of essential medicines.

These financial incentives outlined by the AAM would be further supported by ways to increase regulatory efficiencies to support US-based pharma manufacturing. These include the creation by the US Food and Drug Administration of an internal, intra-agency working group focused on helping to expedite reviews and approvals to onshore pharma manufacturing as well as starting the inspection process of manufacturing facilities during the construction or the validation phase and expediting inspections within 60 days of request for inspection. Another suggestion was to support a model used in other countries, such as India, to support building mega-industrial parks for pharma manufacturing as well as to expedite permitting processes to aid with the construction of new facilities or the modification of existing ones.

In his testimony before the House Health Subcommittee, USP’s Piervincenzi outlined suggestions for Congress, which included providing US government support for developing alternate manufacturing processes for APIs and key starting materials that can be sourced in the US or allied countries to reduce dependence on single-sourced suppliers, supporting the development of advanced manufacturing technologies, and establishing a Drug Supply Chain Resilience Initiative (DSCRI). The DSCRI would have the goal to foster stability in the drug supply chain by providing criteria to value the resilience and reliability of manufacturers, promoting sustainable prices for generic medicines, and incentivizing changes in purchasing practices. The DSCRI would have two key elements: (1) a data-driven system to differentiate suppliers based on reliability and resilience, such as the development of an assessment or benchmark to enable purchasers to identify resilient manufacturers and (2) the establishment of meaningful value-based payment and contracting reforms to incentivize supply chain resilience and reliability.

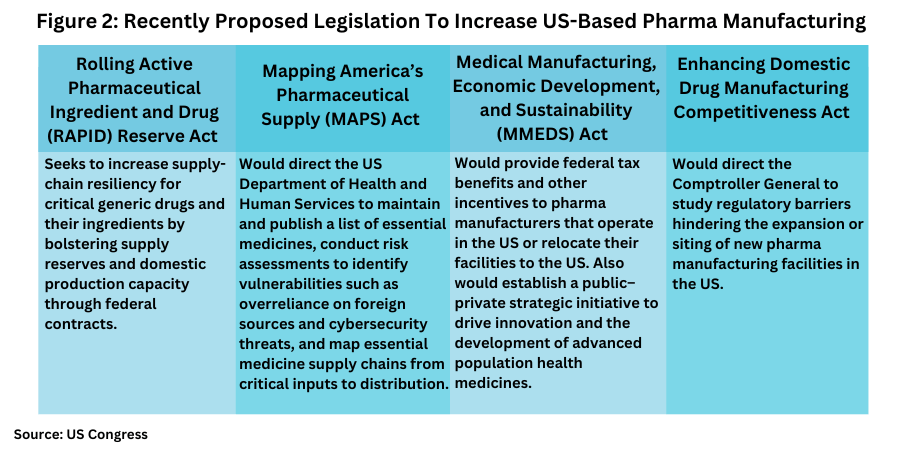

The hearing of the Health Subcommittee of the House Energy and Commerce Committee is one fact-finding effort on the part of Congress to gain input on potential new legislation to support US-based pharma manufacturing overall and specifically for essential medicines, with several bills already introduced (see Figure 2). The Health Subcommittee of the House Energy and Commerce Committee, which held the hearing last week (June 11, 2025), is chaired by Earl L. “Buddy” Carter (R-GA), who earlier this year (2025), formed the American-Made Medicines Caucus in the US House of Representatives, a group focused on promoting policies to onshore pharmaceutical manufacturing for essential medications and reduce US reliance on ex-US manufacturing.

In the US Senate, this week (June 17, 2025), a bipartisan group of senators re-introduced the Rolling Active Pharmaceutical Ingredient and Drug (RAPID) Reserve Act to help increase supply-chain resiliency for critical generic drugs and their key ingredients by bolstering supply reserves and domestic production capacity through federal contracts. The bill, which is co-sponsored by Senators Ted Budd (R-NC), Gary Peters (D-MI), Marsha Blackburn (R-TN.), and Tim Kaine (D-VA), would direct the US Department of Health and Human Services to award contracts to quality manufacturers of critical generic drug products who are based in the US or in a country that is a member of the Organization for Economic Cooperation and Development (OECD) in order to maintain reserves of critical medications and their key ingredients while building the capacity to surge production when needed. The contracts would prioritize domestic manufacturers. The senators also sent a letter to the Government Accountability Office requesting the agency examine underutilized domestic manufacturing capacity and federal efforts to invest in advanced manufacturing capabilities.

Last month (May 2025), another bill, Mapping America’s Pharmaceutical Supply (MAPS) Act, was introduced in the US Senate that would codify certain measures of the Administration’s recent Executive Order on pharma manufacturing by directing the US Department of Health and Human Services to maintain and publish a list of essential medicines, conduct risk assessments to identify vulnerabilities such as overreliance on foreign sources and cybersecurity threats, and map essential medicine supply chains from critical inputs to distribution.

Also, last month (May 2025), a bill, the Medical Manufacturing, Economic Development, and Sustainability (MMEDS) Act, was introduced in the US House of Representative. It would provide federal tax benefits and other incentives to pharmaceutical manufacturers that operate in the US or relocate their facilities to the US and would particularly encourage that investment in economically distressed areas. Another House bill, the Enhancing Domestic Drug Manufacturing Competitiveness Act, introduced in February (February 2025), would direct the Comptroller General to study regulatory barriers hindering the expansion or siting of new pharmaceutical manufacturing facilities in the US.