The US API Manufacturing Base: Generics

A recent analysis by researchers at the Olin Business School at Washington University in St. Louis, Missouri, examines the US manufacturing base for active pharmaceutical ingredients (APIs) for essential medicines and the top 100 generic drugs. What did they find, and what are they recommending to increase US-based production?

Evaluating the US API manufacturing base

In the wake of the COVID-19 pandemic, there have both policy initiatives within the US, European Union, the UK, India, and elsewhere to evaluate pharmaceutical supply chains to determine what action may be needed to strengthen supply-chain resilience. In the US, in June (June 2021), the Biden Administration announced a series of actions and recommendations to improve supply-chain resilience in the US in several industries, including pharmaceuticals. These actions followed a February (February 2021) executive order issued by President Biden that directed an 100-day review of certain industrial supply chains as part of an effort to identify near-term steps the Administration can take, including with Congress. For pharmaceuticals, the Administration is recommending ways to increase domestic production of essential medicines, facilitate manufacturing innovation, and support other measures to facilitate trade and production in US supply chains. In addition to the 100-day review of US supply chains, Biden’s executive order directs year-long reviews for six sectors, which includes the public health and biological preparedness industrial base. These sectoral reviews direct federal agencies and departments to review a variety of risks to supply chains and industrial bases within one year of the date of the executive order issued on February 24, 2021 by which the specified heads of agencies in these six sectors, which includes pharmaceuticals, are required to submit reports to the President.

A study (1), released last month (August 2021) and conducted by the Olin Business School at Washington University in St. Louis, Missouri, with data from the business intelligence firm, Clarivate, analyzed the US manufacturing base for active pharmaceutical ingredients (APIs) for generic APIs. Key findings from the study are outlined below.

- Greater than 80% of APIs for essential medicines and across key therapeutic areas have no US manufacturing source

- Less than 5% of large-scale API sites, globally, are located in the US; the majority of large-scale manufacturing site are in India and China

- The causes for US weakness in API manufacturing are a so-called “race to the bottom” on pricing against global players with structural advantages for ex-US manufacturers in greater government subsidies, lower input costs, and lesser regulatory burdens

- Solutions to protect US healthcare security must address the risks to US healthcare security by creating (1) a critical mass of domestic manufacturing infrastructure to protect domestic interests; (2) a level playing field for global competition; and (3) sustainable domestic markets for US-based manufacturers.

Inside the US API manufacturing base for generics

In quantifing the US API manufacturing base, the study cites a 2019 report that was updated in 2020, Drug Shortages: Root Causes and Potential Solutions: A Report by the Drug Shortages Task Force, by the US Food and Drug Administration (FDA) that noted that in 2018, the majority of manufacturing sites making APIs and finished dosage forms for the US market were located outside the US: 88% of the manufacturing sites for APIs for the US market were located outside the US, and 63% of the manufacturing sites for finished drug products were. That FDA report highlighted three root causes for the API infrastructure prevalent in commoditized essential medicine production: low profitability, low value for quality, and complex, global supply chains.

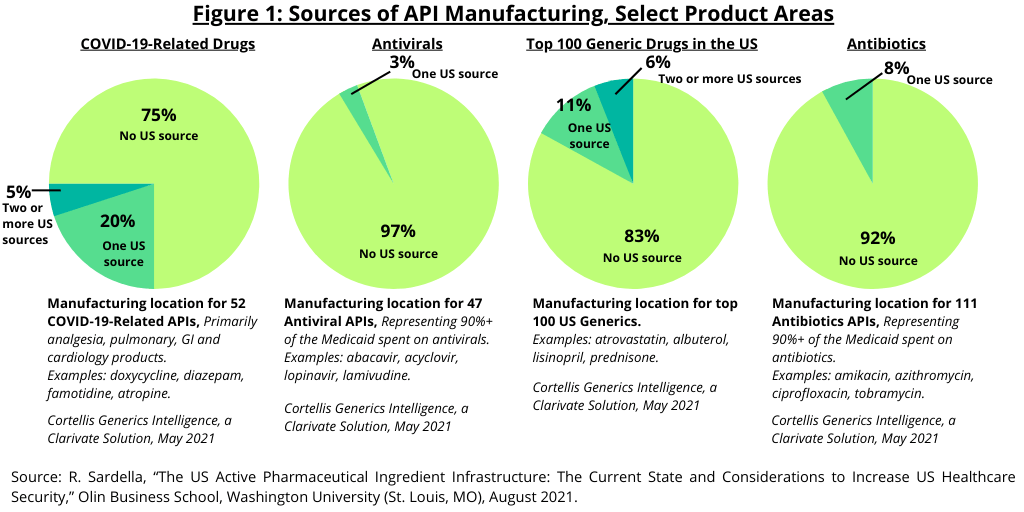

Figure 1 provides further detail of the US API manufacturing infrastructure. In looking at the manufacturing locations for the top 100 generic medicines, 83% of the top 100 generic drugs have no US-based manufacturing source. Eleven percent have one US-based manufacturing source and 6% had two US-based sources.

In looking at specific product areas, 97% of antivirals (generics, based on 47 APIs) did not have a manufacturing source in the US, and 92% of antibiotics (generics, based on 111 APIs) did not have a US-based manufacturing source. In looking at generic drugs to treat COVID-19, 75% of the APIs (based on 52 APIs) did not have a US manufacturing base (see Figure 1).

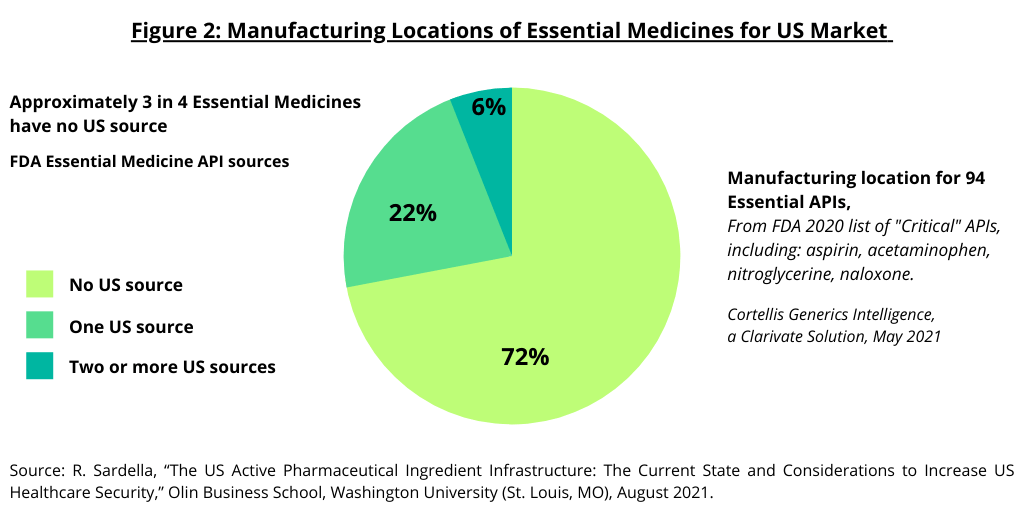

As part of a policy initiative from the Trump Administration to address domestic manufacturing in the US, the FDA published an essential medicines list in 2020, with a set of APIs identified as “critical.” Of 94 APIs (excluding saline, surfactants, basic salts, etc.), 72% have no US source (see Figure 2). Those with a US source are predominantly either controlled substances manufactured at large-scale or niche APIs that smaller scale US manufacturers can compete at smaller scale (1). Of those with no US source, the total US market value for 34, or 31%, of the critical APIs, is estimated to be below $2 million. The study by the Olin Business School at Washington University (1) concludes that given that the cost to develop an API in the US is typically $1 million to $2 million, this creates an economic challenge to reshoring manufacturing.

High-capacity API manufacturing sites and global distribution of API manufacturing

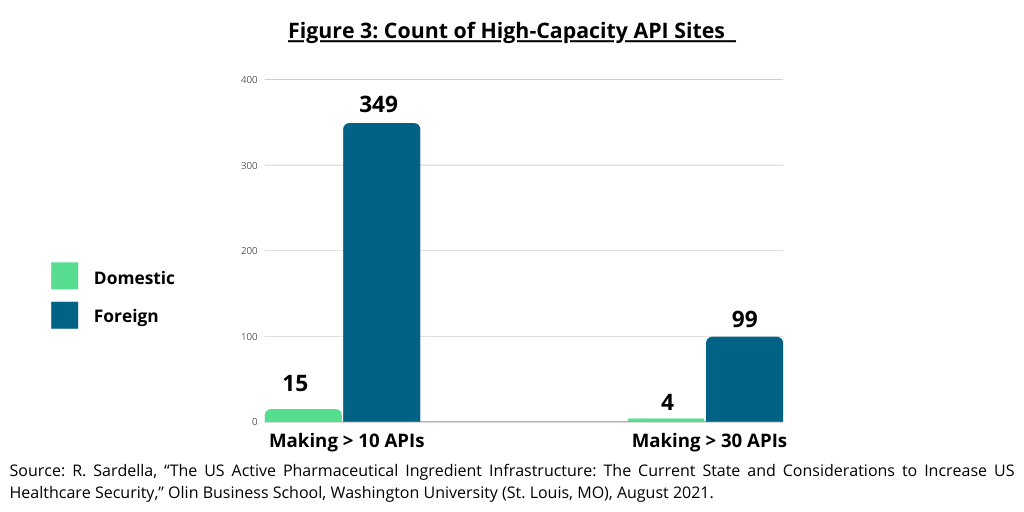

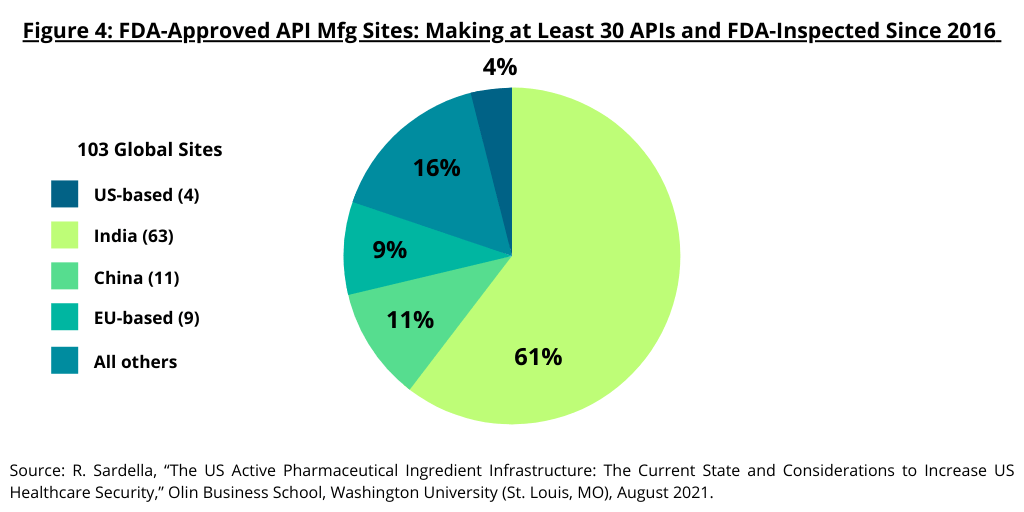

The study by the Olin Business School at Washington University (1) also examined high-capacity API manufacturing sites in the US and the global distribution of API manufacturing sites for generic drugs. The study defined large-scale manufacturing sites as those capable of manufacturing 10 or more different APIs as these sites provide the infrastructure required to deliver APIs cost competitively with “truly” large-scale sites able to manufacture 30 or more APIs for the global market. The study noted that the majority of these large-scale sites are located outside the US (see Figure 3). Only 15 sites capable of producing 10 APIs or more are based in the US compared to 349 abroad. Only four sites capable of producing 30 or more APIs are based in the US compared to 99 abroad (see Figure 3). Of the 103 sites worldwide that manufacture and sell over 30 API products, India has 60-plus API sites and China has 10-plus such sites (see Figure 4).

Proposals to increase US-based API production

One of the possible solutions to increase the cost-competitiveness of US-based API manufacturing is through advanced manufacturing technology, including continuous manufacturing and increased automation. The study concludes that although these methods hold promise, there is still a “substantial gap between bench-scale proof-of-concept and commercial scale cGMP production that has not yet been bridged” (1).

Additionally, the study concludes that US government policy encourages what it calls “a race to the bottom,” which occurs in the absence of US governmental influence or policy, by which basic economics result in the manufacturing of many critical medicines moving from the US to lower-cost countries. The study also points to structural benefits of ex-US manufacturers, such as lower costs for labor, utilities, land acquisition, and other services, as well as goverment subsidiaries.

To address these and other issues, the study (1) outlines several areas to support US-based API production as described below.

Initiate efforts to protect existing API manufacturing base and capabilities currently within the US. To this end, the study points to several means to protect the existing US API manufacturing base: (1) infrastructure investments; (2) supporting innovators of advanced manufacturing technologies and research collaborations; and (3) better defining “Made in America” requirements and harmonizing language under existing federal law as it relates defining US-maded APIs.

Address areas of asymmetry in the global marketplace. The study highlights several areas to address factors that contribute to differentials between US-based and ex-US manufacturers: (1) inspections of foreign and domestic manufacturers: (2) government investment support in domestic infrastructure; and (3) environmental and labor compliance.

Create sustainable domestic markets. The study also recommends several ways to increase US-based API manufacturing by: (1) leveraging US government purchasing for those medicines made with US-produced APIs; (2) account for quality and sustainability in selecting suppliers; and (3) federal regulations defining threshold of US-sourced APIs.

Reference

1. R. Sardella, “The US Active Pharmaceutical Ingredient Infrastructure: The Current State and Considerations to Increase US Healthcare Security,” Olin Business School, Washington University (St. Louis, MO), August 2021.