Brexit: What is Next for the UK, EU and the Pharma Industry?

It has been four years this week (June 23, 2016) since UK voters approved a referendum for the UK to exit the EU (i.e., Brexit). Whether the UK will have a deal or not in forming its future relationship with the EU is still on the negotiating table as the deadline for reaching a deal looms. Where do talks stand, and what is the pharma industry seeking?

Brexit: where it stands

After a multi-year process to exit the EU, the UK officially exited the EU on January 31, 2020 and entered into a 11-month transition period until the end of 2020 to work out or not its future relationship with the EU. During the transition period, EU law and rules are still applicable across the UK, and the UK remains part of the EU single market and custom union. The UK will formally exit the EU in all ways by the end of the transition period on December 31, 2020. Both the EU and UK have until the end of this month (June 30, 2020) to extend the transition period. Although the EU is willing to extend the transition period, UK Prime Minister Boris Johnson has remained firm that the UK will not seek an extension, a point that Ursula von der Leyen, President of the EU Commission made clear earlier this month (June 2020) following a meeting with Johnson and UK officials.

Although the novel coronavirus (COVID-19) pandemic put a working pause on Brexit negotiations, they are scheduled to begin again and with no extension of the transition period in play, the need to move negotiations along is pressing. “One, on our side, have always been ready to grant an extension,” said von der Leyen, in a June 17, 2020 statement. “But it takes two to tango. This means that we are now half-way through these negotiations – with five months left to go. But we are definitely not half-way through the work to reach an agreement. With little time ahead of us, we will do all in our power to reach an agreement. We will be constructive, as we have always been. And we are ready to be creative, to find common ground where there seems to be none.”

The EU has put forth four main areas that it seems critical to reaching a deal with the UK and which von der Leyen emphasized in her June 17, 2020 comments. These include: (1) a level playing field or fair competition, such as using common labor and environmental laws—although the UK is not opposed to fair competition it does not want to be subject to EU laws; (2) governance mechanisms; (3) police and judicial cooperation, including a role for the EU’s judicial body, the Court of Justice of the EU, an issue to which the UK opposes to be subject to EU judicial authority; and (4) fisheries—the UK wants access to EU markets for its seafood and the EU wants access to UK waters, a point of disagreement between the two parties. Both sides want to have a tariff-free, quota-free trade deal ready for when the transition period ends.

The EU is said to want to achieve a deal by the end of October (October 2020), so that such a plan could be approved and ratified by the end of the Brexit transition period. Published reports say that the UK’s Johnson is seeking a quicker timeline to achieve a deal by the end of July (July 2020).

The pharma industry and Brexit

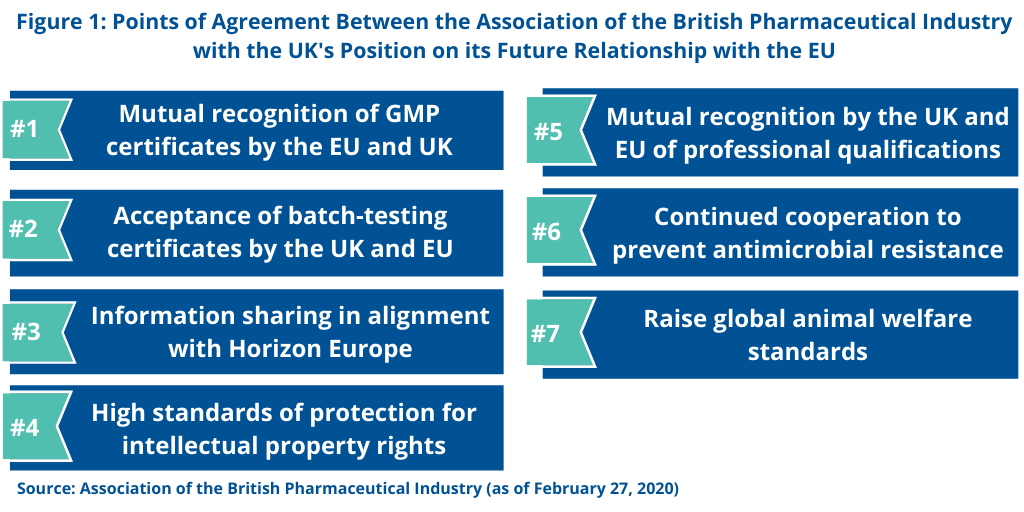

The pharmaceutical industry has long supported throughout for what has become a multi-year process to effectuate a deal between the UK and EU in Brexit to ensure access and supply of medicines. In its most recent statement, issued earlier this year (February 2020), the Association of the British Pharmaceutical Industry (ABPI), which represents research-based innovative pharmaceutical companies specified several goals of the UK government in which the UK pharmaceutical industry supports (see Figure 1). First is an annex of medicinal products that support mutual recognition of GMP certificates and acceptance of batch-testing certificates by the regulatory authorities of the UK and EU. The ABPI is also supporting information sharing, so that regulators can safeguard patient safety and public health. Additionally, the ABPI supports the UK government’s position for participation in Horizon Europe. Horizon Europe is an EUR 100 billion ($113 billon) research and innovation program funded by the European Commission over seven year (2021-2027) to succeed Horizon 2020, the current EU research and innovation program with nearly EUR 80 billion ($91 billion) of funding available over seven years (2014 to 2020). In setting forth the missions or focus areas of Horizon Europe, cancer research is one targeted area. The other focus areas are: adaptation to climate change, including societal transformation; healthy oceans, seas, coastal and inland waters; climate-neutral and smart cites; and soil health and food.

The ABPI is further supporting high standards for the protection of intellectual property rights as well as mutual recognition of professional qualifications. Additionally, the ABPI supports the UK’s goals to have continued cooperation to prevent antimicrobial resistance and to raise global animal welfare standards.

EU pharma groups seek further priorities in wake of COVID-19

In wake of COVID-19, which has underscored issues of economic equity, access to healthcare, including medicines, and the importance of robust drug supply chains, a group of 18 pan-European healthcare stakeholders, issued a statement this month (June 2020), “COVID-19 and Brexit – Protecting Patients across Europe from Pandemics” which highlights the importance of addressing health issues as part of the agreement on the future relationship between the EU and the UK. The statement was signed by 18 pan-European pharmaceutical and healthcare organizations including: the European Federation of Pharmaceutical Industries and Associations (EFPIA), which represents innovator, research-based pharmaceutical companies in Europe and Medicines for Europe, which represents biosimilar and generic-drug manufacturers in Europe.

“Coronavirus has challenged the whole world, not just Europe and not just the EU,” said the June 19, 2020 statement. “It has exacerbated and exposed the vulnerability of our health, health systems and societies. It has brought to the forefront issues such as shortages and unequal access to medicines and personal protective equipment (PPE); the importance of global supply chains and continued supply of medicines; the negative effects of export bans, stockpiling requirements and other restrictions; the importance of international collaboration in maintaining open and resilient supply chains, and in a strong framework for innovation and research; as well as under-investment and slow uptake of new technologies and treatments.

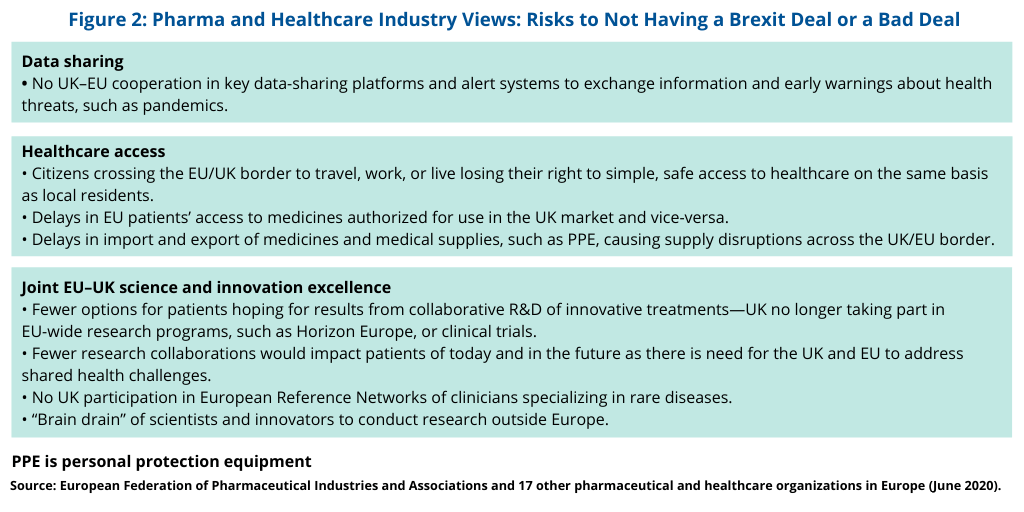

The pharmaceutical and healthcare groups outlined in their statement the risks of having a no deal or a bad deal with respect to the UK leaving the EU (see Figure 2) in light of pandemic risks and the need to come to a consensus between the UK and the EU. “Time is running out to conclude a deal before the post-Brexit ‘transition period’ ends on 31 December 2020,” said the pharmaceutical and healthcare groups in their statement. “Health issues are largely absent from the negotiators’ agenda. There is a danger that a deal could be struck that fails to address health-security issues for patients across Europe, or even that the talks could collapse and result in no agreement at all.”

The groups outlined risks with respect to data sharing, healthcare access, and innovation (see Figure 2). With respect to data-sharing, they point out that the current negotiations reflect that there is no UK–EU cooperation in key data-sharing platforms and alert systems to exchange information and early warnings about health threats, such as pandemics. The group also point to limitations in healthcare access without a Brexit deal, including the loss of healthcare access for citizens crossing the EU/UK border to travel, work, or live; delays in EU patients’ access to medicines authorized for use in the UK market and vice-versa; and delays in import and export of medicines and medical supplies, such as PPE, causing supply disruptions across the UK/EU border. They further identify loss of pharmaceutical and healthcare innovation if a Brexit deal were not to come to fruition, including the loss of the UK’s participation in important EU research collaborations, such as Horizon Europe, an EU-funded investment program for R&D; no UK participation in the European Reference Networks of clinicians specializing in rare diseases; and a “brain drain” of scientists and innovators to conduct research outside Europe (see Figure 2).

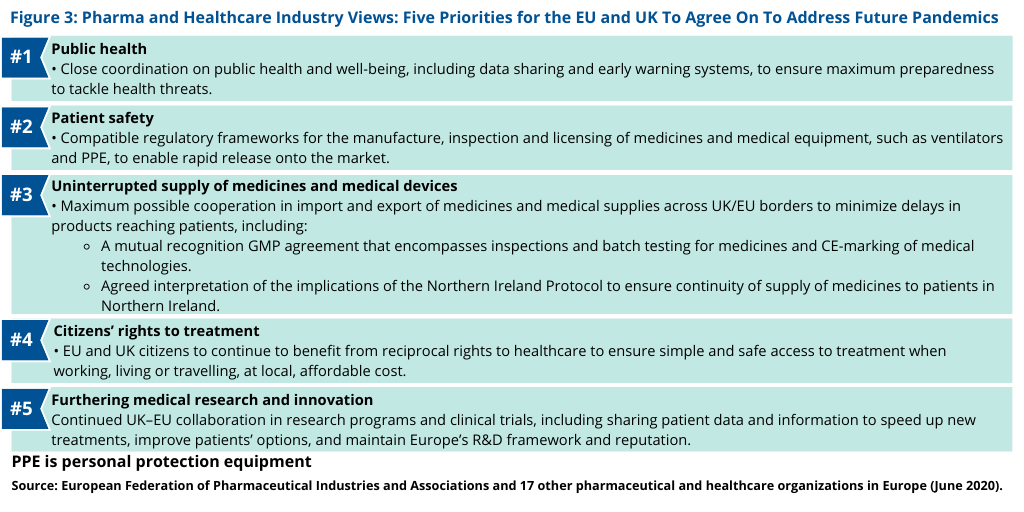

To address these issues, the pharmaceutical and healthcare groups, which includes the EFPIA and Medicines for Europe, have identified five priorities with respect to pandemic preparedness for the UK and the EU to address in their Brexit negotiations (see Figure 3), including with respect to pharmaceutical supply. These include: (1) close coordination on public health and well-being, including data sharing and early health warning systems; (2) compatible regulatory frameworks for the manufacture, inspection and licensing of medicines and medical equipment such as ventilators and PPE to enable rapid release onto the market; and (3) maximum possible cooperation in import and export of medicines and medical supplies across UK/EU borders, which would include a mutual recognition agreement on GMP for inspections and batch testing of medicines and an agreed-to interpretation of the implications of the Northern Ireland Protocol to ensure continuity of supply of medicines to patients in Northern Ireland (see Figure 3). The pharmaceutical and healthcare groups are also calling for (4) the EU and UK citizens to continue to benefit from reciprocal rights and (5) for continued UK–EU collaboration in research programs and clinical trials, including sharing patient data and information to speed up new treatments, improve patients’ options, and maintain Europe’s R&D framework for investments into research (see Figure 3).