CDMOs Ride Momentum into 2022

The CDMO sector experienced a strong 2021, but the question for 2022 is whether momentum continues as macroeconomic headwinds create uncertainty.

By Jim Miller, Content Advisor/Consultant, DCAT

The CDMO industry exited 2020 on a wave of momentum driven by the response to the COVID-19 pandemic. CDMOs provided development and manufacturing capacity for new vaccines and therapeutics while interest rate cuts by the US Federal Reserve and other central banks unleashed a surge of funds into high-risk assets, including venture capital and initial public offerings (IPOs) for emerging bio/pharma companies.

CDMOs rode the 2020 wave into 2021: new funding flooded the market, the pipeline continued to expand, revenues grew at a double-digit rate, and valuations of CDMOs skyrocketed. That momentum continues as we enter 2022, but there are growing signs that the wave may crest this year as financial conditions become less favorable, excesses are wrung from the bio/pharma industry, and resource constraints impact industry growth and performance.

Healthy demand

Financial results for those CDMOs that publish them (including Lonza, Catalent, Siegfried, Bachem, and Dottikon) reported revenue and profit growth in the 10–20% range through mid-year 2021, and anecdotal reports suggest that those are representative of the industry overall.

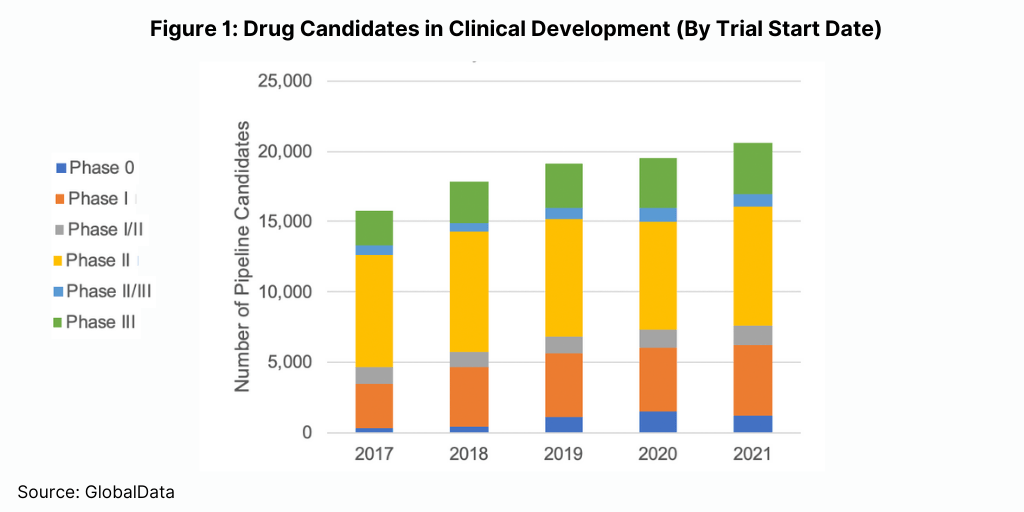

Demand for CDMO services grew due to heightened drug development and manufacturing activity, much of it not tied to the COVID response. According to data compiled by the investment bank William Blair & Company, R&D spending by both large and small bio/pharma companies grew more than 10% for the year. Further, according to data from GlobalData (see Figure 1), the number of drug candidates in clinical development grew about 7% for the year. That followed a difficult 2020 when the COVID-19 outbreak slowed or shut down many clinical trials.

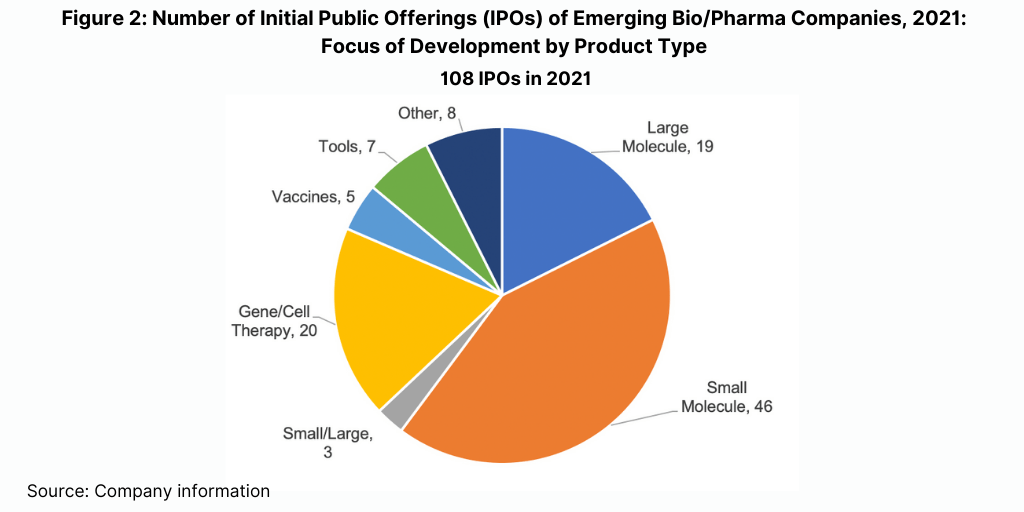

Emerging bio/pharma companies, which are highly dependent on CDMOs, continued to raise large amounts of capital from public offerings and venture capital. Companies raised over $100 billion in 2021, according to data from William Blair & Company, a level below what companies raised in an extraordinary 2020 but well above any other year. Of those companies that went public in 2021, 45% are developing small-molecule candidates (which will surprise many industry observers) while 36% are developing biologics (excluding vaccines), including gene and cell therapies, monoclonal antibodies, and recombinant proteins (see Figure 2).

Funding outlook is uncertain

While 2020 and 2021 were outstanding years for fundraising by CDMO customers, the outlook for 2022 is highly uncertain as the industry enters the year. Central banks are tightening financial conditions in order to dampen high rates of inflation. While interest rates will still be low relative to long-term historical trends, they will be significantly higher than what investors have been used to since the global financial crisis of 2008/2009.

Rising interest rates could reduce the amount of funding emerging bio/pharma companies are able to raise through initial and secondary public offerings and venture capital. That would happen because valuations will decline as discount rates rise, and because higher interest rates will make less-risky investments more attractive. A compounding factor will be disappointing clinical results, which are endemic to emerging bio/pharma companies, but could scare off newcomers to the biotech sector (“tourists” in venture capital parlance).

In fact, valuations of emerging bio/pharma companies have been declining for some time. One indicator of emerging bio/pharma stock valuations, the S&P Biotechnology Select Industry Index, has dropped 35% since it peaked in early February 2021, and 15% from its level in early November 2021. Further, bio/pharma IPO activity dropped sharply in the last quarter of 2021, and the stock prices of 80% of the emerging bio/pharma companies that went public in 2021 were below their IPO price by year-end.

So fewer companies are likely to go public in 2022, and those that do could end up raising less money. That is unlikely to have much impact on CDMO performance in 2022, as 2021 was still a banner year for emerging biopharma fundraising, and many of those companies have substantial cash in the bank. They should have ample resources to buy development services, but they may slow their rate of spend (and be more price sensitive) if they are uncertain about their ability to raise new funds in the future. Any slowdown in demand could be troublesome for CDMOs because so much new capacity is due to come on line in the next two years.

Surging valuations in M&A

Given the robust performance and favorable market conditions, it’s not surprising that the CDMO industry experienced a lot of merger and acquisition (M&A) activity in 2021, but the scale was jaw-dropping. There were at least 60 deals announced or completed in the year, including 45 company acquisitions and 15 facility acquisitions. According to the investment bank RBC Capital Markets, the value of CDMO acquisitions in 2021 totaled almost $37 billion, more than three times the value of 2020 deals.

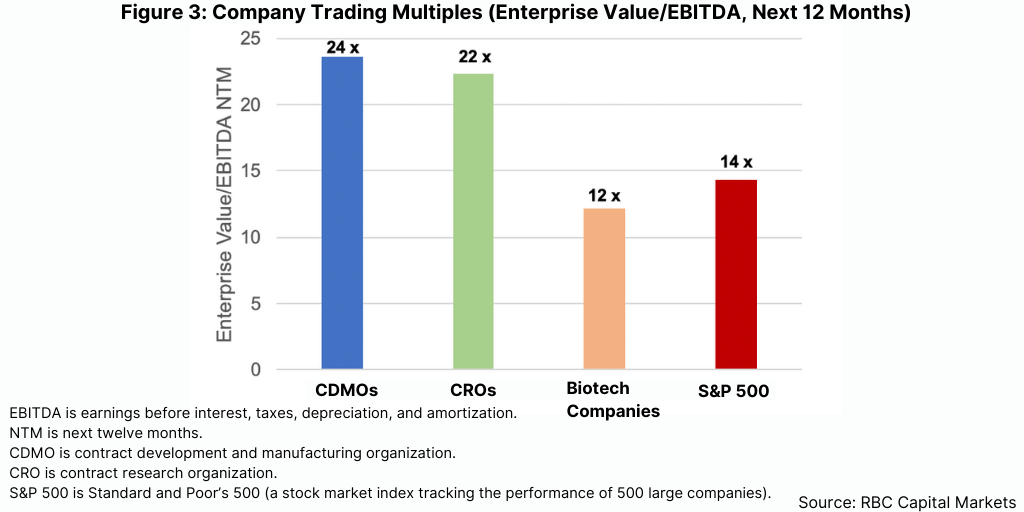

The valuations that buyers placed on the CDMOs they acquired were truly mind-blowing. RBC Capital Markets calculated that the average deal valued the acquired CDMO at approximately 18 times its last 12 month’s EBITDA (earnings before interest, tax, depreciation, and amortization expenses) compared to approximately 14x in 2020. The publicly traded CDMOs currently trade at almost 24x next 12 month’s EBITDA on average, second only to that of the life-science tools industry and nearly twice the EBITDA multiple of Standard & Poor’s 500 (see Figure 3).

The deal activity reflected multiple factors, including the attractiveness of the industry due to its growth and profit margin characteristics, the strategies of companies to add to their drug- delivery and processing technologies, and the need to achieve greater scale and breadth of services. Acquisitions were spread across most major industry sub-segments, including solid dose, injectables, and large- and small-molecule drug substance. Surprisingly, oral solid dose had the most deals; many of those involved companies with specialized processing capabilities or facilities shed by major pharma companies.

While there were some large, potentially transformative deals, several stood out because of their unusual nature as outlined below.

- Phillip Morris International, best known as a manufacturer of cigarettes with no presence in the pharmaceutical industry, acquired two CDMOs with specialized drug- delivery capabilities: Vectura, a UK-based manufacturer of inhalation products, and Fertin, a Danish manufacturer of specialty oral formulations, including chewing gum and fast-dissolving tablets. Those deals were driven by Phillip Morris’s “Beyond Nicotine” strategy, announced in February (February 2021), which set a goal to generate more than 50% of its total net revenues (at least $1 billion) from smoke-free products by 2025 by leveraging its expertise in inhalation and aerosolization into adjacent areas, including respiratory drug delivery and selfcare wellness.

- Two publicly traded CDMOs were taken private by private equity firms during the year: Stockholm-based Recipharm was acquired by EQT while UDG, the parent of contract packager, Sharp, was taken over by an affiliate of Clayton Dubilier & Rice. There is precedence for such go-private deals in the pharma services space, notably the private equity acquisitions of CDMOs—Patheon, Catalent, AMRI (now Curia), and Cambrex— and clinical CROs, PPD and Parexel. Private ownership gives the companies time and space to fix operating and financial issues before re-entering public ownership.

This year (2022) could be another big year for CDMO M&A. Industry dynamics are still attractive, investors still want in, and a number of companies with revenues in the $500-million to $1-billion range could come to market. Higher interest rates could dampen valuations by increasing discount rates and by raising the cost of the debt used to finance deals. Nevertheless, many strategic and private equity investors remain anxious to get into the business or add to their positions, so sellers are still likely to get attractive returns, even if valuations are not quite so rich as in 2021.

Other sources of uncertainty

Several other factors could challenge CDMO growth prospects and profit margins.

Higher interest rates will mean higher debt servicing costs, especially for those CDMOs that carry acquisition debt and those that are borrowing to finance new capital expenditures. The largest CDMOs, especially those owned by large multinational companies, will have ready access to capital at favorable rates, but smaller CDMOs could feel some pain as they race to keep up with demand.

Capital investment is placing big demands on CDMO cash flows: announced CDMO industry capital investment is in the range of $10 billion to $15 billion, much of it in biologics, cell and gene therapies, and injectables. For instance, there are more than 60 new vial-filling lines that have been announced or have recently come on line. The big effort to expand capacity has increased the cost and delivery times for new equipment, and that has been compounded by capacity shortages and inflation throughout the economy. Capacity expansion will continue because the demand for services is strong, but the assumptions that drove those investments may need to be re-visited and the returns on that investment could be negatively impacted by the rising costs.

Another cost challenge facing CDMOs is the intense battle for scientific, technical, and professional talent going on in the bio/pharma industry, and across the entire economy. The industry is experiencing high turnover and high vacancy rates as companies compete for talent to fill vacancies, drive growth, and staff their expanded laboratory and manufacturing capacity. Further, CDMOs are competing with emerging bio/pharma start-ups and established biopharma companies for talent and may be challenged to offer competitive compensation packages.

An additional cost challenge for CDMOs comes from key production inputs, including vials and syringes, single-use change parts, and some active pharmaceutical ingredients. CDMOs began managing through cost and availability issues in 2020 and while conditions have improved somewhat, there is still a lot of supply-chain uncertainty.

Rising costs will be a challenge for CDMO executives through 2022, and probably beyond. CDMOs have limited room to raise prices because much of their business comes from long-term commercial contracts and because their customers often pressure them on costs. Given current market demand for services and supply-chain constraints, it may be a seller’s market, but the prices that CDMOs can charge are not infinitely elastic.

Expectations vs. reality

The CDMO industry is entering 2022 with the wind at its back, but it’s likely to encounter some headwinds that will slow its momentum. Industry executives will need to manage through a tougher environment and start planning for, or at least consider, some less favorable scenarios in subsequent years.

Understand that this is an issue of expectations versus a changing reality, and of the need for more circumspection and less unbridled enthusiasm. CDMO valuations in the range of 15–20 times EBITDA embody a highly optimistic outlook on the future that may not be quite so rosy, especially in the near term. There is little doubt that contract drug development and manufacturing is a great business, that it has been a gamechanger for the bio/pharma industry, and that it is permanently part of how bio/pharma companies do business. But it is not immune to macroeconomic conditions, and those conditions could be more difficult over the next few years.