FDA, FTC Join To Increase Biologic Drug Competition

The FDA and FTC are collaborating to advance market competition in biologics, including for biosimilars. What have the agencies done thus far and what are they planning to do?

The US market for biologics

Earlier this month (February 2020), the US Food and Drug Administration (FDA) and the US Federal Trade Commission (FTC) issued a joint statement regarding enhanced collaboration to advance market competition of biologic-based drugs, including the adoption of biosimilars and interchangeable products. This joint statement describes steps the agencies will take to address promotion about biosimilars within their respective authorities and ways in which they plan to facilitate the entry of biosimilar and interchangeable products in the market.

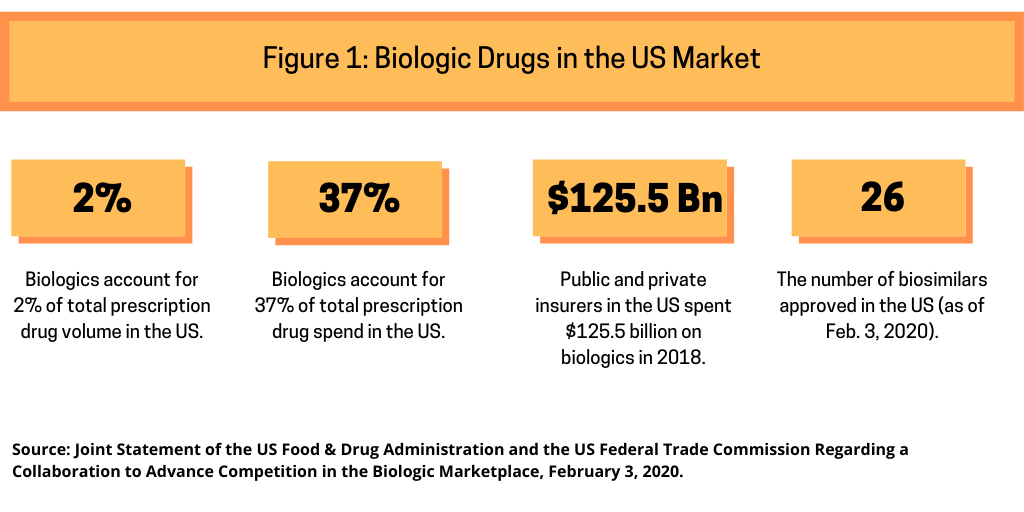

In issuing their joint statement, the FDA and FTC provided information to show the position of biologics in the US market (see Figure 1). They note that biological products are often more expensive than small-molecule drugs, accounting for 2% of total prescription volume but 37% of total prescription drug spend in the US. In 2018, public and private insurers in the US spent $125.5 billion on biologics. While the US market for biosimilar versions of biological products is still maturing, the FDA’s research suggests that after market entry, biosimilars marketed in the US typically have launched with initial list prices 15% to 35% lower than comparative list prices of the reference products. To date, theFDA has approved 26 biosimilars although certain business and intellectual property issues have contributed to the delayed launch of some approved products.

FDA builds on prior actions to advance biosimilars

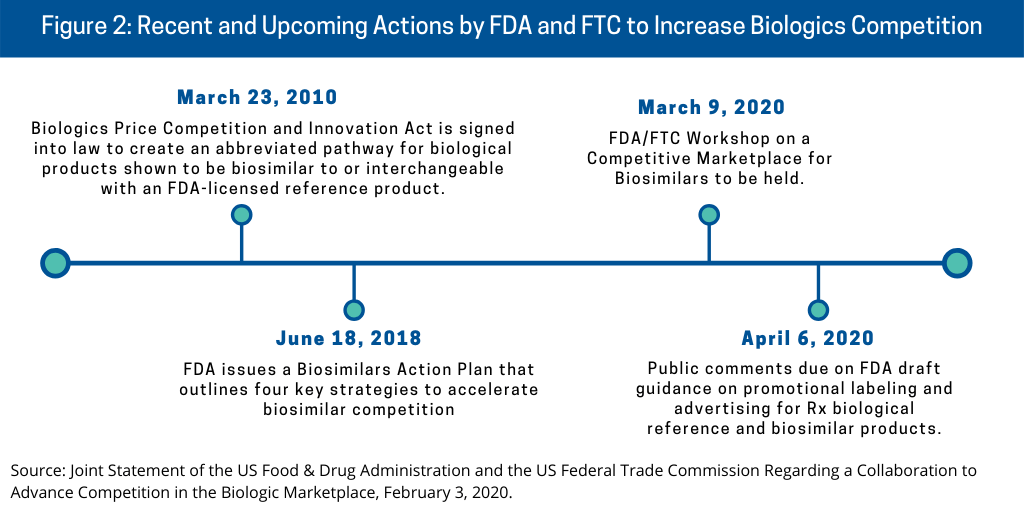

The FDA and FTC’s plan to advance competition of biologics, including biosimilars, in the US builds on previous actions by the agencies (see Figure 2) and as outlined below.

Biologics Price Competition and Innovation Act. The regulatory pathway for biosimilars in the US came into being in July 2010 with the signing into law of the Biologics Price Competition and Innovation Act (BPCI Act), which created an abbreviated pathway for biological products demonstrated to be biosimilar to or interchangeable with an FDA-licensed reference product. A biosimilar is a biological product that is highly similar to its reference product, a biological medication already approved by the FDA. Biosimilars have no clinically meaningful differences from the reference product in terms of safety or effectiveness. Generally described, an interchangeable is a biosimilar to the reference product that meets additional requirements outlined in the BPCI Act. Additional information is needed to show that an interchangeable is expected to produce the same clinical result as the reference product in any given patient. Also, for a biological product administered more than once to patients, the FDA will have evaluated the risk in terms of safety and reduced efficacy of switching back and forth between an interchangeable product and a reference product. An interchangeable product may be substituted for the reference product without the involvement of the prescriber. The abbreviated pathway enables potentially shorter and less costly drug development programs for biosimilar and interchangeable products.

FDA’s Biosimilars Action Plan. The FDA issued a Biosimilars Action Plan in July 2018 that outlines four key strategies to accelerate biosimilar competition: (1) improving the efficiency of the development and approval process for biosimilars and interchangeable products; (2) improving clarity of scientific and regulatory requirements for biosimilar product development; (3) developing effective communication to educate clinicians, patients and payors about biosimilar and interchangeable products; and (4) supporting market competition by reducing use of FDA requirements or other means to delay biosimilar market entry.

FDA’s and FTC’s plan to further advance biologics competition

In issuing their joint statement, the FDA and FTC outlined further actions that the agencies plan to take to advance biologics competition (see Figure 2) as part of deliverables of FDA’s Biosimilar Action Plan. As part of an overall effort to provide clearer direction to the industry on the development of promotional materials for medical products, the FDA issued draft guidance in the form of a question-and-answer document on promotional labeling and advertising for prescription biological reference and biosimilar products. The draft guidance addresses certain considerations, such as how to present information from the studies conducted to support licensure of the reference product in biosimilar product promotional materials, how to present data or information from the studies conducted to support a demonstration of biosimilarity in biosimilar product promotional materials, and how to present comparisons between a reference product and a biosimilar product. The FDA is accepting comments from the public on the draft guidance from February 4 to April 6, 2020.

As specified in their joint statement, the FDA and the FTC will also collaborate on future public outreach efforts, including bringing together participants from industry, academia, and government agencies to discuss issues relating to competition in the biologics market. To this end, the FDA and FTC will hold a public workshop, “FDA/FTC Workshop on a Competitive Marketplace for Biosimilars” on March 9 at the FDA’s White Oak Campus in Silver Spring, Maryland. Topics for discussion include: US biosimilar markets and the FDA’s approval process; enforcement activities by the FDA and FTC; the benefits of competition; and improving stakeholder engagement.

In addition to these activities, the agencies say they will further collaborate on ways to advance biologics competition. This includes further exchanging information, when appropriate, about best practices to prevent activities that impede access to samples of the reference product that the prospective biosimilar applicant needs for testing. To strengthen the partnership and interagency coordination between the FDA and the FTC, the agencies say they will help each other to address and deter anticompetitive behavior in the US market for biological products. Such behavior might include reverse-payment agreements, repetitive regulatory filings, or misuse of restricted drug-distribution programs. Additionally, the FTC says it intends to review patent-settlement agreements involving biosimilars, to prevent anti-competitive behavior.

Additionally, the FDA recently issued final guidance for the industry related to certain types of citizen petitions intended to delay FDA action on a generic or other abbreviated application. This guidance is intended to help the FDA allocate resources efficiently when addressing petitions likely to obstruct entry of generic and biosimilar medications. The FDA is also highlighting in its annual report to Congress its determinations of petitions submitted with the primary purpose of delaying an approval.