What is Next for Novartis? Restructuring on the Way

Novartis is implementing a $1-billion restructuring plan and is deciding on its options for its generics and biosimilars business, Sandoz. What moves may be next for the company?

CEO

Novartis

New operating structure and executive changes

One key component for the strategy of Novartis CEO Vas Narasimhan is to implement a new organizational structure and operating model with the aim of achieving cost savings of $1 billion in selling, general and administrative expenses by 2024 (see Figure 1). Novartis had first announced the new operating structure in April (April 2022). With that new organizational structure, the company has made several changes in executive leadership.

The company is integrating its Pharmaceuticals and Oncology business units into an Innovative Medicines business to create two separate commercial organizations—Innovative Medicines US and Innovative Medicines International. The two units have full profit and loss responsibility across all therapeutic areas and ownership of customer experience, marketing and sales, and market access for their respective markets. The new model will support the company’s core therapeutic areas in cardiovascular, hematology, solid tumors, immunology and neuroscience.

Marie-France Tschudin, formerly President, Novartis Pharmaceuticals, became President, Innovative Medicines International and Chief Commercial Officer in early April (April 2022). In her capacity as Chief Commercial Officer, she is overseeing global marketing, medical affairs, and value and access across all therapeutic areas. Victor Bulto, formerly Head of US Pharmaceuticals, became President, Innovative Medicines US. Both report directly to Novartis CEO Vas Narasimhan/

Novartis also created a new Strategy & Growth function combining corporate strategy, R&D portfolio strategy, and business development (see Figure 1). This new function will be led by a Chief Strategy & Growth Officer, who will become a member of Novartis’ Executive Committee and report to the CEO. The search is currently underway for this new leader, and in the interim the function is being led by Lutz Hegemann, M.D., Ph.D., President, Global Health.

Additionally, the company is combining its Technical Operations and Customer & Technology Solutions units to create a new Operations unit to provide an operational backbone to accelerate multiple technology transformation initiatives, create digital solutions at scale, and increase productivity. Steffen Lang, formerly Global Head of Novartis Technical Operations, became President, Operations in April (April 2022). In all general and administrative functions—Finance, People & Organization, Ethics, Risk & Compliance, Legal, and Communications & Engagement—are being integrated on global and country levels.

The company also announced changes to its global drug-development leadership. Shreeram Aradhye, a former Novartis executive returning to the company, became President, Global Drug Development and Chief Medical Officer, effective May 16, 2022. Dr. Aradhye was most recently Executive Vice President and Chief Medical Officer at Dicerna Pharmaceuticals, where he led the development of multiple clinical stage RNAi assets. Previously, he was Chief Development Officer at Axcella Health. During his 20-year tenure at Novartis, he held several global leadership roles, including as development head for the company’s neuroscience franchise and Global Head of Medical Affairs for the Pharmaceuticals business unit.

With the changes in organizational structure and operating model, John Tsai, M.D., currently the President of Global Drug Development and Chief Medical Officer at Novartis, has decided to pursue opportunities outside Novartis, effective May 15, 2022.

Novartis expects value creation through these operational improvements and to achieve a least 4% sales growth (compound average annual growth rate in 2020–2026) and margins in the high 30s in its Innovative Medicines business in the medium term and 40%+ in the mid- to long-term.

Finding strategic alternatives for Sandoz

Another keypiece of Novartis strategy regards Sandoz, its generics, biosimilars, and legacy product business. Last October (October 2021), Narasimhan reported that the company would begin a strategic review of Sandoz and has since been evaluating options ranging from retaining the business to separation. The decision to move on with Sandoz comes as the business faces revenue and pricing pressure and followed a previous unsuccessful attempt by Novartis to sell part of the business. Pricing and margin pressures, particularly in the US generics market, was the impetus behind Novartis’ decision in 2018to divest a portion of Sandoz’s US portfolio to focus on more value-added medicines, complex generics, and biosimilars. Novartis had struck a deal with Aurobindo Pharma USA, the US arm of Aurobindo Pharma, a Hyderabad, India-based generics and manufacturing company, to sell Sandoz’s US dermatology business and US oral solids generics portfolio for approximately $1 billion ($800 million upfront plus cash and potential earnouts). The deal was conditional on obtaining regulatory approval, and the companies mutually terminated the deal in April 2020 after not receiving approval from the US Federal Trade Commission within agreed timelines.

Focus on innovative medicines

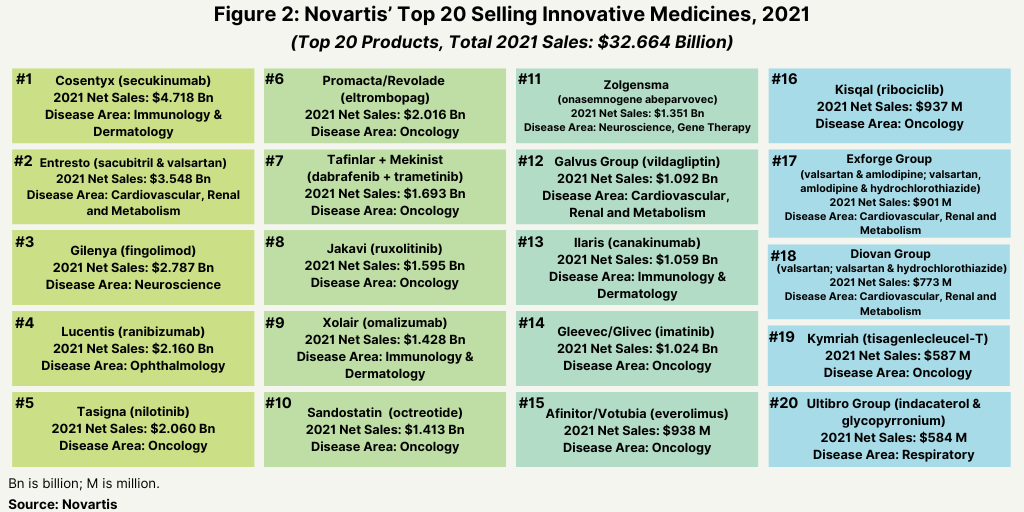

Novartis’ $1-billion cost-saving program, new organizational structure, and alternatives for Sandoz are part of the larger company goal to further drive growth in its Innovative Medicines business. Figure 2 outlines the company’s top-selling 20 products in 2021, which accounted for nearly $33 billion in sales. Overall, in 2021, the company had 14 blockbuster products (defined as products with sales of more than $1 billion or more), with oncology being a leading area of growth.

At its R&D Day last December (December 2021), Novartis’ Narasimhan outlined the company’s near- and long-term growth strategy for its Innovative Medicines business. In the near term, the company is seeking to achieve a compound annual growth rate (CAGR) of 4%+ through 2026, led by six key products. He also outlined up to 20 pipeline assets, with possible approval by 2026, with potential blockbuster status. Beyond 2030, the company is seeking to increase its product development in biologics and products with advanced technology platforms, which include cell and gene therapies, RNA-based therapies, radioligand therapies, and targeted protein degraders used for undruggable small-molecules drugs.

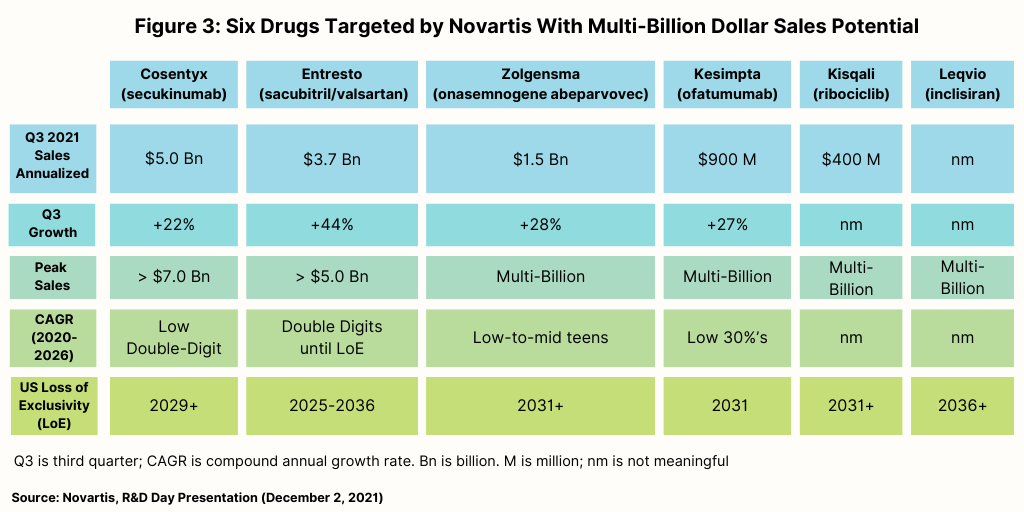

In the near term, Novartis is targeting six products, three of which have reached blockbuster status, and three which have potential for blockbuster status (see Figure 3). Of those three blockbusters, one is a biologic—Cosentyx (secukinumab)—one is a small molecule—Entresto (sacubitril/valsartan)—and one is a gene therapy, Zolgensma (onasemnogene abeparvovec).

Cosentyx, used to treat psoriasis, ankylosing spondylitis, and psoriatic arthritis, has forecasted peak sales through 2026 of more than $7.0 billion, according to information from Novartis. Entresto, used to treat heart failure, has forecasted peak sales through 2026 of more than $5.0 billion. Zolgensma, used to treat a rare disease, spinal muscular atrophy, has forecasted peak sales through 2026 in the multi-billion range (see Figure 3 above).

The three other drugs Novartis is targeting for blockbuster status in the near term consist of a biologic, a small molecule, and a small interfering RNA (siRNA) therapy, one of the advanced technology platforms being targeted by Novartis. On the precipice for blockbuster status is the biologic, Kesimpta (ofatumumab), for treating relapsing forms of multiple sclerosis, with forecasted peak sales through 2026 in the multibillion-dollar range, according to information from Novartis. Kisqali (ribociclib), a small-molecule drug used to treat certain types of breast cancer, and Leqvio (inclisiran), a chemically synthesized siRNA therapy to reduce low-density lipoprotein cholesterol, also are projected by Novartis to achieve blockbuster status by 2026 (see Figure 3 above). Leqvio is approved in 50 countries, including the European Union and the UK, and is under regulatory review in the US. Novartis gained inclisiran in its $9.7-billion acquisition of The Medicines Company in 2020.

The company’s near-term strategy seeks to not only drive growth but to compensate for a projected $9-billion loss in revenue through 2026 due to generic-drug competition for key products. Products with future generic-drug impact up to 2026 include: Entresto (sacubitril/valsartan) for treating heart failure, assuming loss of exclusivity in the US in 2025; Lucentis (ranibizumab) for treating macular degeneration (the drug was developed by Roche and is marketed by Novartis in Europe); Gilenya (fingolimod) for treating multiple sclerosis; Tasigna (nilotinib) for treating chronic myeloid leukemia; Promacta (eltrombopag) for treating immune thrombocytopenia and severe aplastic anemia; Sandostatin (octreotide) for treating carcinoid tumors and acromegaly; Xolair (omalizumab) for treating severe allergic asthma and chronic spontaneous urticaria; Afinitor (everolimus) for treating breast cancer and giant cell astrocytoma; the Q-Family of certain respiratory products; and Votrient (pazopanib) for treating late-stage kidney cancer and advanced soft tissue sarcoma.