Challenging Years Are Ahead for the Biopharma Industry

A recent DCAT webinar, featuring Graham Lewis, Vice President, Global Pharma Strategy, IQVIA, evaluates the market impact on the COVID-19 pandemic on pharmaceutical industry performance and how fundamentals and growth prospects have been affected. What can the industry expect going forward?

The pharma industry’s outlook

In a recent webinar, hosted by the Drug, Chemical & Associated Technologies Association (DCAT), Graham Lewis, Vice President of Global Pharma Strategy, IQVIA, provided a “sober assessment” of the outlook for the biopharma industry over the next two years. His analysis provided the latest market data and analysis from IQVIA, which was occasioned by the evolving implications of the COVID-19 pandemic on the global economy and the biopharma industry. Lewis expects that most, if not all geographies, will face disruption at least until 2022/2023 and that biopharma companies will have to adapt their business models and react quickly in a highly uncertain environment.

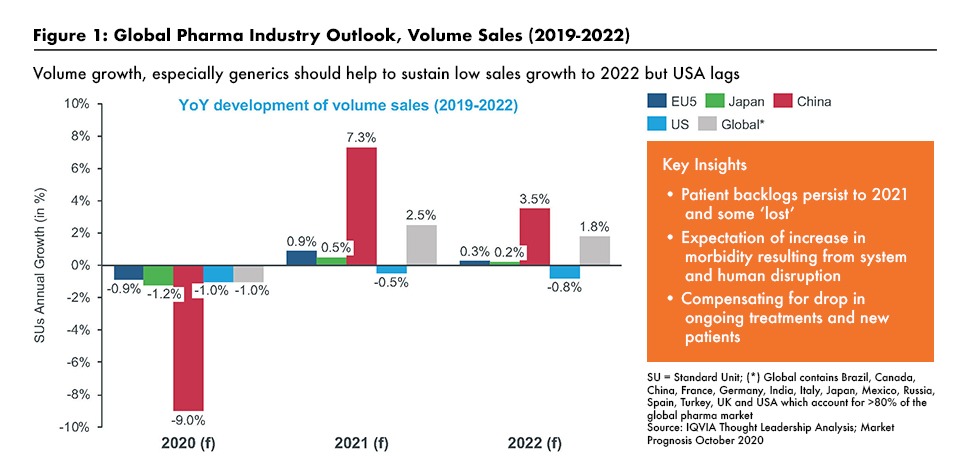

Lewis said that IQVIA expects low single-digit growth in pharma sales at net prices (i.e., after rebates and discounts) for the next two years. As outlined in Figure 1, drug-product volumes have declined in 2020 as visits to physicians and hospitals have dropped as a result of the pandemic. While he expects some rebound in 2021/2022, especially in Asia, volume growth is likely to remain subdued in the US and Europe although the availability of a COVID-19 vaccine would improve growth in volumes (see Figure 1).

Drug prices are expected to be under pressure, according to Lewis. Rebates and discounts are increasing. As countries emerge from the pandemic, healthcare systems will strongly focus on cost effectiveness and value as they seek to balance budgets as economies seek to recover from the huge cost burdens inflicted by the pandemic. Real-world evidence of value, innovations (especially those which ease pressure on healthcare systems), precision medicines (which improve outcome efficiencies), and technology (which permits the sensitive tracking of patient status) offer real opportunities for Pharma to partner with healthcare systems to ensure patient access to the medicines they need.

Meanwhile, healthcare systems face the challenges of the backlog of care, i.e., undiagnosed and untreated patients, which have grown during the pandemic when access to healthcare professionals was limited or not possible. The pharma industry is very aware of these pressures and is responding by providing patient and professional support wherever it can.

Fragile healthcare systems

|

|

Graham Lewis |

In fact, Lewis argues, healthcare systems will remain fragile for several years, even as COVID-19 is confronted. In adapting to increasing numbers of remote engagements between healthcare professionals and patients, telemedicine has been making up for some of the shortfall, but the number of patient engagements with healthcare professionals is still well short of what they were pre-pandemic. Hospital visits and elective surgeries are well down too.

Lewis emphasized that biopharma companies must become adept at finding and managing new ways of engaging with healthcare professionals and patients. As more patient visits are conducted remotely, he expects that home care may become more prevalent. Further, remote interactions, e.g., via videoconferencing, have had to be substituted for face-to-face interaction between pharma sales professionals and physicians. Those customers are increasingly expressing a preference for remote interactions because they are more convenient and less intrusive than tradition sales visits at a time when there is so much pressure on availability. These changes will require biopharma companies to invest more in digital technology and content to make these remote interactions more effective and worthwhile for patients and healthcare providers.

Some impacts may be even more fundamental. Lewis noted, for instance, that the incidence of central nervous system (CNS) diseases, including depression brought on by the pandemic, far outweighs that of cancers and rare diseases, which account for the biggest share of pharma R&D spending. There is also likely to be an increasing focus on infectious diseases. Thus, R&D priorities may need to be realigned, possibly returning the focus to high prevalence diseases and those with exponential risks.

Specialty generics opportunity

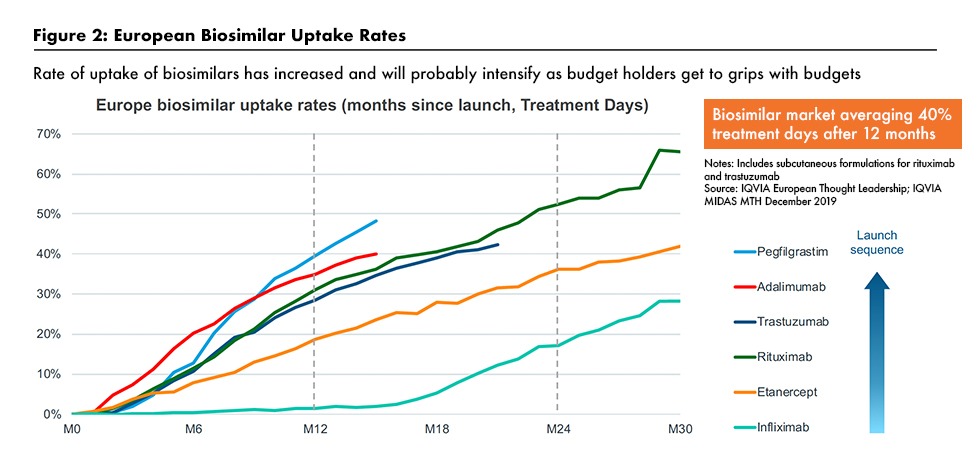

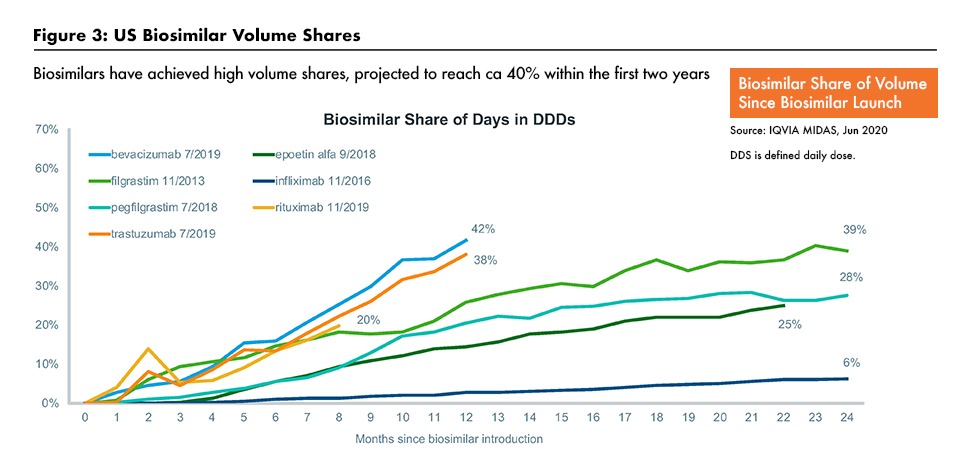

One major trend is the growth of specialty small-molecule generics and biosimilars. Lewis noted that many of the medicines coming off patent are in specialty therapeutic areas, such as oncology and immunology. Growth of biosimilars is likely to take off in the US, where penetration has been slower than in the European Union (EU) as healthcare professionals and payers work harder to control costs. Figure 2 outlines biosimilar uptake rates in the EU, and Figure 3 outlines biosimilar market share, based on volumes, in the US for selected biosimilars. A key issue is whether biosimilar substitution will become more widely adopted.

Pharma supply chains

Lewis also weighed in on expected changes in pharmaceutical supply chains, especially the expectation that government policies will favor repatriation of substantial portions of the pharma supply chain back to the US and Europe. He argues that major supply-chain changes are unlikely as national concerns over healthcare costs will outweigh the willingness to raise drug prices to cover the higher costs of domestic production. He expects that over the next five years, Indian and Chinese drug manufacturers will rise to the challenge of attaining international safety and quality standards in their operations, thereby allaying many of the concerns being raised in the developed markets. India is likely to remain ahead of China in this regard.

New priorities in pharma companies’ strategies

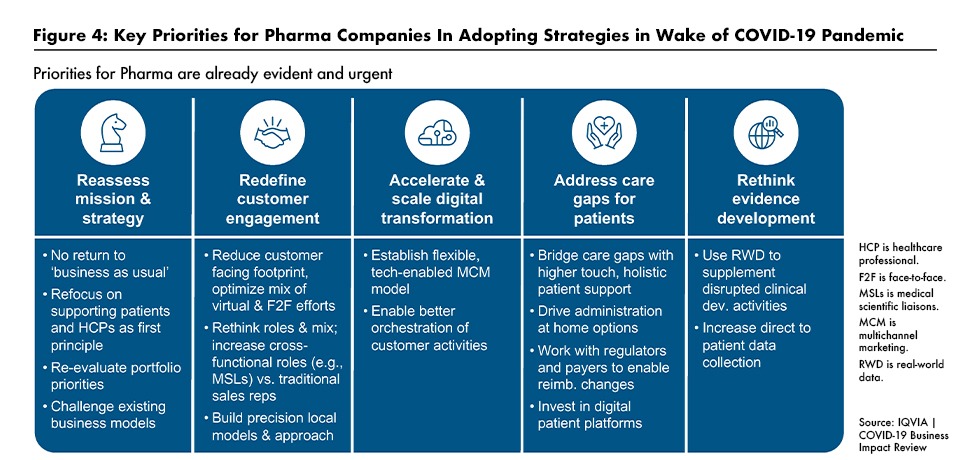

In his summation, Lewis reiterated his main point that as a consequence of the economic damage caused by the COVID-19 pandemic, the healthcare ecosystem is undergoing substantial change from what it was prior to the pandemic. He underscored the need for biopharma companies to fundamentally reset their priorities and business models. As outlined in Figure 4, major elements of the reset will include: refocusing on the need to support patients and providers; finding new ways to engage with constituencies; and embracing digital technologies and real-world evidence. And, perhaps most importantly in Lewis’ assessment, companies have to start changing now, before the ‘new normal’ becomes reality.

Note: DCAT would like to thank our sponsors, AbbVie, Stevanato Group, and Thermo Fisher Scientific, for their support for the October 27, 2020 DCAT webinar, “Pipelines, Product Launches, and Performance: The Impact of COVID-19 on the Pharma Industry,” which served as the basis for this article.

|

|

|