Biotech Financing Trends: What Can Be Expected in 2023 & Beyond?

By Arda Ural, PhD EY Americas Industry Markets Leader, Health Sciences and Wellness

Biotech companies are facing slowing capital flow in venture capital funding and IPOs, but will Big Pharma use its financial firepower to fund M&A to close its innovation deficit?

Weakening fundamentals after recent growth

The bio/pharma industry has experienced some significant macroeconomic and legislative challenges while facing a massive wave of loss of exclusivity of its biologics portfolio since the second half of 2022, so what may be in store for 2023 as it relates to financing flow into the industry?

EY Americas Industry Markets Leader, Health Sciences and Wellness

Since its last disruption in 2010–2012 due to its first patent cliff of small molecules, the industry has benefited from a growing biologics portfolio, easy access to funding, a healthy balance sheet due to its strong cash-generation capability, no meaningful pricing pressures, and the ability to merge or acquire assets. In addition, the pandemic raised the industry’s profile as an innovator, albeit temporarily. However, that relatively favorable picture quickly turned into a challenging environment in the second half of 2022.

This has occurred in parallel to a looming innovation deficit for large bio/pharmaceutical companies. The upcoming biologics patent cliff puts an estimated $300 billion–$350 billion in revenue in jeopardy over the next three years and is expected to start eroding the industry’s top line as early as 2023. The current pipeline available to replenish the top line is limited and is heavily skewed toward earlier phases. Putting further pressure on margins in the US is the Inflation Reduction Act (IRA), which became law in August 2022 and which includes drug-pricing reforms. Notable provisions include the ability of the US government to negotiate drug prices for select high-cost, mature products under Medicare, the US government healthcare program for individuals aged 65 or older, as well as other pricing reforms such as benchmarking prices from previous years to limit year-over-year price increases as well as capping of out-of-pocket costs for drugs under Medicare. The IRA potentially limits the growth of products exposed to Medicare utilization. Drug shortages and supply-chain bottlenecks could be worsened by the geopolitical uncertainty caused by Russia’s invasion of Ukraine. Further deglobalization could significantly impact the flow of active pharmaceutical ingredients to manufacturers. Recent upheaval in the banking sector has put a spotlight on the funding challenges that have constrained small- and mid-sized biotechs for the last couple of years. With valuations normalizing from their post-pandemic high in mid-2021 and the initial public offering (IPO) window remaining closed, many biotechs are now struggling to find funding to advance their programs after years of easily accessible cash.

The financial pressures facing emerging biotechs and the patent expirations confronting the major players underline the interreliance of biotechs and Big Pharma when it comes to developing new products and bringing them successfully to market. Traditional mergers and acquisitions (M&A) are by no means the only option for driving innovation. Alternative approaches, such as building an ecosystem of partnerships and alliances, can deliver results that benefit all parties.

How biotech funding has dried up

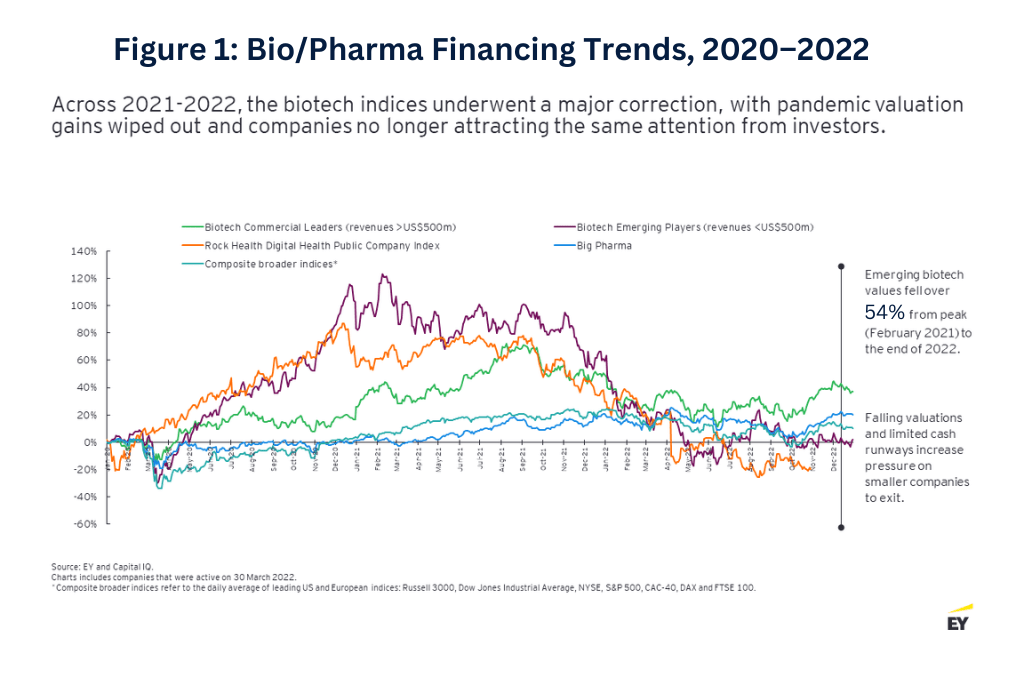

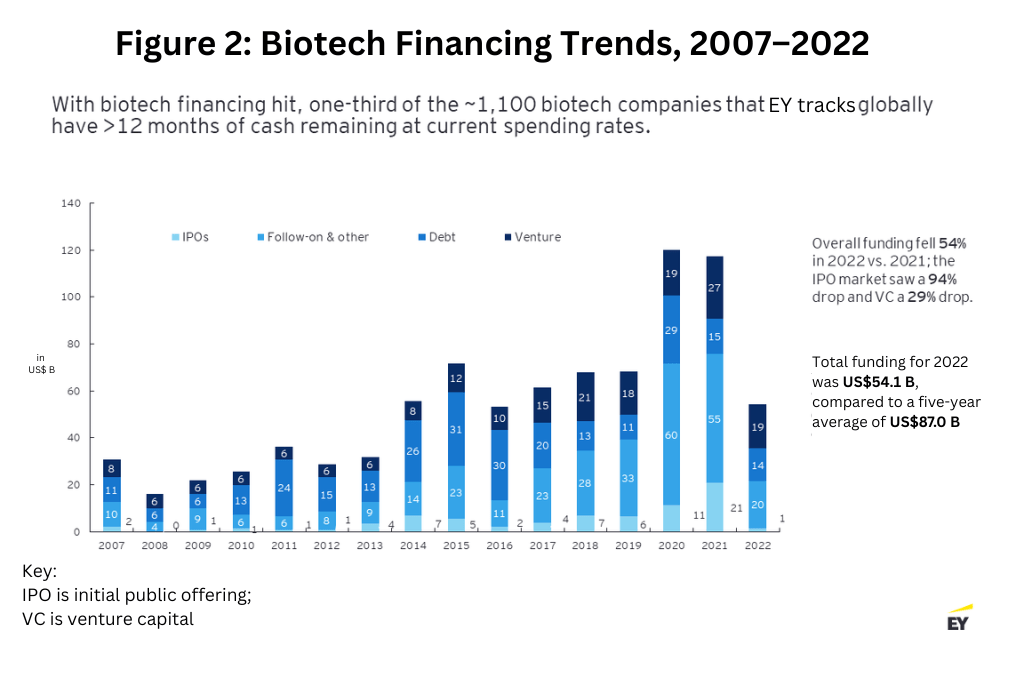

To understand how biotech got where it is today, you have to rewind five years to when times were good (see Figure 1 below). In 2018, there was an outsized number of biotech IPOs, with almost 70 biotech companies debuting on the public market, raising a total of $7 billion. It seemed as if any company—regardless of clinical data or corporate maturity—could execute an IPO. This was driven by the large venture capital (VC) funding rounds that seemed like they would never end. The VC numbers kept climbing as biotech valuations surged during the early stages of the COVID-19 crisis, and, in 2021, more than 160 biotechs completed an IPO, raising upwards of $20 billion.

This momentum came to a halt toward the end of 2021. Cross-sector funding started to fizzle out as investors from other industries became more cautious, and biotech valuations started to better reflect asset maturity and the availability of clinical trial data. Only 21 biotech companies made public offerings in 2022, and only five have sought to access the public market via this pathway as of April 2023. Overall, funding fell 54% in 2022 from the prior-year period, with VC funding also dropping 29% (see Figure 2 below).

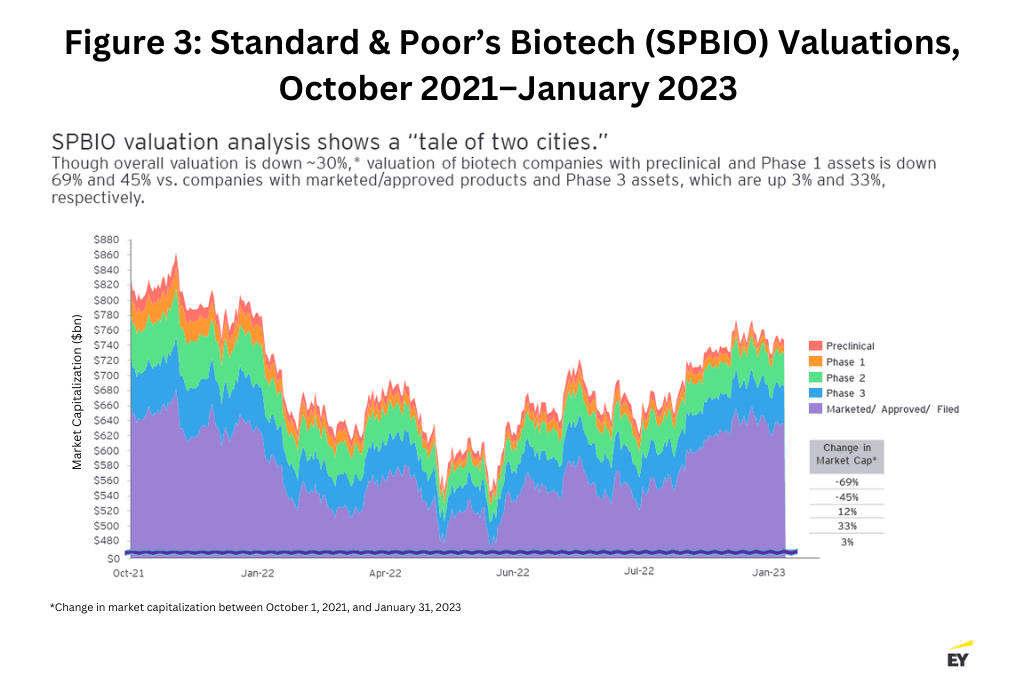

As more emphasis is once again placed on proof of concept, overall biotech valuations have dropped 30%. Those companies with assets in the preclinical phase and Phase I are down 69% and 45%, respectively, as of January 2023. Prior to the recent biotech boom years, most companies were evaluated by the strength of their clinical trial data, which accrues as the asset matures. Those standards for investing were largely ignored during the recent boom years as companies with little to no trial data were able to garner large investments based solely on promises. Those traditional standards for investment have returned, with companies that have late-stage, Phase III assets showing valuations up 33% (see Figure 3 below).

The recent failure of Silicon Valley Bank, which catered to a large number of biotech clients, showed just how little cash many biotechs actually have on hand (many small biotechs feared that they would not be able to make payroll before the government stepped in) and highlighted how little venture funding is currently available.

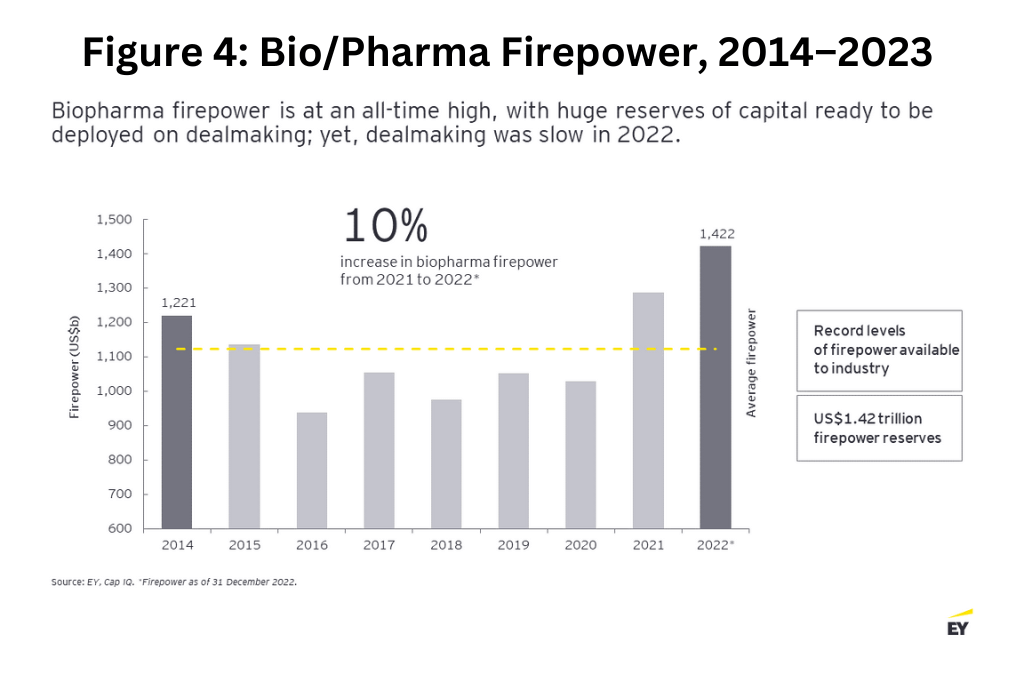

However, this restricted funding environment stands in contrast to the record levels of firepower—a company’s capacity to carry out M&A based on the strength of its balance sheet—that are available to the industry. After two years of top-line growth for bio/pharmaceutical companies driven by the therapeutics and vaccines developed to treat COVID-19, the bio/pharma industry has entered 2023 with firepower at an all-time high of $1.42 trillion (see Figure 4 below). The obvious next question: Will the big pharmaceutical companies now deploy this firepower to close the innovation gap?

What’s driving the innovation deficit?

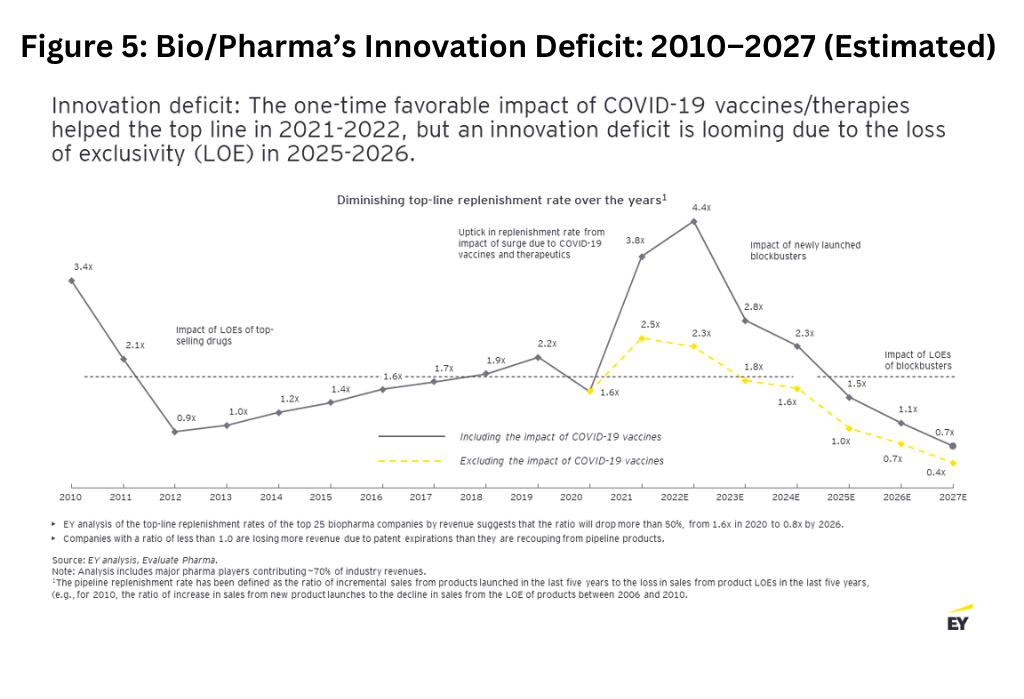

While the innovative therapeutics and vaccines that were rapidly developed in response to the COVID-19 pandemic were a shot in the arm to revenues for the industry during 2021 and 2022, the sales boost has already worn off, as reported in the last two quarter-earnings releases (fourth quarter 2022 and first quarter 2023). As with the declines seen during the waves of patent expirations in 2012, large bio/pharmaceutical companies are expected to see significant revenue erosion from 2025 onward, with $356 billion in global prescription drug sales at risk by 2028. At the same time, bio/pharmaceutical companies are taking longer to bring new drugs to market and have not had the same high drug approval rates that were seen in the years leading up to the pandemic (see Figure 5 below).

The rate of pipeline replenishment is one way to understand a company’s sales growth. The replenishment rate shows the ratio of incremental sales from products launched in the last five years to losses in sales from patent expirations over the same time period. That rate is forecast to fall from 2022 through 2026 as industry sales at risk from upcoming patent expirations outweigh sales from new products to be launched.

The EY analysis of the replenishment rates of the top 25 bio/pharma companies by revenue suggests that the ratio will drop more than 80%, from 2.5x in 2021 to 0.4x by 2027. Companies with a ratio of less than 1 are losing more sales due to having more patent expirations than what they are recouping from pipeline products. A multiple of ~1.7x is the historical average that the companies need to stay above.

This comes at a time when the IRA and other state legislation in the US are setting limits on how much bio/pharmaceutical companies can increase drug prices, thus curbing growth through pricing mechanisms.

Building an innovation and partnering ecosystem

Despite the large amount of dry powder available to Big Pharmas, M&A has been slow the last couple of years, with only $136 billion in global life-sciences M&A during 2022, down 39% from the prior year, according to the 11th edition of the annual EY M&A Firepower report.

The industry hasn’t seen many large, transformative transactions recently, with only three megadeals announced since the beginning of 2021 in the pharma space. Medtech hasn’t been much different, with only four megadeals announced during that same time frame. The life-sciences industry’s generally cautious M&A stance aligns with broader, global dealmaking trends, with an overall drop in 2022 M&A investment worldwide reflecting the uncertainties of ongoing macroeconomic volatility, heightened by ongoing geopolitical tensions.

The deal landscape has instead been dominated by “bolt-on” acquisitions, allowing Big Pharma to bolster pipelines with one or two bolt-on assets at a time. It has also been a boom time for strategic alliances, with Pharma making more than double the alliances by volume on a quarterly basis than traditional acquisitions.

During the first quarter of 2023, eight bolt-on deals were announced, along with one transformative deal: Pfizer’s announced acquisition of Seagen. That $43-billion deal was the driver of deal value during the first quarter of 2023, making up a majority of the $52.3 billion in total deal value for the first three months of 2023.

Despite the limited activity in 2022 and ongoing global disruption, a fourth-quarter spike in dealmaking underscores that the life-sciences industry has strong structural factors favoring M&A and ecosystem-building. Following the market corrections of 2021–2022, the valuation drop in the biotech sector could also increase the incentives to acquire as a “buyer’s market” takes shape.

Life-sciences executives understand that an ecosystem model can provide significant advantages over traditional business approaches, according to the EY Ecosystem Survey, which included more than 100 life-sciences C-suite executives.

Ecosystems are business arrangements between two or more entities that are designed to create and share a higher level of value collectively for a common set of customers than the members can create individually, considering time, capital, brand permission, market access and other real-world constraints.

Building an ecosystem of alliances and partnerships allows companies to reduce costs while driving efficiencies. For instance, an alliance around a joint manufacturing facility will allow for supply-chain agility while incurring significantly lower costs for each participating bio/pharma company compared to, for example, end-to-end supply-chain localization.

Meanwhile, R&D alliances can give companies greater access to talent while also improving the likelihood of R&D success and fostering innovation. These sorts of partnerships also reduce the risk for any one company.

Entering into alliances for promising assets early with an option to acquire in Phase II could provide a good balance between risk and return compared to developing products in-house, potentially maximizing the value of assets. For smaller biotechs, linking with a larger company can provide the scale and commercial capabilities to bring a drug to market.

Ernst & Young LLP has identified three areas of focus for executives as they think about their dealmaking strategy as outlined below.

De-risk assets by investing in early partnerships or alliances that could lead to acquisition: A dealmaking model that allows for greater investment as assets mature and have more clinical data to back them up provides larger companies with some insulation against failure when investing in high-risk, high-reward therapeutics. It also gives smaller biotechs access to funding and expertise to get them to the next milestone.

Focus on platforms or technologies that could help secure future growth: The life-sciences industry is in a renaissance age of innovation and technology. Advancements in cell and gene therapies, personalized medicine, data analytics, and platform technologies are moving at a rapid pace and shifting the way patients receive care. Investing in the right technologies now will provide growth in dividends beyond just a single asset.

Have the processes and systems in place to seamlessly integrate companies and technologies: Whether conducting traditional M&A or building an ecosystem, having connective technologies that can allow for integration quickly will allow companies to focus on the science instead of the administration.

Whether large pharma or small biotech, the atmosphere is abundant with an opportunity for both. While traditional avenues of funding and exits for biotech may be harder to come by than in recent years, biotechs can capitalize on the need for pharma to fill their pipeline and access exciting innovations. For large pharma, current market conditions are likely to mean that adding new innovations to their lineup will come at a discount.

Arda Ural, PhD, is EY Americas Industry Markets Leader, Health Sciences and Wellness.

The views reflected in this article are the views of the author and do not necessarily reflect the views of Ernst & Young LLP or other members of the global EY organization.