Company on the Move: Viatris

Viatris is the new company formed from the combination of Upjohn, Pfizer’s off-patent branded and generic established medicines business, and Mylan. The companies had announced the deal in July 2019, and now that the deal is closed and Viatris is launched, what and who is behind the new company?

Rationale for the new company

For both Mylan and Pfizer, the deal represents the execution of strategic decisions to address performance in their respective businesses. In August 2018, Mylan, a generic-drug company, formed a strategic review committee to evaluate alternatives for its businesses following weak performance in its North American segment. Mylan, like other large generic-drug companies, faced increased pricing pressure and competition, particularly in the US market. For its part, Pfizer had been evaluating possible separation of its generics and established product business dating back to when the company was led by Ian Read, who stepped down as Chief Executive Officer (CEO) in January 2019, with Albert Bourla, formerly the Chief Operating Officer of Pfizer, taking the role of CEO. Pfizer then re-organized into three main areas: the Biopharmaceutical Group, which includes its prescription, innovator products; Upjohn, which includes its off-patent branded and generic established medicines business; and Consumer Healthcare, which includes its over-the-counter business. As part of a strategy to focus on its Biopharmaceutical Group and core business of innovative prescription products, in addition to making the move to spin off Upjohn, Pfizer’s Consumer Healthcare business was combined with GlaxoSmithKline’s consumer healthcare business in 2019 to form a new consumer healthcare joint venture in which Pfizer held a 32% equity stake (note: within three years of the closing of the transaction, GSK said it planned to separate the joint venture via a demerger).

|

|

Robert J. Coury |

Inside the new Viatris: products

Viatris is now composed of Upjohn, Pfizer’s off-patent branded and generic established medicines business, and Mylan. Upjohn posted 2019 revenues of $10.2 billion, representing approximately 20% of Pfizer’s 2019 revenues of $51.75 billion. The company’s Biopharma business (consisting of innovative prescription products) accounted for $39.4 billion, or approximately 76% of Pfizer’s 2019 revenues, and Consumer Healthcare approximately $2.1 billion or 4% of total revenues.

Upjohn consists primarily of off-patent solid oral dose legacy brands. It had two products with sales of more than $1 billion in 2019: Lyrica (pregabalin), drug for treating epilepsy, post-herepetic neuralgia, diabetic peripheral neuropathy, fibromyalgia, and certain neuropathic pain, with sales of $3.32 billion, and Lipitor (atorvastatin), a drug for treating high cholesterol, with sales of $1.97 billion. Its other top-selling products in 2019 were: Norvasc (amlodipine) for treating hypertension, with 2019 revenues of $950 million; Celebrex (celecoxib) for treating arthritis pain and inflammation, and acute pain, with 2019 revenues of $719 million; and Viagra (sildenafil) for treating erectile dysfunction with 2019 revenues of $497 million.

Mylan posted 2019 revenue of $11.5 billion, a 1% gain over 2018. On a product basis, the company provides branded generics (off-patent products that are sold under an approved proprietary name for marketing purposes), select prescription products, unbranded generics, and over-the-counter products. Generics (unbranded) account for more than 50% of its nets sales. On a geographic basis, North America accounted for $4.164 billion (a 2% gain year over year) in product sales or 37%. Europe had sales of $4.037 billion (a 3% decline year over year), or 35%, and the rest of the world had product sales of $3.169 billion (a 5% gain year over year) or 28%.

|

|

Michael Goettler |

Mylan is also positioned in biosimilars. Its collaboration agreements are primarily focused on the development, manufacturing, supply and commercialization of multiple, high-value generic biosimilar compounds, insulin analog products and respiratory products, among other complex products. Mylan’s collaboration and licensing agreements include those with Pfizer, Momenta Pharmaceuticals (recently acquired by Johnson & Johnson), Theravance Biopharma, Biocon, and Fujifilm Kyowa Kirin Biologics. Pfizer’s biosimilar products, those internally developed by Pfizer and those acquired in Pfizer’s $17-billion acquisition of Hospira in 2015 as well as the hospital products acquired from Hospira, are not part of Viatris.

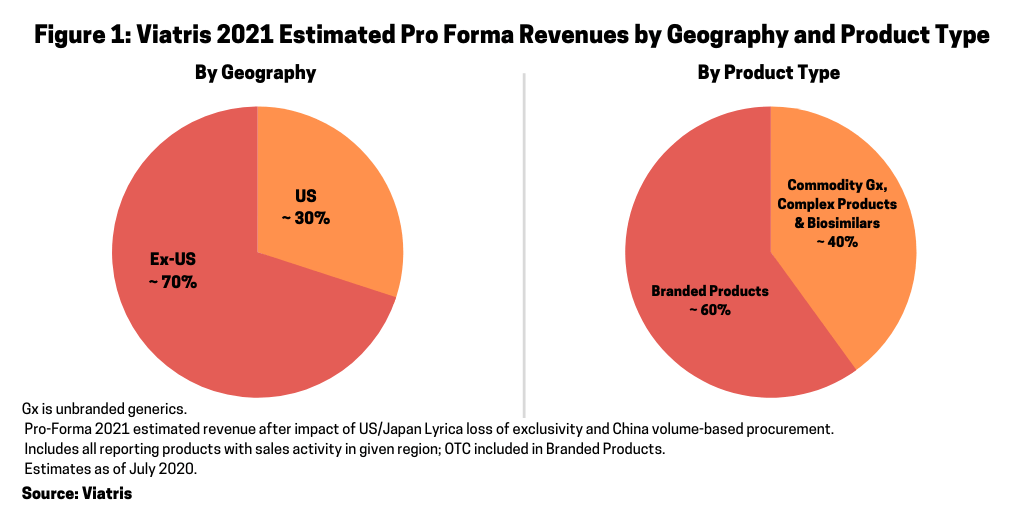

The portfolio of Viatris now comprises more than 1,400 approved molecules for generic, complex generic and branded medicines, biosimilars, and over-the-counter consumer products. Figure 1 outlines the distribution of Viatris’ 2021 estimated pro forma revenues by geography and product type. On a geographic basis, approximately 70% of estimated 2012 pro forma revenues are outside the US and 30% are in the US (which includes approximately 15% of US unbranded generics). On a product basis, approximately 60% of the company’s estimated 2021 revenues are branded products; they account for 60% of estimated revenues despite accounting for only 35% of the company’s portfolio. Forty percent of its estimated 2021 revenues are from commodity generics, complex generics, and biosimilars.

Inside the new Viatris: manufacturing

On a manufacturing basis, Upjohn had seven manufacturing plants (as of December 31, 2019). Mylan owns 53 manufacturing plants, distribution facilities, and administrative facilities (as of December 31, 2019). In the US and Puerto Rico, Mylan owns 16 manufacturing plants, distribution facilities, and administrative facilities. Principal facilities include: the company’s headquarters in Canonsburg, Pennsylvania; its campus in Morgantown, West Virginia, which includes a R&D center of excellence and manufacturing plant; and its distribution center in Greensboro, North Carolina. Outside the US and Puerto Rico, Mylan owns 37 production, distribution, and administrative facilities in 15 countries. In Europe, principal facilities include: its executive offices in Hatfield, Hertfordshire, England; its global center in Dublin, Ireland and; key facilities in Ireland, Hungary, and France. It also operates key facilities in India, Australia, and Japan. In India, principal facilities include its global center in Bangalore; an R&D center of excellence in Hyderabad; and several manufacturing plants located throughout the country.

Inside Viatris: leadership, company structure, and cost-savings plan

In creating Viatris, the deal was structured as an all-stock, Reverse Morris Trust transaction, Upjohn was spun off/split off to Pfizer’s shareholders and, immediately thereafter, combined with Mylan with Pfizer shareholders owning 57% of the combined new company, and former Mylan shareholders 43%.

Viatris will be led by Robert Coury, Executive Chairman, formerly Executive Chairman of Mylan, and Michael Goettler, CEO, formerly Group President, Upjohn. Rajiv Malik, formerly Mylan President, is now President of Viatris. Heather Bresch, Mylan’s former CEO, had earlier announced plans to retire from Mylan upon the close of the transaction. The Board of Directors of the new company will include its Executive Chairman and its CEO as well as eight members designated by Mylan and three members designated by Pfizer for a total of 13 members.

The combined company currently has 45,000 employees and is headquartered in the US and has global centers in Pittsburgh, Shanghai, and Hyderabad, India. The new company has initiated a global restructuring program in order to achieve synergies of $1 billion. The company is currently in the process of defining the specific parameters of the program, including workforce actions and other restructuring activities. Further details for this program are expected to be disclosed by the end of 2020 as plans are finalized. Key activities of the expanded program are expected to reduce the company’s cost base through the rationalization of its global manufacturing and supply network and the optimization of the company’s functional and commercial capabilities.