US, EU Detail Plan for Pharmaceutical Tariffs

The White House and European Commission have released further details on the recently agreed-to US-EU trade deal, including further details on tariffs on pharmaceuticals. What’s the bottom line for the pharma industry?

By Patricia Van Arnum, Editorial Director, DCAT, pvanarnum@dcat.org

The US and EU release details of trade framework

The White House and the European Commission released further details this week (August 21, 2025) on the trade deal that the United States and the European Union (EU) came to agreement to late last month (July 27, 2025), and for the pharma industry, the news is mixed. While avoiding much higher tariffs, considered a win for the European Union (EU) and the pharmaceutical industry, the agreement imposes a 15% tariff on EU exports to the US.

The terms of the deal were announced in an Joint Statement by the US and the EU, which creates a Framework Agreement that outlines much-anticipated details on specific tariff measures. “This Framework Agreement will put our trade and investment relationship – one of the largest in the world – on a solid footing and will reinvigorate our economies’ reindustrialization,” said the US-EU Joint Statement issued August 21, 2025. “It reflects acknowledgement by the European Union of the concerns of the United States and our joint determination to resolve our trade imbalances and unleash the full potential of our combined economic power. The United States and the European Union intend this Framework Agreement to be a first step in a process that can be further expanded over time to cover additional areas and continue to improve market access and increase their trade and investment relationship.”

The political agreement reached on July 27, 2025, and the now-published Joint Statement are the first steps in a process to formalize the terms of US-EU trade policy. The Framework Agreement maintains what had been a key part of the agreement earlier reached in July: a 15% baseline tariff on EU goods to the US.

The 15% ceiling applies to nearly all EU exports currently subject to reciprocal tariffs, referring to country-by-country-imposed tariffs (except where the US most-favored-nation (MFN) tariff exceeds 15%, in which case only the MFN tariff applies with no additional tariffs on top). The Trump Administration first laid out a plan for imposing reciprocal tariffs in February (February 2025) to counter non-reciprocal trading arrangements with its trading partners and to improve US competitiveness, including in manufacturing. Those reciprocal taxes were scheduled to go into effect on April 9, 2025, but the Administration placed a 90-day pause (until July 9, 2025) on their implementation to enable countries to negotiate these tariffs with the US government. The US government then extended the deadline once again to August 1, 2025, and the US and the EU have been working since to negotiate a trade deal on these tariffs.

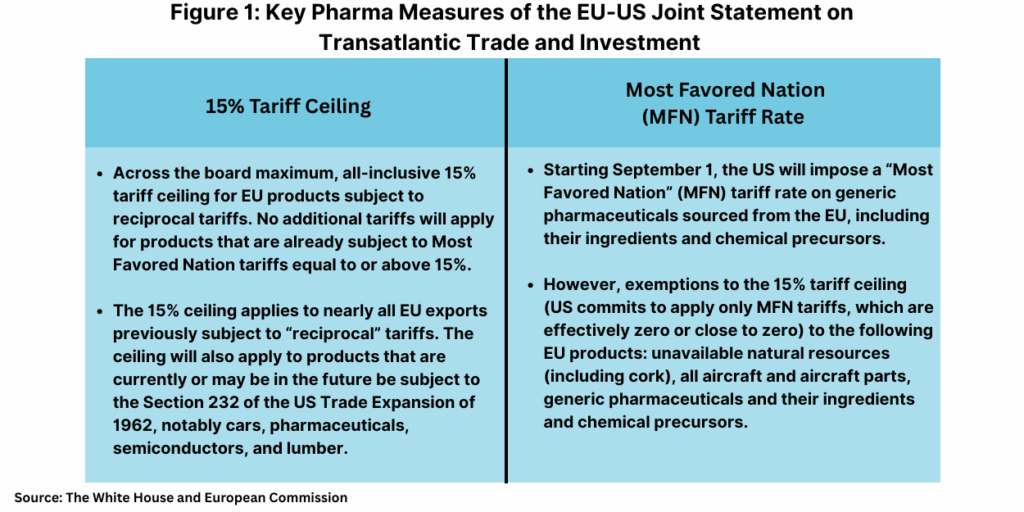

For the pharma industry, the Framework Agreement subjects pharmaceuticals to the across-the board, maximum, all-inclusive 15% tariff ceiling for EU products subject to reciprocal tariffs (see Figure 1). No additional tariffs will apply for products which are already subject to MFN tariffs equal to or above 15%. Important for the EU and the pharma industry is a commitment from the US to ensure that EU exports of pharmaceuticals are included in the 15% tariff ceiling once the results of corresponding investigations under Section 232 of the US Trade Expansion of 1962 (as amended) are concluded.

Section 232 measures allows the US President to impose import restrictions based on an investigation and affirmative determination by the US Department of Commerce that certain imports threaten to impair US national security. The US had initiated a Section 232 investigation earlier this year (April 2025) for pharmaceuticals, and at question for the industry was whether tariffs under Section 232 measures would result in much higher tariffs. The Framework Agreement, however, says the 15% tariff ceiling will also apply to products that are currently or may be in the future be subject to the Section 232 measures, according to the European Commission.

The Framework Agreement allows for exemptions to the 15% tariff ceiling (US commits to apply only MFN tariffs, which are effectively zero or close to zero) to the following EU products: unavailable natural resources (including cork), all aircraft and aircraft parts, generic pharmaceuticals and their ingredients and chemical precursors, according to information frm the European Commission. The EU and US say they will work on expanding this list further in the future.

Impact on pharma

The Joint Statement by the US and EU provided some much needed clarity for industries, including for the pharmaceutical industry, but the 15% tariff does raise concerns. According to information from the European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents innovator drug companies and pharmaceutical trade associations in Europe, the estimated cost of a 15% tariff on pharmaceutical exports from the EU to the US equates to approximately EUR 18 billion ($21 billion).

EFPIA is critical of the US–EU tariff scheme noting that the impostion of tariffs on pharmaceuticals deviates from historical trade policy in which pharmaceuticals were exempt from tariffs. “EFPIA acknowledges the U.S.-EU Joint Framework Agreement published today [August 21, 2025] by the European Commission and the U.S. Administration,” said EFPIA in an August 21, 2025, statement. “The proposal breaks a 30-year commitment between Governments to protect patients by eliminating tariffs on innovative medicines and their components.”

EFPIA raised concerns on the negative impact that tariffs would have on the pharma industry overall and in Europe. “We understand the environment that European policy makers are operating in, and recognize the efforts to secure a trade deal for the region that works for all,” said Nathalie Moll, Director General, EFPIA, in an August 21, 2025, statement. “With a potential 15% U.S. tariff on pharmaceuticals, no clear path for exemptions for innovative medicines and no visibility on future trade and pricing policies, we remain concerned for the future of patients and our sector in Europe.”

EFPIA said placing tariffs on medicines will harm patient care and the industry and have the potential to create shortages, impact access for patients, and build barriers to global R&D. “Adding barriers to highly functioning and complex supply chains is not a route to national resilience, increased manufacturing or better patient care,” said EFPIA’s Moll. “They impact our ability to collaborate on discovering new treatments to tackle global health challenges, with billions of Euros diverted away from medical research. As discussions on exemptions continue, we urge the EU and Member States to secure exemptions for innovative medicines to protect patients and ensure the EU pharmaceutical industry is competitive.”

EFPIA says it is urgently seeking a strategic sector dialogue with the European Commission and EU member states “to secure the future of the industry in Europe. We believe that with the right support, companies can continue to invest here and ensure that the health and economic security that medical innovation brings, stays in Europe,” said EFPIA in its statement.