What Makes A Customer of Choice: Are Pharma Companies & Suppliers Aligned?

In times of supply-chain uncertainty, a new DCAT Research & Benchmarking report addresses a key question in the pharma customer–supplier relationship: What does it take to become a “Customer of Choice” and are customers and suppliers aligned in their expectations?

By Jim Miller, Content Advisor, DCAT, jmiller@dcat.org

New report from DCAT Research & Benchmarking

As bio/pharma companies and their suppliers continue to wrestle with supply chain security, strong customer–supplier relations are a strategic must. Evaluating supplier performance is common, but what about the performance of customers to their suppliers?

A new report, What Makes A Customer of Choice: Are Pharma Companies & Suppliers Aligned? by DCAT Research & Benchmarking, takes an in-depth look at how bio/pharma companies are positioning themselves as “Preferred Customers” or “Customers of Choice” to their suppliers as a means to bolster the dependability and value of their supply relationships and how suppliers—both CDMOs and suppliers of materials and other inputs—are supporting those efforts. The full report is exclusively available to DCAT Member Companies here.

DCAT is a not-for-profit, corporate member-supported, and volunteer-led global business development association for companies throughout the global bio/pharmaceutical business ecosystem. DCAT Research & Benchmarking provides in-depth studies examining the crucial issues impacting the bio/pharma customer–supplier relationship. The study was developed by the DCAT Research & Benchmarking Committee, composed of volunteers from DCAT Member Companies with diverse industry experience, which identify topics of greatest interest for DCAT Member Companies. The study was based on a survey of DCAT Member Companies and supplemented by further research.

Defining a Customer of Choice

A simple definition of Customer of Choice is one provided by the management and supply chain consultancy, Gartner: “A customer of choice is one that receives priority treatment when accessing the services or products of a provider” (1). The “priority treatment” customers expect when being designated a Customer of Choice typically includes: preferential access to capacity and materials; closer collaboration with suppliers for current and future needs; and priority access to important innovations.

The Customer of Choice concept has gained traction as supply chain challenges have shifted the balance of power in the customer–supplier relationship in the direction of the supplier. Buyers of manufacturing inputs and services are keenly aware that having good relations with suppliers can be critical to ensuring that key inputs remain available and that their operations run smoothly. The rapidly expanding range of modalities, formulations, and delivery routes rely on purchasing specialty materials and services, so having close and mutually respectful relationships with the suppliers of these key inputs and services is critical to business success.

Probe into three main questions

The DCAT Research & Benchmarking Committee focused its 2025 study on exploring what initiatives bio/pharma companies are taking to becoming Preferred Customers of their suppliers, how suppliers are designating those “Customers of Choice,” what benefits customers and suppliers receive from such efforts, and whether the expectations of bio/pharmaceutical companies and their suppliers are aligned.

The study addressed three main questions:

- What criteria do suppliers use in designating “Customers of Choice” or “Preferred Customers”?

- What initiatives are bio/pharma companies taking to make themselves “Customers of Choice” or “Preferred Customers” at their supplier companies? To what degree do they have formal programs in place with their suppliers to evaluate their performance as a customer?

- Are bio/pharma companies and suppliers aligned in what constitutes a “Customer of Choice”?

Highlights of key findings

The survey explored multiple aspects of the Customer of Choice relationship: Some highlights of the key findings are outlined below. The full report and related findings are available for download to DCAT Member Companies here.

Prevalence of Customer of Choice programs. The study found that suppliers claim to have a formal Customer of Choice program, and most customers claim to aspire to the Customer of Choice designation, but neither side seems focused on getting the most value out of it. In particular, many suppliers said that their customers may not have been informed that they had been designated as a Customer of Choice while most bio/pharma company respondents indicated that they do not make a proactive effort to become a Customer of Choice.

One possible explanation of this discrepancy is that the definition of “Customer of Choice” varied widely among suppliers. When asked to provide their own definition of Customer of some supplier respondents defined it as a strategic relationship, as we would expect, but others were more transactional, even to the point where “Customer of Choice” is any company they do business with.

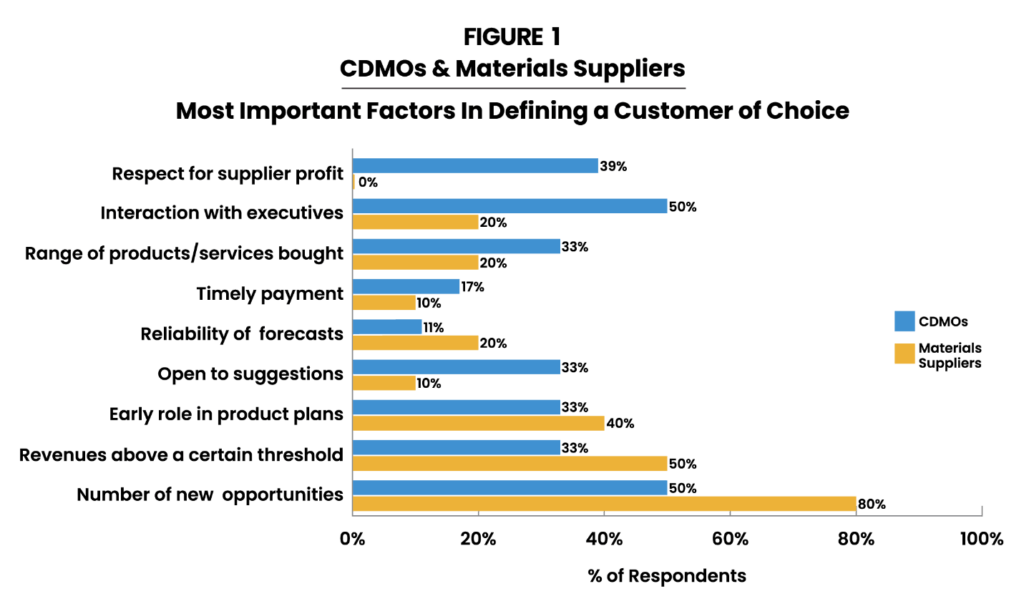

Customer of Choice criteria. The study showed that suppliers consider a range of factors when determining whether a customer is a Customer of Choice, but CDMOs and materials suppliers weigh the factors somewhat differently (see Figure 1).

Source: Drug, Chemical & Associated Technologies Association (DCAT) Report, What Makes A Customer of Choice: Are Pharma Companies & Suppliers Aligned? (May 2025).

In delving deeper into the criteria used by suppliers, CDMOs use a broad range of criteria for determining whether a customer should be designated a Customer of Choice. Their most commonly indicated criteria, “Number of new opportunities presented to us,” and “Revenues above a certain threshold” were named by less than half of CDMO respondents. CDMOs incorporated criteria that reflected the closeness of the customer–supplier relationship, including number of new opportunities, respect for their need to be profitable, and willingness to involve the CDMO in early product planning.

Materials suppliers similarly named “Number of new opportunities presented to us” and “Revenues above a certain threshold”, but by much greater margins while other criteria were less common among materials suppliers. The results suggest that materials suppliers have a more transactional perspective than CDMOs.

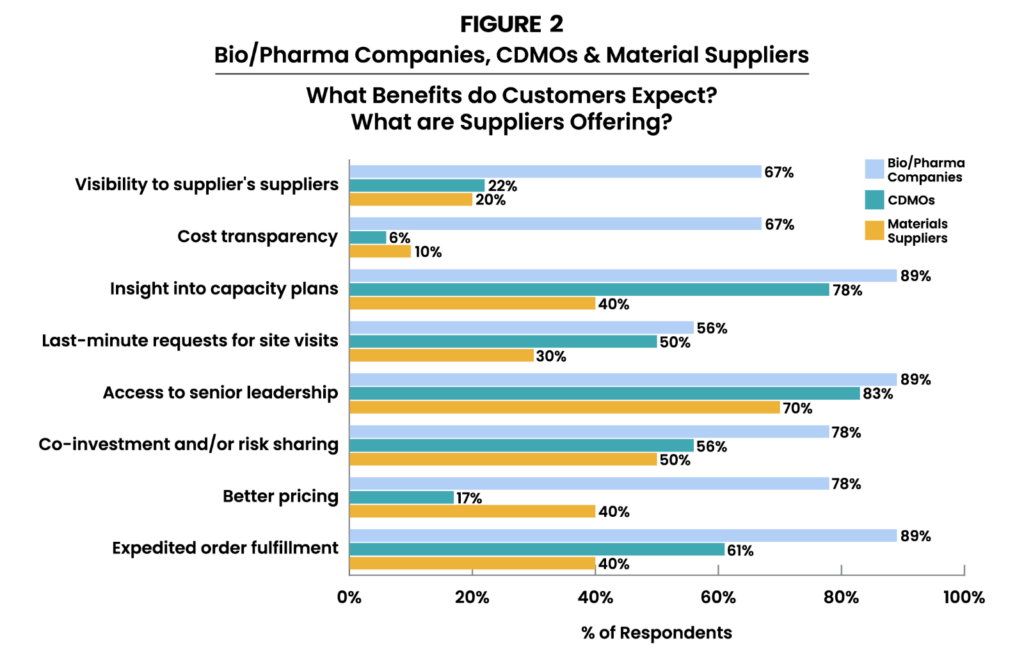

Benefits of being a Customer of Choice. Suppliers generally are willing to offer a broad array of benefits to their Customers of Choice. Most of those benefits reflect the opportunity to build closer collaboration between supplier and customer, including insight into capacity plans, risk sharing and co-investment, and more interaction with senior leadership. Fewer than 50% of suppliers named “better pricing” as a benefit of being a Customer of Choice, but more materials suppliers than CDMOs appear to offer that (see Figure 2).

Source: Drug, Chemical & Associated Technologies Association (DCAT) Report, What Makes A Customer of Choice: Are Pharma Companies & Suppliers Aligned? (May 2025).

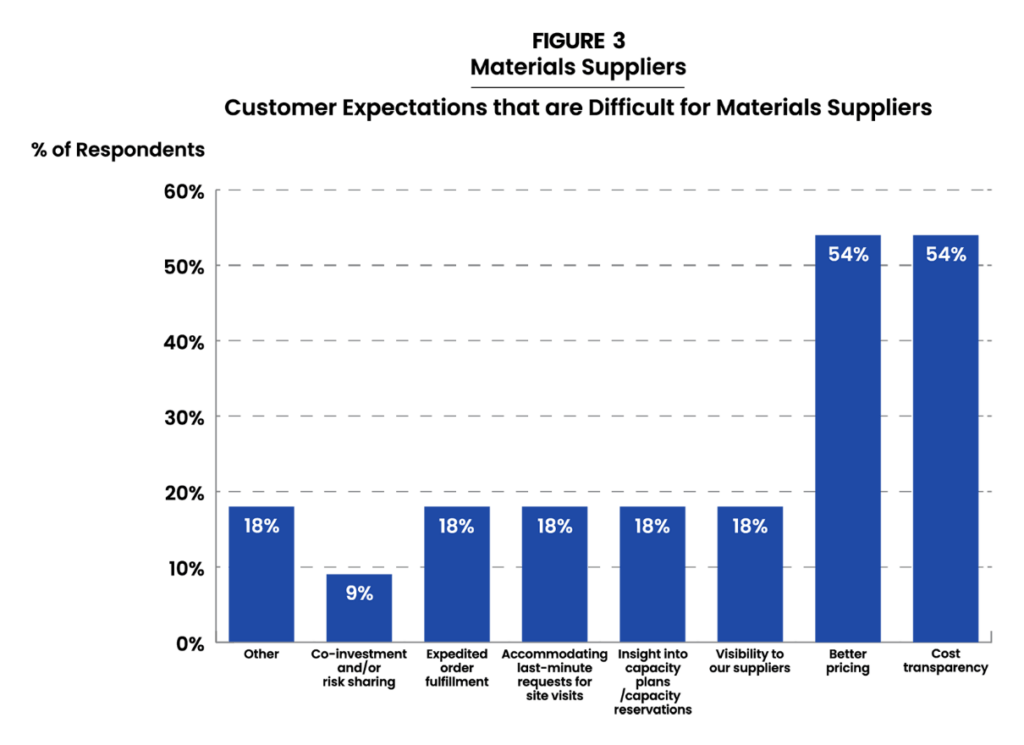

As customers, bio/pharma companies expect a full array of benefits from being designated a Customer of Choice, including the ones suppliers are quite willing to offer and a few that they are not. In particular, both materials suppliers and CDMOs are very reluctant to accede to bio/pharma companies’ expectations of access to their operating cost data. They are somewhat more willing to provide visibility to their supply chains. Materials suppliers said that customer expectations of better pricing are especially difficult for them (see Figure 3) while CDMOs cited customer expectations of exclusivity as problematic.

Source: Drug, Chemical & Associated Technologies Association (DCAT) Report, What Makes A Customer of Choice: Are Pharma Companies & Suppliers Aligned? (May 2025).

Customers’ self-evaluation of their performance. It was unexpected to learn that less than half of customers regularly seek feedback from suppliers on how they, as customers, are to work with. One would expect that being perceived as a good customer would be important to bio/pharma companies wanting to maintain a smoothly operating supply chain.

CDMOs are much more likely to participate in a customer’s evaluation process than materials suppliers. Most materials suppliers said that less than 10% of their customers have a formal process for evaluating their (the customer’s) performance as a customer, but the majority of CDMOs said a significant share of their customers have some sort of process. The most common method by which bio/pharma companies are evaluated by suppliers on their performance as customers is by ad-hoc, event-driven feedback (67%), followed by monthly/ quarterly reviews (44%), annual reviews (44%), and surveys (33%). The principal criteria on which bio/pharma companies said they ask to be reviewed are information sharing and responsiveness.

Implications

The findings of the 2025 DCAT Research & Benchmarking study, What Makes a Customer of Choice: Are Pharma Companies & Suppliers Aligned? suggest that in the context of the bio/pharmaceutical industry, the concept of Customer of Choice is vague and not fully appreciated. Respondents overwhelmingly emphasized transaction-based criteria (volume, number of new opportunities) over strategic criteria. The low emphasis given to more strategic criteria by both customers and suppliers suggests that many have missed the potential value of the Customer of Choice designation even while claiming to embrace it.

In general, it seems that bio/pharma companies are more concerned with their performance as customers to their CDMOs than they are for materials suppliers. This is not unexpected given that CDMOs are often the principal (even sole) source of manufactured products for the bio/pharma company and are subject to stricter regulatory oversight than most materials suppliers. CDMOs are not readily replaced and qualifying second sources is expensive, so the supply chain risks of an uneven customer–supplier relationship may be greater. But as bio/pharma companies increasingly rely on materials suppliers for more sophisticated ingredients and delivery device components, often on a sole-source basis, they are likely to want to make sure that they stand in good stead with their materials suppliers.

The most interesting finding was how little effort many bio/pharma companies make to assess their own performance as customers. Being respectful of the supplier and reducing friction in customer–supplier interactions is not only central to being a Customer of Choice, but also just good business, especially in the context of the supply chain challenges that companies face and the critical importance of many suppliers. Ensuring that their relationship with the supplier is strong would seem critical for supply chain security and access to advantageous innovations.

So, to answer the question asked in the sub-title of this report, “Are Pharma Companies and Suppliers Aligned?,” the survey suggests that they are somewhat aligned but have a way to go.

The relationship between bio/pharma companies (especially large global companies) and their suppliers has traditionally been an uneven one, with the bio/pharma company typically holding the more influential position in the relationship. However, as products grow more complex and dependent on the contributions from external suppliers, the alignment of customers and suppliers is likely to improve.

The full report is available for download to DCAT Member Companies here.

Reference

- M. Cossio (Gartner) and R. Bowman (SupplyChainBrian), “How to Become a ‘Customer of Choice’ to Your Suppliers,” webinar, SupplyChainBrain, September 4, 2024.