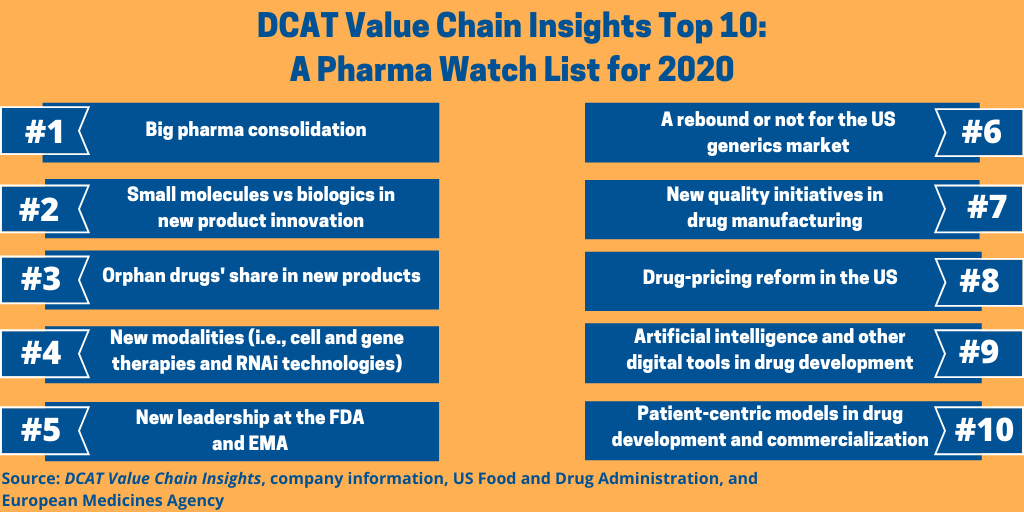

A Top 10 Pharma Watch List for 2020

With 2020 underway, what are key developments and trends in the pharmaceutical industry that are on the industry’s radar for this year? DCAT Value Chain Insights provides its Top 10 Pharma Watch List for 2020.

The Top 10 Pharma Watch List for 2020

1. Big Pharma consolidation. On the top of the list for 2020 is the impact of merger and acquisition activity among the large pharmaceutical companies. Last year (2019) saw three mega-mergers: the $74-billion acquisition of Celgene by Bristol-Myers Squibb, which was announced in January 2019 and completed in November 2019; AbbVie’s pending $63-billion acquisition of Allergan, which was announced in June 2019 and is expected to close in the first quarter of 2020; and Takeda’s $62-billion acquisition of Shire. Announced in 2018, Takeda completed its $62-billion of Shire in January 2019, making it the first mega-merger of 2019.

These acquisitions not only shuffle the rankings of the top 20 pharmaceutical companies, but in raising the critical mass of the combined companies, the deals raise the question of what other major deals may be in the offing for 2020.

2. Small molecule versus biologics. On a product level, small molecules still lead over biologics among all marketed drugs and in recent new drug approvals, but with the industry’s early-stage pipeline now balanced roughly 50:50 among small molecules and biologics, the question is how will biologics fare in 2020 and beyond?

Small molecules dominated in approvals of new molecular entities by the US Food and Drug Administration’s (FDA) Center for Drug Evaluation and Research (CDER) in 2018 with 42 (71% of NME approvals) compared to 17 biologic-based NME approvals (29% of NME approvals), which included one antibody drug conjugate (ADC). This product mix in 2018 is consistent with NME approvals in 2017 and with recent years with the exception of 2016. In 2017, small-molecule NME approvals accounted for 74% of new drug approvals and biologics 26%. Between 2010 and 2015, small molecules accounted for between 71% and 81% of NME approvals. The exception was in 2016, when a lower number of NME approvals occurred with 22 NME approvals, which included 13 small-molecule NME approvals or 59%.

3. Orphan drugs’ share of new drug approvals. Orphan drugs, defined as drugs to treat rare diseases or conditions and by the FDA as drugs that treat 200,000 or less people, have been a mainstay of recent new drug approvals by the FDA over the last several years, and for 2020, the question is whether that trend will continue.

Overall, orphan drugs have accounted for more than 40% of NME approvals by the FDA and reached a recent high of 59% of NME approvals in 2018. In 2019, 21 of FDA’s 48 novel drug approvals (44%) were orphan drugs, and in 2018, 34 of CDER’s 59 novel drugs (58%) were approved to treat rare or orphan diseases. In 2017, 18 of CDER’s 46 novel drugs (39%) were approved to treat rare or orphan disease. In 2016, 41% or 9 of the 22 NMEs approved by the FDA were orphan drugs. In 2015, 47%, or 21 of the 45 NMES approved by the FDA were for orphan drugs.

Orphan-drug designation qualifies the sponsor of the drug for various development incentives, including tax credits for qualified clinical testing, certain exemptions from prescription-drug user fees, and incentives for market exclusivity. In addition, given the niche nature of orphan drug, market competition is often limited, and the orphan drug is serving an unmet medical need, thereby having a market, although smaller market, for the drug. These conditions have laid the foundation for increased orphan-drug development.

4. New modalities (i.e., cell and gene therapies and RNAi technologies). Although a niche modality, cell and gene therapies have been a recent active area of investment by pharmaceutical companies to add products to their pipelines and manufacturing capabilities and by certain contract development and manufacturing organizations (CDMOs) to add capabilities in this area, and for 2020, key items to watch are continued deal-making and product progression in this area.

Among the key deals were: Roche’s $4.3-billion acquisition of Spark Therapeutics, a commercial gene-therapy company based in Philadelphia, in 2019; Novartis’ acquisition in 2019 of CELLforCURE, a CDMO of cell and gene therapies in Europe, from LFB, a French pharmaceutical company, which included a cell and gene manufacturing facility located outside of Paris in Les Ulis, France and the related adjacent land; Novartis’ $8.9-billion acquisition in 2018 of AveXis, a gene-therapy company, and subsequent FDA approval of the gene therapy, Zolgensma (onasemnogene abeparvovec-xioi), for treating pediatric patients with spinal muscular atrophy, a rare neuromuscular disorder; Gilead Sciences’ $11.9-billion acquisition of Kite Pharma in 2017 and subsequent manufacturing expansion at its facilities in California; and among CDMOs in 2019, Catalent’s $1.2-billion acquisition of Paragon Bioservices, a Baltimore, Maryland-based contract provider of viral vector development and manufacturing services for gene therapies, and Thermo Fisher Scientific’s $1.7-billion acquisition of Brammer Bio, a CDMO of viral vector manufacturing for gene and cell therapies.

5. New leadership at the FDA and the EMA. Important to the pharmaceutical industry on a policy level in 2020 will be new leadership at both the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) and what changes, if any, may be forthcoming in the policy direction of those two agencies. In the US, Dr. Stephen Hahn, Chief Medical Executive at the University of Texas MD Anderson Cancer Center in Houston, Texas and Professor in the Department of Radiation Oncology, Division of Radiation Oncology at MD Anderson, was confirmed as the new FDA Commissioner last month (December 2019). Dr. Hahn succeeds FDA Acting Commissioner Dr. Norman Sharpless, who served from April 5, 2019 to November 1, 2019, following FDA Commissioner Scott Gottlieb stepping down from his post earlier in 2019.

At the same time, the EMA is moving forward with plans to find a new Executive Director. The current EMA Executive Director, Guido Rasi, who has served for two terms, is set to step down when his term comes to an end in November 2020. The new Executive Director will be the fourth in EMA’s history. Rasi has served two five-year terms as the EMA’s leader and will be completing his second five-year term in November 2020.

6. A rebound or not for the US generics market. Always a cost-competitive market, the generics market, particularly the US market, has seen recent restructuring due to product and cost pressures and a key issue going forward is how the market will shape out in 2020. One new player will be the combination of Mylan and Pfizer’s off-patent and generic drug business (Upjohn), a deal announced in 2019 and expected to close in 2020, as the latest trying to improve performance in generics. With other large generic-drug companies, such as Novartis’ Sandoz and Teva also restructuring over the past several years, the question for 2020 is can improved performance in generics be achieved?

7. Drug-manufacturing quality. One of the important news stories that surfaced in 2018 and that continued in 2019 was increased focus on drug-manufacturing quality relating to company recalls and investigations by the FDA and the EMA into nitrosamine impurities into certain active pharmaceutical ingredients (APIs), most notably “sartan”-containing APIs, used in anti-hypertensive and cardiovascular drugs, such as valsartan candesartan, irbesartan, losartan, and olmesartan, and later into prescription and over-the-counter forms of ranitidine, a H2 (histamine-2) blocker used to decrease the amount of acid created by the stomach. Last month (December 2019), the FDA also began investigating the potential of nitrosamine impurities in the diabetes drug, metformin. These investigations raise issues whether other drugs will become subject to further examination and how regulatory agencies will further update or refine impurity testing for chemically produced APIs.

8. Drug-pricing reform in the US. Drug pricing in the US has been a hot topic of debate on both the federal level with policy proposals from the Trump Administration and Congress as well as on individual state levels. On the federal level, healthcare reform is one of the leading issues for the US Presidential election in 2020. Drug pricing factors into that debate, and there already have been several legislative proposals to address ways to lower the cost of prescription drugs in the US. Suggested reforms to date have included a system of linking US drug pricing to international drug pricing for certain drugs, penalties imposed on drug manufacturers for not entering into negotiations with the US federal government on drug pricing for a specified number of drugs annually, and a proposal to establish a US federal agency overseeing drug pricing. What will emerge from these policy debates from a myriad of stakeholders, including the pharmaceutical industry, is not yet known, but it will certainly be a key issue for 2020.

9. Artificial intelligence and other digital tools in drug development. Ways to improve the drug-development process are always a high priority for the pharmaceutical industry, and the advancement of digital tools, such as artificial intelligence (AI) is a key development to watch for in 2020. A recent analysis by Deloitte, which cited research from MarketsandMarkets, notes that the market for AI in the biopharma industry is expected to increase from $198.3 million in 2018 to $3.88 billion in 2025, with a compound annual growth rate of 52.9%. The four applications projected to drive the majority of the AI market in biopharma between 2018 and 2025 include: drug discovery, precision medicine, medical imaging & diagnostics, and research.

10. Patient-centric models in drug development and commercialization. Whether it is the continued movement to precision medicine in drug development, the role of real-world data in clinical trials, or the application of wearables or other forms of biometric monitoring, more patient-oriented approaches will continue to guide drug development and commercialization strategies in 2020.